|

�

Archives

September 2021

Categories

All

|

Back to Blog

Why do the rich pay less for housing month on month? How do they make their money grow? How many of them can survive one month without a pay-check? I read the 2020 report from Resolution Foundation on wealth in the UK to see what research says about how to be rich in the UK. Keep reading to see the surprising answers. First, a quick recap: What is Wealth? Wealth is your assets (An asset: is a thing of value that grows e.g. savings, pension, real estate, art, gold etc.) minus your debt. We also call this your net-worth. In this study, 4 types of wealth were measured:

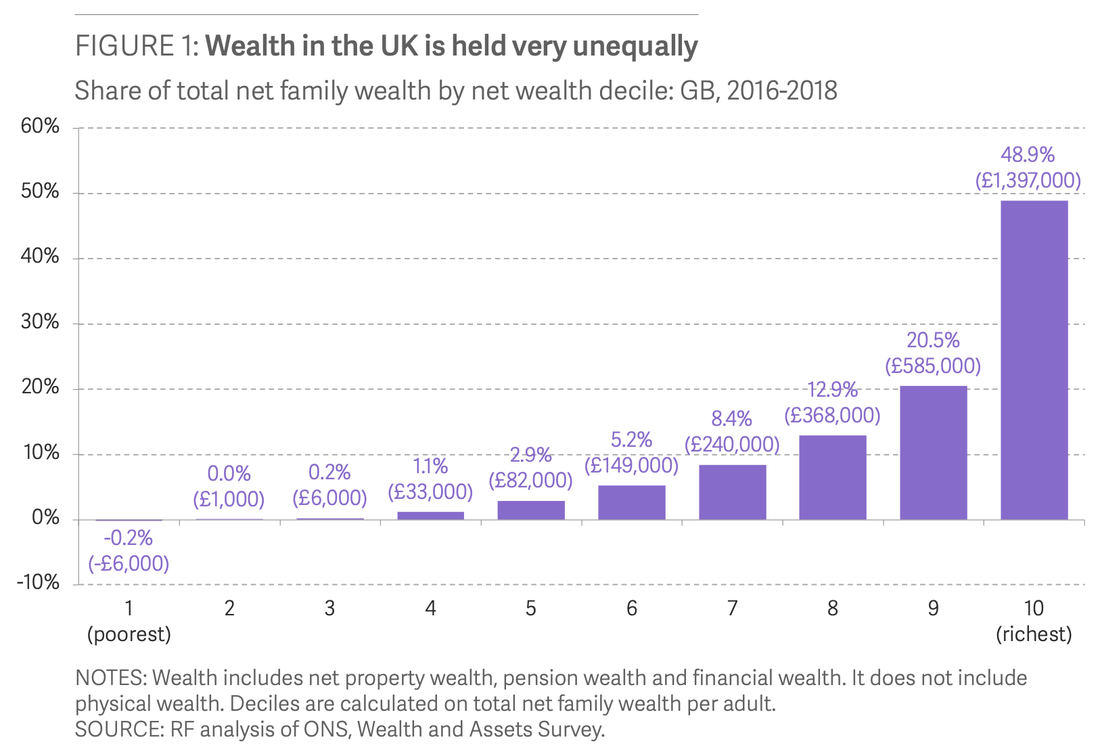

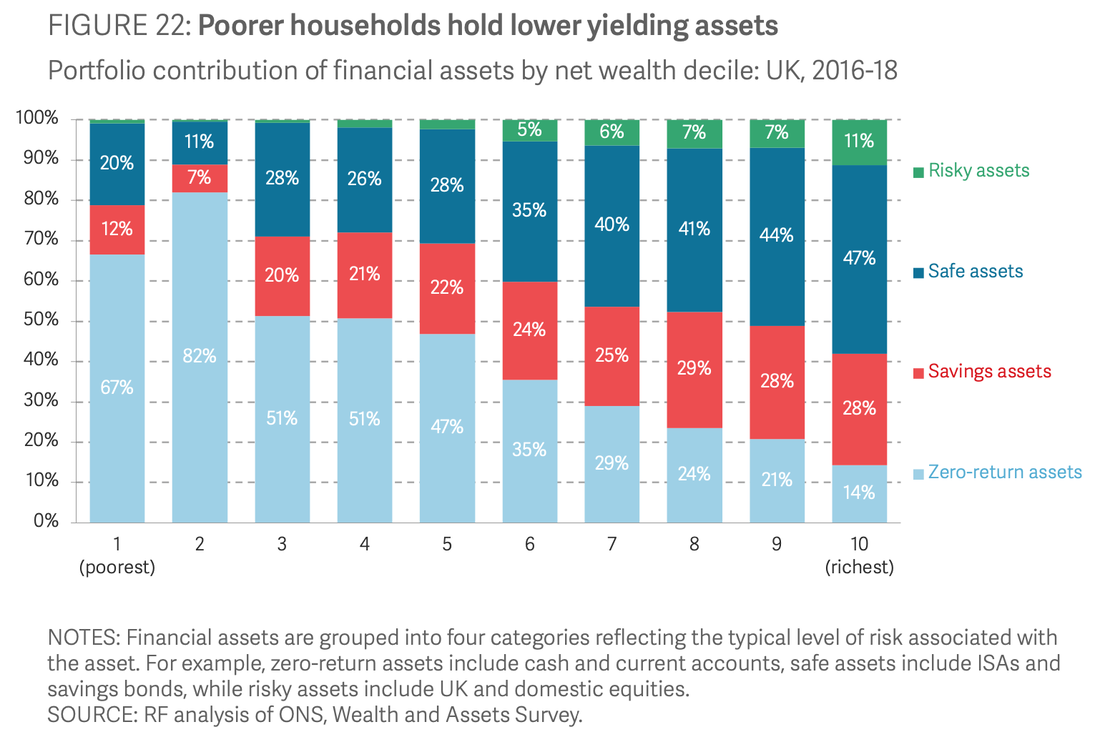

So, how do the rich manage their money?The top 10% have about 50% of UK's wealthThe average net worth of the 10% is £800,000. But, where do they grow their money? Keep reading to find out.Do it like the Rich: When it comes to financial assets, the Rich hold less cash and more of their money in growth assets like savings bonds, ISAs, and Stocks and Shares.Poor households hold most of their money in cash or current accounts where there is very little growth. When the rich hold money in savings bonds, ISAs, and Stocks and Shares, they benefit from:

