|

�

Archives

September 2021

Categories

All

|

Back to Blog

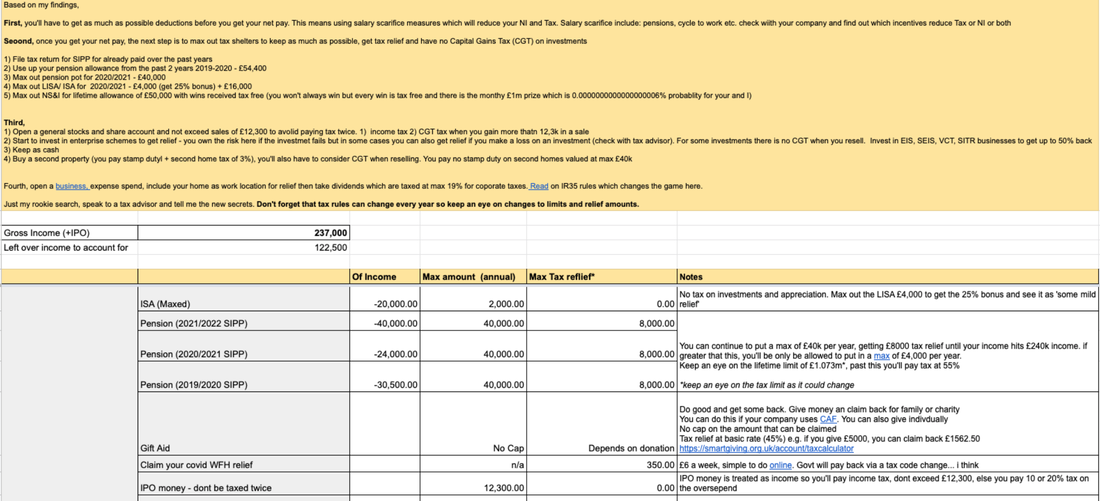

Someone reached out to me to try to solve the puzzle related to earning a high income as an employee (£237,000 to be exact) and using tax laws and perks to keep the most of the money to save and invest.

I scoured the tax rules to pull a quick report that broke down how that money can be allocated in tax friendly accounts or where tax relief can be obtained. This exercise was a great reminder on why we should invest in a tax advisor to help us keep most of our money. A tax advisor is available to all income levels and although there could be costs associated with this service you can save up and use them at least once a year to get your monies in order. If you are on a low income, you can get free advice from the government. I have just opened a Money pot called Life Admin where I'll be saving to get a tax advise and formalise a Will. Many wealth builders have great lawyers, accountants, doctors and financial advisors. What can a tax advisor do for you:

How to manage a £237,000 income and Tax. Click here or the image below to see the full report. Need a Tax Adviser, click here to choose who is appropriate for you or use the all in one service from Taxscouts and get 10% off.

0 Comments

Read More

Back to Blog

What money lies have I stopped telling myself? What is my biggest financial asset? How do I spend and save today? A few years ago I had ZERO knowledge about money and in this post, I look back to see what key mistakes I've stopped making that have become a game changer in my life. My 5 money mistakes

I remember always being so surprised that I had nothing left at the end of the month Spending and spending with no real plan Before I began to get an handle on my finances, my money would come into my current account and all of it would stay there. Slowly my rent, bills would get paid and if at all anything was left, I would still have a reason to spend it. I remember always being so surprised that I had nothing left at the end of the month and when I thought about the effort it would take to go through my spending, in my mind, it was not worth the effort. The money was already gone. Today, I have a budget which I optimise (find ways to reduce my expenses and increase my savings and investments) regularly. Nothing stays in my current account after all bills are paid (my current account doesn't pay interest) and monthly savings and investments have left. Every planned spending is accounted for and I no longer suffer the end-of-the-month-where-did-my pennies-go-syndrome. If you need a money goal to help you plan your spending start here. To be honest, by the time I was 23 years old, no one or school had taught me how to save, no one sat me down to talk about debt or showed me savings accounts and it definitely did not come up as a topic amongst my friends. I simply had no positive money role models. Not being deliberate about saving Just as I spent with no real plan, it is no shocker that I had nothing to save and this happened every time. To be honest, by the time I was 23 years old, no one or school had taught me how to save; no one sat me down, showed me savings accounts, opened a piggy bank and it definitely did not come up as a topic amongst my friends. I knew I wanted to have money but to me it was magic that makes this happen and this magic happens to special people. Little did I know that magic starts with a budget. A budget is the greatest energy source for your money - no lie, they are like batteries you charge to take you far. It shows you where all your money goes and how you are doing. Today, I know of many magic wands that are accessible to all of us where it is savings accounts, the stock market, pensions, private equity, real estate, peer to peer lending, Crypto. This is how I am now deliberate about my savings are as follows:

Thinking I've got my pay-check. That's all I can make right now... Once I got my first proper job, I breathed a sign of relief I now have money. I revised this thinking after my first pay-check (with National Insurance (NI) and taxes deducted, very little was left). Since this was my only source of income, there wasn't much else I could do except find ways to increase my income constantly - this was a hard task. I knew I had to find a way to fatten my income outside of my employment. I went to a seminar once and they spoke about making money while you sleep and multiplying your hourly rate. Since then, this quote from Dave Ramsey has stuck with me-Your most powerful wealth building tool is your income. One of the ways I am applying this principle is by allowing other companies to work for me by buying into funds or shares. When these companies do well, their prices increase and/or they give a dividend. If they don't do great, I take the risk of having lower return but on average and over a long period of time, I should win. Of course there are other things you can do like getting another job for your 5 to 9 but if want an 'simple' co-worker earning for you without any additional effort, you now know your options. The results:

Before writing this post, I looked at my overall pension to see the current value and hands down - it is the largest financial asset I own today. Not setting my pension to the max matching to get free employee match When I started my first job, I think I opted out of the work pension plan initially or I may have begun with saving 1%. At this time, if I put in up to to 5% of my salary, the company would match that 5% and I would have 10% paid into my pension pot. Now as a 23 year old, why would I give away 5% of my money for old age when I am young and in my view at that time, close to the London poverty line? I kept this view for about a year and half when I got serious about transforming my financial life. I spoke to a friend at that time who advised that the easiest place to start getting money was by increasing my pension saving to the 5%. This not only allows me to get free money but it also reduces my taxes. Before writing this post, I looked at my overall pension to see the current value and hands down - it is the largest financial asset I own today. This is not surprising given this UK research where pensions can make up to 60% of households net worth. This are some reasons for the growth:

I am now looking forward to being older; I've even calculated how much I'll need to live comfortably. I also have some peace of mind that the efforts I am putting in now will lead to a beautiful life and that is exciting. I like pensions because they force us to save for old age (otherwise, we will just stumble into it), once the money is gone it is out there working, growing to make the most for you. Fast forward to age 24, I read a book by Tony Robbins which simplified the foreign language and and so I quickly open my brokerage account with £25. I have not looked back. Believing the stock market is scary As a young girl, I remember watching CNN evening news and at 9pm GMT, we would hear the NYSE Bell ringing to close the day of trading. I must have watched this happen hundreds of time but I never understood why the bell was there in the first place and what those green and red triangles next to names like LSE, NYSE, DAX etc. meant. I did not know that I was witnessing the opening and closing of money making opportunities. The commentary the pundit gave after each closure was like a foreign language to me, one I found very boring. Fast forward to age 24, I read a book by Tony Robbins which simplified the foreign language and and so I quickly open my brokerage account with £25. I have not looked back. Today, I know the stock market is a huge source of wealth for the top 1% in the UK and is designed to be confusing (with the graphs and financial terms). It is actually not confusing and I am very supportive of the low fee robo-advisors that make it easy for you and me to take part this huge wealth engine. Last week, a family member was discussing a real estate scheme that guaranteed 8% return if she put in £5000. I immediately opened by brokerage app and told her that one of my fund is posting 22% gain. Five years ago, there is no way I wold have been able to suggest this as an option to explore but now I know more and can suggest ideas that could generate a 14% pay bump. This is the true power of knowledge. Now, your turn, do you have any mistakes you've made?

