|

�

Archives

September 2021

Categories

All

|

Back to Blog

This amount of Stocks will make you rich7/20/2020 The sweet spot for many stock market investors is knowing where to put their money to make it grow consistently over time. When you are new to investing it can be difficult to know how put your hard earned cash to good use. This post explores 4 methods everyday investors can use to know how much stocks, bonds and commodities to hold. Where you choose to put your money within the stock market can make a BIG difference to how your much and fast your money grows. Inspite of the risk, the stock market remains a viable option to increase your wealth, beat inflation and get better interest rates than what your bank. So, the question is how should you spend your money in the stock market? Keep reading to find out:

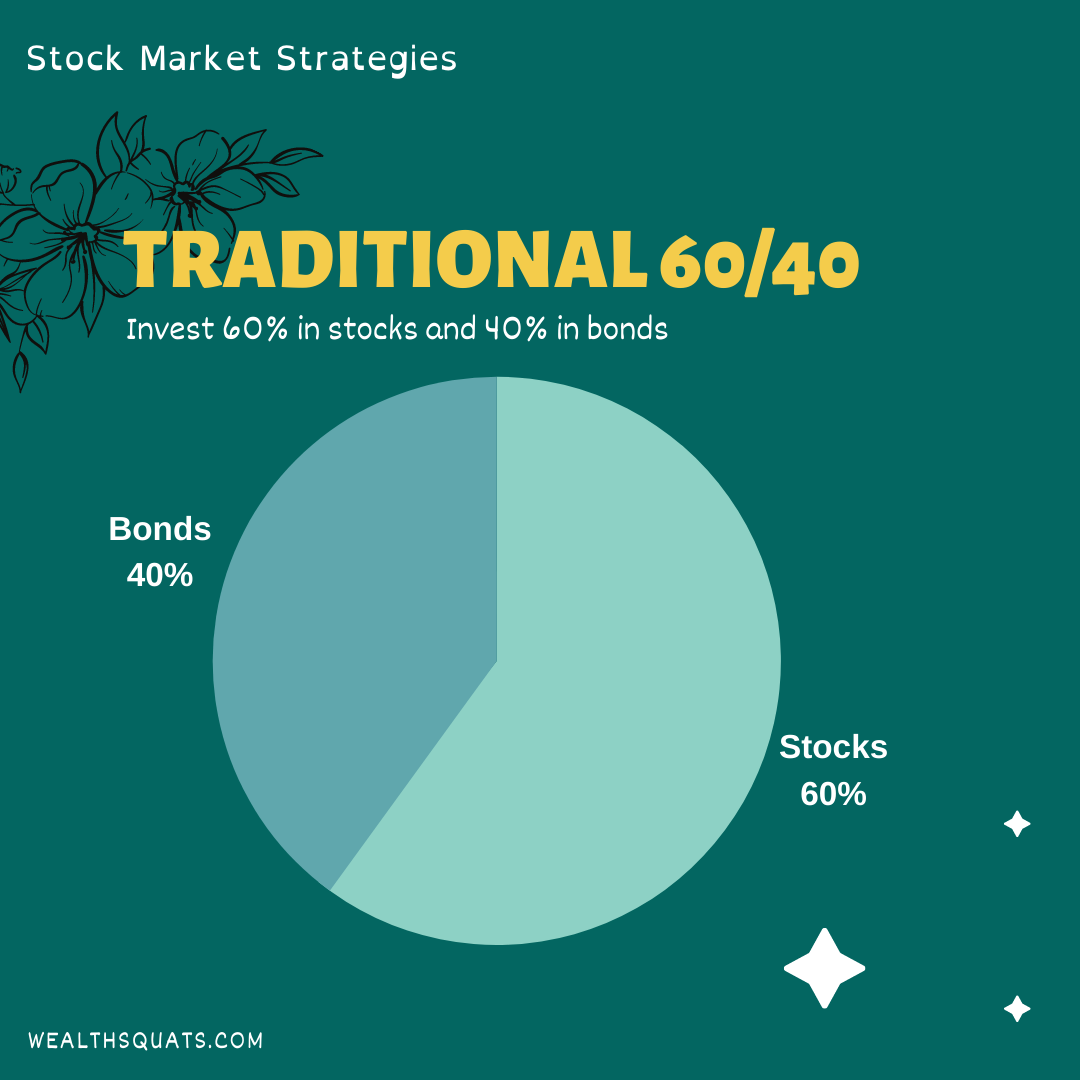

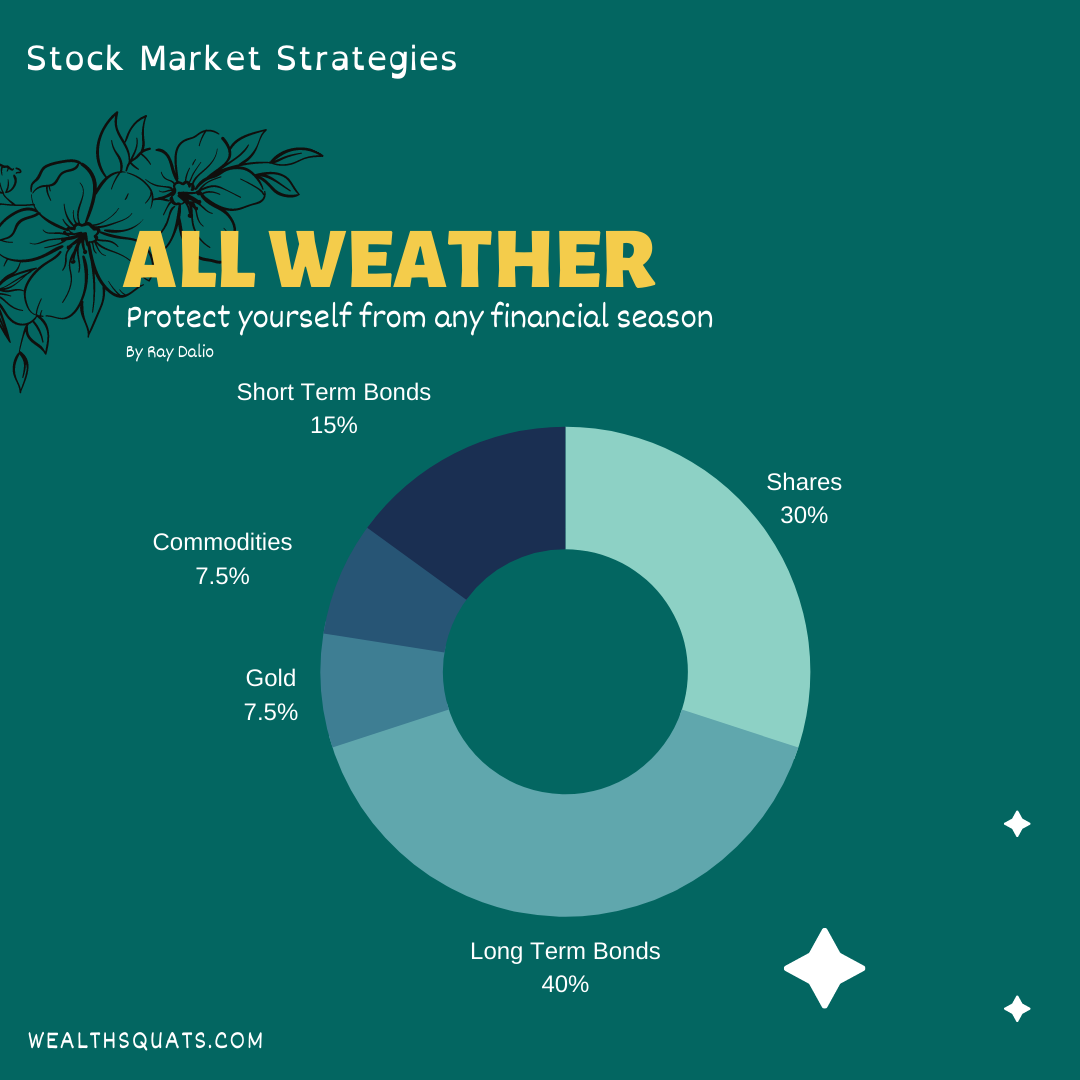

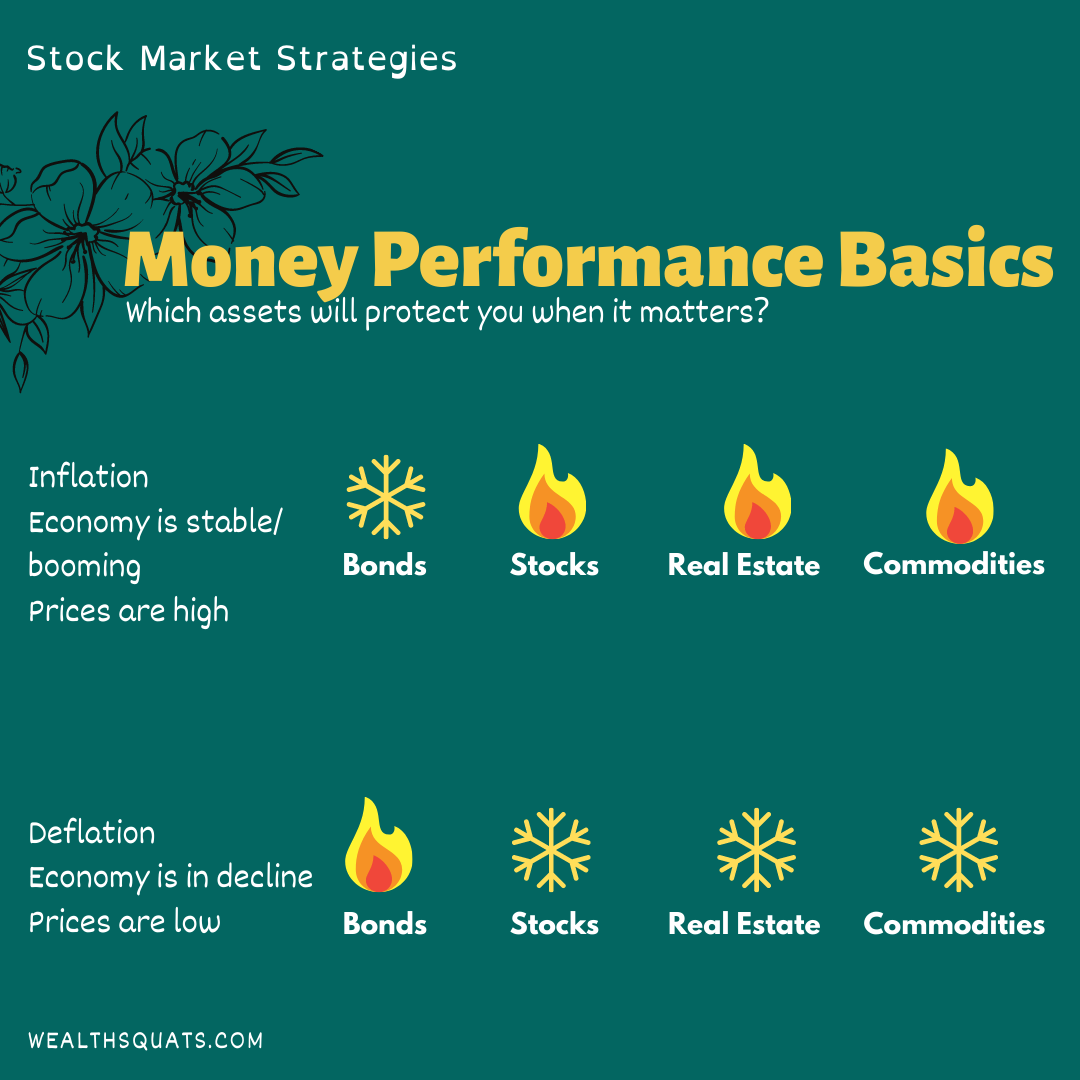

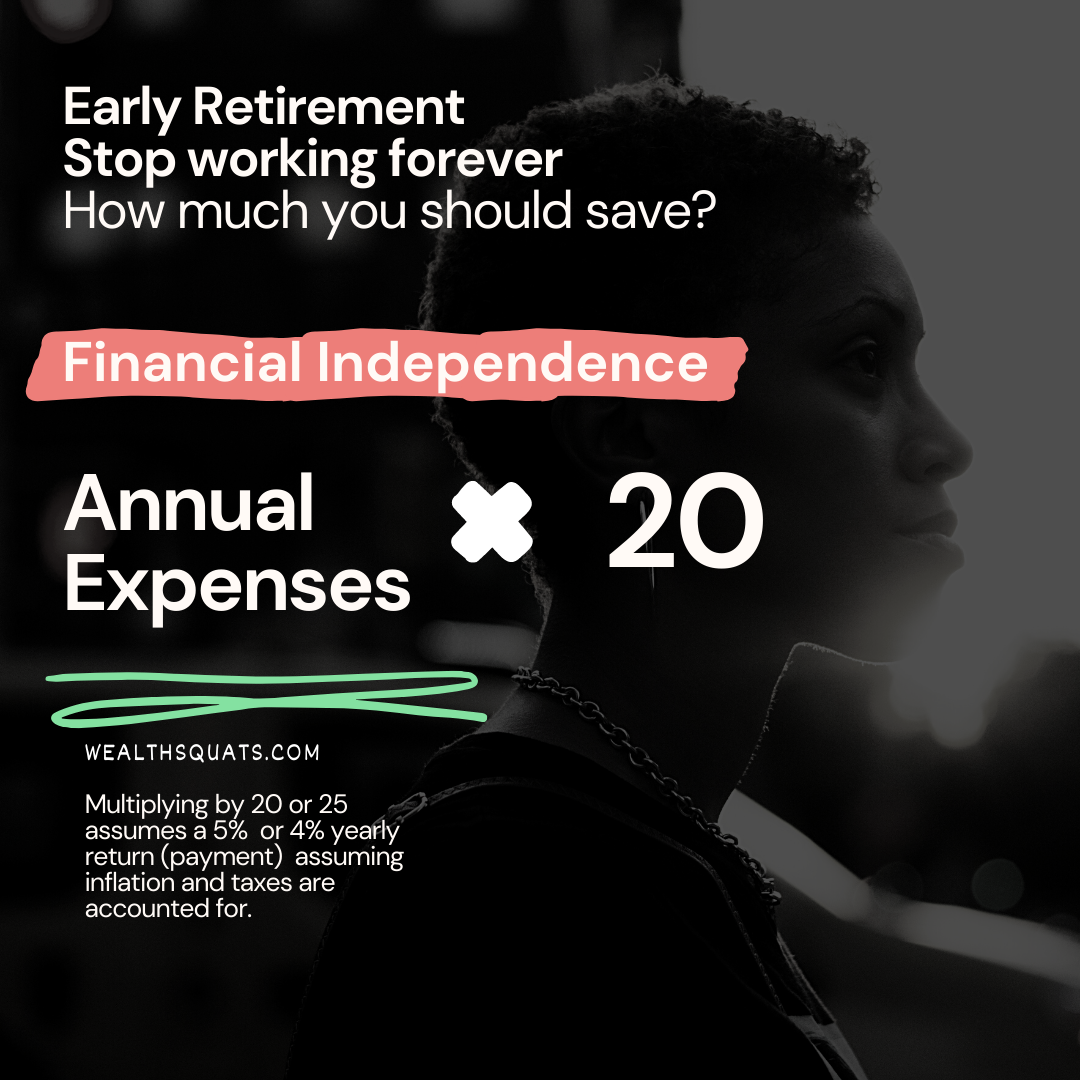

First, some quick definitions. Methods/strategies: can be a rule or way of doing things to achieve a goal. For example, a high risk strategy will be focused on growing money very fast and could choose to put investments in riskly companies. A low risk strategy is focused on protecting money