|

�

Archives

September 2021

Categories

All

|

Back to Blog

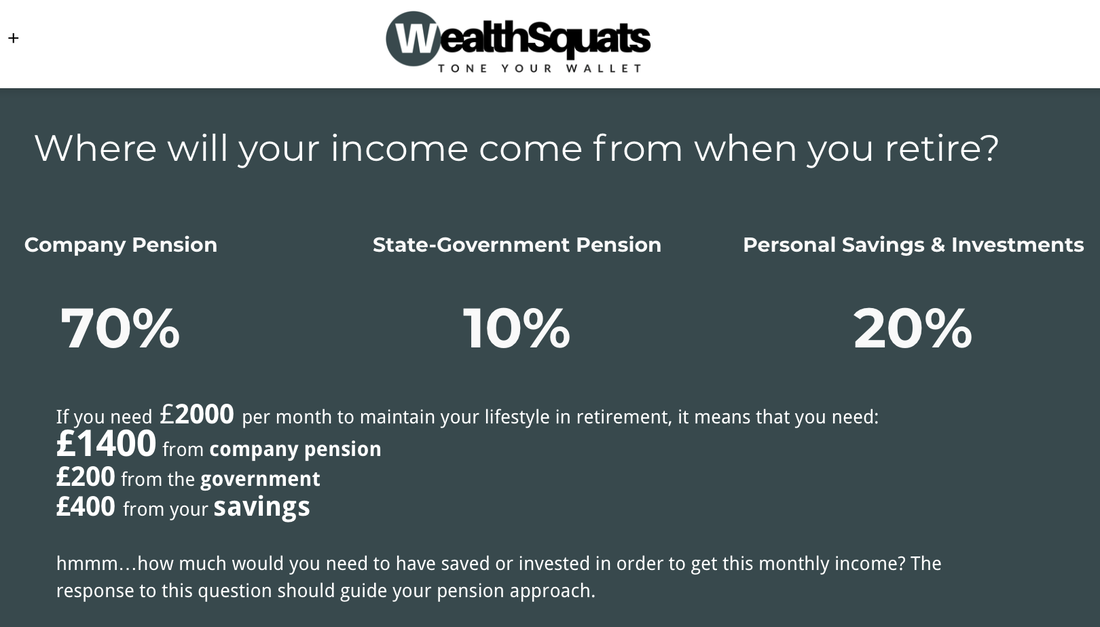

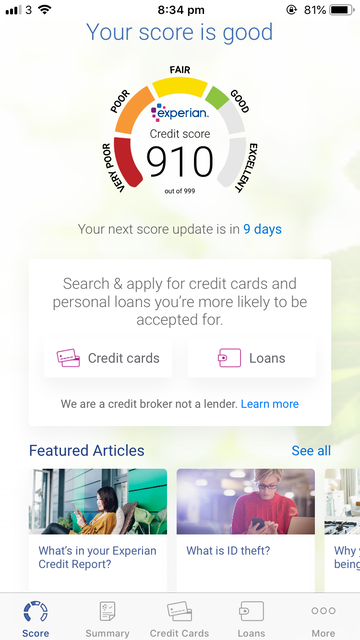

This is why I dread old age9/30/2021 The image below from tax.service.gov.uk is one reason I dread old age. It is from the UK government website and it says I'll get about £700 a month to live on when I am of retirement age. This is IF the state pension will still be around. I encourage you to look at your personal tax details to get a sense of your own situation. Notice that you can only get this monthly sum if you contribute for a minimum (10) and a maximum number of years (depending on your retirement age, example below is 26 years). This is also a reminder that state pension is mean to be one part of your pension income. If this amount allows you to meet your needs at say age 71, then do nothing new. If on the other hand, you want to travel, cover expenses, start businesses, eat well, and give more, then you'll need to supplement this by saving for your self today either in a work pension, a SIPP, a LISA or open a separate savings account solely for old age care. Flip the dread and read more on pensions. What can I do? A 3 min peek into your pension Have a look at your pension savings, how much is in there? Is it on track for the future? Do you need to make any change?

Check out this article on how to get a free pension top up. If you do not have a pension, you can open a savings account, a SIPP or a LISA; speak to a financial adviser or look online for the best product for yourself.

1 Comment

Read More

Back to Blog

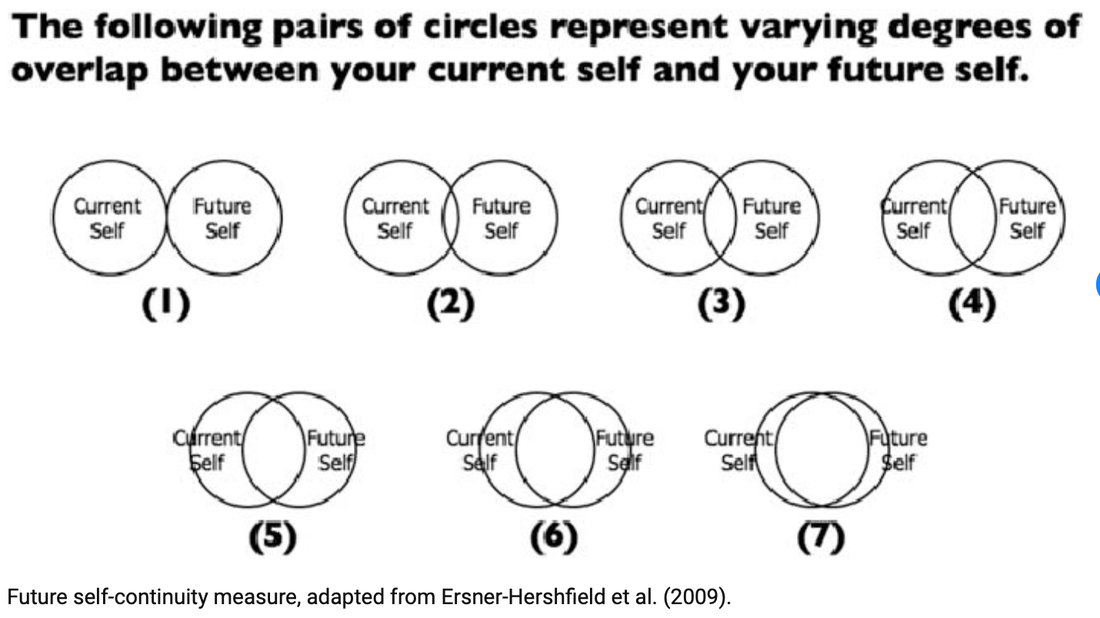

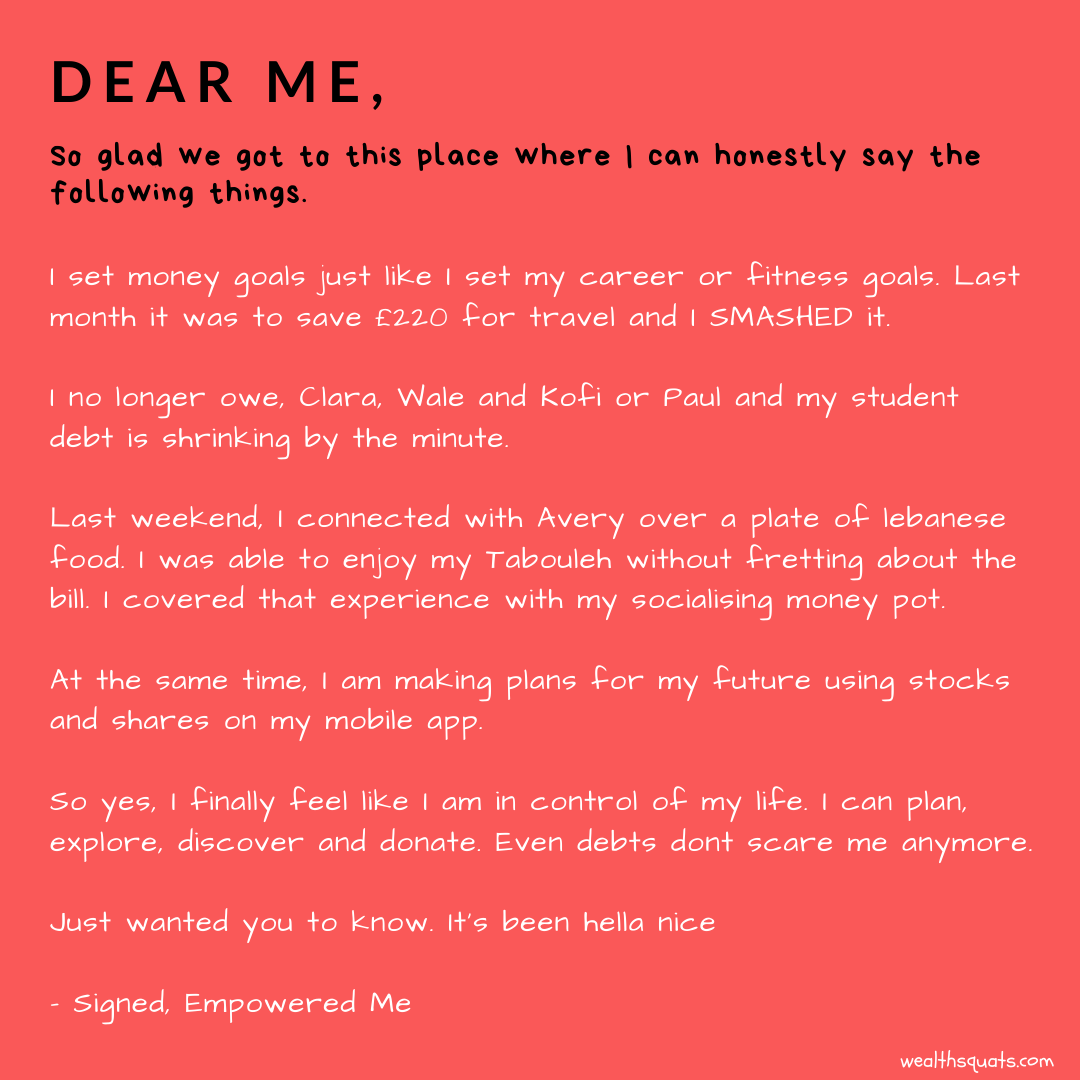

Are you friends with your future $£lf?7/26/2021 How do you see your self in the future? Research shows that people who are able to imagine their future self in a "vivid and realistic" manner as an extension of their current self end up having more money and assets. Source: Ersner-Hershfield et al. (2009) It can be difficult to imagine yourself 4 weeks, 4 years 40 years from now but the research shows that "what matters is how much a given individual feels he or she will be the same person over time" (i.e. approaching No 7 in the image above). By 'same' the researchers mean, you expect your interests, dislikes, values and beliefs to remain aligned. If you see your future self as a stranger, you won't feel like giving your money to help them because you won't feel like you are getting anything in return. In money terms, you are unlikely to save for the future or put money aside for retirement. On the other hand, If you feel like your future self is an extension of your current self, then helping your future self is just like giving your current self a helping hand. That feels good and so you'd be more likely to give your future self money through savings or pensions and feel rewarded. Interestingly this applies at a wider level - countries that have positive attitudes towards the elderly reported higher savings rates. How can you get closer to your future self?

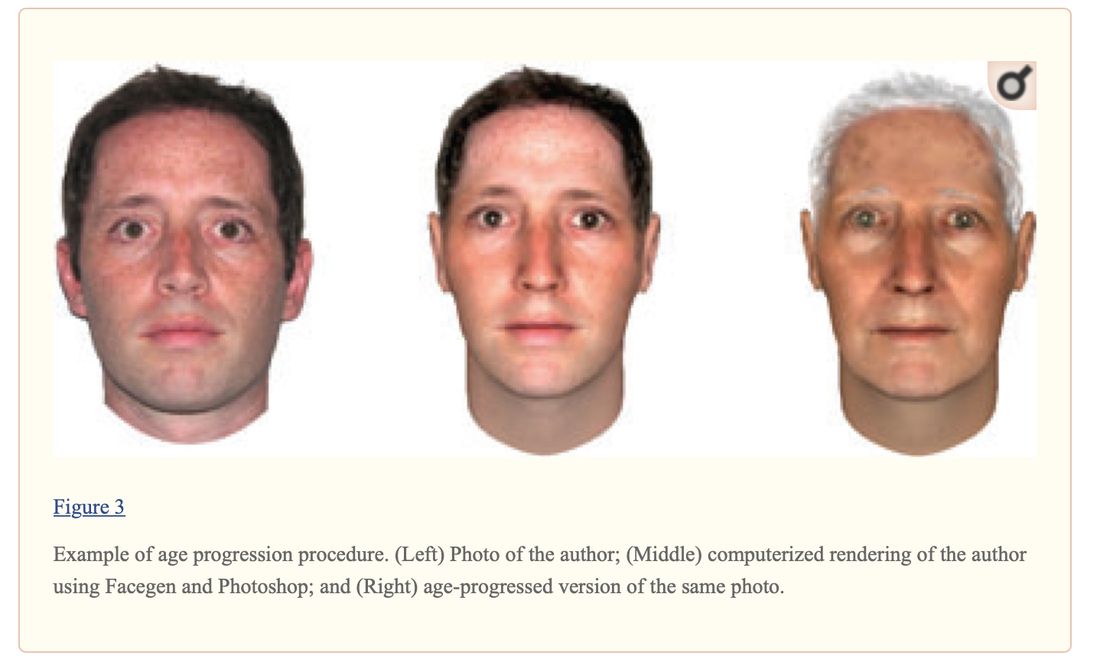

1) Create a realistic picture of future you via Apps at different ages - 25, 40, 60, and beyond (see example below). Do you like what you see? Are you willing to give old you some money? Save the image on your phone or print it out and hang it up. 2) As your future self, write an optimistic and detailed letter to your current self. Describe how you are doing and what you have accomplished. Want to get started? See our money habit of the month below. By doing these exercises, the hope is that you'll agree to give your future self a raise by saving and investing regularly for a better lifestyle.

Back to Blog

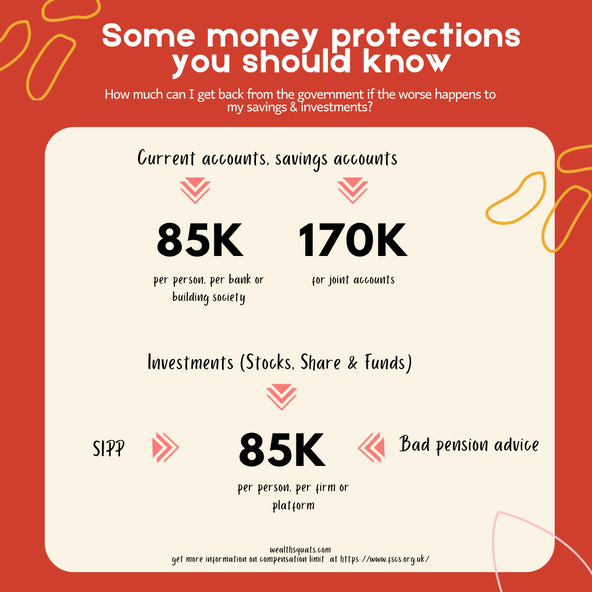

Is your money safe with banks?6/29/2021 You are on track with your savings and investments plans. You also have different bank accounts for your money. What's more, your mortgage is from another provider and you use different apps to invest and manage your pension. Think about this - what if the bank or investment platform goes bust (like this one), how much can the UK government pay you back to protect some of your hard earned cash? The FSCS is a scheme you may have recognised on banks website, investment websites, emails and more. What are they trying to tell you? How can you make a claim and how much protection do you actually have? Trivia: Imagine you have £50k in Lloyds bank and £50k in Halifax, how much of your money is protected? Hint: not all of it.

