|

�

Archives

September 2021

Categories

All

|

Back to Blog

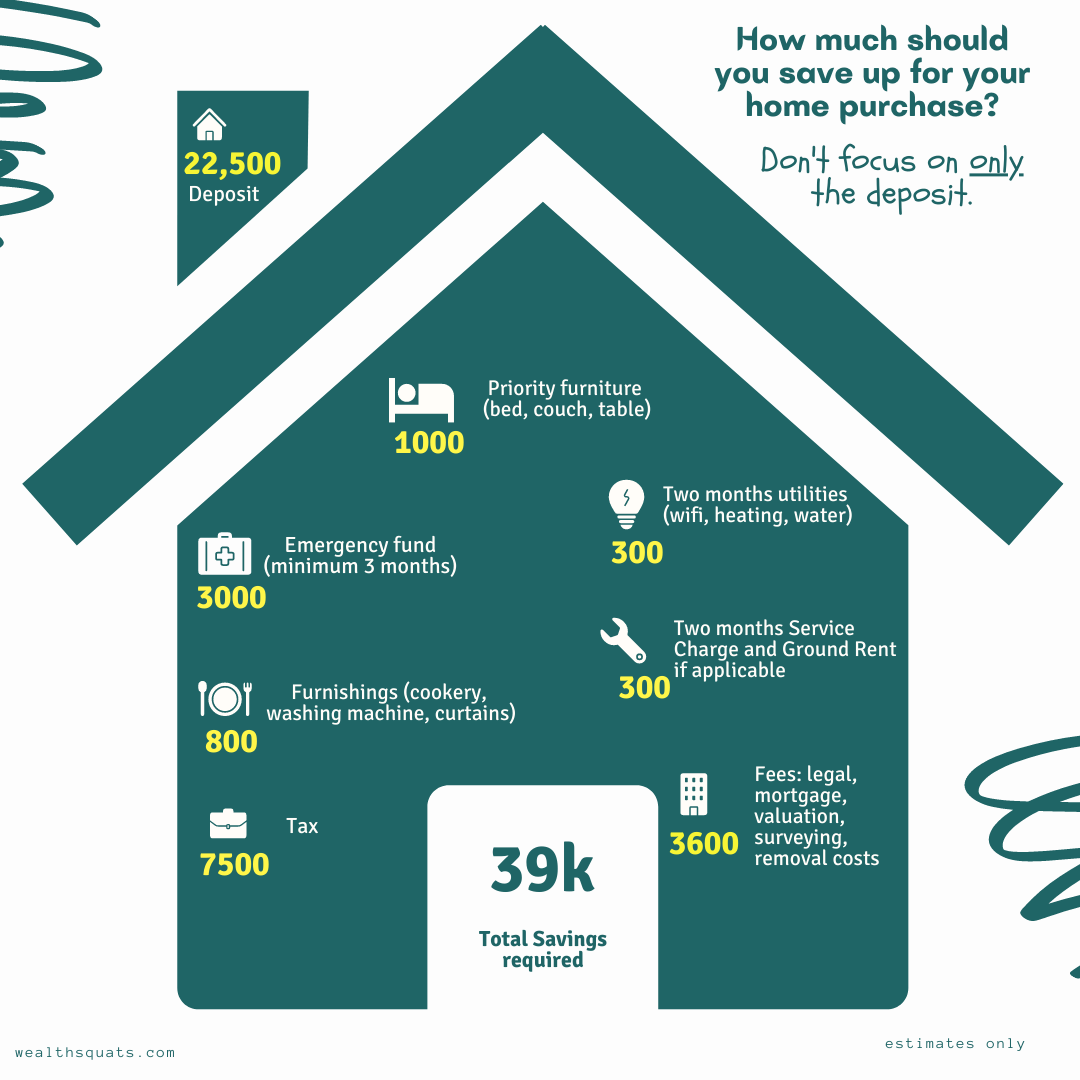

Home ownership is a goal many have but I have seen many stories of people buying their home and becoming worse off financially because they have saved for years and have put ALL their savings to get a roof over their head. 6 months later, they have save just enough to get a couch and the slog continues. This doesn't have to happen. in this post, we explore ways to avoid being house poor and it takes planning and prioritising your well being. Rule of Thumb: The deposit is just the start add fees, tax and savings. Key takeaways

Build your emergency fund. This fund should not be used for the home. Your emergency fund is purely for your own insurance and should cover a minimum of 3 months. I would even take this further and have a small pot for fun so you remember to prioritise yourself. Don't only save for your deposit, legal fees and Tax. Factor in payments for furniture, furnishings and at least two months utilities. Let us know if we are missing any other costs.  Get cash back for all the spending. As a new home owner, you'll be buying a lot of things in a given time period. So get cash back to get paid while you spend. This is money you can spend else where.

12+ guilt free ways I cut my spending to save more If it doesn't appreciate, get it pre-loved To save money, use pre-loved websites like e-bay or gumtree for things that you are not to precious about. Things like flower pots, cookery are great candidates. Stick to your budget and take your time You've already made a budget for your home purchase. Your budget is the cornerstone of your financial life - it is your partner in helping you to achieve your financial priorities. It also keeps your focused for all the other non home expenses you need. So future you asks that you stick to it and prioritise your joy. I stopped making these mistakes and it changed everything

0 Comments

Read More

Leave a Reply. |

Proudly powered by Weebly