|

�

Archives

September 2021

Categories

All

|

Back to Blog

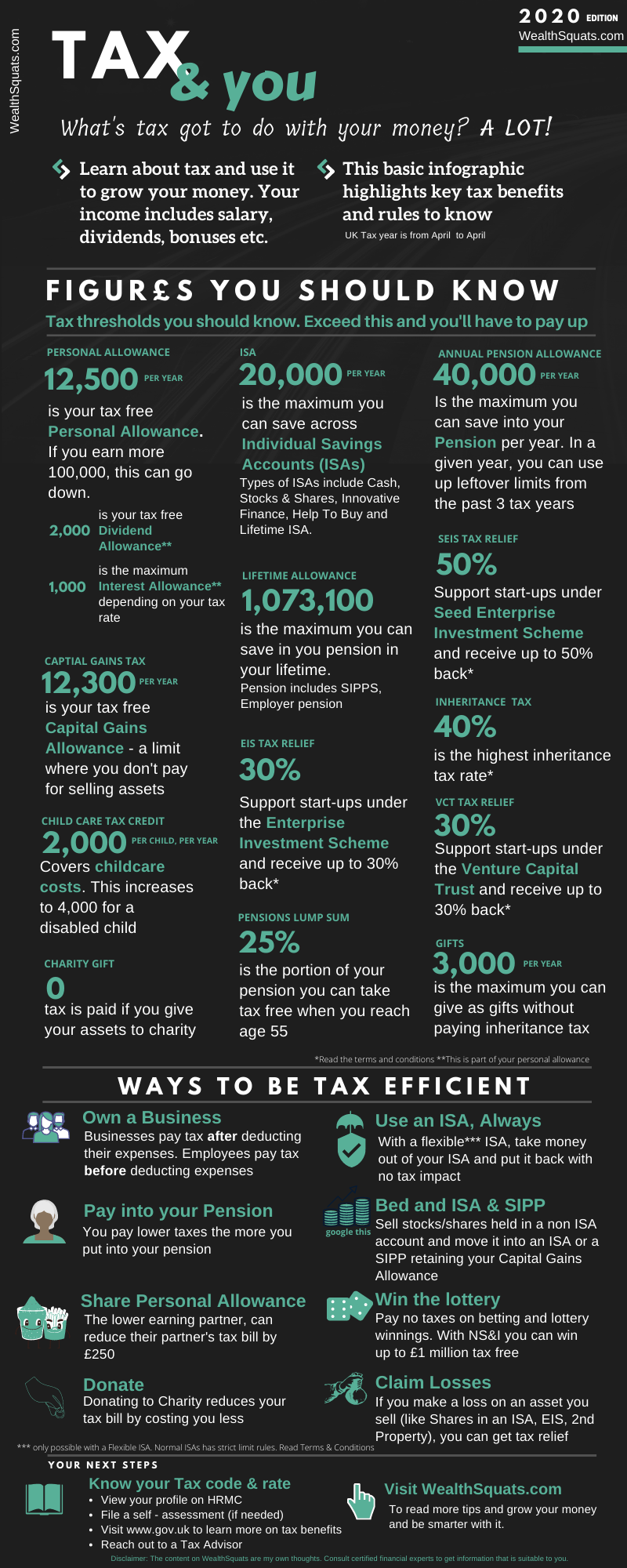

Tax is part of our lives whether we want it or not. It touches our income, contributes to our society, our healthcare, education, roads and more. In this post, I spend some time looking at the UK tax rules to find out which benefits we could use to grow and protect our money. I put my basic findings in an infographic to make it simple [Scroll down to view]. So let's learn about tax so we no longer label it as highly-confusing and downgrade it to somewhat confusing (a much better space to be in). [Quick definitions] The Tax WebThroughout this research, I found that Tax is actually not hard to understand on its own. The confusion comes when you have to consider all parts. Take this example: You have an income over the personal allowance threshold whilst saving for a pension and a home which your family will support you with a deposit. I call this the web because to understand your tax position, you need to understand the Tax rules for income, pension, stamp duty tax and gifts. No wonder you and I shun this topic...but to our own wealth demise. Did you know that if you make a loss when you sell your home, shares in an ISA, or a personal possession worth £6,000 you can get a tax relief? Imagine that getting paid when you lose. These are the kinds of helpful money tips I want to know about (I've added much more below). Get Clarity If you work for an employer, your income tax is typically handled by your company. If you are self employed, you'll file paperwork on your own or via an accountant/certified tax advisor to pay the appropriate tax and claim relief. Anyone can reach out to an accountant or tax advisor on tax matters. Before we move on, one question. What tax rate payer are you? If you don't know the answer, keep reading to find out. What Tax Rate Payer are you?

