|

�

Archives

September 2021

Categories

All

|

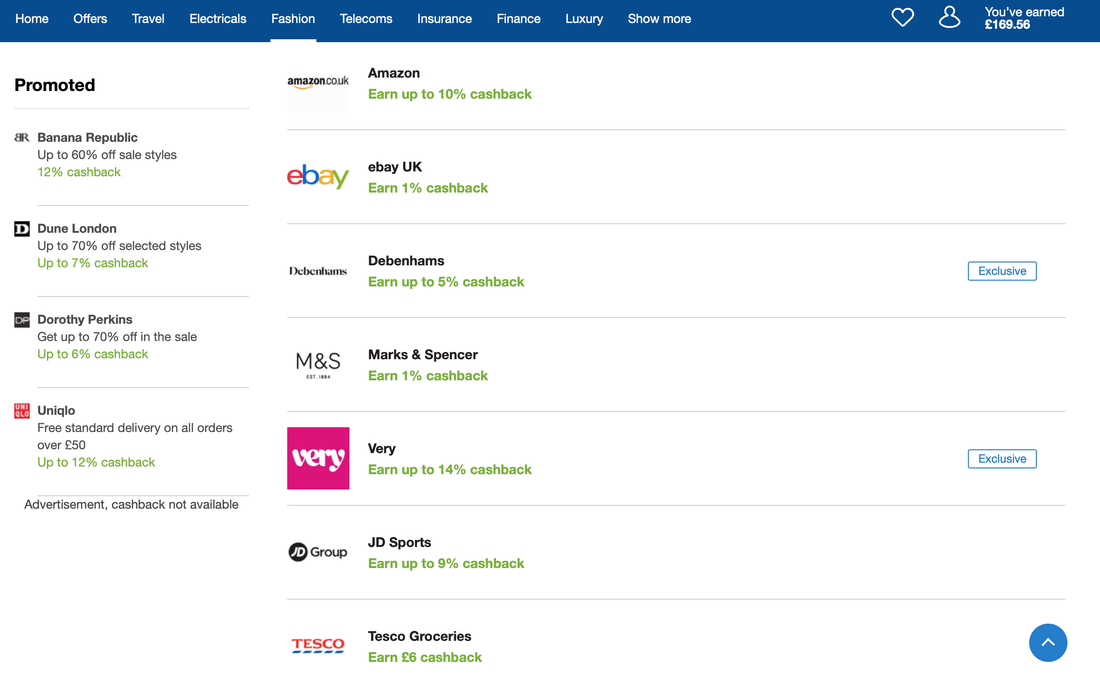

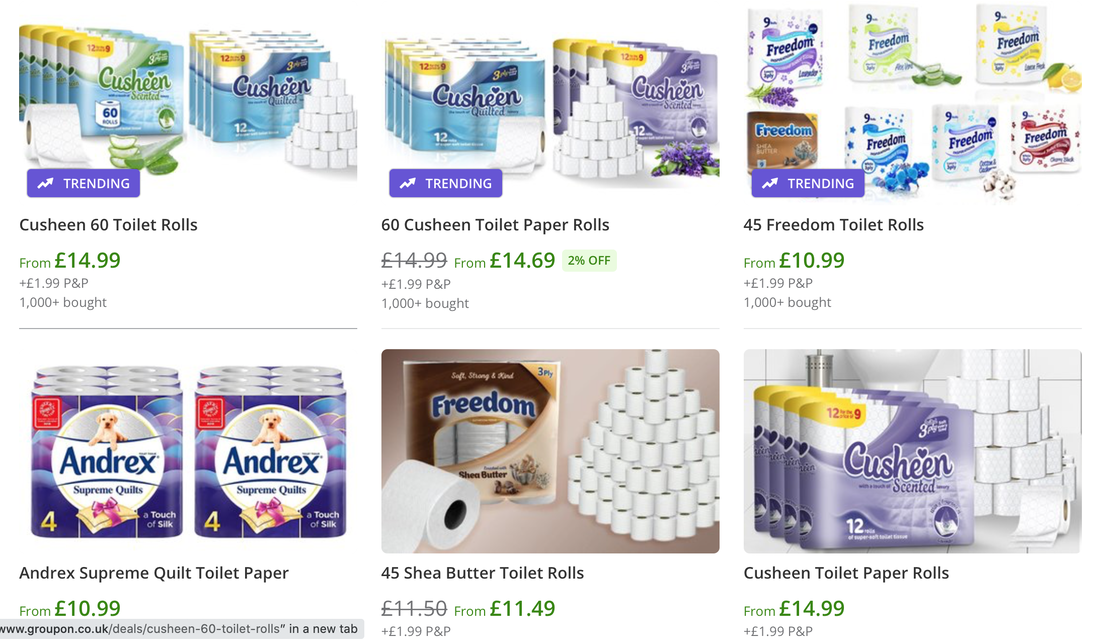

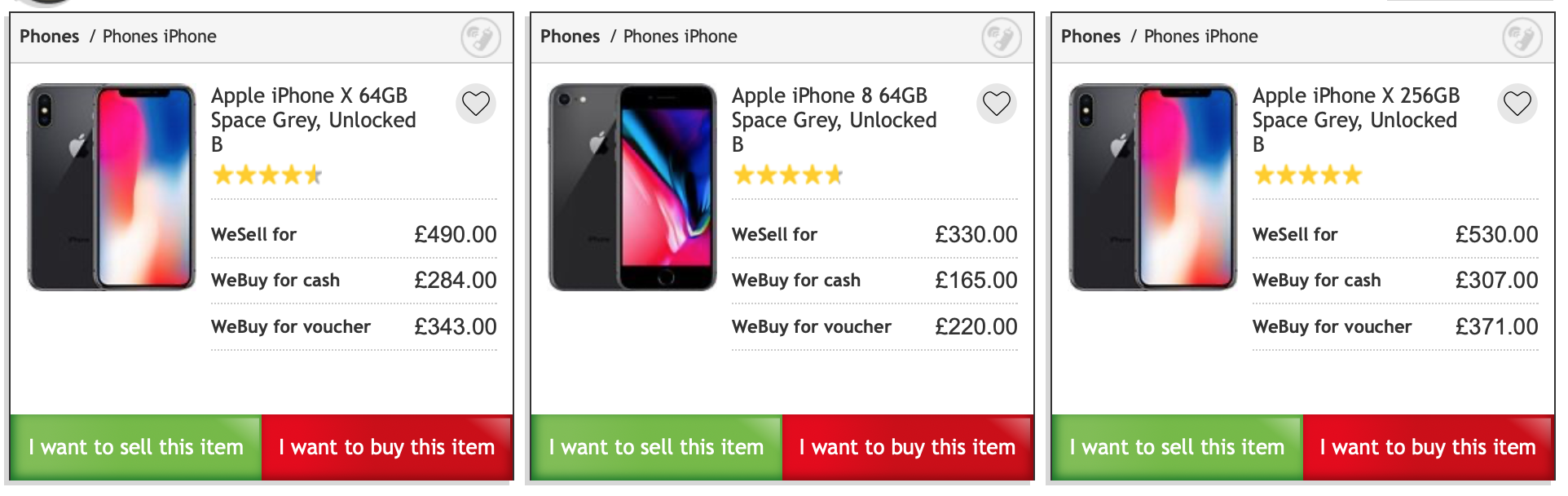

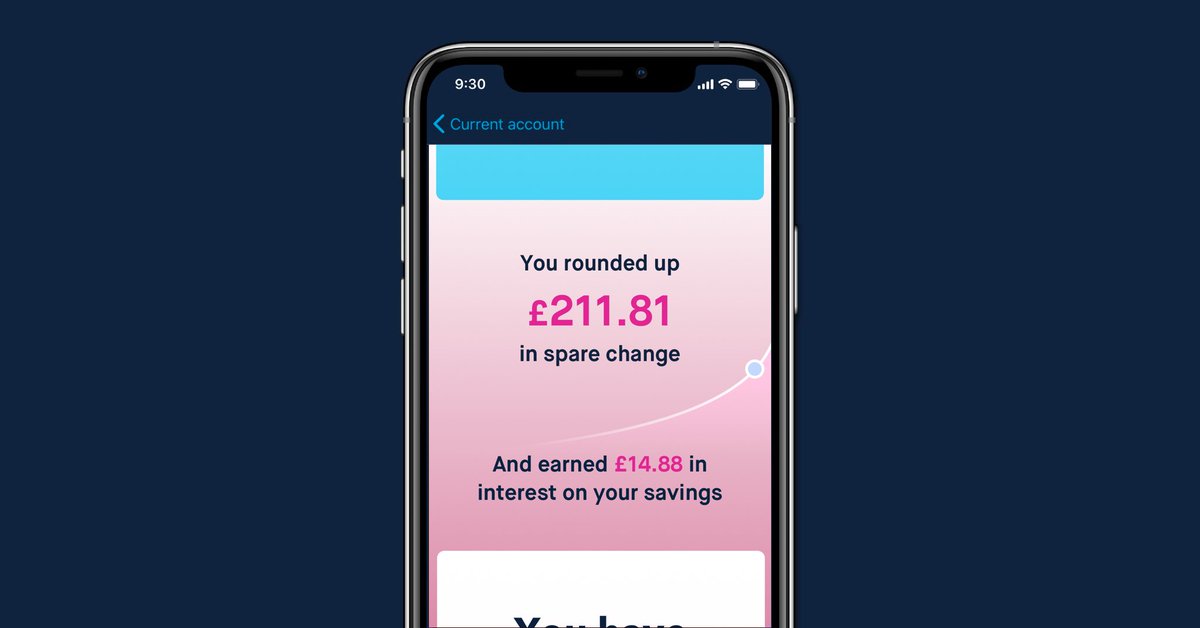

Back to Blog

If you are looking for super smart ways to pay less for things you need, this post is for you. I have and continue to look out for easy ways to reduce my spending allowing me to save more guilt free. Keep reading to see the tips I use to cheer up my finances! 1. My credit card pays me for spending If you have a credit card, get or swap to credit card that provide cash back on expenses. I have cards that provide 0.5% on all spending and if I pay with contactless, I get 1% . So for every £100 I spend, I get back up to £1. Sometimes, the bank has deals with retailers who provide more than 1% cash back. This may sound like a small amount but it does add up. Since getting my credit card 2 years ago, I've gotten back around £500. Remember to read terms and conditions and to payback your credit card in full. 2. Switch providers and get cash back Many companies want you as a customer and will pay you to get your attention. Look out for ads from utilities companies, banks etc. who will pay you if you for instance to switch from BT to EE as your telephone provider or from British Gas to Utility point for your electricity and energy. Before doing this, check how long you have to stick with the company and use this approach to get the cheapest prices for your needs. I negotiated and have cut my monthly broadband bill by 10% for 12 months. Go further and use Cashback Apps to save even more. 3. Use companies like Quidco and Top cash back to get paid while spending Companies like Quidco aggregate all cash backs provided by companies. Last year, I was looking for a new internet provider and a friend introduced me to Quidco. I signed up in 5 minutes and I was