|

�

Archives

September 2021

Categories

All

|

Back to Blog

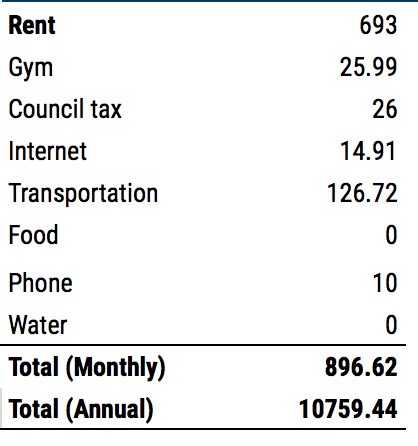

How do I nail down my expenses?9/22/2018 Managing your expenses is good way to find money that you can free up save and invest. What is an expense? An expense is something that takes money away from your pocket. This is my favourite definition provided by Robert Kiyosaki. An expense is in contrast an asset or investments which put money into your pocket (read Rich Dad, Poor Dad). Taking note of your expenses is about making you aware of what things, actvities, or people that are taking money away from your pocket. The table below provides a sample list of expenses. You can also use this simple spreadsheet to quickly calculate yours.

An example of expensesThe 70:30 Rule

As part of my research to gain a PHD in understanding money management, I always remember one rule that I carry around. It is called the Millionaire rule which states that Millionaires save or invest 30% of their income after tax and spend 70% on their expenses. This is called the 70:30 rule. If you are able to save 30% of what you make on a monthly basis in line with the compounding effect you are truly on your path to managing your money. The 70:30 rule is a guideline for managing your finances. Depending on your situation, you can define what ratio works for you and that can be 80:20 or 75:25. You can even start with 90:10 and then work up to a ratio that you feel comfortable with. The goal here is to ensure that you do not feel strapped or have to struggle to save. If you start to struggle, you will dip into your savings frequently and that is not likely to help you achieve your financial goals.

0 Comments

Read More

Leave a Reply. |

Proudly powered by Weebly