How much of your money is protected? Source: FSCS Money held in banks or building society

Money in Investments

Mortgage

*Intermediation is when an entity works on your behalf to get you financial products Your Pensions

Your Debt

Insurance

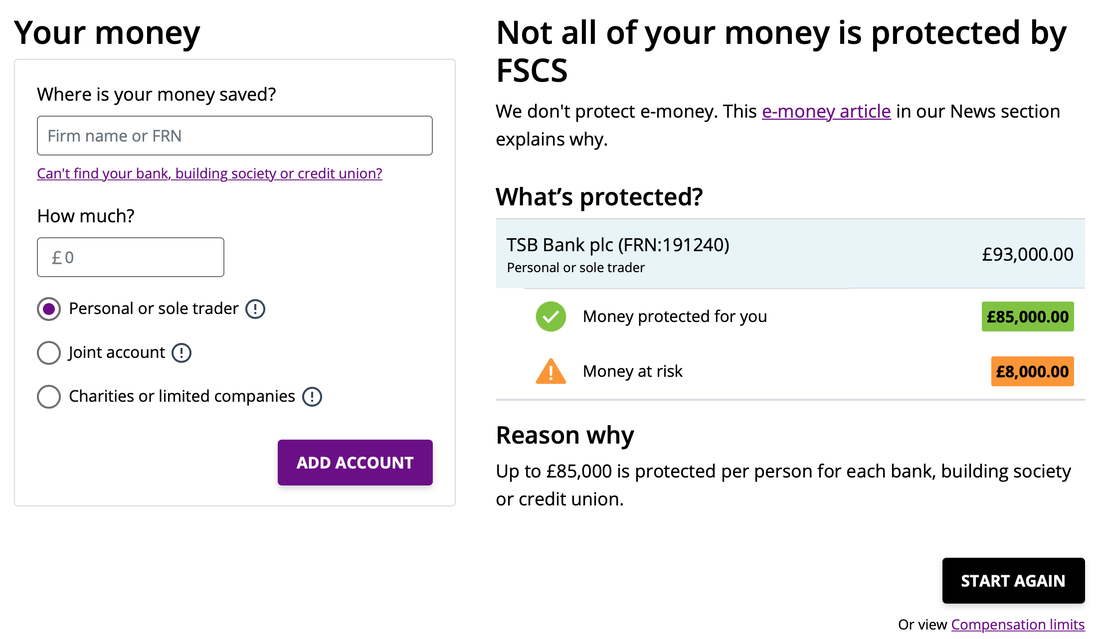

What if I have more than £85k? Based on my research you may to have distribute the excess of your money across different banks and or platforms to be fully protected. Sometimes, this can be expensive due to the fees that could be paid. This also also be difficult to manage over time as you cannot exceed 85k in total (capital + interests or dividends). Alternatively you can trust that the provider is taking the right steps to protect your money and is in alignment with the Financial Conduct Authority (FCA) rules. How do you make a claim? To make a claim, click here to find out if you are eligible. Remember: Your money is safe with FSCS up to a limit. Your checklist

FSCS Protection Checker A 2 min video on FSCS

Back to Blog

Three ways to go Green with your money5/30/2021 Savings accounts that plant trees when you open an account, Banks that only loan to charities, Cheaper mortgages that reward you for an energy efficient home or 1-click robo-advisors that help you invest your money in green ways. ESG, Impact Investing or Green Investing is taking off these days. But what is it about and how can you use your money to align to your beliefs? There is a lot of about 'Going Green'; you may be actively looking for ways to use and grow your money in ways that are helpful to society, the environment and in alignment with your own ethics or beliefs. You may be interested in supporting companies that for instance, treat workers well, are socially responsible and take sustainability seriously. Your money has impact and investing is one way you can make a loud positive noise. If you are interested learning how to make it happen, below are 3 ways to grow your money and do good. Savings Account that plant trees One of the first areas you might to consider is where to put your cash. Companies like Gatehouse bank is encouraging savers to open on of their green savings accounts; by doing this, a tree will be automatically planted. Charity Bank uses your savings to make loans to charities and social businesses. Cheaper rates, Green Mortgages for Energy Efficient homes If you buy an energy efficient home, some banks (like NatWest, Barclays) are promising lower mortgage rate (monthly payments) to encourage you to remain sustainable. The banks will look at the energy performance certificates (EPC) or your energy rating of your property which must be rated A or B along with other typical factors (like your income, deposit, credit score and more) to determine your mortgage. EPCs are valid for 10 year and if you want to know the rating of your home, click here to find out. Invest in Green funds on the Stock Market Impact Investing, Environmental, social and corporate governance (ESG) funds, Ethical Investing, Green funds used interchangeably are themes or words that allude to a group of companies that are focused on doing good. These companies typically create products or have plans in plans to become more ESG sound. As a shareholder buying into one of these companies of funds (group of companies) you have the ability to use your influence to help them raise their ethical or green standards. You can choose individual companies to invest in that are creating products that are ESG friendly. You can look at their annual reports to see what they are doing about ESG or Going Green. You can also choose funds that have been set up to focus on ESG. A quick google search can yield multiple results. Many robo-advisors have set up 1-click funds for investors to get started with no hassle. Now, some of these companies or funds may be using green as a new buzz word to get you hooked so it is important to check the credentials of these companies to ensure they align with your moral goals. Read here to remember to keep fees low. Invest in Everyday people...building insect pet protein

Everyday people are also taking part in the Green Wave. Websites like Seedrs and Crowdcube allow you to invest in small early stage companies that are tackling the ESG challenge head on. Where it is creating biodegradable products, building technology to reduce carbon emissions, creating insect protein pet food or even building plastic roads; you can choose to support an entrepreneurs dream to create products that you'd like to see in the world. Of course every investment has its own risks so read the terms and conditions carefully.

Back to Blog

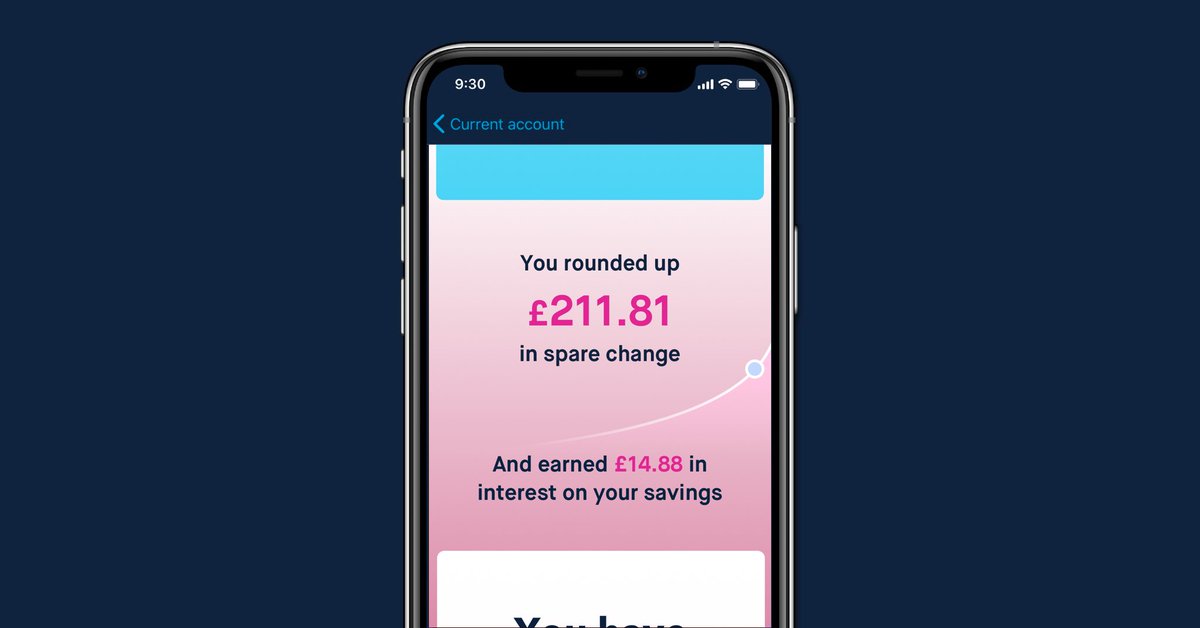

Home ownership is a goal many have but I have seen many stories of people buying their home and becoming worse off financially because they have saved for years and have put ALL their savings to get a roof over their head. 6 months later, they have save just enough to get a couch and the slog continues. This doesn't have to happen. in this post, we explore ways to avoid being house poor and it takes planning and prioritising your well being. Rule of Thumb: The deposit is just the start add fees, tax and savings. Key takeaways

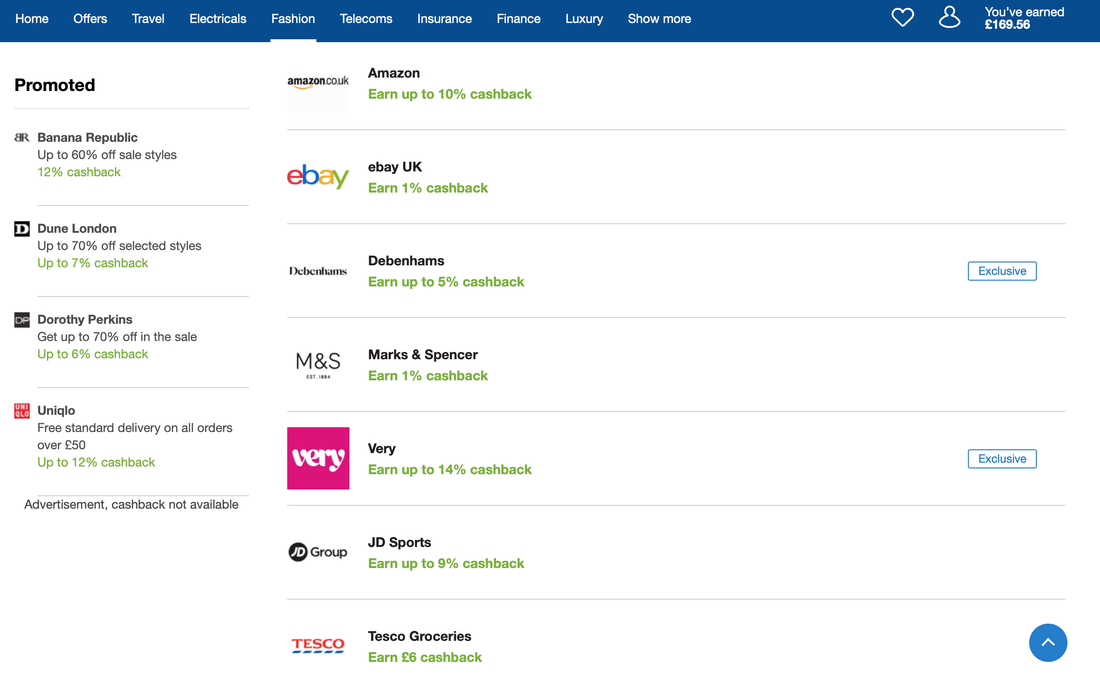

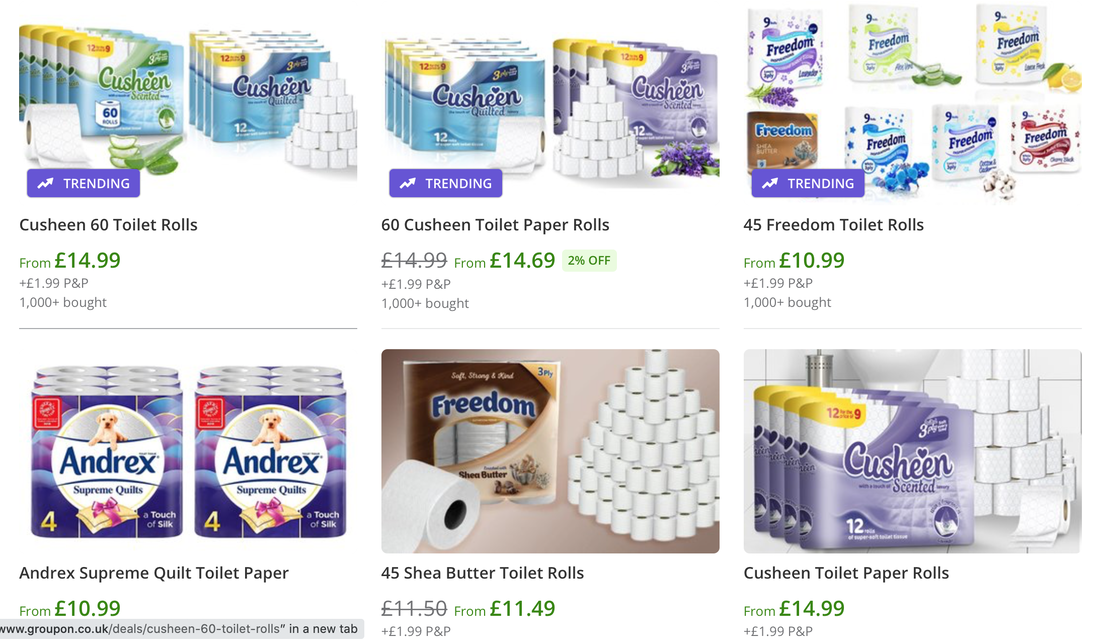

Build your emergency fund. This fund should not be used for the home. Your emergency fund is purely for your own insurance and should cover a minimum of 3 months. I would even take this further and have a small pot for fun so you remember to prioritise yourself. Don't only save for your deposit, legal fees and Tax. Factor in payments for furniture, furnishings and at least two months utilities. Let us know if we are missing any other costs.  Get cash back for all the spending. As a new home owner, you'll be buying a lot of things in a given time period. So get cash back to get paid while you spend. This is money you can spend else where.

12+ guilt free ways I cut my spending to save more If it doesn't appreciate, get it pre-loved To save money, use pre-loved websites like e-bay or gumtree for things that you are not to precious about. Things like flower pots, cookery are great candidates. Stick to your budget and take your time You've already made a budget for your home purchase. Your budget is the cornerstone of your financial life - it is your partner in helping you to achieve your financial priorities. It also keeps your focused for all the other non home expenses you need. So future you asks that you stick to it and prioritise your joy. I stopped making these mistakes and it changed everything

Back to Blog

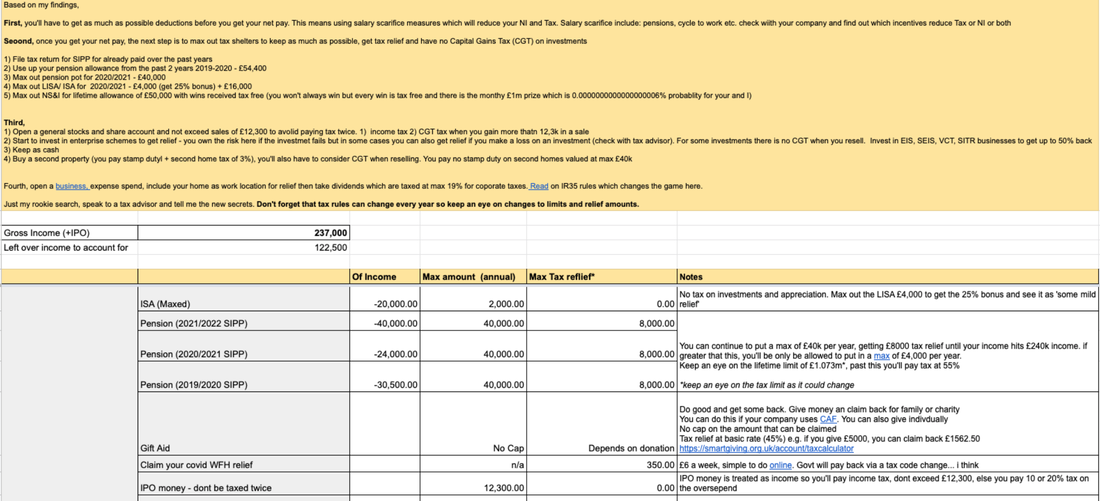

Someone reached out to me to try to solve the puzzle related to earning a high income as an employee (£237,000 to be exact) and using tax laws and perks to keep the most of the money to save and invest.