able to get £65 cash for choosing my internet provider. Even better, once my transaction had been confirmed I was able to send my Quidco cash back directly to my bank account. I always check Quidco to see if they list a retailer when I want to go shopping so I can get a cash back from Quidco and via points via my credit card (see number 1). 4. Split costs with people Anything divided by more than one is cheaper! If you use Netflix, Spotify, ASOS (premier delivery for £9.95 a year) split the costs with friends or family. Where possible get one account and share the costs and services. If you want to travel to exotic places, split costs like hotel, transport and more. To keep track of each person's share use apps like Splitwise where you can record all costs, include your friends and track your spending. 5. Use websites like Groupon/Wowcher/Amazon to get cheap bulk products Since time is money, I've stopped going through the hassle of getting toilet rolls from physical stores. Plus it all get delivered to my door saving me time. I go through Quidco for all my Groupon purchases (see number 3). The same applies to Amazon, I get my long-life milk for 25p less in bulk delivered to my door. No more do I need to carry 5, 1litre liquids for the sake of enjoying my cereal. 6. Travel the world and pay only £99 for flight & hotel If you have dreams of travelling the world. It does not have to cost a fortune. A friend introduced me to Wowcher's Mystery £99 all inclusive holidays with flight and accommodation for over 2-3 nights covered. It works like this, you buy the Wowcher voucher and then an agent calls you to tell you which country you have been allocated (if you do not like it, you can change the dates and location with the agent). If you do not like the hotel provided in the package, you can pay a supplement to upgrade. I visited Budapest and Porto, Portugal using this method. This