|

�

Archives

September 2021

Categories

All

|

Back to Blog

Save this to Stop Working FOREVER7/20/2020 Achieving financial independence is a major goal that many of us have. It is owning the chance to save enough money to maintain a desired lifestyle, stop working forever and doing what you please with your time. If you think you need millions saved to achieve this goal, I have found that this is not necessary the case. You can reach this goal much earlier than you might imagine. What you need How much do you spend per month? What lifestyle do you have today What lifestyle do you want when you retire Let's start by making some assumptionsLet's take the following example:

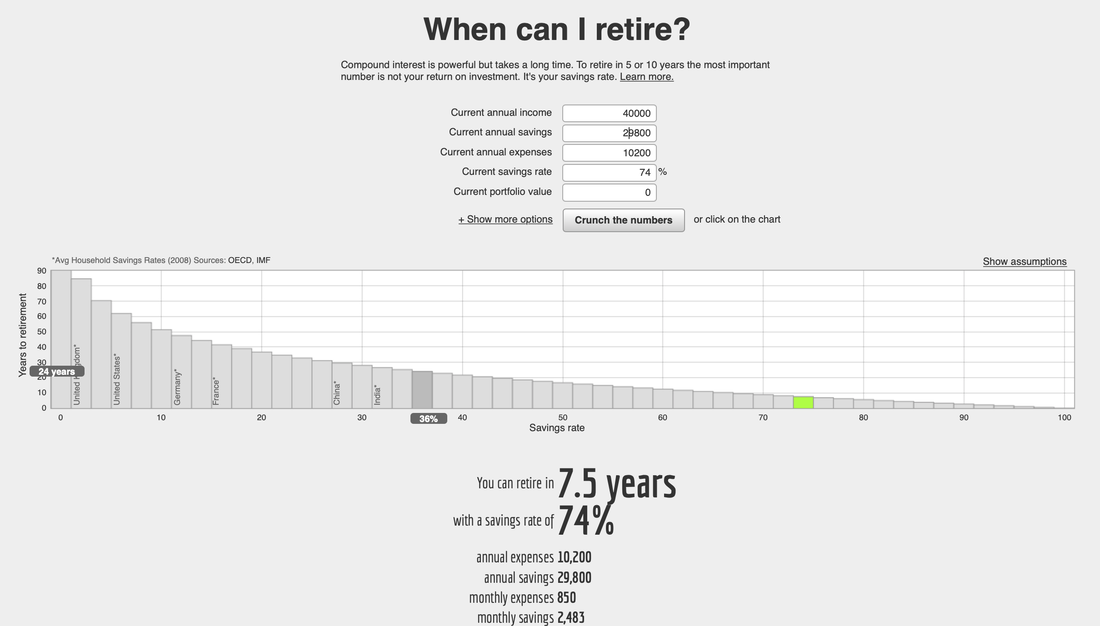

This is the amount you need to save to stop workingTaking the figures above, your financial independence number is (15,000 * 20) = 300,000 So you need to save 300,000 which pays 4% per year (after taxes and inflation). 4% is 15,000 which means your expenses are fully covered. If you want to cover accommodate other expenses or luxuries like travel, you can multiply the annual expense by 25. I've seen other articles that suggest multiplying your annual expense with a figure between 20 to 30. Multiplying by 20 means you expect your savings to pay you 5% annually, if you multiply by 25, you assume a 4% return. It is important to note that returns will vary with changes in the economy. When the economy is up, you can expect higher return and pay yourself more. With a bad economy, you reduce your spending. You'll also notice that the rule assumes you are invested mostly in the stock market, read more about this here. How many years are you away from retirement? 6 years? You can also use this calculator to find out. My financial independence number is too high - what can I do? Before completing this post, I calculated the financial independence number for a friend. This was the first time she'd ever calculated this figure. Once she saw this, she found her number to be achievable and started to think about how to reduce her expenses and particularly her debts to achieve freedom faster. What can you do:

Calculator: How long will it take you to retire? Find out hereSo go ahead, calculate your figure and Memorise this number Watch the Video below to learn about the FIRE movement.

0 Comments

Read More

Leave a Reply. |

Proudly powered by Weebly