Your income determines how much tax you pay. The UK uses a progressive tax system, where the more you earn the more you pay in tax. So, if you earn up to £12,500 per year, you'll pay £0 tax. On the other hand, the highest income earners pay up to 45% of their income in tax. This can be very difficult to accept which is why many people look at ways to legally reduce their tax bill by using some of the options outlined in the infographic such as increasing payments to their pension, using ISAs to prevent being taxed again or not taking out dividend income for a given tax year (deferring it). Some others flee the UK to low tax rate countries. Just know that your tax solution or option is unique to your personal circumstance. Find out what tax rate payer your are here. TIP More tips & resources

Remember this: Get Tax Advice

Videos on Taxes

0 Comments

Read More

Back to Blog

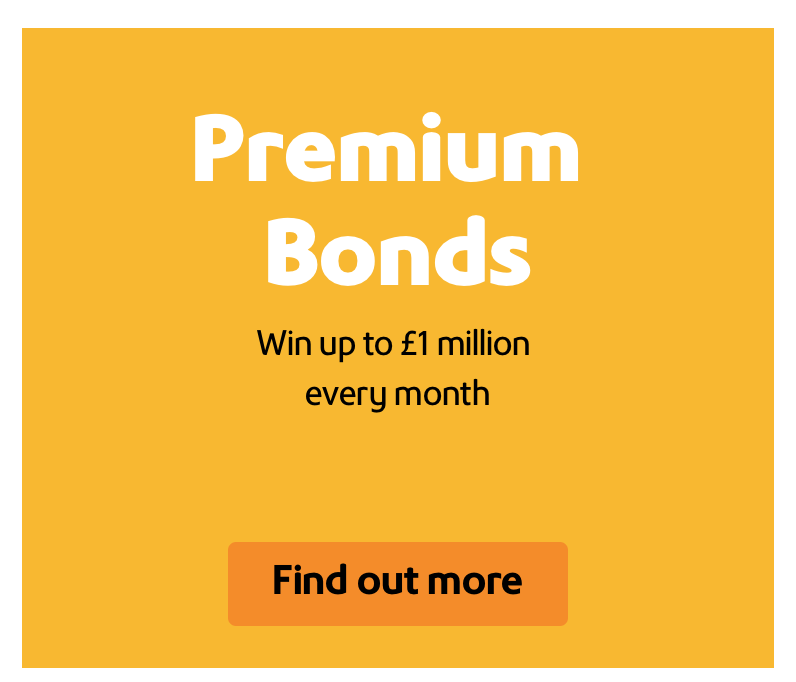

Premium bonds is a savings product backed by the U.K. government that allows you to save and enter the chance to win prizes with up to £1 million instead of earning interest. What you need to know

I recently found out about premium bonds whilst reading a money diary entry on Refinery29.co.uk. The diary entry said she put away £50k in premium bonds- this piqued my interest and I quickly visited NS&I to learn more. How do Premium bonds work? Premium bonds allows you to save monthly, it’s fully secure which means the risk of losing your money is very very low. Instead of paying monthly or annual interest to participants the equivalent interest amount is shared as prizes. Each month a prize draw takes places and you can find out if you win. The odds are 24500 to 1- not a very high chance but the more you save, you more chances you get. In addition, whatever you win is tax free and your money can with withdrawn at anytime. Can premium bonds grow my money? If you are the person that has always wanted to gamble without the risk- this might be for you. Pros

How to register for Premium bonds

How I plan to use Premium Bonds

Having assessed the pros and cons, I’ve decided to allocate a minimum of £25 a month into this savings product. This is a very, very low risk strategy and since I won’t be losing my principal (the money I put in monthly) I am happy to let it it be my - I hope I get LAS VEGAS lucky magic growth pot’.

