|

�

Archives

September 2021

Categories

All

|

Back to Blog

Books9/25/2018 A selection of books to inspire your own journey. I'll continue to add to this page as I find new and interesting resources.

1 Comment

Read More

Back to Blog

Where did I learn my money habits?9/23/2018 One of my friends asked her dad about how to save and he told her to google itLooking back it is very likely that my friend's dad did not know much about saving and investing. To begin my own journey into understanding how I could plan and manage my money better, I had to go to the beginning and be honest about the following question-What do I know about money today and how to make it work for me? To unravel this question, we must first understand where individuals learn habits in the first instance? As a child, you learn your speech, behaviors and values from your surroundings which is made up of family and friends. In just the same way you also learn your money habits from your surroundings. Your money habits include how you spend, save and think about money. “Your money habits include how you spend, save and think about money.” Your surroundings can have a profound effect on how you manage your money. It also defines your path to wealth. It is therefore critical to assess how much your money habits is attributed to what you have learnt from your surrounding in line with evaluating your current circumstance. This insight will allow you to understand how a family can have wealth for generations, because the rich teach their children rich habits and the less well off teach less well off habits. Teach can also be observation. Take for example, if you lived in a household where there was always a scramble to pay rent and meet monthly expenses, you could accept this a normal and find yourself with very little to spend at the end of each month as a working adult. But you can make another choice, you can take the time to assess why the scramble took place and plan how you can make money work for you and not fear it. “Your surroundings can have a profound effect on how you manage your money. It also defines your path to wealth.” My middle class parents did not teach me about money and financial management. This was in part due to the fact that they did not get an education from their parents. To be frank, money is not a subject that most families or friends discuss in open. To some any topic about money is best held in private or not at all. But if you want to manage money successfully, you need to understand it and you need to talk about it in order to develop successful money habits. WealthSquats is intended to help others understand that they can start their own path towards financial with the right information, patience and discipline. There is no complex jargon about finance-it is basic, it is simple and it works. It all starts with knowing that with what you have today, you can make the most of it by starting small. If you want to manage money successfully, you need to understand it and you need to talk about it in order to develop successful money habits Take Pleasure in saving money

|

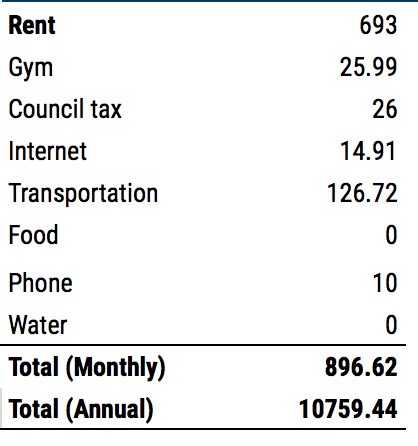

Types of Expenses |

Description |

Amount I spent per month is.. |

Rent |

Money spent on housing. This should be circa 30% of your monthly income |

... |

Mortgage |

Money spent on owning a home. This should be circa 30% of your monthly income |

... |

Groceries |

Money spent to buy food |

... |

Gym Membership |

Money spent on fitness |

... |

Recreation |

Money spent on socialization including theatre, concerts, dining out, going to the movies etc. |

... |

Electricity/water/gas bill |

Money spent on your home utilities |

... |

Telecom |

Money spent on phone credit, phone payment plans and phone upgrades. |

... |

DSTV/Television |

Money spent on television packages |

... |

Clothing |

Money spent on clothing,bags, shoes,sneakers etc. |

... |

An example of expenses

As part of my research to gain a PHD in understanding money management, I always remember one rule that I carry around. It is called the Millionaire rule which states that Millionaires save or invest 30% of their income after tax and spend 70% on their expenses. This is called the 70:30 rule.

If you are able to save 30% of what you make on a monthly basis in line with the compounding effect you are truly on your path to managing your money.

The 70:30 rule is a guideline for managing your finances. Depending on your situation, you can define what ratio works for you and that can be 80:20 or 75:25. You can even start with 90:10 and then work up to a ratio that you feel comfortable with. The goal here is to ensure that you do not feel strapped or have to struggle to save. If you start to struggle, you will dip into your savings frequently and that is not likely to help you achieve your financial goals.