|

�

Archives

September 2021

Categories

All

|

Back to Blog

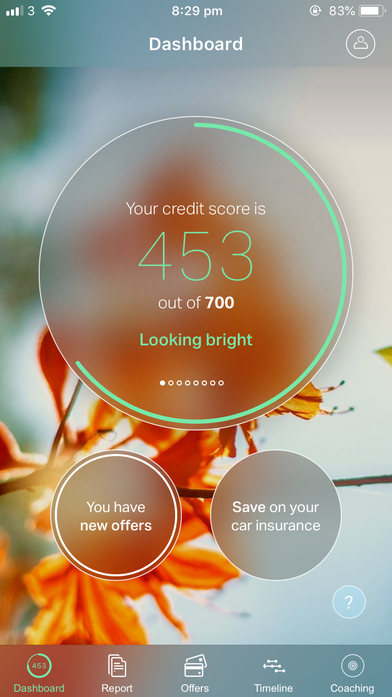

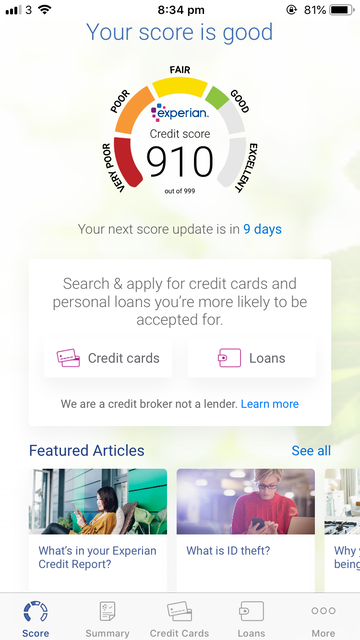

Want to know what lenders and employers think of your financial situation? Download these 2 Apps!2/6/2020 We all know what we think of ourselves. But how does the financial world view you? Knowing my credit score was and remains a crucial part of my financial education. I recently downloaded two super easy Apps - ClearScore by Equifax and Experian. These Apps have made it much simpler for me to track my credit score and to see how lenders view me. A bank sees you as a number. This number can change EVERYTHING |

Proudly powered by Weebly