Back to Blog

Over the past weeks, two things continue to dominate the news: health and the economy. This pandemic has highlighted how important and fragile these two aspects of our lives are. Because we feel good, we can easily neglect to check on our health Apart from the regular advice to eat better and exercise, one thing we can do moving forward is to get an annual health check. In my view this is particularly important if you have a pre-existing condition, a family history of an illness or are past the age of say 35+. Many of us may think that we need private healthcare to get this but this is not the case. Last year, I used Wowcher to get a £120 health check for a family member with a pre-existing condition to make sure everything was fine. The report was detailed and highlighted some known and unknown problems in a clear PDF. This provided some peace of mind for the whole family. The NHS also provides health checks, although you have to be 40+ to qualify. Also factor in health checks for specific areas (breast checks, kidney checks etc), depending on your medical history. Apart from our financial investment, we should have a health saving pot that is allocated to getting needed health care. We are not only responsible for ourselves but also our friends and family and it is important that we remind and help others to invest in their health as well. In the UK, we are lucky that we can get free health services. On a couple of occasions I forgot, or dismissed the need to complete my General Practitioner (GP) checks or vaccines - not a good idea. I got a chance to get a health check via work and the GP told me that we all should contact our GP if something does not feel right. The earlier the better. The NHS does not cover everything however, special services like dentistry, dermatology, physical therapy can all incur supplemental charges. Again a money pot can really save you here. This is especially true if you have children who may specifically require services like braces, paediatric assessments etc. If you want services beyond the NHS, you can shop around to get the best health insurance for yourself where you can pay a monthly fee to get covered. Look at what health services are covered before you make a decision. Many people think they need a job that offers private insurance, but self pay can be as low as £15, and may actually turn out cheaper than paying out of pocket per visit. One more thing, if you have a family and a serious pre-existing conditions/family history of health problems, consider getting life insurance to protect your loved ones. 5 ways you can invest in your health:

As part of our financial investment, we should have a health saving pot that is allocated to getting a health check. 6 ways to create financial safety nets to weather unprecedented stormsLast year I explored the definition and steps that lead to financial vulnerability - last week, I read an article that sums up how this happens ' first gradually and then suddenly'. In the news today, we see many stories of people who have been forced to lose their jobs particularly those in the gig economy and retail industries. This has been particularly difficult for women, many of who are employed in these sectors. For the lucky ones who qualify for the government support, they can still earn up to 80% of their income. But even still, a 20% pay cut can leave people in very tough conditions. Nonetheless, without this government support, I shudder to think of how life can be. Here are a few things I think we can do: 1. It is very important to Build and Sustain an emergency fund. A emergency fund is a saving account where you save enough to cover your expenses for a period of time if you are unable to work. Everyone should have an emergency fund. Start with saving 1 month worth of expenses then aim for at least 3 months, then 6 months. An emergency fund allows you to build the foundation to have something to tap into when things get really tough. If you are able to take this one step further, build a curve ball account to cover the day-to-day expenses that WILL arise. 2. Consider insurance to cover income loss in the event you get ill or lose your job. This way, if your income stops, you can get covered for up to 24 months until you are able to get back on your feet. Like other forms of insurance, you pay a monthly amount and if anything goes wrong, you get an income paid to you no matter what. 3. Consider getting mortgage insurance to reduce the risk of losing your home If you own a home, your mortgage is likely to be your largest monthly expense. In the event that your are unable to keep up with your payments, a mortgage insurance makes sure that you are covered. 4. Have a pension pot I cannot imagine how retirees with low or no pension are supporting themselves in this pandemic. We can be short sighted in these times and forget that we will live a long life. When we retire, our pension pot will become the core income source to weather storms like these. Making sure you are building a sizeable pension pot for when you are older is a constant goal for us all. 5. Invest in the stock market You are not going out, eating out or going on vacation. With the world on lockdown, the stock market is feeling the effects making some stocks/share and funds are cheaper. If you’ve got spare change, this is a great time to get stocks cheap. With interest rates getting lower (I saw one lender providing a 0.05% on savings), the stock market is one place where you can get a good return in the long run. 6. Negotiate the interest payments on your debts We know that there are good and bad ways to handle debts. If you are paying high interest on your debts, this might be a good opportunity to negotiate low rates with your provider. I have seen many articles of companies announcing support to their customers in this unprecedented time. Reach out and see what they can do to make you life easier for the long term. All in all, I hope we can do our very best to give ourselves and our loved ones the strongest chance of living a healthy life. Remember health is wealth!