I scoured the tax rules to pull a quick report that broke down how that money can be allocated in tax friendly accounts or where tax relief can be obtained. This exercise was a great reminder on why we should invest in a tax advisor to help us keep most of our money. A tax advisor is available to all income levels and although there could be costs associated with this service you can save up and use them at least once a year to get your monies in order. If you are on a low income, you can get free advice from the government. I have just opened a Money pot called Life Admin where I'll be saving to get a tax advise and formalise a Will. Many wealth builders have great lawyers, accountants, doctors and financial advisors. What can a tax advisor do for you:

How to manage a £237,000 income and Tax. Click here or the image below to see the full report. Need a Tax Adviser, click here to choose who is appropriate for you or use the all in one service from Taxscouts and get 10% off.

Back to Blog

What money lies have I stopped telling myself? What is my biggest financial asset? How do I spend and save today? A few years ago I had ZERO knowledge about money and in this post, I look back to see what key mistakes I've stopped making that have become a game changer in my life. My 5 money mistakes

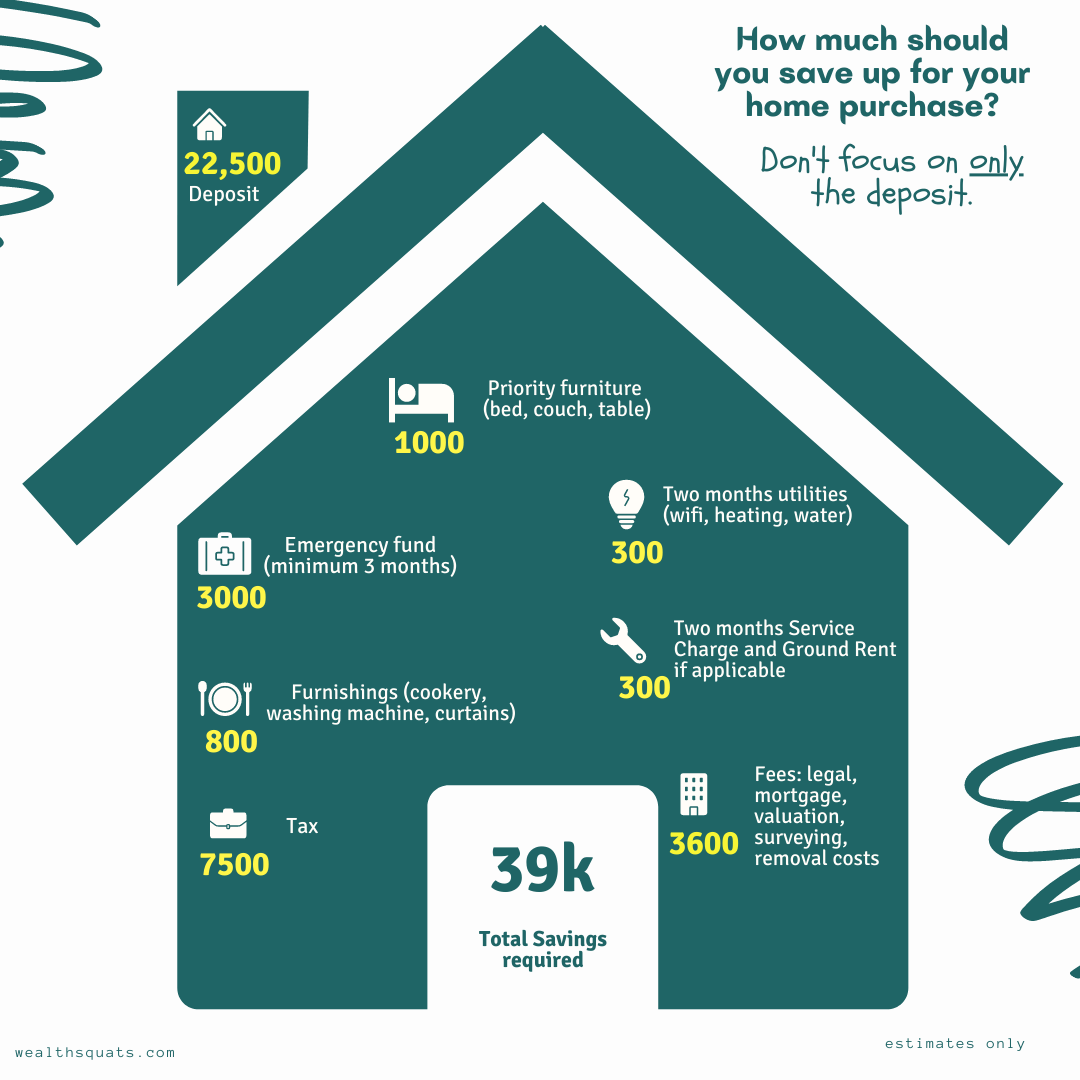

I remember always being so surprised that I had nothing left at the end of the month Spending and spending with no real plan Before I began to get an handle on my finances, my money would come into my current account and all of it would stay there. Slowly my rent, bills would get paid and if at all anything was left, I would still have a reason to spend it. I remember always being so surprised that I had nothing left at the end of the month and when I thought about the effort it would take to go through my spending, in my mind, it was not worth the effort. The money was already gone. Today, I have a budget which I optimise (find ways to reduce my expenses and increase my savings and investments) regularly. Nothing stays in my current account after all bills are paid (my current account doesn't pay interest) and monthly savings and investments have left. Every planned spending is accounted for and I no longer suffer the end-of-the-month-where-did-my pennies-go-syndrome. If you need a money goal to help you plan your spending start here. To be honest, by the time I was 23 years old, no one or school had taught me how to save, no one sat me down to talk about debt or showed me savings accounts and it definitely did not come up as a topic amongst my friends. I simply had no positive money role models. Not being deliberate about saving Just as I spent with no real plan, it is no shocker that I had nothing to save and this happened every time. To be honest, by the time I was 23 years old, no one or school had taught me how to save; no one sat me down, showed me savings accounts, opened a piggy bank and it definitely did not come up as a topic amongst my friends. I knew I wanted to have money but to me it was magic that makes this happen and this magic happens to special people. Little did I know that magic starts with a budget. A budget is the greatest energy source for your money - no lie, they are like batteries you charge to take you far. It shows you where all your money goes and how you are doing. Today, I know of many magic wands that are accessible to all of us where it is savings accounts, the stock market, pensions, private equity, real estate, peer to peer lending, Crypto. This is how I am now deliberate about my savings are as follows:

Thinking I've got my pay-check. That's all I can make right now... Once I got my first proper job, I breathed a sign of relief I now have money. I revised this thinking after my first pay-check (with National Insurance (NI) and taxes deducted, very little was left). Since this was my only source of income, there wasn't much else I could do except find ways to increase my income constantly - this was a hard task. I knew I had to find a way to fatten my income outside of my employment. I went to a seminar once and they spoke about making money while you sleep and multiplying your hourly rate. Since then, this quote from Dave Ramsey has stuck with me-Your most powerful wealth building tool is your income. One of the ways I am applying this principle is by allowing other companies to work for me by buying into funds or shares. When these companies do well, their prices increase and/or they give a dividend. If they don't do great, I take the risk of having lower return but on average and over a long period of time, I should win. Of course there are other things you can do like getting another job for your 5 to 9 but if want an 'simple' co-worker earning for you without any additional effort, you now know your options. The results:

Before writing this post, I looked at my overall pension to see the current value and hands down - it is the largest financial asset I own today. Not setting my pension to the max matching to get free employee match When I started my first job, I think I opted out of the work pension plan initially or I may have begun with saving 1%. At this time, if I put in up to to 5% of my salary, the company would match that 5% and I would have 10% paid into my pension pot. Now as a 23 year old, why would I give away 5% of my money for old age when I am young and in my view at that time, close to the London poverty line? I kept this view for about a year and half when I got serious about transforming my financial life. I spoke to a friend at that time who advised that the easiest place to start getting money was by increasing my pension saving to the 5%. This not only allows me to get free money but it also reduces my taxes. Before writing this post, I looked at my overall pension to see the current value and hands down - it is the largest financial asset I own today. This is not surprising given this UK research where pensions can make up to 60% of households net worth. This are some reasons for the growth:

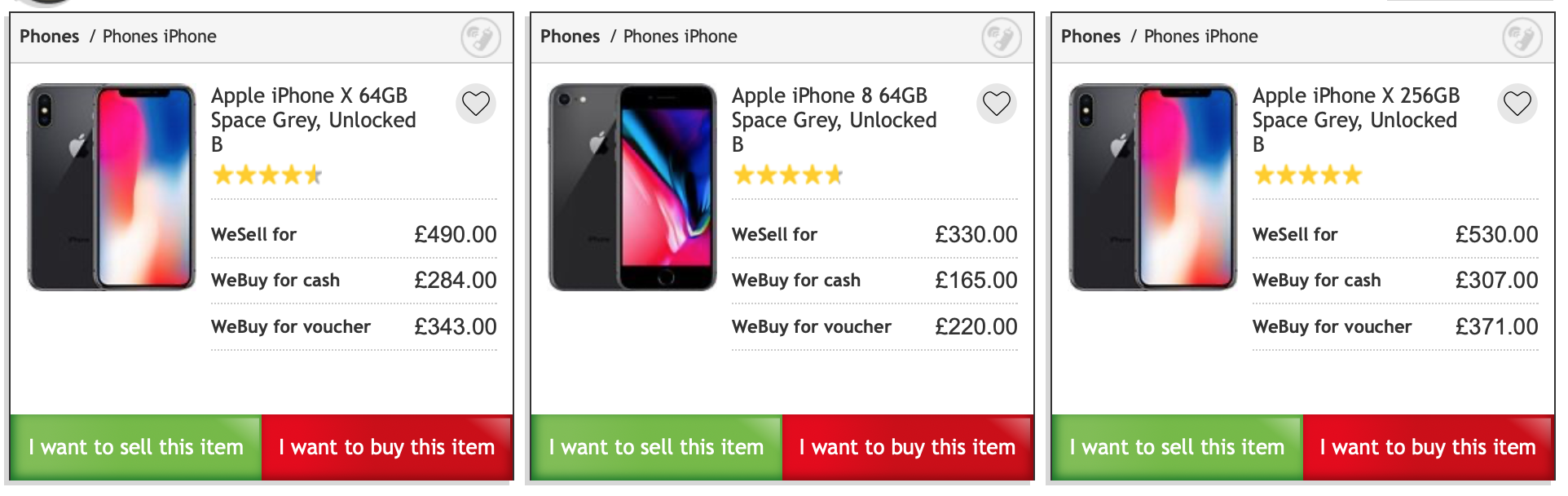

I am now looking forward to being older; I've even calculated how much I'll need to live comfortably. I also have some peace of mind that the efforts I am putting in now will lead to a beautiful life and that is exciting. I like pensions because they force us to save for old age (otherwise, we will just stumble into it), once the money is gone it is out there working, growing to make the most for you. Fast forward to age 24, I read a book by Tony Robbins which simplified the foreign language and and so I quickly open my brokerage account with £25. I have not looked back. Believing the stock market is scary As a young girl, I remember watching CNN evening news and at 9pm GMT, we would hear the NYSE Bell ringing to close the day of trading. I must have watched this happen hundreds of time but I never understood why the bell was there in the first place and what those green and red triangles next to names like LSE, NYSE, DAX etc. meant. I did not know that I was witnessing the opening and closing of money making opportunities. The commentary the pundit gave after each closure was like a foreign language to me, one I found very boring. Fast forward to age 24, I read a book by Tony Robbins which simplified the foreign language and and so I quickly open my brokerage account with £25. I have not looked back. Today, I know the stock market is a huge source of wealth for the top 1% in the UK and is designed to be confusing (with the graphs and financial terms). It is actually not confusing and I am very supportive of the low fee robo-advisors that make it easy for you and me to take part this huge wealth engine. Last week, a family member was discussing a real estate scheme that guaranteed 8% return if she put in £5000. I immediately opened by brokerage app and told her that one of my fund is posting 22% gain. Five years ago, there is no way I wold have been able to suggest this as an option to explore but now I know more and can suggest ideas that could generate a 14% pay bump. This is the true power of knowledge. Now, your turn, do you have any mistakes you've made?

