|

�

Archives

September 2021

Categories

All

|

Back to Blog

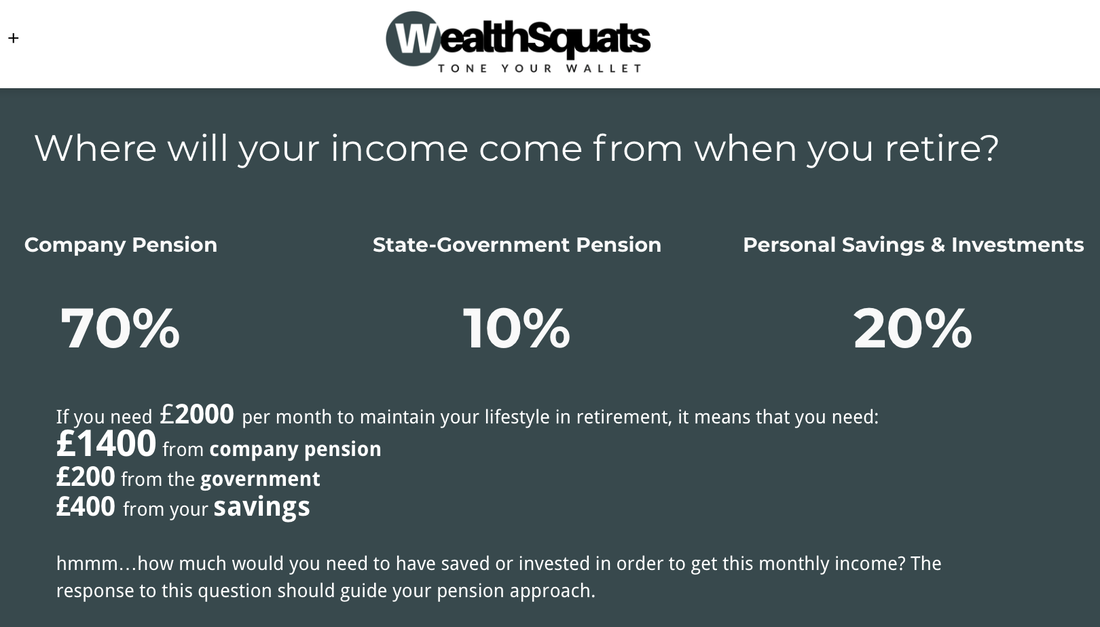

This is why I dread old age9/30/2021 The image below from tax.service.gov.uk is one reason I dread old age. It is from the UK government website and it says I'll get about £700 a month to live on when I am of retirement age. This is IF the state pension will still be around. I encourage you to look at your personal tax details to get a sense of your own situation. Notice that you can only get this monthly sum if you contribute for a minimum (10) and a maximum number of years (depending on your retirement age, example below is 26 years). This is also a reminder that state pension is mean to be one part of your pension income. If this amount allows you to meet your needs at say age 71, then do nothing new. If on the other hand, you want to travel, cover expenses, start businesses, eat well, and give more, then you'll need to supplement this by saving for your self today either in a work pension, a SIPP, a LISA or open a separate savings account solely for old age care. Flip the dread and read more on pensions. What can I do? A 3 min peek into your pension Have a look at your pension savings, how much is in there? Is it on track for the future? Do you need to make any change?

Check out this article on how to get a free pension top up. If you do not have a pension, you can open a savings account, a SIPP or a LISA; speak to a financial adviser or look online for the best product for yourself.

1 Comment

Read More

|

Proudly powered by Weebly