|

�

Archives

September 2021

Categories

All

|

Back to Blog

Is your money safe with banks?6/29/2021 You are on track with your savings and investments plans. You also have different bank accounts for your money. What's more, your mortgage is from another provider and you use different apps to invest and manage your pension. Think about this - what if the bank or investment platform goes bust (like this one), how much can the UK government pay you back to protect some of your hard earned cash? The FSCS is a scheme you may have recognised on banks website, investment websites, emails and more. What are they trying to tell you? How can you make a claim and how much protection do you actually have? Trivia: Imagine you have £50k in Lloyds bank and £50k in Halifax, how much of your money is protected? Hint: not all of it.

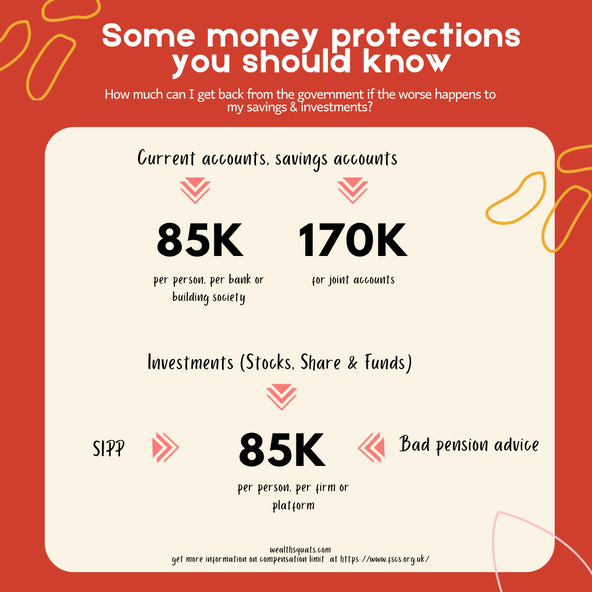

How much of your money is protected? Source: FSCS Money held in banks or building society

Money in Investments

Mortgage

*Intermediation is when an entity works on your behalf to get you financial products Your Pensions

Your Debt

Insurance

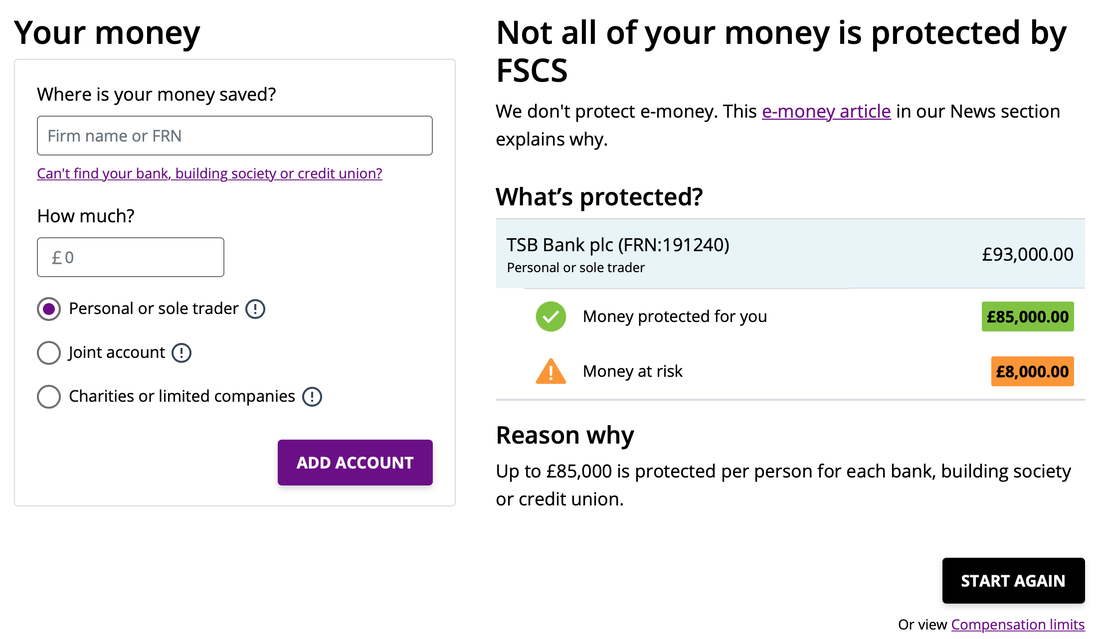

What if I have more than £85k? Based on my research you may to have distribute the excess of your money across different banks and or platforms to be fully protected. Sometimes, this can be expensive due to the fees that could be paid. This also also be difficult to manage over time as you cannot exceed 85k in total (capital + interests or dividends). Alternatively you can trust that the provider is taking the right steps to protect your money and is in alignment with the Financial Conduct Authority (FCA) rules. How do you make a claim? To make a claim, click here to find out if you are eligible. Remember: Your money is safe with FSCS up to a limit. Your checklist

FSCS Protection Checker A 2 min video on FSCS

0 Comments

Read More

|

Proudly powered by Weebly