What other things are you doing to invest in your health and finances?

Back to Blog

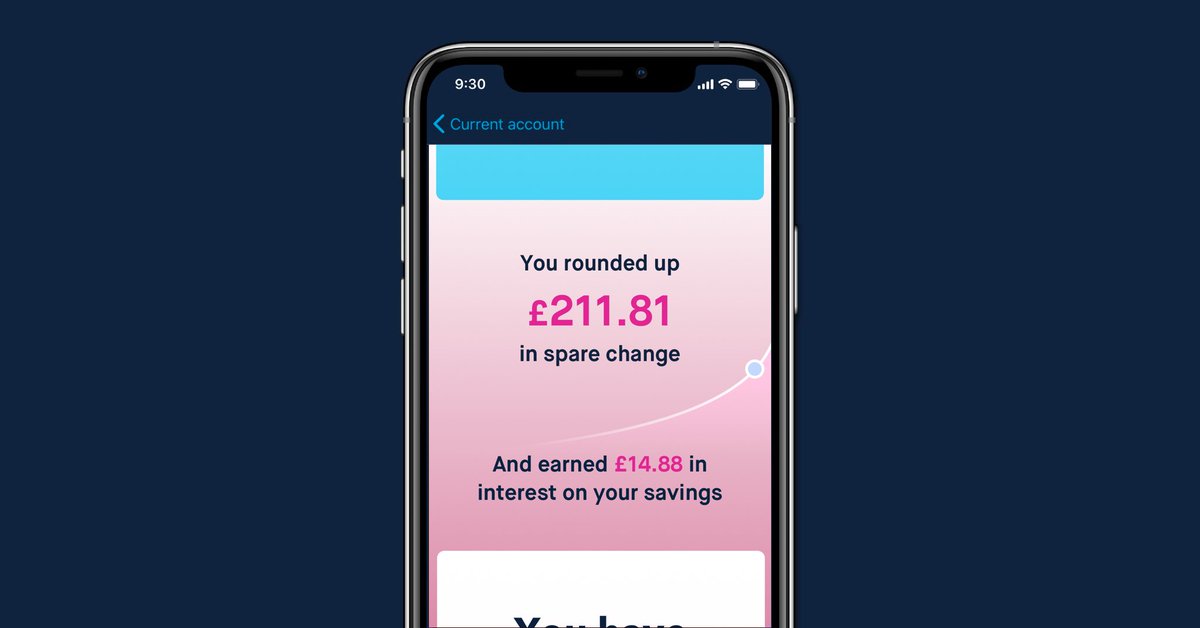

Companies like Revolut and Monzo have these two neat features that have made it easy for me to set up my curve ball savings account. Using one account, I am now able to split my expected expenses (such as travel, phone replacement, transport, beauty service) into different pots. PLUS I get interest payments. Curveball accounts help you manage the WHEN and IF it comes! The problems I was having Up till now, I used one savings account to save for curveball expenses. This account did not let me split my expenses and so I set up my automatic savings to hold it all in one go. if I wanted to split expenses into a savings account, I would need multiple savings accounts to track each of my curveballs. For me this was too much overhead. I don’t want too many savings account to track and maintain. Saving pots with Monzo and Vaults with Revolut My new curveball best friends are these saving pots and vault features from monzo and revolut. Why I like them

6 benefits! I am abuzz. At this time, I decided to go with Monzo saving pots because Revoluts saving vaults is only available to members with a Metal card which is available at £12.99 a month. At the time of wring this article, the Revolut interest rate is higher than Monzo'. If you have a Revolut Metal Card, watch the video below to see how to set up your VaultHow I have set mine up