Back to Blog

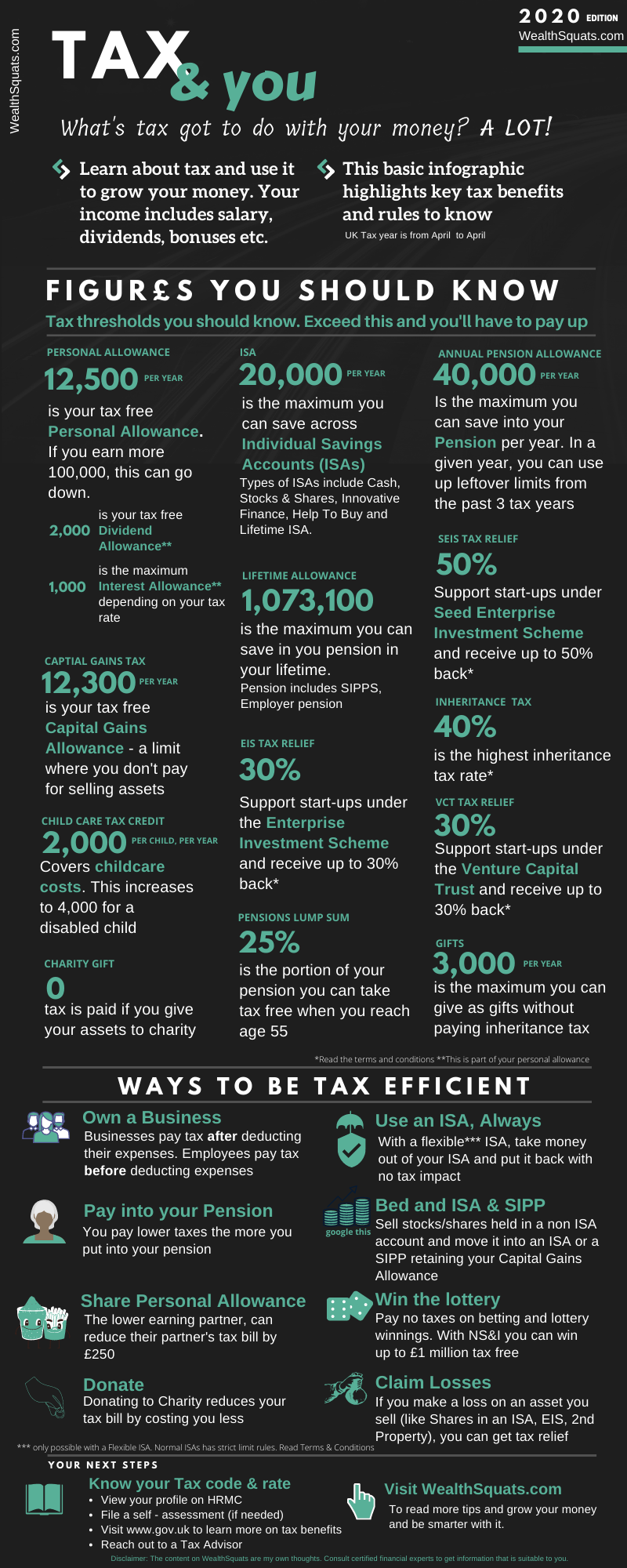

Tax is part of our lives whether we want it or not. It touches our income, contributes to our society, our healthcare, education, roads and more. In this post, I spend some time looking at the UK tax rules to find out which benefits we could use to grow and protect our money. I put my basic findings in an infographic to make it simple [Scroll down to view]. So let's learn about tax so we no longer label it as highly-confusing and downgrade it to somewhat confusing (a much better space to be in). [Quick definitions] The Tax WebThroughout this research, I found that Tax is actually not hard to understand on its own. The confusion comes when you have to consider all parts. Take this example: You have an income over the personal allowance threshold whilst saving for a pension and a home which your family will support you with a deposit. I call this the web because to understand your tax position, you need to understand the Tax rules for income, pension, stamp duty tax and gifts. No wonder you and I shun this topic...but to our own wealth demise. Did you know that if you make a loss when you sell your home, shares in an ISA, or a personal possession worth £6,000 you can get a tax relief? Imagine that getting paid when you lose. These are the kinds of helpful money tips I want to know about (I've added much more below). Get Clarity If you work for an employer, your income tax is typically handled by your company. If you are self employed, you'll file paperwork on your own or via an accountant/certified tax advisor to pay the appropriate tax and claim relief. Anyone can reach out to an accountant or tax advisor on tax matters. Before we move on, one question. What tax rate payer are you? If you don't know the answer, keep reading to find out. What Tax Rate Payer are you?