Back to Blog

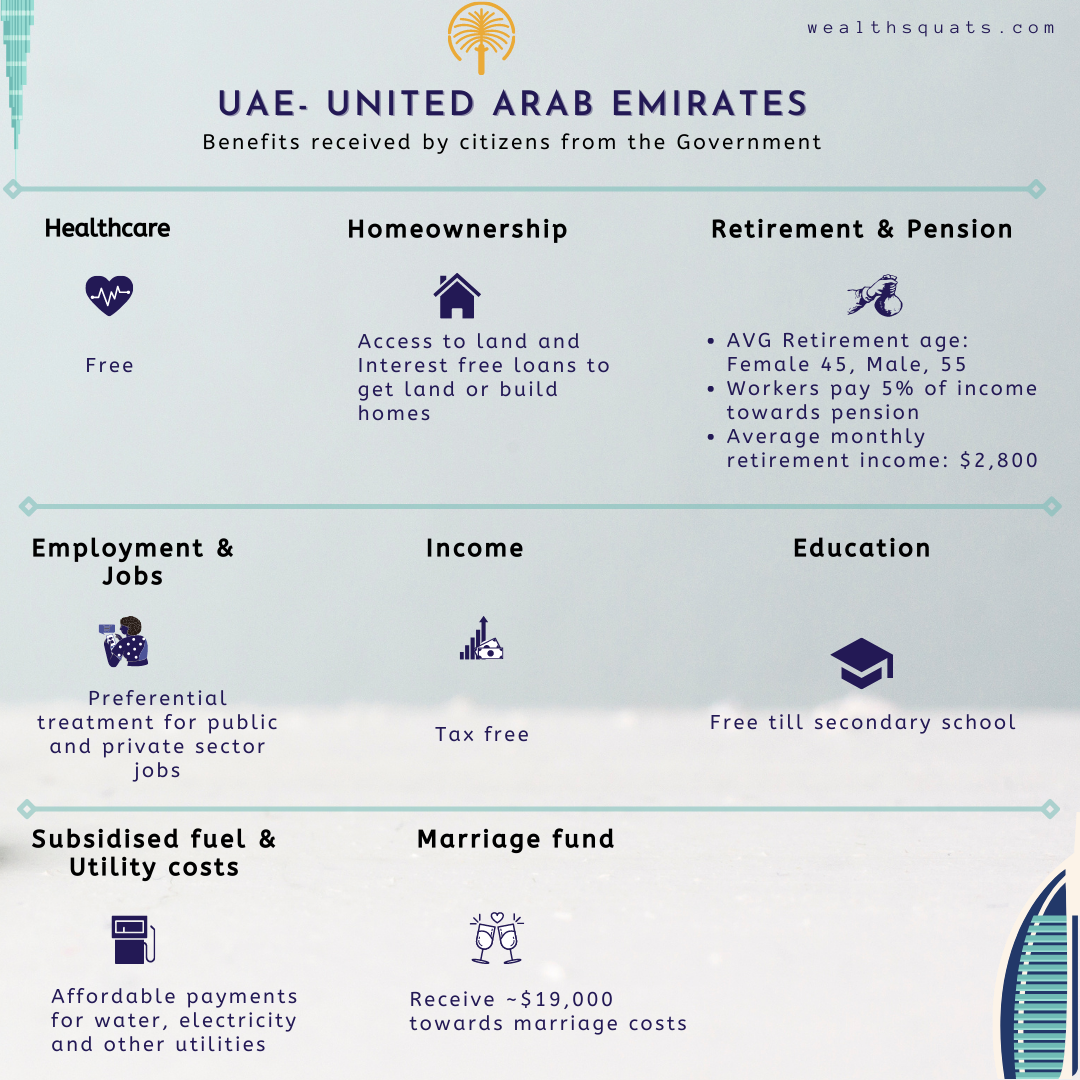

Is your country making you rich? I've written extensively about what we can do on our own to build wealth over time; have a savings goal, build an emergency fund, stock market investments, a pension and more. Let's change the focus for a moment and imagine you don't have to do 80% of this because your government has programmes to easily help you build wealth. How would that feel? In this post, I explore the United Arab Emirates (UAE) and the perks given to it 1.4 million Emirati citizens who have an average net worth of $99,000. Key Lesson

Infographic: What do you get an a citizen of UAE? Plenty!Healthcare (free). Roof over my head (check). Job (guaranteed), Large pension (check) & more

UAE is a country known for Dubai, its oil wealth, architectural landmarks, home to millions of expats and more. Its government has created a financial cushion for its citizens with the focus on giving them a high standard of living. It seems Emirati citizens might have the dream quite a lot of people are after, much akin to lottery winners; you don't have to worry about a job, your old age, your health even your marriage costs! Some lessons and next steps

Back to Blog

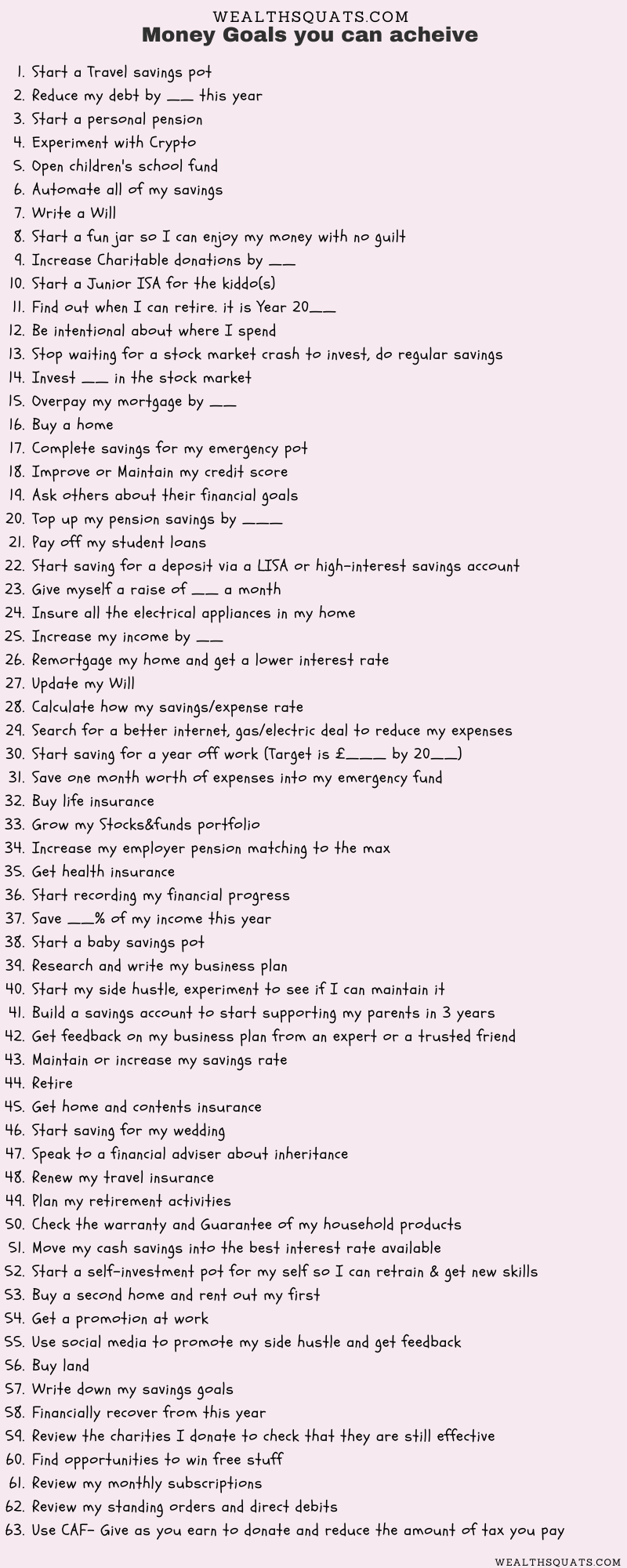

60+ Financial Goals you can achieve anytime12/20/2020 Here's a 60 plus list of money goals you can achieve anytime. We've covered the research behind the power of writing down your goals. So choose yours or add to the list. Do right with my cash savings

Travel & FunProtecting my Family

Save better and more

Manage Debt

Take care of my future

Give BackHomeownership

Financial Health Check

Experiment with my ideas

Enablers

Big overall Goals

Back to Blog

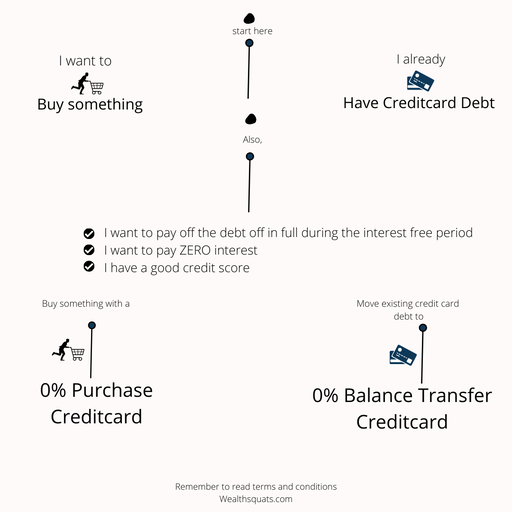

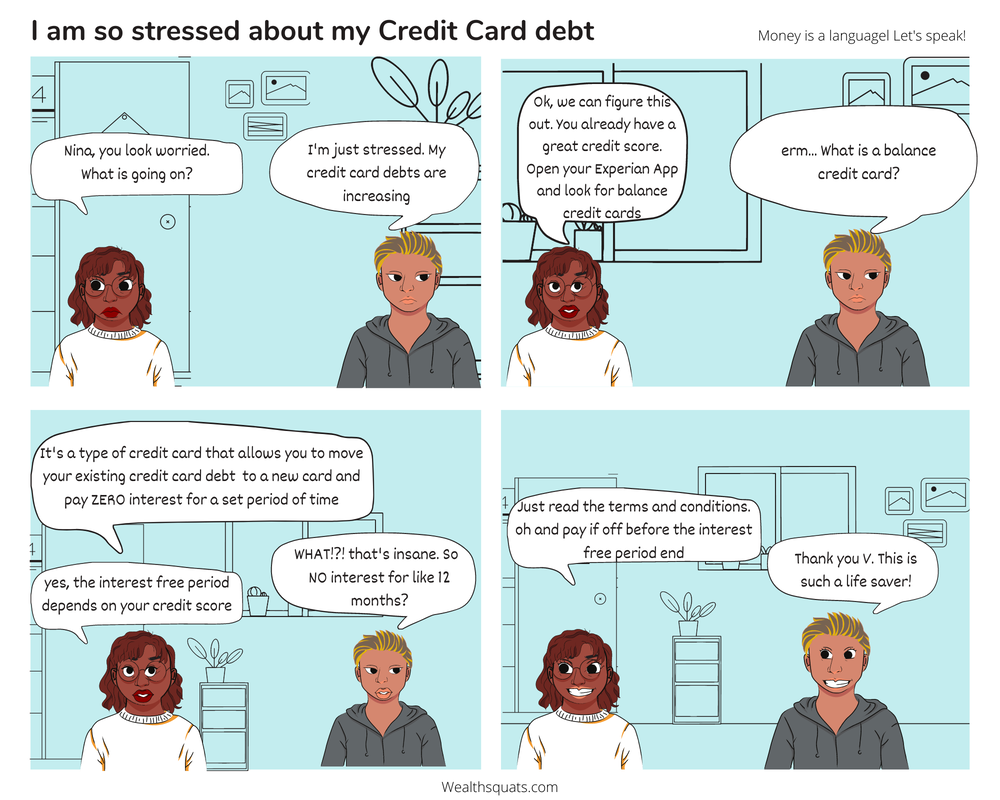

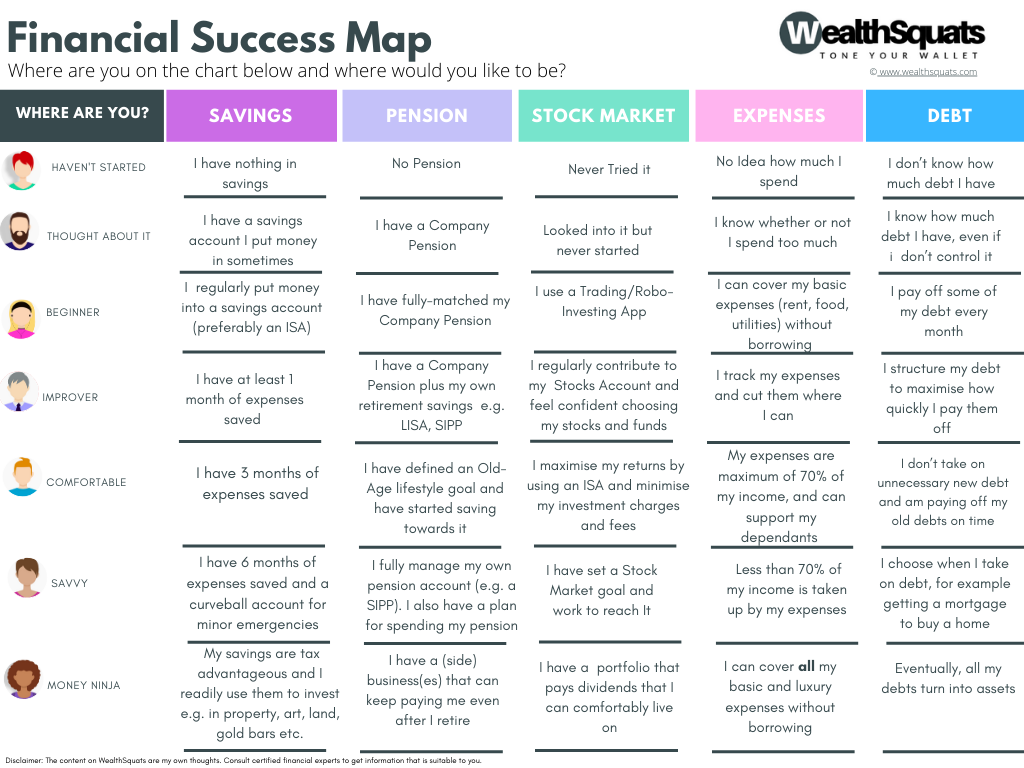

Pay ZERO interest on your Credit Card debt11/20/2020 When you get a credit card, the one thing of concern is the interest rate. Unmanageable and very high interest rates can be a problem when managing our money. While credit card companies make money off of high interest rates, we can sometimes struggle to keep up and are left with high repayments and bad credit scores. If you have credit card debt or want to make a big purchase, keep reading to learn how to pay off your debt and no interest using Balance Transfer and Purchase credit cards. Let's change the game In this post, we learn how to pay zero interest rate using credit cards. This applies if you 1) already have a high credit card balance or 2) you want to make a large purchase. There are rules to play by but learning this technique can put money back into your pocket as opposed to putting the money in the lenders account. Key Points Balance Credit Card Move debt from your existing credit card to another and pay ZERO interest during the interest free period Purchase Credit Card Buy goods or services and pay ZERO interest during the interest free period Your Credit card should be doing this for youA credit card is a type of unsecured debt that is to pay for goods or services. If you are able pay in full, you credit card helps you build a good credit score and puts you in good financial health. If you do not pay in full, lenders charge high interest rates and the debt can grow if it is not managed. Make sure your credit card is giving you one of the following. You can contact your lender to discuss options available to upgrade your card.

Read More The Good and Bad of the Credit Card How to build a Credit Score Use a Balance Credit Card to pay ZERO interest if you already have credit card debtA balance credit card is a product that allows you to move your leftover credit balance onto a balance credit card. Doing this allows you:

An Example: The good and less good way of using Balance Transfer Credit Card Jess has £5,000 in credit card debt to pay. So far, Jess pays the minimum per month and also pays interest. Jess wants to pay this debt off in 18 months and has been working on improving her credit score. Jess looks online and see companies like Virgin money, Halifax, HSBC, M&S and more who have balance transfer offers. Jess applies and moves her balance to the new balance card. She makes sure she pays the minimum each month to retain the interest free off. By month 16, Jess has paid off all her debt. She closes the account with no penalty and moves on with the rest of her glorious life. THE OUTCOME: Jess pays off ALL of her debt and ZERO interest. If Jess only paid £3,000 during the 18 months, the left over debt of £2,000 will incur an interest rate of e.g. 20%. THE OUTCOME: Jess pays down SOME of her debt and pays HIGH interest on the remaining debt Use balance credit cards if:

Tips Download Clearscore or Experian. Depending on your credit score, they can pre-approve you for balance transfer credit cards. This means based on the information they hold on you, you can find out which card and terms you are eligible for. I checked with some friends and found that the better your credit score, to larger the interest free period you can get. So a friend with a relatively lower credit score, could get balance transfer cards with a maximum of 6 months interest period and another with the highest credit score was eligible for 29 months. Mind you, the credit limit you get will depend on your credit history. When searching for a balance transfer card, keep an eye of on the following so you pay less:

Use a Purchase Credit Card if you want to make big purchases and pay it off in a given time

A purchase credit card gives similar benefits to a balance transfer card.

What's the difference?