allowed me to meet my goal of visiting at least 2 new countries per year. If this is not your cup of tea, in general you can always save money by booking up to 6-9 months in advance so you have something to look forward to. Also if you want a local tour in these locations, look up free walking tours to find a local guide. At the end you pay what you like - if you want. Bonus tip: Get Air miles or AVOIS points when you travel and spend them on 'free' or cheaper hotels, flights or entertainment.  Travelling does not need to be expensive. You can do it. Travelling does not need to be expensive. You can do it. 7. Make a Packed lunch for work or class On Sundays I spend 1 hour to create my lunch for the week. I can be as simple or as elaborate as I want. This way I save up to £10 a day which amounts to £200 a month on food. If I want to treat myself I have zero guilt doing so. If you want some quick 'meal prep' ideas- check youtube for easy meals to make. 8. Need Free Entertainment- Yoga, Comedy, Arts? There are so many free things to do in this world. I have gotten autographed books, visited the House of Commons, took Shorinji Kempo (Martial arts) classes, attended really good comedy events without paying a dime. I use websites like eventbrite to find free classes for yoga, arts, dance and more. 9. Scroll through Gumtree for big items (2nd hand shopping) Since furniture does not appreciate in value. I used gumtree to get great deals on furniture. For instance, I got a really great sofa for £350 (retail was £1200) and it was used for only 2 years. I also got my armchair for £50 with free delivery! Using gumtree saved me hundreds of pounds. If you find something you like, go with a friend to see the product before you buy. Also remember to haggle to reduce the price on offer. 