Now I can track all my curveballs in one place and this has significantly made it easy for me to be on top of things. If I want to save for another thing maybe a trip next year, I can set up the a new travel pot and start saving so it does have to be a worry. Watch the vido below to Learn more about Monzo

Back to Blog

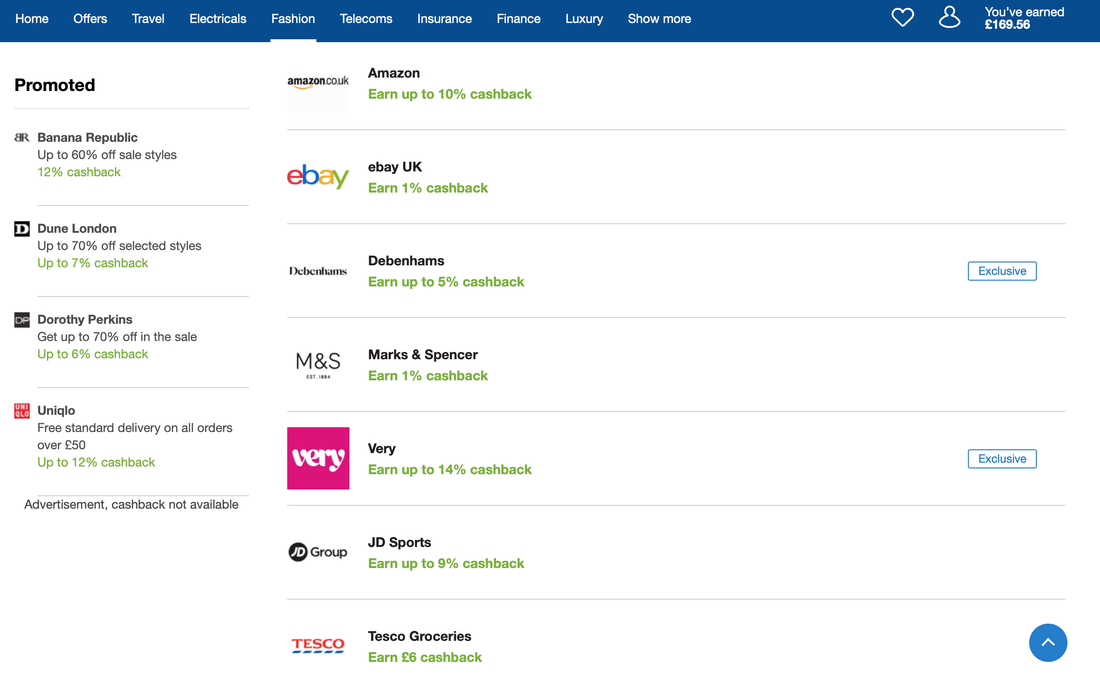

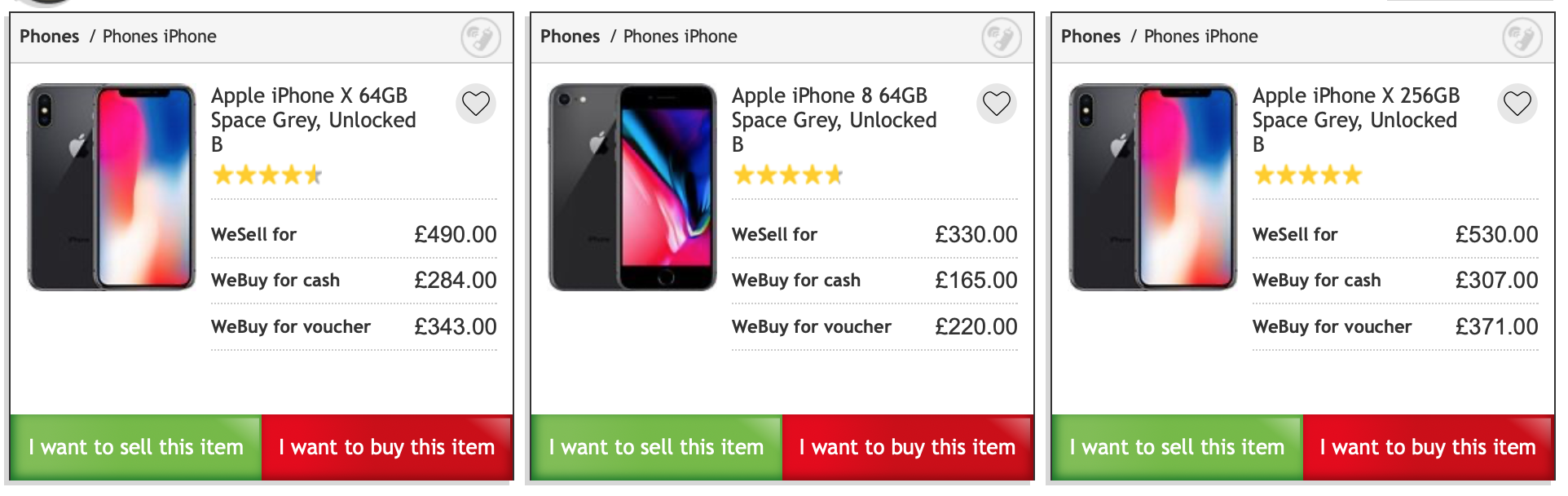

If you are looking for super smart ways to pay less for things you need, this post is for you. I have and continue to look out for easy ways to reduce my spending allowing me to save more guilt free. Keep reading to see the tips I use to cheer up my finances! 1. My credit card pays me for spending If you have a credit card, get or swap to credit card that provide cash back on expenses. I have cards that provide 0.5% on all spending and if I pay with contactless, I get 1% . So for every £100 I spend, I get back up to £1. Sometimes, the bank has deals with retailers who provide more than 1% cash back. This may sound like a small amount but it does add up. Since getting my credit card 2 years ago, I've gotten back around £500. Remember to read terms and conditions and to payback your credit card in full. 2. Switch providers and get cash back Many companies want you as a customer and will pay you to get your attention. Look out for ads from utilities companies, banks etc. who will pay you if you for instance to switch from BT to EE as your telephone provider or from British Gas to Utility point for your electricity and energy. Before doing this, check how long you have to stick with the company and use this approach to get the cheapest prices for your needs. I negotiated and have cut my monthly broadband bill by 10% for 12 months. Go further and use Cashback Apps to save even more. 3. Use companies like Quidco and Top cash back to get paid while spending Companies like Quidco aggregate all cash backs provided by companies. Last year, I was looking for a new internet provider and a friend introduced me to Quidco. I signed up in 5 minutes and I was able to get £65 cash for choosing my internet provider. Even better, once my transaction had been confirmed I was able to send my Quidco cash back directly to my bank account. I always check Quidco to see if they list a retailer when I want to go shopping so I can get a cash back from Quidco and via points via my credit card (see number 1). 