Back to Blog

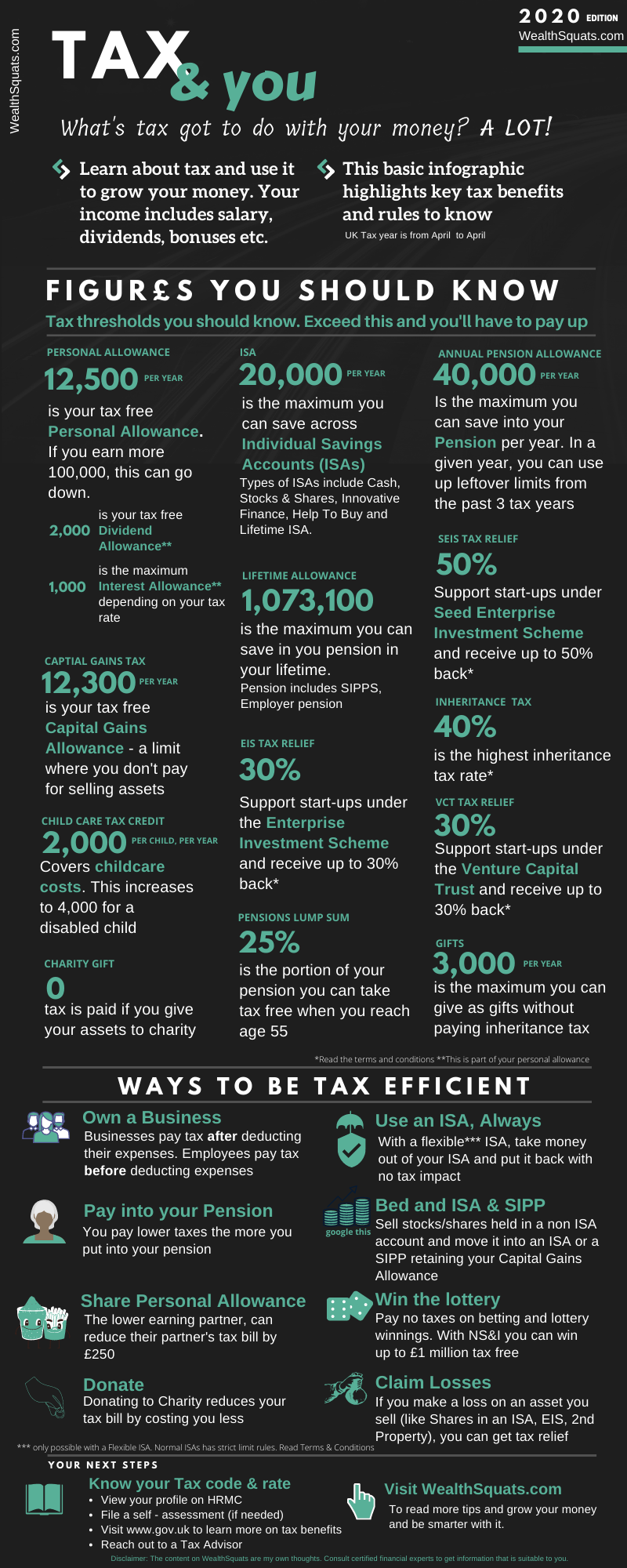

Tax is part of our lives whether we want it or not. It touches our income, contributes to our society, our healthcare, education, roads and more. In this post, I spend some time looking at the UK tax rules to find out which benefits we could use to grow and protect our money. I put my basic findings in an infographic to make it simple [Scroll down to view]. So let's learn about tax so we no longer label it as highly-confusing and downgrade it to somewhat confusing (a much better space to be in). [Quick definitions] The Tax WebThroughout this research, I found that Tax is actually not hard to understand on its own. The confusion comes when you have to consider all parts. Take this example: You have an income over the personal allowance threshold whilst saving for a pension and a home which your family will support you with a deposit. I call this the web because to understand your tax position, you need to understand the Tax rules for income, pension, stamp duty tax and gifts. No wonder you and I shun this topic...but to our own wealth demise. Did you know that if you make a loss when you sell your home, shares in an ISA, or a personal possession worth £6,000 you can get a tax relief? Imagine that getting paid when you lose. These are the kinds of helpful money tips I want to know about (I've added much more below). Get Clarity If you work for an employer, your income tax is typically handled by your company. If you are self employed, you'll file paperwork on your own or via an accountant/certified tax advisor to pay the appropriate tax and claim relief. Anyone can reach out to an accountant or tax advisor on tax matters. Before we move on, one question. What tax rate payer are you? If you don't know the answer, keep reading to find out. What Tax Rate Payer are you?

Your income determines how much tax you pay. The UK uses a progressive tax system, where the more you earn the more you pay in tax. So, if you earn up to £12,500 per year, you'll pay £0 tax. On the other hand, the highest income earners pay up to 45% of their income in tax. This can be very difficult to accept which is why many people look at ways to legally reduce their tax bill by using some of the options outlined in the infographic such as increasing payments to their pension, using ISAs to prevent being taxed again or not taking out dividend income for a given tax year (deferring it). Some others flee the UK to low tax rate countries. Just know that your tax solution or option is unique to your personal circumstance. Find out what tax rate payer your are here. TIP More tips & resources

Remember this: Get Tax Advice

Videos on Taxes

Back to Blog

NS&I have cut Interest rates meaning you get less back for your money. There is speculation that other bank/lenders will follow NS&I's lead. This means that holding a lot of your money in cash will not make you rich anytime soon. What else can you do with your cash?

Back to Blog

Leaving university can be an overwhelming and stressful time for students and I firmly believe that Personal finance does not have to be one of these issues. The truth is, all you need are a few basics to set you up for life and luckily, these are not complicated. Looking back I wish I had someone to teach me personal finance whilst at university and so in this post, I share my experience, key tips and hacks related to budgeting, saving, investing and borrowing. Key points

University is a fantastic starting point to begin building a brilliant fiancial future because students have the benefit of time to apply their skills to do meaningful work My Experience I know from my experience, even with a degree in economics and a job in banking, I could use someone discussing money with me. It has been one of my goals to bring this valuable knowledge back to schools. I launched wealthsquats.com to start this journey. My vision is for all students to make clever financial choices whether it is how much to save, how to manage debt, how to use the stock market, how to be rich or how to have peace of mind about money. This post is my view of how students can get started on their financial journey. The first step is to set up some money goals that you want to acheive. When I began this journey, my goal was to track and increase my net worth. As I progressed, I increase the amount of money I paid into my company pension from 3% to 5% to benefit from company matching and I opened a Stocks & Shares ISA to get involved in the stock market. Will you be self employed or work for an employer? Many students will choose to work for themselves as the freelance and consulting industries continues to form a significant part of the UK economy. Others and the likely majority will find jobs with employers for instance through graduate schemes. As a student, what does it mean to be self-employed or employed? Self employed

Company Employed

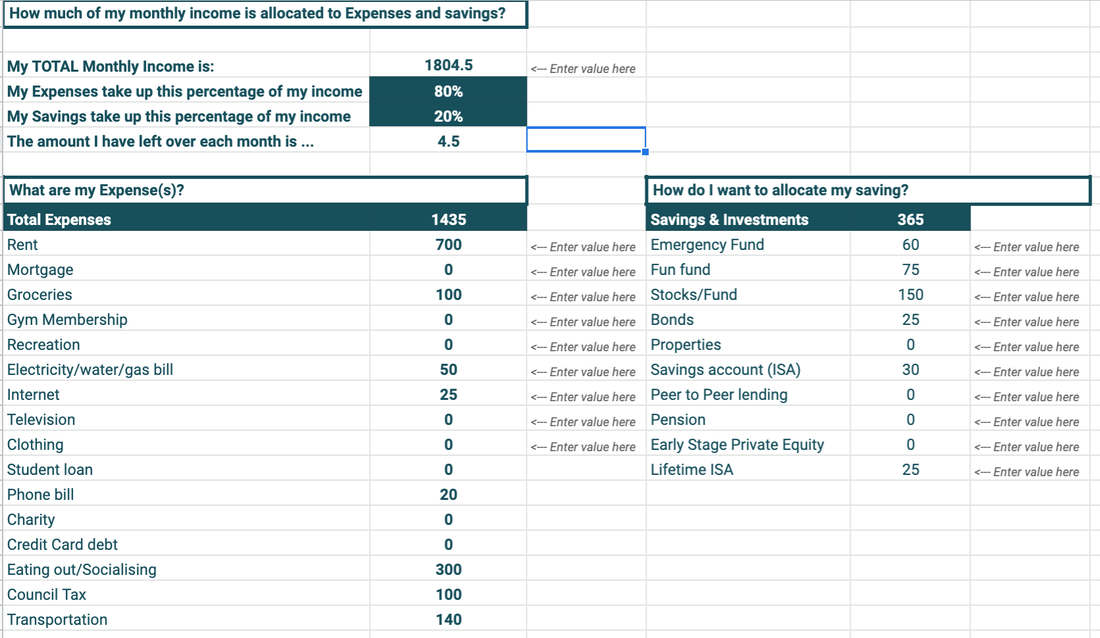

The first financial decision you make as a Graduate is what Salary to choose Let's use the example of a student who will be employed in London. The salary this student can expect to get in London is around £29,000 - the average annual salary for graduates in London. Of course depending on the role, sector and negotiation, this figure can vary. It is important to know that the salary you choose will form the basis of how much you can save or invest. If you are able to have other sources of income, your savings and investments can expand accordingly. The salary you choose upon graduation will form the basis of how much you can save or invest What could be your salary? Using the salary calculator, If you make, £29,000 a year your actual take home pay is around £1,800. As a working member of the population, you will start to contribute to the wider economy via taxes and national insurance. In addition, your company will likely have a pension plan which is deducted before you receive your take home pay. Also, if you have student loans, these will be deducted as well. For 2019/2020, the personal allowance - which is the amount of money on which you do not pay taxes on is £12,500. So what is likely to be your take home pay?

Your TAKE HOME PAY (salary after tax) is £1804.50 Next, we deduct your expenses?

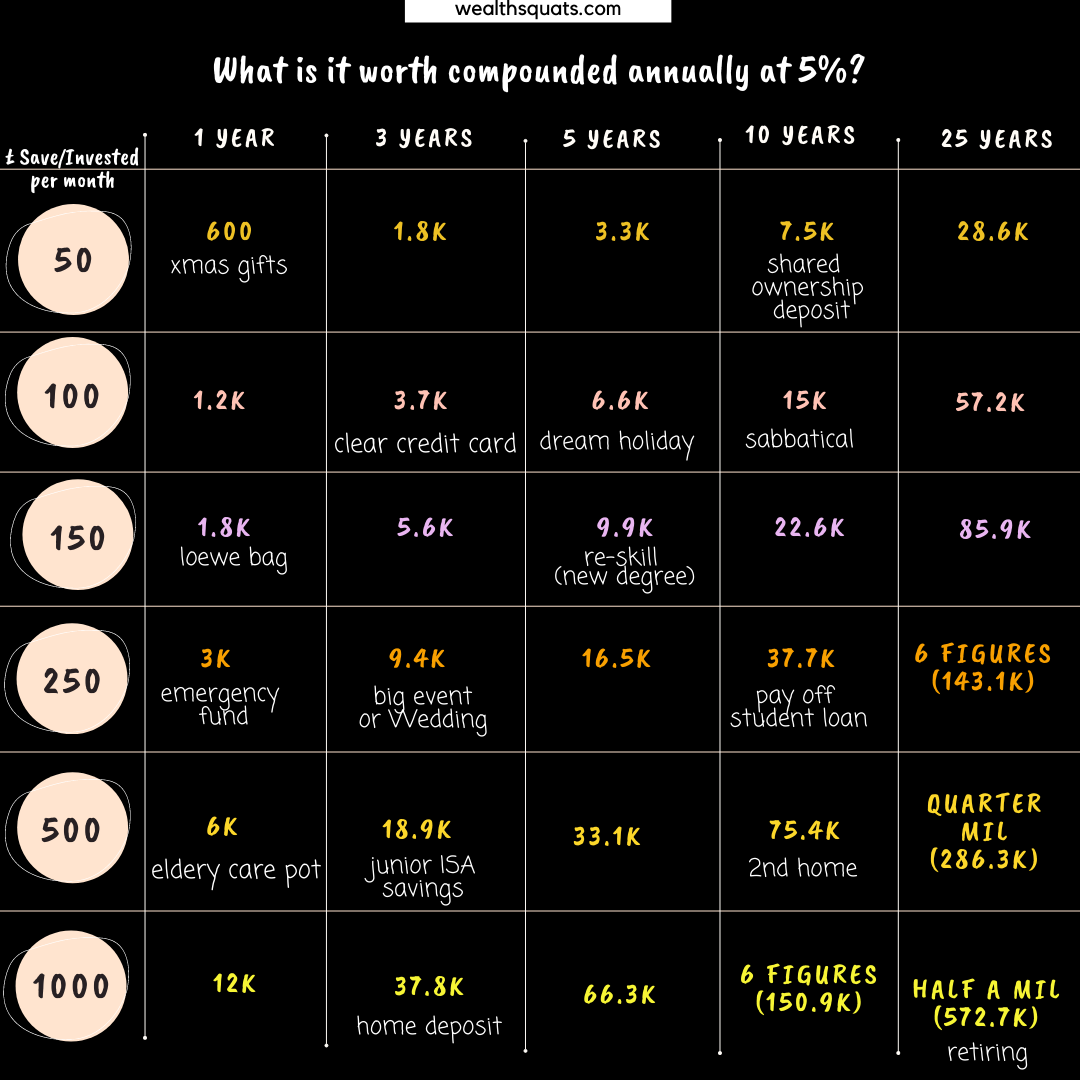

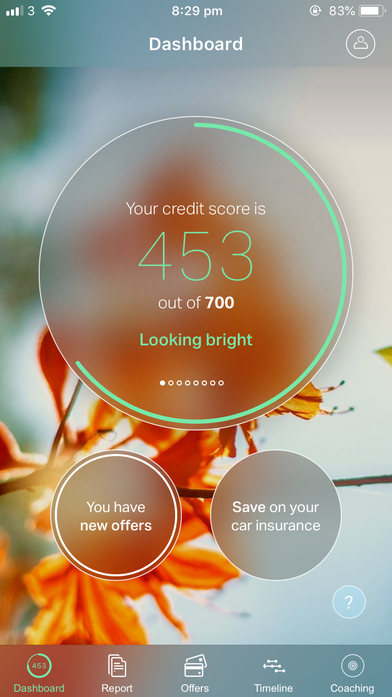

Your TOTAL EXPENSES: £1435 What is LEFTOVER: (£1804.50 - £1435) = £369.5 Most people do not get rich by winning the lottery or via inheritance. For many, they just saved in assets that grow over a long period of time. What steps can I take to build a brilliant futureAs a student, it is from the £369.5 that you can start to save and invest. The expenses example above is just an example of what you can have to build a great financial future. This amount is much higher than what I began with and I focused on investing in things that grow. Step 1: Choose how much to save and where Here is how you could save or invest £369.5. £60 Emergency Fund (Cash Savings) £30 Oops account (Cash Savings) £75 Travel & Fun account £150 Stocks & Shares £25 LISA £25 Bond Account (5 years) TOTAL SAVINGS & INVESTMENTS: £365 To maximise your savings, continue to invest each month (automate this process) and keep tracking your performance. Most people do not get rich by winning the lottery or via inheritance. For many, they just saved in assets that grow over a long period of time. In my experience, I have found my pension to be one of the fastest way to grow my overall net worth this is because if I put in 5% of my salary, my company matches it by 5% so I get 100% increase each month on my pension savings. Step 2: Step up a budget Entering your savings and expenses into the WealthSquats tracker, you can see that your expenses make up around 80% of your income and you are only able to save around 20%. Now you can take steps to creatively think about how to increase your savings. In my case, I moved to a cheaper room to reduce my rent after reading that rent should take no more than 30% of my income. Thereafter, I significantly reduced my eating out and put every extra savings into cash savings or the stock market. Today, I still continue to find ways to optimise. There is a rule of thumb that says, wealth creators save 30% of their income and spend 70% on expenses. This rule is a rough guide but can help wealth builders like yourself to control your outgoings. I do not believe in budgeting and suffering, we should still live a good life no matter what income we have so it is crucial that you add 'enjoyment' into your budget so you do not restrict your self from doing what you like. Every month, I make sure that I save or invest my target amounts and once I've done that, I am free to spend whatever is left as I please! Step 3: Control your Debts Debt is another expense that can significantly reduce your ability to create wealth. I suggest you read this post on how to spot good and bad debt behaviours. To summarise, save and invest in things that grow Wealth building is fundamentally about saving and investing in things that grow. With this in mind, use the tips below to build that brilliant future.

