|

�

Archives

September 2021

Categories

All

|

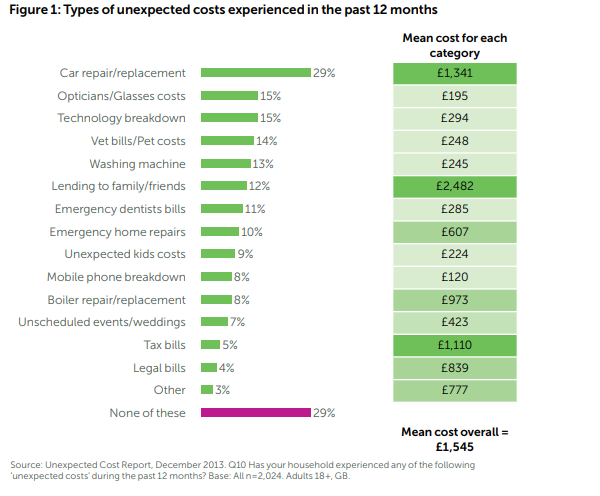

Back to Blog

Recently I came across the following key words Financial Vulnerability, Financial Capability and Financial resilience. I generally attribute the words vulnerability, capability and resilience to life, emotions and an overall wellbeing. In the articles spewing these words they explored the following how easy is it for you to weather a sudden financial storm? In other words, how ready are you to manage curve balls. In this blog, we discuss the need for a new savings account to cover unexpected however large or small. Imagine this, two individuals Niya and Hurley receive an email that says you owe £450 from phone contract which you did not formally close if you do now address the cost, it will continue to increase. This is how people become suddenly poor A key goal of WealthSquats to encourage ourselves to build financial resilience, the ability to progress with our financial goals in the face of the unexpected. It is about building a strong finical muscle. What are examples of curve balls |

Proudly powered by Weebly