4. Split costs with people Anything divided by more than one is cheaper! If you use Netflix, Spotify, ASOS (premier delivery for £9.95 a year) split the costs with friends or family. Where possible get one account and share the costs and services. If you want to travel to exotic places, split costs like hotel, transport and more. To keep track of each person's share use apps like Splitwise where you can record all costs, include your friends and track your spending. 5. Use websites like Groupon/Wowcher/Amazon to get cheap bulk products Since time is money, I've stopped going through the hassle of getting toilet rolls from physical stores. Plus it all get delivered to my door saving me time. I go through Quidco for all my Groupon purchases (see number 3). The same applies to Amazon, I get my long-life milk for 25p less in bulk delivered to my door. No more do I need to carry 5, 1litre liquids for the sake of enjoying my cereal. 6. Travel the world and pay only £99 for flight & hotel If you have dreams of travelling the world. It does not have to cost a fortune. A friend introduced me to Wowcher's Mystery £99 all inclusive holidays with flight and accommodation for over 2-3 nights covered. It works like this, you buy the Wowcher voucher and then an agent calls you to tell you which country you have been allocated (if you do not like it, you can change the dates and location with the agent). If you do not like the hotel provided in the package, you can pay a supplement to upgrade. I visited Budapest and Porto, Portugal using this method. This allowed me to meet my goal of visiting at least 2 new countries per year. If this is not your cup of tea, in general you can always save money by booking up to 6-9 months in advance so you have something to look forward to. Also if you want a local tour in these locations, look up free walking tours to find a local guide. At the end you pay what you like - if you want. Bonus tip: Get Air miles or AVOIS points when you travel and spend them on 'free' or cheaper hotels, flights or entertainment.  Travelling does not need to be expensive. You can do it. Travelling does not need to be expensive. You can do it. 7. Make a Packed lunch for work or class On Sundays I spend 1 hour to create my lunch for the week. I can be as simple or as elaborate as I want. This way I save up to £10 a day which amounts to £200 a month on food. If I want to treat myself I have zero guilt doing so. If you want some quick 'meal prep' ideas- check youtube for easy meals to make. 8. Need Free Entertainment- Yoga, Comedy, Arts? There are so many free things to do in this world. I have gotten autographed books, visited the House of Commons, took Shorinji Kempo (Martial arts) classes, attended