Once you've got the hang of this, your money goals will evolve and you'll already have the wealth building basics. What to consider when deciding on your first salarySelf employed

Company Employed

So what choice will you make?

Remember to share these tips with your friends and start taking active steps to build a wonderful financial future. Get in touch if you have more questions.

Back to Blog

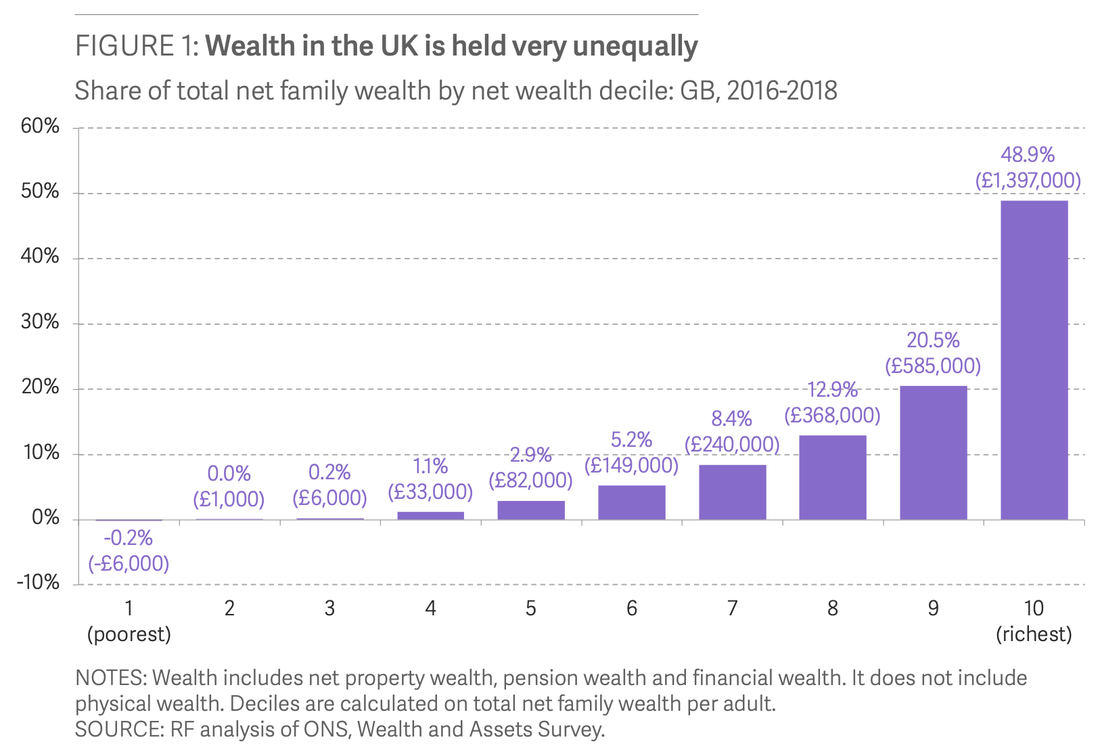

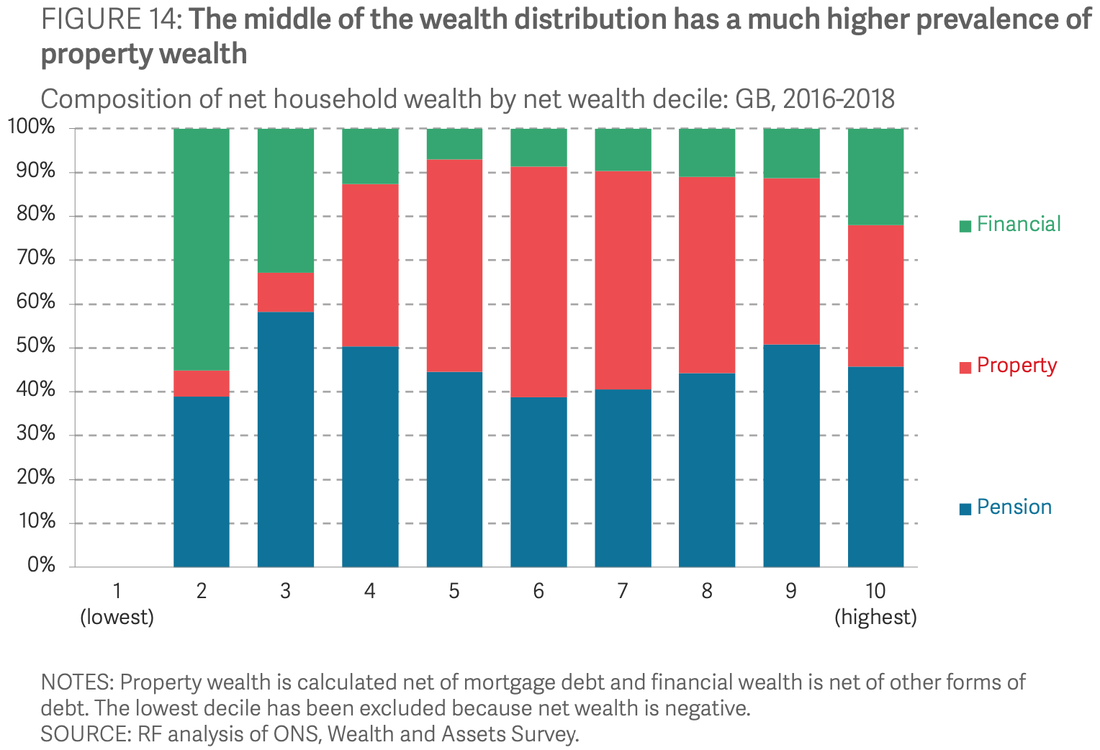

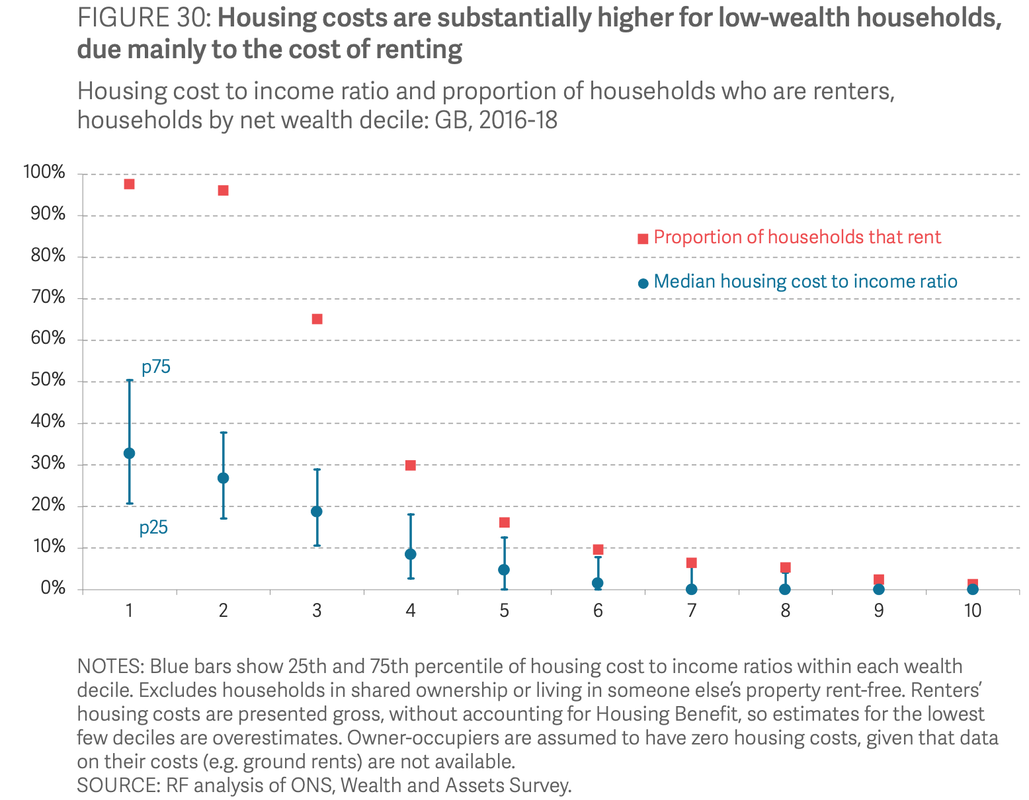

Why do the rich pay less for housing month on month? How do they make their money grow? How many of them can survive one month without a pay-check? I read the 2020 report from Resolution Foundation on wealth in the UK to see what research says about how to be rich in the UK. Keep reading to see the surprising answers. First, a quick recap: What is Wealth? Wealth is your assets (An asset: is a thing of value that grows e.g. savings, pension, real estate, art, gold etc.) minus your debt. We also call this your net-worth. In this study, 4 types of wealth were measured:

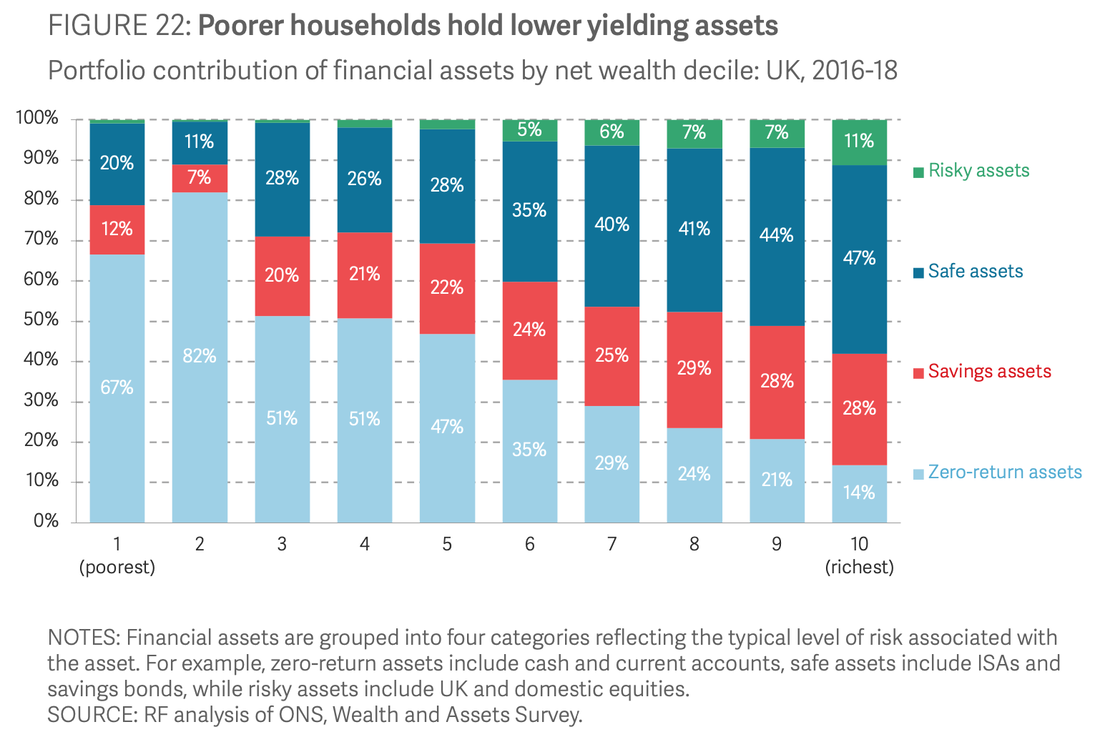

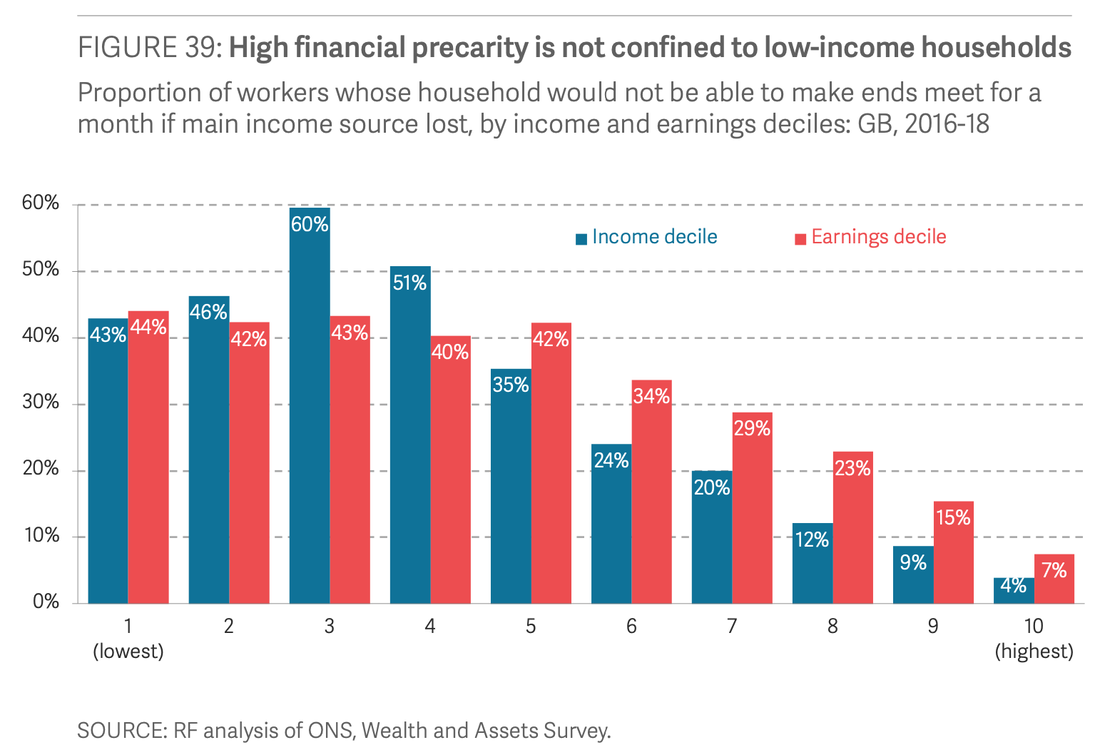

So, how do the rich manage their money?The top 10% have about 50% of UK's wealthThe average net worth of the 10% is £800,000. But, where do they grow their money? Keep reading to find out.Do it like the Rich: When it comes to financial assets, the Rich hold less cash and more of their money in growth assets like savings bonds, ISAs, and Stocks and Shares.Poor households hold most of their money in cash or current accounts where there is very little growth. When the rich hold money in savings bonds, ISAs, and Stocks and Shares, they benefit from:

Do it like the Rich: The Rich have about 45% of their money in pension pots, 35% in property and 20% in financial assets (savings bonds, ISAs, and Stocks and Shares) Financial wealth (in high growth assets) increased substantially in the last 10 years and this contributed significantly (80%) to the overall wealth of the rich.As mentioned above, the financial assets of the rich are held in growing assets like bonds and the stock market. The Stock Market grew substantially in the past 10 years and it made the rich richer. The poor held most of their money in zero growth assets e.g. cash or current accounts and even when they added more money in these places, it grew at a much lower rate. Do it like the rich: Richer families tend to be homeowners Their housing costs are around 5% of their income if they own their home outright or 11% of their income if they have a mortgageDo it like the Rich: The Rich have emergency funds 7% of the rich would have a hard time if their main source of income is impacted as opposed to 44% of the poor.An emergency fund allows the rich to stay afloat if a shock like a pandemic or job loss takes place. Young females who are not degree educated were the most at risk if their income ran out. Do it like the Rich: There you have it. Some insights into the habits of the rich. Of course there are other ways to get rich, such as owning a successful business, investing in start ups, inheriting money or owning art for example. The options above are the accessible ways to start to build wealth and is the reality for many everyday people. See this infographic on how to spend £2000 which highlights the step by step guide to implementing the lessons above.