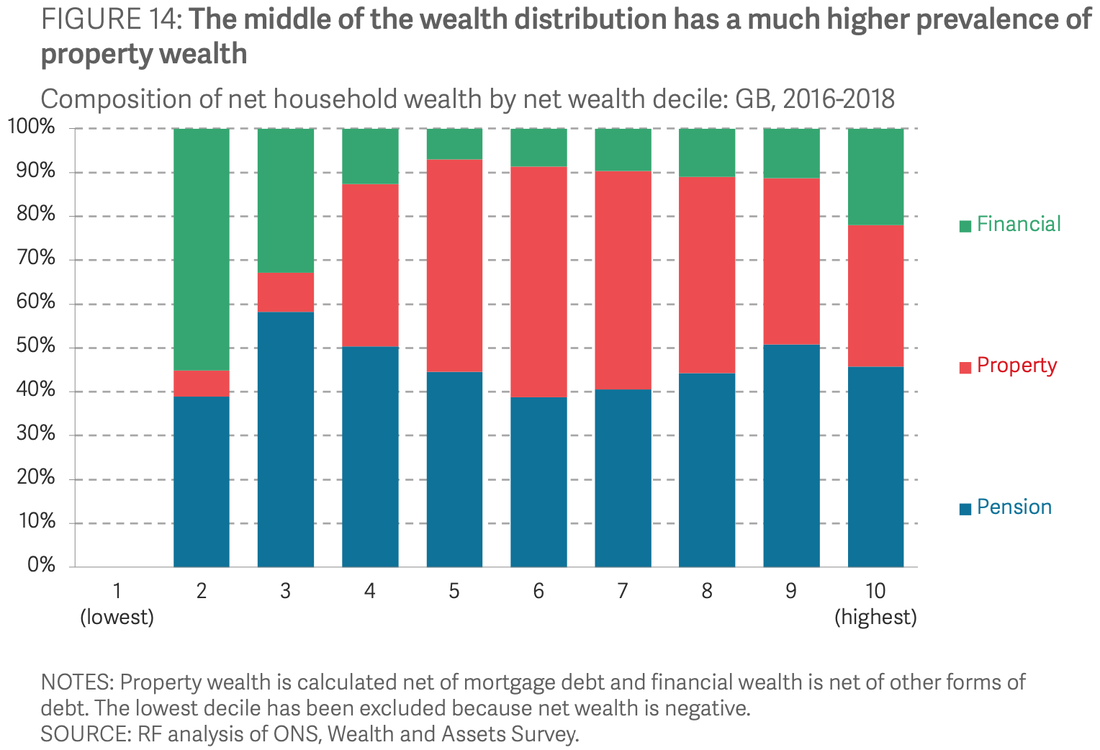

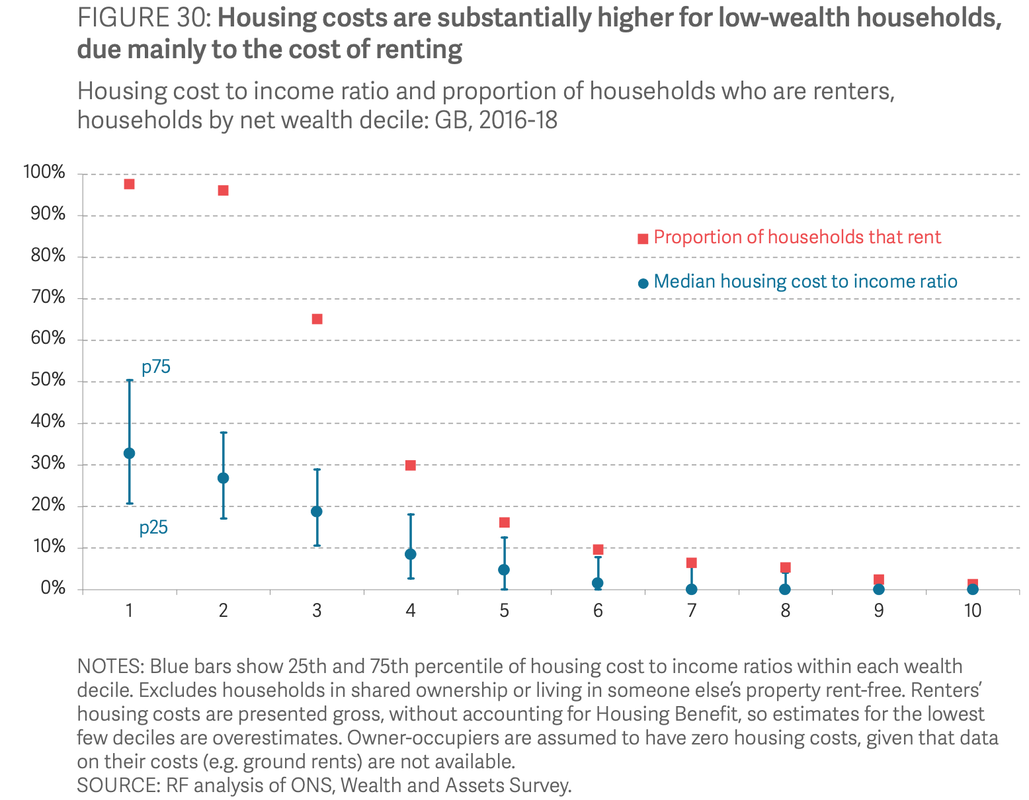

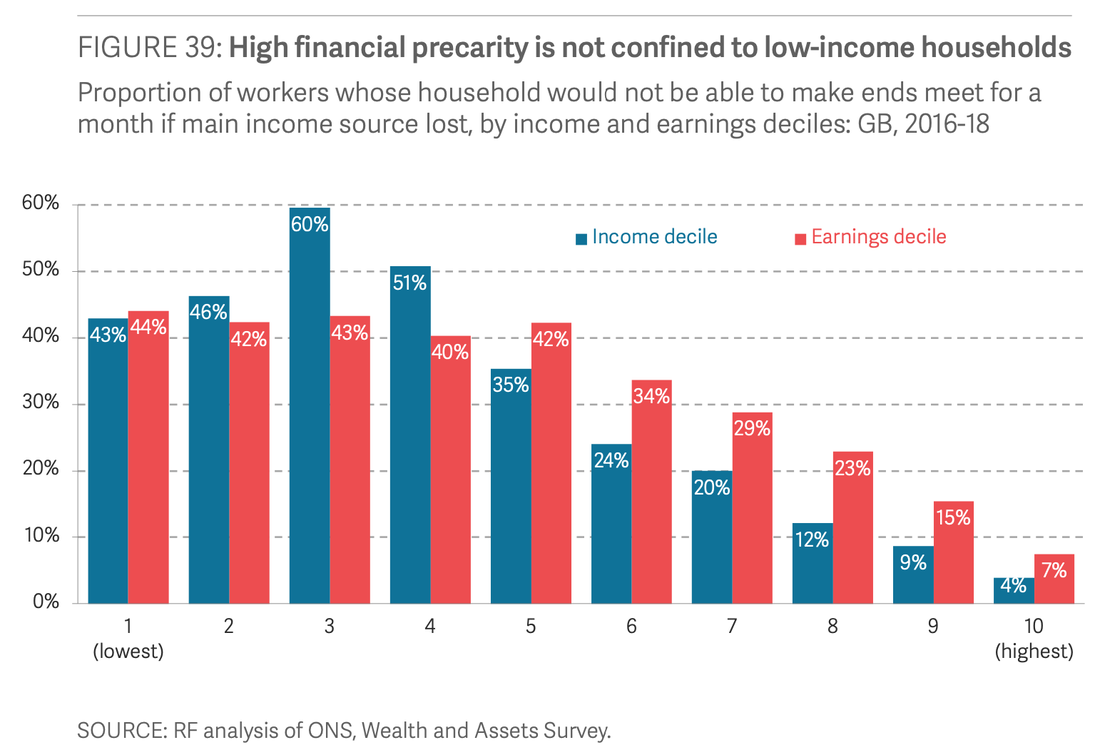

Do it like the Rich: The Rich have about 45% of their money in pension pots, 35% in property and 20% in financial assets (savings bonds, ISAs, and Stocks and Shares) Financial wealth (in high growth assets) increased substantially in the last 10 years and this contributed significantly (80%) to the overall wealth of the rich.As mentioned above, the financial assets of the rich are held in growing assets like bonds and the stock market. The Stock Market grew substantially in the past 10 years and it made the rich richer. The poor held most of their money in zero growth assets e.g. cash or current accounts and even when they added more money in these places, it grew at a much lower rate. Do it like the rich: Richer families tend to be homeowners Their housing costs are around 5% of their income if they own their home outright or 11% of their income if they have a mortgageDo it like the Rich: The Rich have emergency funds 7% of the rich would have a hard time if their main source of income is impacted as opposed to 44% of the poor.An emergency fund allows the rich to stay afloat if a shock like a pandemic or job loss takes place. Young females who are not degree educated were the most at risk if their income ran out. Do it like the Rich: There you have it. Some insights into the habits of the rich. Of course there are other ways to get rich, such as owning a successful business, investing in start ups, inheriting money or owning art for example. The options above are the accessible ways to start to build wealth and is the reality for many everyday people. See this infographic on how to spend £2000 which highlights the step by step guide to implementing the lessons above.

Which Rich habit will you start to use?

0 Comments

Read More

Leave a Reply. |

Proudly powered by Weebly