really good comedy events without paying a dime. I use websites like eventbrite to find free classes for yoga, arts, dance and more. 9. Scroll through Gumtree for big items (2nd hand shopping) Since furniture does not appreciate in value. I used gumtree to get great deals on furniture. For instance, I got a really great sofa for £350 (retail was £1200) and it was used for only 2 years. I also got my armchair for £50 with free delivery! Using gumtree saved me hundreds of pounds. If you find something you like, go with a friend to see the product before you buy. Also remember to haggle to reduce the price on offer. 10. Use CEX to get cheap but durable Electronics I don't buy new phones anymore. Why? again, they don't grow in value and in my case, Apple will be replacing them every 3 years anyway. So to significantly reduce the cost of paying for a new device, I get phones and other electronics from stores like CEX that also provide 24 months guarantee. CEX sells games, TVs, earphones, cameras etc. They also always have the latest phones as a discount and describe the condition of the product if it is in good or mint condition. 11. Sign up for warranty on all appliances I learnt a tough lesson with this tip. I bought a kettle last year and it started to have loose parts this year. I wanted to get it fixed and found that I forgot to sign up for the 3 year warranty which would have entitled me to a free fix or a new kettle. When buying appliances, make sure it has a warranty and most importantly activate the warranty. 12. Get a homecare plan to reduce out of pocket costs for plumbing, heating, white goods damage and more If you want to reduce the headache of paying the sometimes large sum of fixing a broken boiler or getting a plumber to come around, consider a homecare plan. These plans are monthly payments you make such that if you need to fix these type of issues, the provider will cover the repair costs. I have seen as little ar £2.81 for oven, fridge/freezer, coooker hood and hob cover. Read ther terms before your apply. 13. Switch ON the ROUND UP feature on your app. Monzo and other money Apps have this option and I am using it to make little progress towards my goals. 14. If you don't need it, Cancel it review your subscriptions and direct debits to services that no longer serve you. 15. Save load by paying annually: I saved 25% on my white goods insurance by choosing to pay a one off annual fee instead of making monthly payments. If this option is not presented to you, just ask. In summary, find ways pay less or get paid for spending!