Which Rich habit will you start to use?

Back to Blog

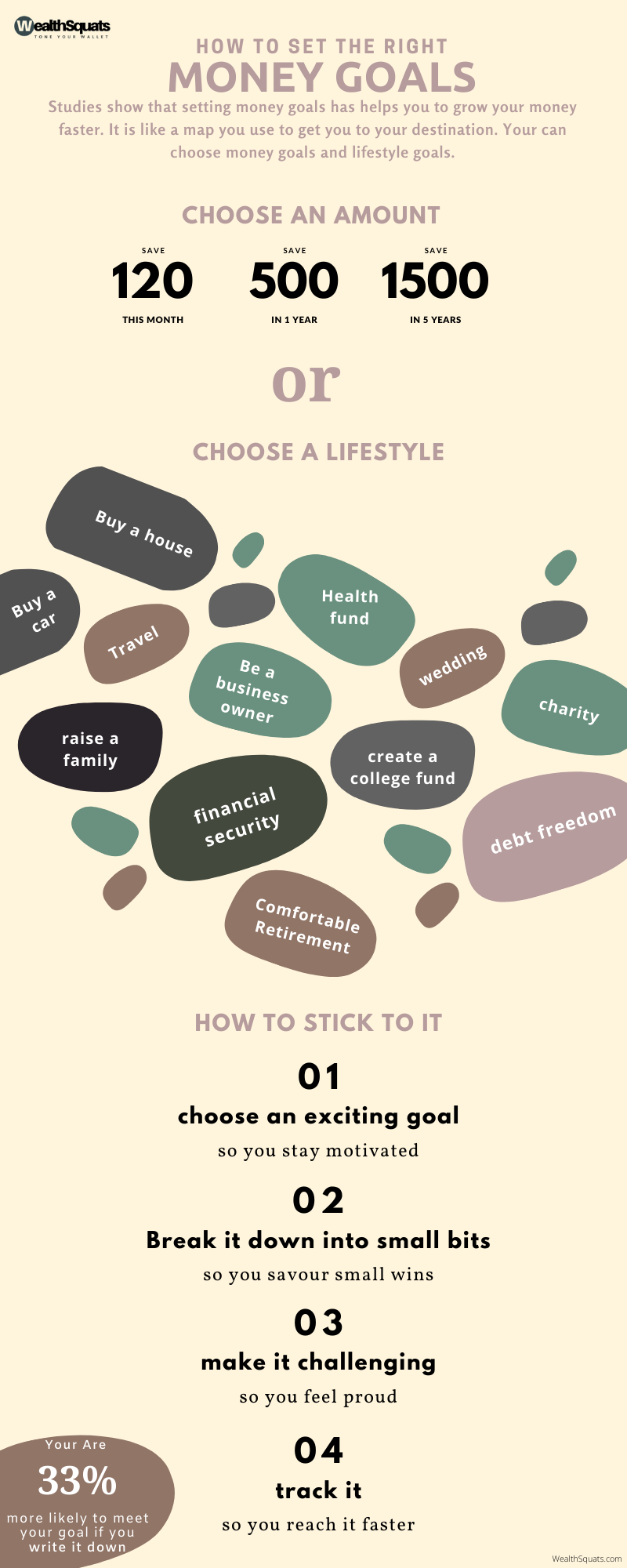

What do you want to be when you grow up? What is your 5 year plan? What are your career goals? What are your relationship goals? We've all heard this at one point in time and I wonder, why do we not also ask: WHAT ARE YOUR MONEY GOALS? if you are the kind of person that writes your life goals, does it include money goals? Research has shown that writing your goals down can make you reach them faster. Keep reading to find out how you can incorporate this money habit for success. What you need to know

I asked 5 readers to share their money goals:I asked 2 questions: 1. What makes you want to save and invest 2. What DOES NOT make you want to save and invest Click on the images below to see their responses. The research and experience of writing money goals Every year, I write my money goals down. So far, I have found that I met them before or after the deadline I had initially set. I believe that there is some magic to writing things down. Once you write it down, it is autosaved in your brain and then somehow, you start to focus consciously or unconsciously to make it happen. My experience aside, research has shown that setting goals makes you more confident, motivate and in control - no wonder employers use performance reviews to set and monitor targets- they know that if done well, it motivates employees and can also help their business grow. If you want to actually make it happen, start by writing them down. 'A study by Gail Mathews, found that you are 33% more likely to meet your goals if you write them down, share it with a friend and review it frequently'. Want to meet a money goal? write it down. How to Write a Goal that you stick to (4 ways)1. Choose an exciting goal According to Business Insider, 'Instead of being afraid of your finances, focus on the goals that excite you'. Why? when you choose an exciting goal, you stay motivated to make it happen. Here are the types of goals you can write down: Types of Goals

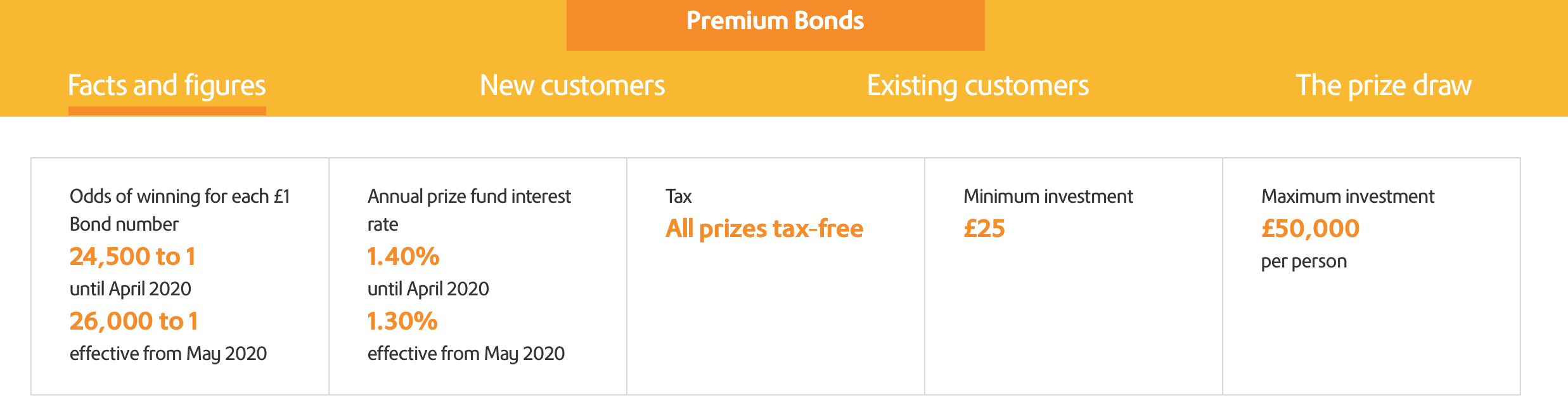

2. Break it down into small bits Big goals can feel overwhelming and when it comes to money goals it is important to break it down. A Harvard study explains, 'When we’re judging the difficulty of a goal, the first thing our brains see is the size of the gap that separates the goal from the baseline. The bigger the gap, the more difficult the goal' For example, if you are planning that trip to tour the East Africa and it would cost 2000. Saving 2000 might today can feel challenging. To make progress, you can break it down to save 100 a month and add more in months where you can. After 5 months, you'll have 500 saved and have covered 25% of the cost. With an exciting goal ahead of of you, you can celebrate the small progressive wins and that is key, 3. Make it Challenging If the goals is too simple, you won't be satisfied. Research has shown that you achieve 'greater satisfaction from achieving goals that help you improve as opposed to maintaining the status quo'. So, If you are dedicated to clearing your 3 credit card debts of 2000, 1000 and 300, you'll likely be more satisfied clearing the 300 than paying off the minimum for each month which would make you feel like you are not improving. Going back to the readers response on What DOES NOT make you want to save and invest? I noticed most of the response was about making sacrifices today so they can enjoy tomorrow. I think this is another crucial element of satisfaction, delaying gratification, allows the reward at the end to be more enjoyable. 4. Track It Truth session. Years ago I began tracking one specific money goal. Since then, that number has increased by a whopping 4024% to be exact. How come? What you cannot track, you cannot measure. Remember the research I mentioned earlier, it said, if you share your goal with a friend on a monthly basis, to keep you accountable, it happens. My friends are my spreadsheet, MUTAZ, and you readers of this post. I review my spreadsheet monthly to check how I am doing. Tracking helps me to stay focused and also allows me to think of new ways to reach my goals faster. Grab a copy of the WealthSquats smart budgeter to write and track yours. Need help on where how to start tracking? Use Financial Success Map to make a plan.In Summary