Your income determines how much tax you pay. The UK uses a progressive tax system, where the more you earn the more you pay in tax. So, if you earn up to £12,500 per year, you'll pay £0 tax. On the other hand, the highest income earners pay up to 45% of their income in tax. This can be very difficult to accept which is why many people look at ways to legally reduce their tax bill by using some of the options outlined in the infographic such as increasing payments to their pension, using ISAs to prevent being taxed again or not taking out dividend income for a given tax year (deferring it). Some others flee the UK to low tax rate countries. Just know that your tax solution or option is unique to your personal circumstance. Find out what tax rate payer your are here. TIP More tips & resources

Remember this: Get Tax Advice

Videos on Taxes

Back to Blog

NS&I have cut Interest rates meaning you get less back for your money. There is speculation that other bank/lenders will follow NS&I's lead. This means that holding a lot of your money in cash will not make you rich anytime soon. What else can you do with your cash?

Back to Blog

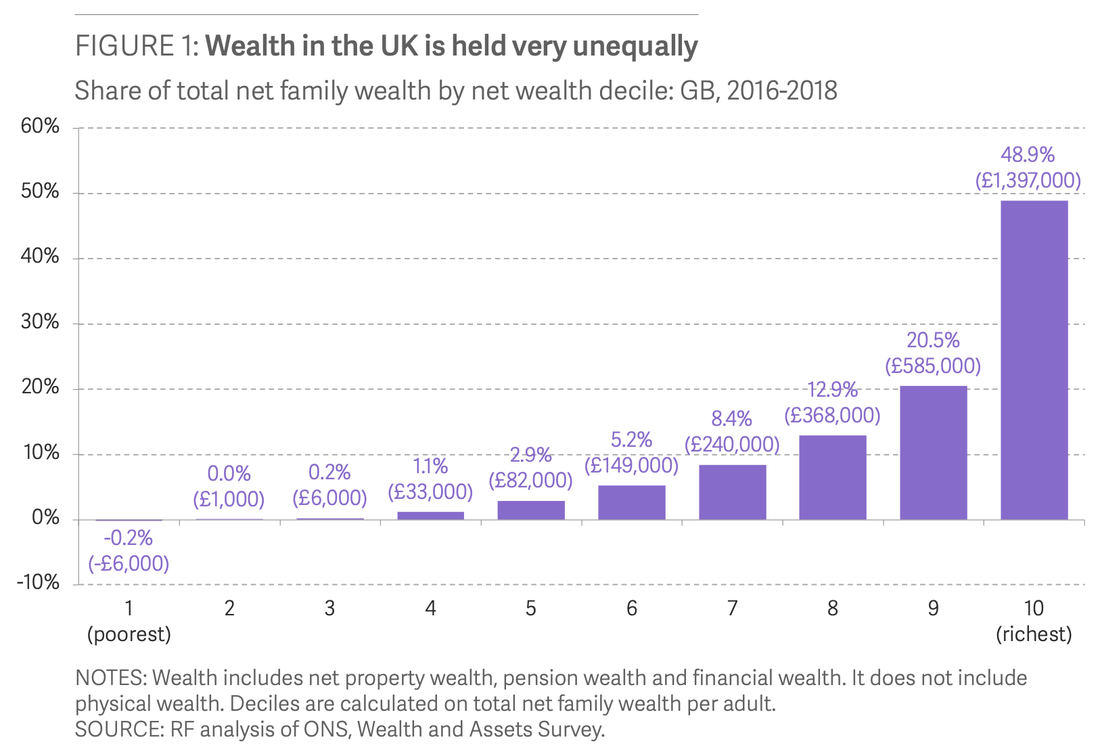

Why do the rich pay less for housing month on month? How do they make their money grow? How many of them can survive one month without a pay-check? I read the 2020 report from Resolution Foundation on wealth in the UK to see what research says about how to be rich in the UK. Keep reading to see the surprising answers. First, a quick recap: What is Wealth? Wealth is your assets (An asset: is a thing of value that grows e.g. savings, pension, real estate, art, gold etc.) minus your debt. We also call this your net-worth. In this study, 4 types of wealth were measured:

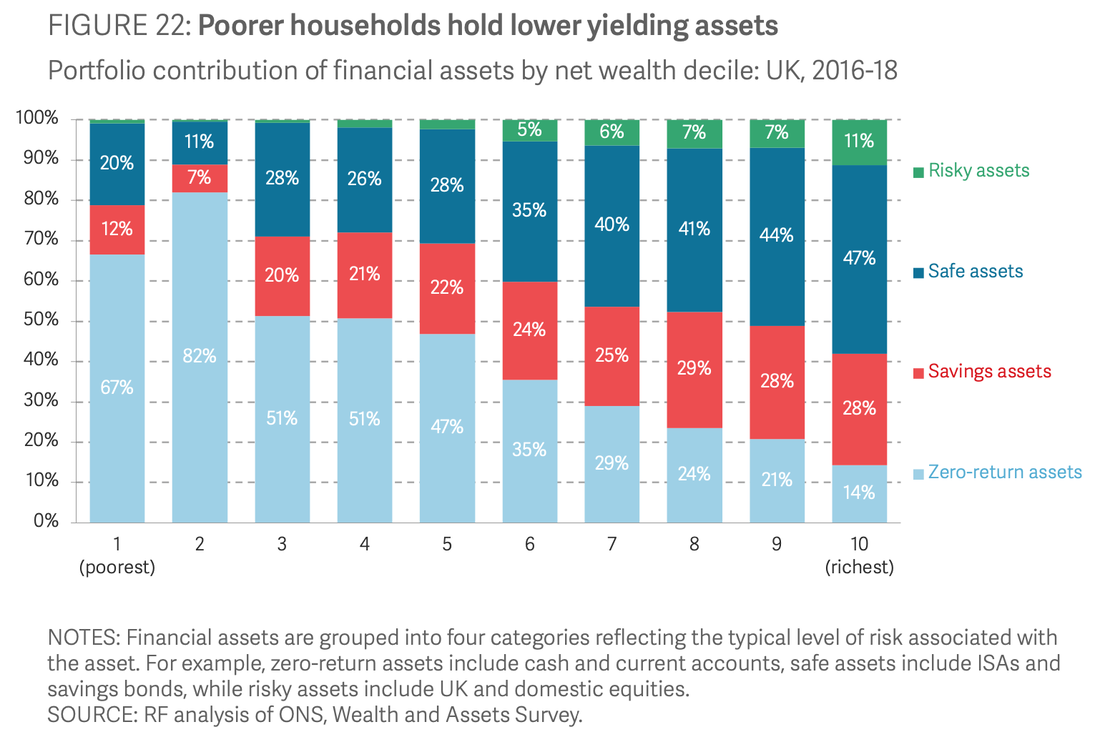

So, how do the rich manage their money?The top 10% have about 50% of UK's wealthThe average net worth of the 10% is £800,000. But, where do they grow their money? Keep reading to find out.Do it like the Rich: When it comes to financial assets, the Rich hold less cash and more of their money in growth assets like savings bonds, ISAs, and Stocks and Shares.Poor households hold most of their money in cash or current accounts where there is very little growth. When the rich hold money in savings bonds, ISAs, and Stocks and Shares, they benefit from:

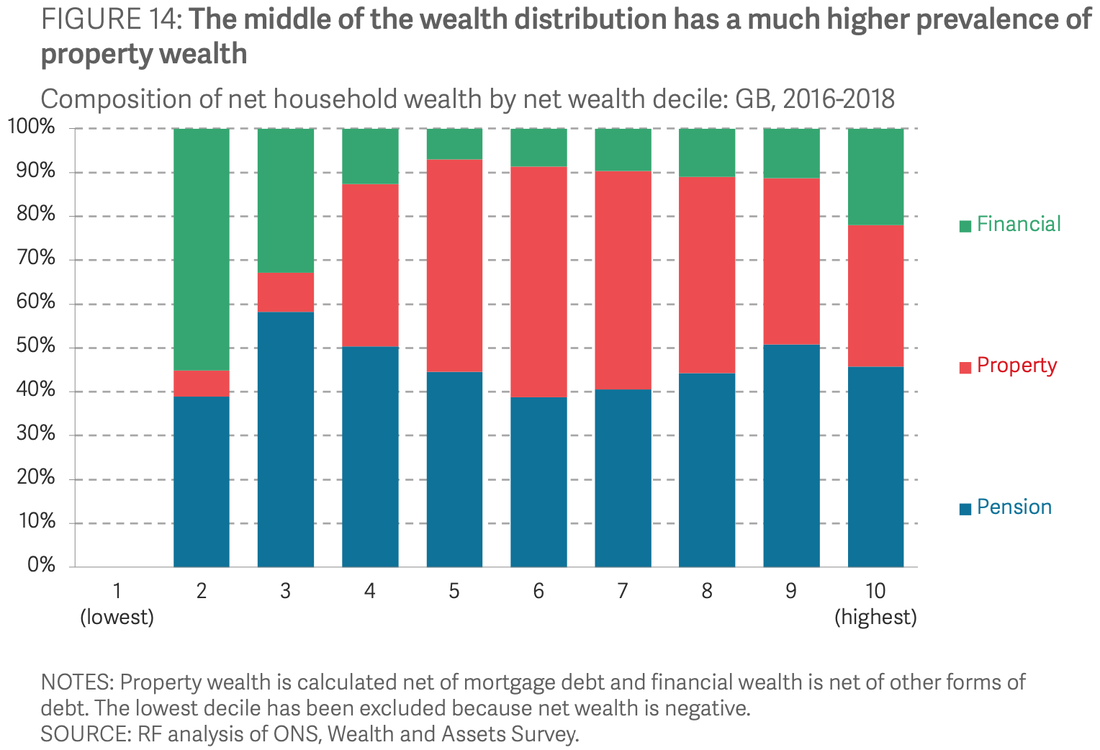

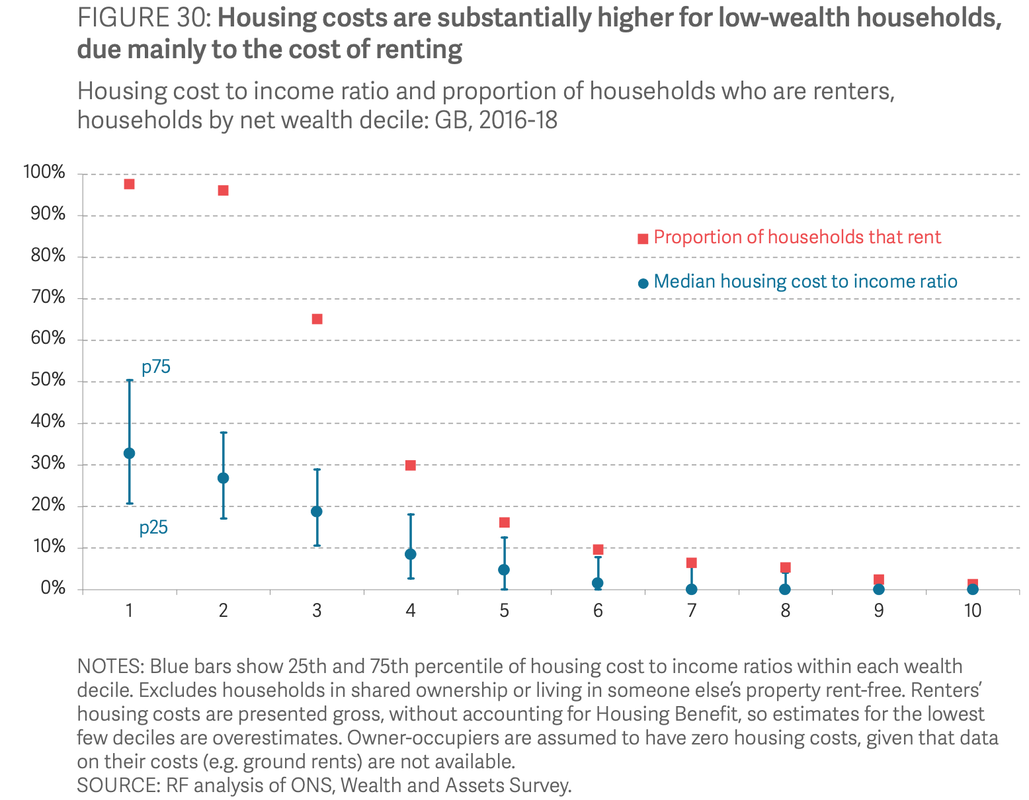

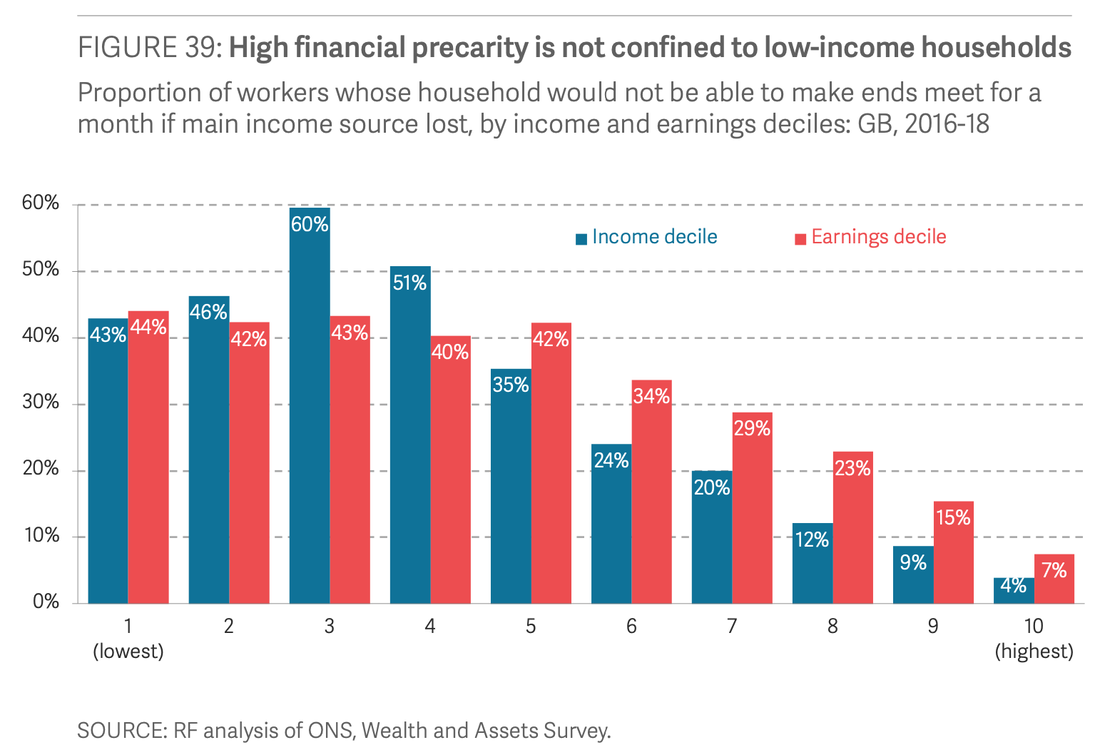

Do it like the Rich: The Rich have about 45% of their money in pension pots, 35% in property and 20% in financial assets (savings bonds, ISAs, and Stocks and Shares) Financial wealth (in high growth assets) increased substantially in the last 10 years and this contributed significantly (80%) to the overall wealth of the rich.As mentioned above, the financial assets of the rich are held in growing assets like bonds and the stock market. The Stock Market grew substantially in the past 10 years and it made the rich richer. The poor held most of their money in zero growth assets e.g. cash or current accounts and even when they added more money in these places, it grew at a much lower rate. Do it like the rich: Richer families tend to be homeowners Their housing costs are around 5% of their income if they own their home outright or 11% of their income if they have a mortgageDo it like the Rich: The Rich have emergency funds 7% of the rich would have a hard time if their main source of income is impacted as opposed to 44% of the poor.An emergency fund allows the rich to stay afloat if a shock like a pandemic or job loss takes place. Young females who are not degree educated were the most at risk if their income ran out. Do it like the Rich: There you have it. Some insights into the habits of the rich. Of course there are other ways to get rich, such as owning a successful business, investing in start ups, inheriting money or owning art for example. The options above are the accessible ways to start to build wealth and is the reality for many everyday people. See this infographic on how to spend £2000 which highlights the step by step guide to implementing the lessons above.

Which Rich habit will you start to use? |

Proudly powered by Weebly