10. Use CEX to get cheap but durable Electronics I don't buy new phones anymore. Why? again, they don't grow in value and in my case, Apple will be replacing them every 3 years anyway. So to significantly reduce the cost of paying for a new device, I get phones and other electronics from stores like CEX that also provide 24 months guarantee. CEX sells games, TVs, earphones, cameras etc. They also always have the latest phones as a discount and describe the condition of the product if it is in good or mint condition. 11. Sign up for warranty on all appliances I learnt a tough lesson with this tip. I bought a kettle last year and it started to have loose parts this year. I wanted to get it fixed and found that I forgot to sign up for the 3 year warranty which would have entitled me to a free fix or a new kettle. When buying appliances, make sure it has a warranty and most importantly activate the warranty. 12. Get a homecare plan to reduce out of pocket costs for plumbing, heating, white goods damage and more If you want to reduce the headache of paying the sometimes large sum of fixing a broken boiler or getting a plumber to come around, consider a homecare plan. These plans are monthly payments you make such that if you need to fix these type of issues, the provider will cover the repair costs. I have seen as little ar £2.81 for oven, fridge/freezer, coooker hood and hob cover. Read ther terms before your apply. 13. Switch ON the ROUND UP feature on your app. Monzo and other money Apps have this option and I am using it to make little progress towards my goals. 14. If you don't need it, Cancel it review your subscriptions and direct debits to services that no longer serve you. 15. Save load by paying annually: I saved 25% on my white goods insurance by choosing to pay a one off annual fee instead of making monthly payments. If this option is not presented to you, just ask. In summary, find ways pay less or get paid for spending!

1 Comment

Read More

|

Proudly powered by Weebly