from loss and an investor can choose bonds Portfolio: think of it as a folder that holds, a certain amount of stocks, bonds and commodities (gold, oil, coffee, silver) An asset: is a thing of value that grows e.g. pension, real estate, art, gold etc. Inflation: the price of things you buy go up. So you'll need more money to get the same amount of the thing you buy or you get less of the thing you want with the same amount of money How much Stocks should you own forever?1. 100 Age rule Your Age minus 100 is how much you should put into stocks. The premise of this approach is that is the younger you are, the more risk you can take. So, if you are 25 years old, you should have 75% in stocks and 25% in bonds. As you get older, you will want to take less risk with your money so you will move towards having more bonds (which are seen as less risky and provide lower returns) and less stocks (relatively seen as more risky because share prices can go up and down frequently). Some investors are taking this rule one step further and making it 110 or 120 minus age to take more risk. For women, who live longer on average, this could be an approach to make sure their investments last throughout their lifetime. As with every rule of thumb, this rule does not factor your individual circumstance or preferences. 2. The Traditional 60/40 ruleThis is the traditional method of investing. The idea is to have 60% in stocks and 40% in government or corporate bonds. This method allows you to take some risk but also allows you to get regular income when the economy goes down. As your stocks and bonds rise or fall in value, experts suggests to maintain this ratio at least once a year by selling and buying the respective bonds or stocks. This rule has performed well over the past decades but following the 2008 financial crisis experts are asking - how will it perform over the coming decades? 3. The All Weather I came across this rule when reading Tony Robbins' Book Master the Money Game. Tony reached out to Ray Dalio of Bridgewater Associates to answer this question: how should investors spend their money in the stock market? One thing that stood out to me in the book is the notion risk. Ray explained that an investor with the 60/40 portfolio above is exposed to 3 times more risk (the potential for significant loss of money) which comes from owning stocks as they are more risky. Bonds which have a 40% allocation, contribute about 5% risk to the overall portfolio. In response to the reality of the size of these risks, Ray created the All Weather portfolio. He also identified 4 financial seasons that impact prices. These prices change depending on the growth or decline of the economy and inflation (when the prices of things you buy go up). The All weather portfolio allocates an equal amount of risk (25%) to these four seasons. Investors can create the All Weather Portfolio using the strategy shown below. 4. The Dragon Portfolio I learnt of this rule while watching this video on how to build a portfolio that is strong enough to withstand a recession. Artemis Capital Management carried out research over the past 90+ years to find out which strategy made the most money for investors. They concluded that investors should "Find assets that can perform when stocks and bonds collapse, and boldly own them regardless of short term performance". How can we do that? Author Chris Cole, gives the following example: Take assets (a thing of value that grows) X, Y and Z

According to the author Chris Cole, the optimal mix for an investor is roughly 20% of X + Z or Y + Z. You can buy more of each asset when it becomes cheaper during an economic decline and grow your money long term. This strategy is summarised in The Dragon Portfolio. The author found that over 90 years, the Dragon Portfolio generated a 14.4% return with lower risk.

|

Proudly powered by Weebly