Back to Blog

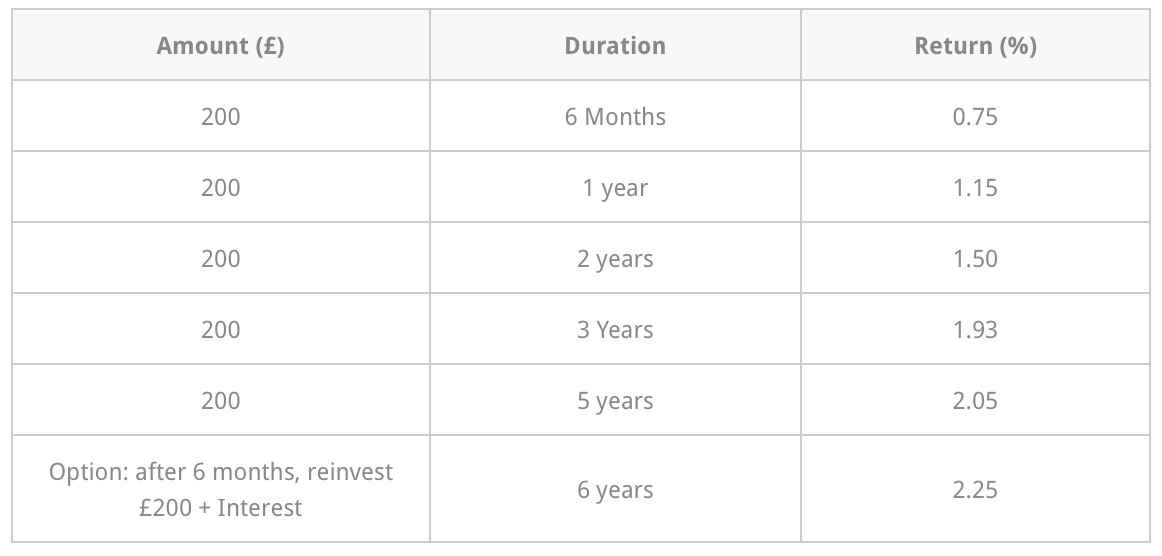

Recently I came across a new idea called Bond Ladder which allows investors like us to arrange our bonds in ways that provides flexibility with regular returns. This can be an attractive option if:

I am actually going to rename these bond trees as they money bloom all year round. Who doesn't like that How a bond ladder worksSay you have £1000 to save. You can either put the whole amount into a single fixed bond for 10 years with a 2.33% return. With this option you will not be able to access any part of the £1000 for the duration of the 10 years. If you feel that this ties you down, you can also opt to create bond ladder. With a bond ladder, you split your £1000 into different amounts across different bonds that mature at different times which also offer varying interest rates as return. With your £1000 bond ladder, you get the amount you invest back at different times so the first will be £200 + interest after 6 months. You can use that amount to sort our any expenses or you can reinvest it into for example, a 6 year bond to keep the process of building your ladder and getting a guaranteed income each time. As normal with bonds, you'll get the highest interest rate with a longer maturity period. Essentially the issuer or bond provider rewards you more the longer they hold your funds as a loan. If you are retired or you know someone who is about to retire A bond ladder is a good way to manage your savings or lump sum pension while you retain your capital. With a bond ladder, you are guaranteed a monthly (if you bond provides this) income via interest payments across multiple years. Remember Do keep an eye out of the interests you get to ensure that you are getting the types of returns you want. You can also create bond ladders using:

Click here to learn more about bonds.

Back to Blog

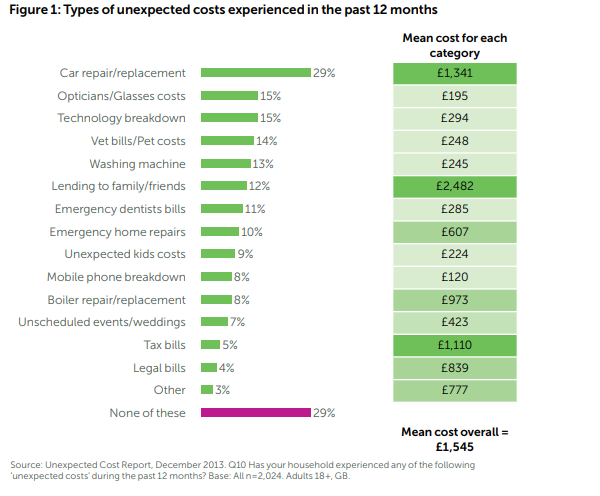

Recently I came across the following key words Financial Vulnerability, Financial Capability and Financial resilience. I generally attribute the words vulnerability, capability and resilience to life, emotions and an overall wellbeing. In the articles spewing these words they explored the following how easy is it for you to weather a sudden financial storm? In other words, how ready are you to manage curve balls. In this blog, we discuss the need for a new savings account to cover unexpected however large or small. Imagine this, two individuals Niya and Hurley receive an email that says you owe £450 from phone contract which you did not formally close if you do now address the cost, it will continue to increase. This is how people become suddenly poor A key goal of WealthSquats to encourage ourselves to build financial resilience, the ability to progress with our financial goals in the face of the unexpected. It is about building a strong finical muscle. What are examples of curve balls |

Proudly powered by Weebly