|

�

Archives

September 2021

Categories

All

|

Back to Blog

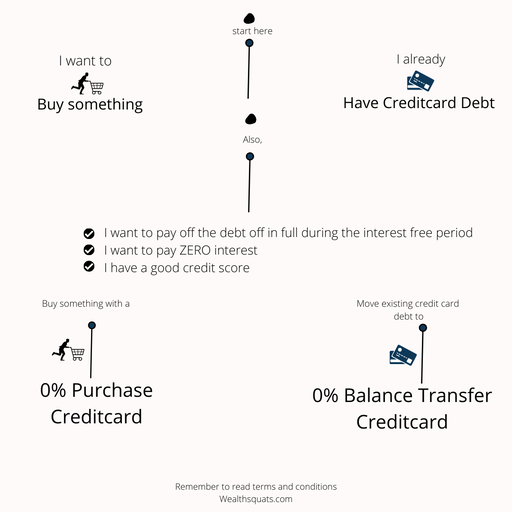

Pay ZERO interest on your Credit Card debt11/20/2020 When you get a credit card, the one thing of concern is the interest rate. Unmanageable and very high interest rates can be a problem when managing our money. While credit card companies make money off of high interest rates, we can sometimes struggle to keep up and are left with high repayments and bad credit scores. If you have credit card debt or want to make a big purchase, keep reading to learn how to pay off your debt and no interest using Balance Transfer and Purchase credit cards. Let's change the game In this post, we learn how to pay zero interest rate using credit cards. This applies if you 1) already have a high credit card balance or 2) you want to make a large purchase. There are rules to play by but learning this technique can put money back into your pocket as opposed to putting the money in the lenders account. Key Points Balance Credit Card Move debt from your existing credit card to another and pay ZERO interest during the interest free period Purchase Credit Card Buy goods or services and pay ZERO interest during the interest free period Your Credit card should be doing this for youA credit card is a type of unsecured debt that is to pay for goods or services. If you are able pay in full, you credit card helps you build a good credit score and puts you in good financial health. If you do not pay in full, lenders charge high interest rates and the debt can grow if it is not managed. Make sure your credit card is giving you one of the following. You can contact your lender to discuss options available to upgrade your card.

Read More The Good and Bad of the Credit Card How to build a Credit Score Use a Balance Credit Card to pay ZERO interest if you already have credit card debtA balance credit card is a product that allows you to move your leftover credit balance onto a balance credit card. Doing this allows you:

An Example: The good and less good way of using Balance Transfer Credit Card Jess has £5,000 in credit card debt to pay. So far, Jess pays the minimum per month and also pays interest. Jess wants to pay this debt off in 18 months and has been working on improving her credit score. Jess looks online and see companies like Virgin money, Halifax, HSBC, M&S and more who have balance transfer offers. Jess applies and moves her balance to the new balance card. She makes sure she pays the minimum each month to retain the interest free off. By month 16, Jess has paid off all her debt. She closes the account with no penalty and moves on with the rest of her glorious life. THE OUTCOME: Jess pays off ALL of her debt and ZERO interest. If Jess only paid £3,000 during the 18 months, the left over debt of £2,000 will incur an interest rate of e.g. 20%. THE OUTCOME: Jess pays down SOME of her debt and pays HIGH interest on the remaining debt Use balance credit cards if:

Tips Download Clearscore or Experian. Depending on your credit score, they can pre-approve you for balance transfer credit cards. This means based on the information they hold on you, you can find out which card and terms you are eligible for. I checked with some friends and found that the better your credit score, to larger the interest free period you can get. So a friend with a relatively lower credit score, could get balance transfer cards with a maximum of 6 months interest period and another with the highest credit score was eligible for 29 months. Mind you, the credit limit you get will depend on your credit history. When searching for a balance transfer card, keep an eye of on the following so you pay less:

Use a Purchase Credit Card if you want to make big purchases and pay it off in a given time

A purchase credit card gives similar benefits to a balance transfer card.

What's the difference?

2 Comments

Read More

|

Proudly powered by Weebly