Back to Blog

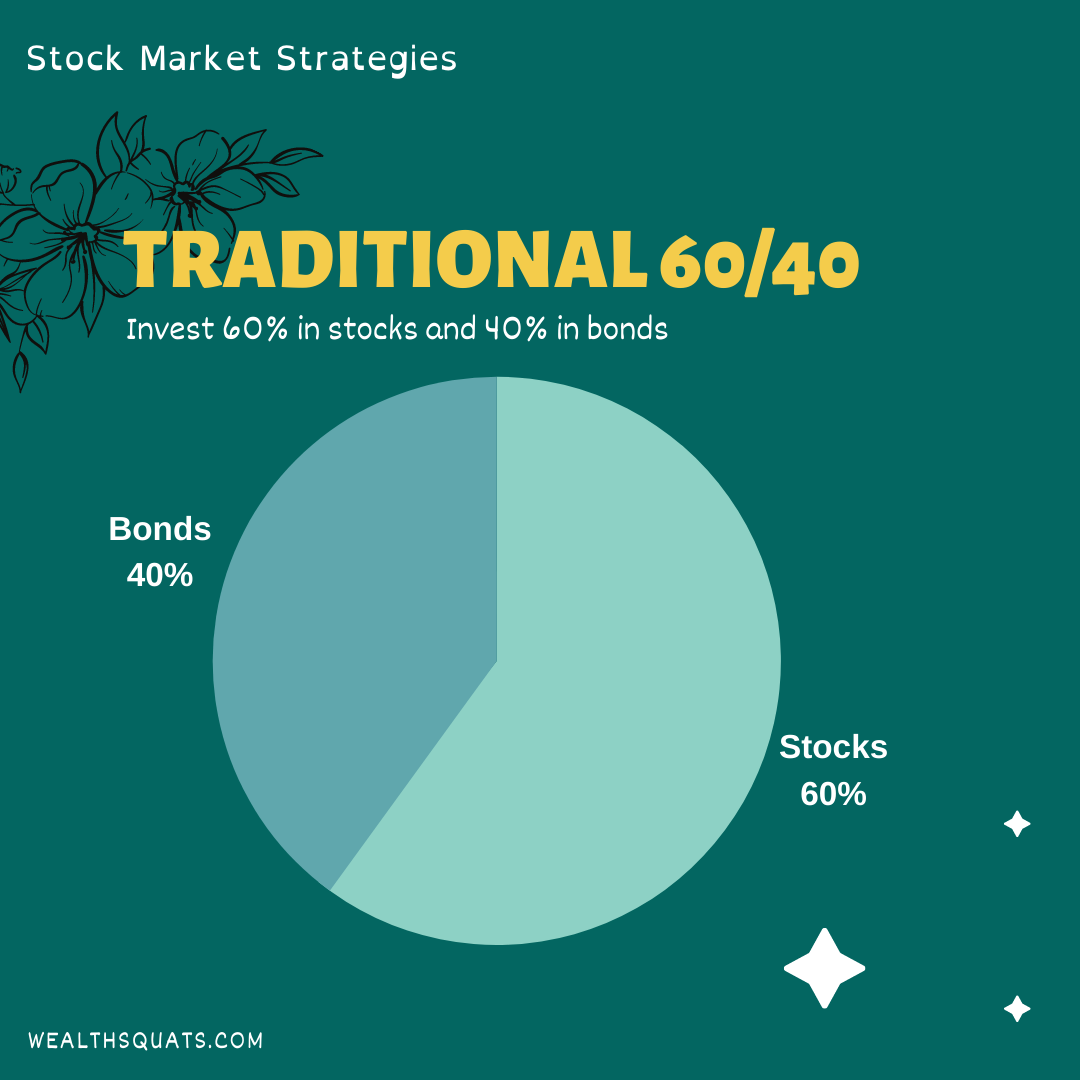

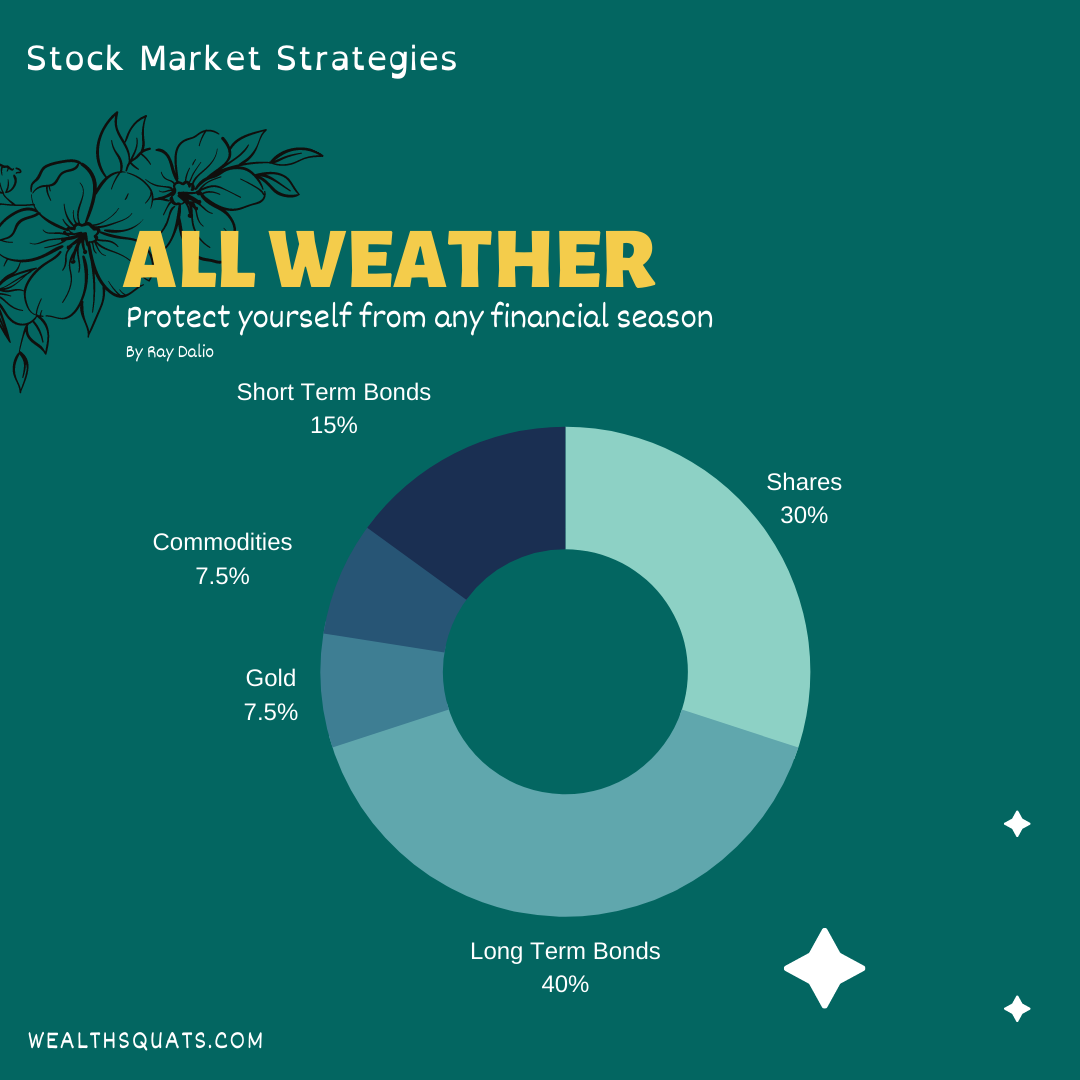

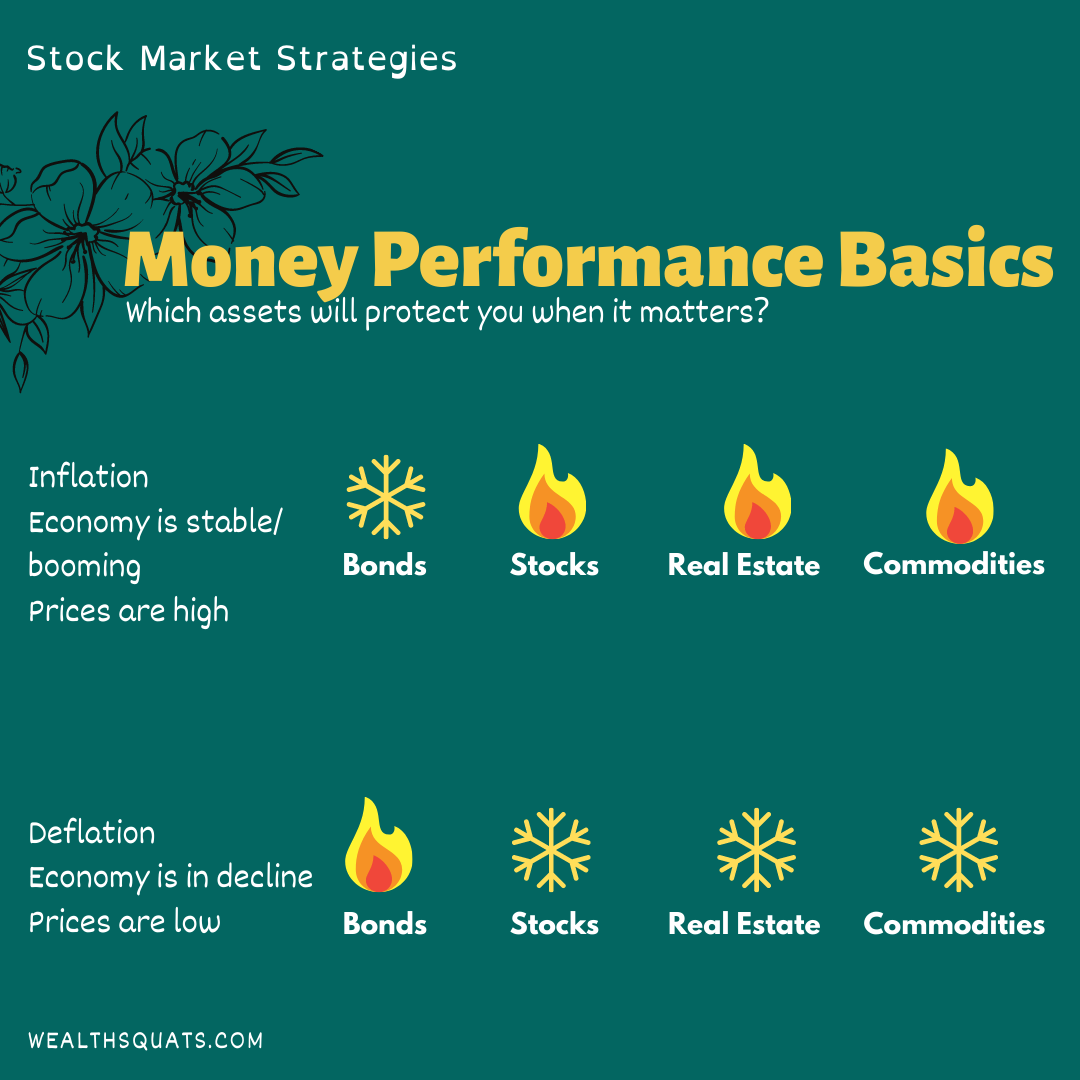

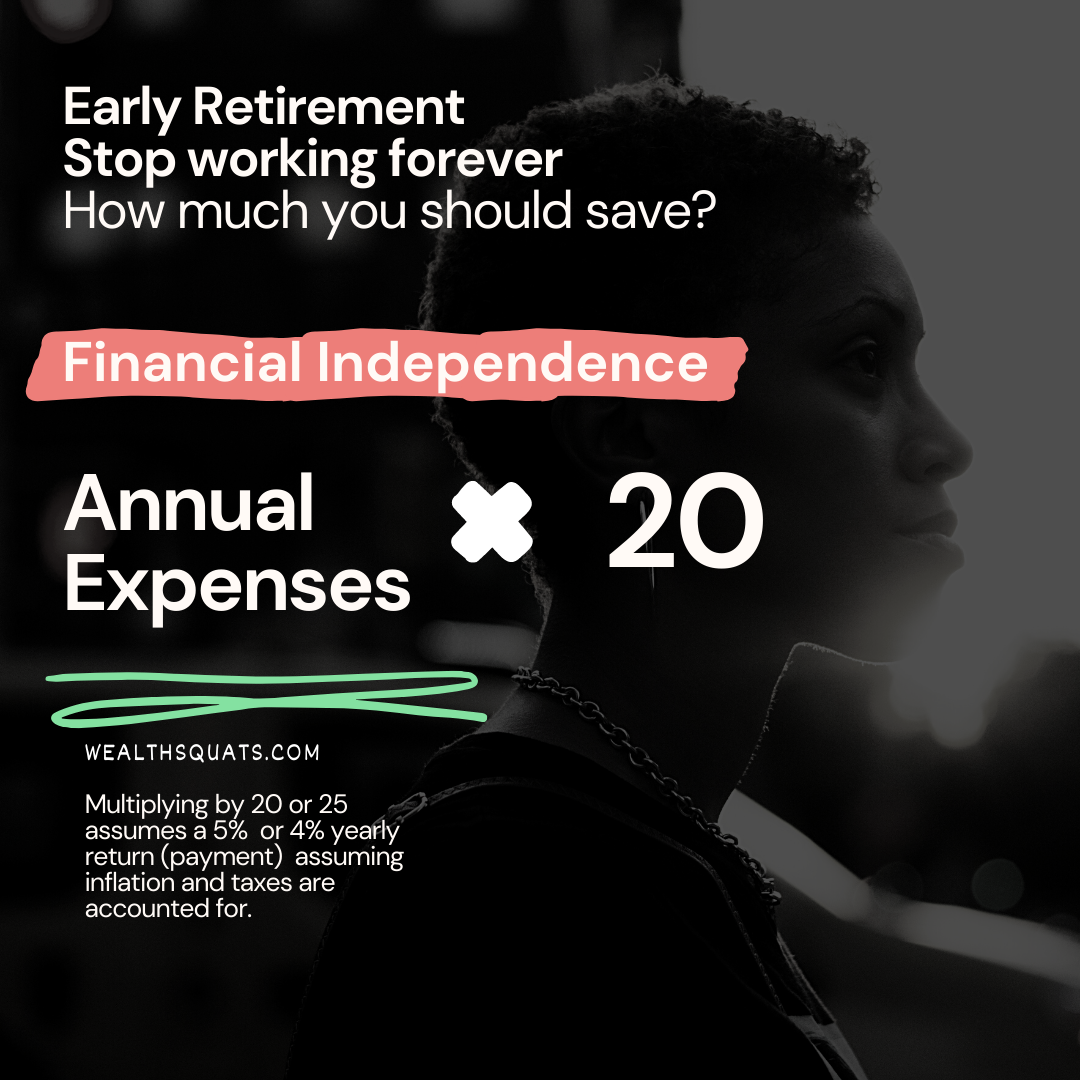

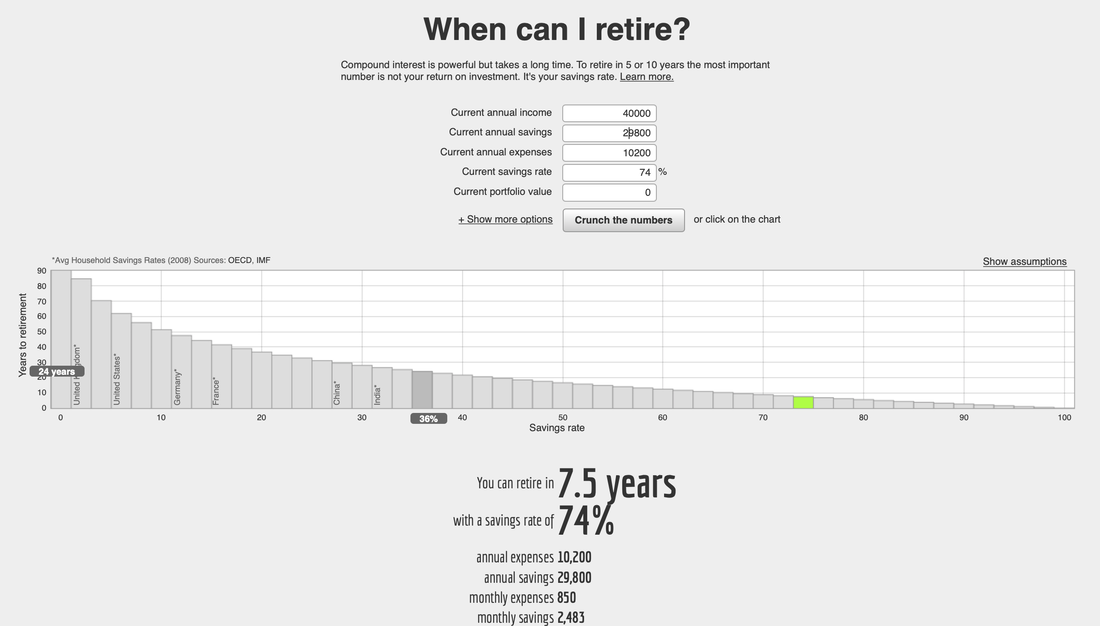

This amount of Stocks will make you rich7/20/2020 The sweet spot for many stock market investors is knowing where to put their money to make it grow consistently over time. When you are new to investing it can be difficult to know how put your hard earned cash to good use. This post explores 4 methods everyday investors can use to know how much stocks, bonds and commodities to hold. Where you choose to put your money within the stock market can make a BIG difference to how your much and fast your money grows. Inspite of the risk, the stock market remains a viable option to increase your wealth, beat inflation and get better interest rates than what your bank. So, the question is how should you spend your money in the stock market? Keep reading to find out:

First, some quick definitions. Methods/strategies: can be a rule or way of doing things to achieve a goal. For example, a high risk strategy will be focused on growing money very fast and could choose to put investments in riskly companies. A low risk strategy is focused on protecting money from loss and an investor can choose bonds Portfolio: think of it as a folder that holds, a certain amount of stocks, bonds and commodities (gold, oil, coffee, silver) An asset: is a thing of value that grows e.g. pension, real estate, art, gold etc. Inflation: the price of things you buy go up. So you'll need more money to get the same amount of the thing you buy or you get less of the thing you want with the same amount of money How much Stocks should you own forever?1. 100 Age rule Your Age minus 100 is how much you should put into stocks. The premise of this approach is that is the younger you are, the more risk you can take. So, if you are 25 years old, you should have 75% in stocks and 25% in bonds. As you get older, you will want to take less risk with your money so you will move towards having more bonds (which are seen as less risky and provide lower returns) and less stocks (relatively seen as more risky because share prices can go up and down frequently). Some investors are taking this rule one step further and making it 110 or 120 minus age to take more risk. For women, who live longer on average, this could be an approach to make sure their investments last throughout their lifetime. As with every rule of thumb, this rule does not factor your individual circumstance or preferences. 2. The Traditional 60/40 ruleThis is the traditional method of investing. The idea is to have 60% in stocks and 40% in government or corporate bonds. This method allows you to take some risk but also allows you to get regular income when the economy goes down. As your stocks and bonds rise or fall in value, experts suggests to maintain this ratio at least once a year by selling and buying the respective bonds or stocks. This rule has performed well over the past decades but following the 2008 financial crisis experts are asking - how will it perform over the coming decades? 3. The All Weather I came across this rule when reading Tony Robbins' Book Master the Money Game. Tony reached out to Ray Dalio of Bridgewater Associates to answer this question: how should investors spend their money in the stock market? One thing that stood out to me in the book is the notion risk. Ray explained that an investor with the 60/40 portfolio above is exposed to 3 times more risk (the potential for significant loss of money) which comes from owning stocks as they are more risky. Bonds which have a 40% allocation, contribute about 5% risk to the overall portfolio. In response to the reality of the size of these risks, Ray created the All Weather portfolio. He also identified 4 financial seasons that impact prices. These prices change depending on the growth or decline of the economy and inflation (when the prices of things you buy go up). The All weather portfolio allocates an equal amount of risk (25%) to these four seasons. Investors can create the All Weather Portfolio using the strategy shown below. 4. The Dragon Portfolio I learnt of this rule while watching this video on how to build a portfolio that is strong enough to withstand a recession. Artemis Capital Management carried out research over the past 90+ years to find out which strategy made the most money for investors. They concluded that investors should "Find assets that can perform when stocks and bonds collapse, and boldly own them regardless of short term performance". How can we do that? Author Chris Cole, gives the following example: Take assets (a thing of value that grows) X, Y and Z

According to the author Chris Cole, the optimal mix for an investor is roughly 20% of X + Z or Y + Z. You can buy more of each asset when it becomes cheaper during an economic decline and grow your money long term. This strategy is summarised in The Dragon Portfolio. The author found that over 90 years, the Dragon Portfolio generated a 14.4% return with lower risk.

|

| 1. What should I invest in? Low cost stock and bond index funds that capture the entire market. 2. How much stocks and bonds should I have? A range and mix of 25% - 75% that you modify according to your age. If you have more time to invest, you can afford to take more risks. 3. How can I improve my returns?

|