|

"I am passionate about empowering women to enjoy themselves while establishing strong financial foundations that deliver tangible results from day 1"

Chiamaka Odikanwa Founder, Wealthsquats.com |

Growing up, I had no positive financial role models. But I didn’t let that stop me. In 2014, a financial disaster struck that left me feeling inadequate, terrified and helpless. But it was also the wake-up call that I needed to change my life for good.

I spent countless hours, days, months and years learning about money. I had to unlearn the psychological behaviors that kept me poor. I had to face the reality of what it means to be a woman in today’s world - we live longer but earn less. I had to tackle the financial language that would keep me from tapping into the key sources of wealth that are being generated in this century. And I had to rebuild my own confidence by making time to cater to my financial health and overall well-being. As my financial literacy grew, so did my confidence and financial net-worth. And I began sharing my learnings with friends, family and colleagues. And I found out they too knew very little about money. Because of the silence around money, they had no one to speak with. They wanted someone who would break down the basics and walk alongside them. And the more I spoke with women, the more I heard about two recurring imposters: embarrassment and fear. These co-conspirators can keep women frozen, scared and small - not knowing where to start - pushing us further and further away from touching our rightly-owned rich lives. In 2018, I launched wealthsquats.com to demystify money and my personal results have been astounding! This work began as a hobby and I am still on a journey. I am determined to bring other women along because empowered women do powerful things. I want every woman to be fluent in money speak, to live longer with comfortable endowments and to design her own life on her own terms. To my fellow women who feel anxious about money, I am hopeful that a new dawn has set upon us. Yes you may face setbacks and false alarms, but this time you will be doing this from a place of unrivalled confidence. So let us build generational wealth, enjoy lattes, buy that bag, travel the world, be charitable, negotiate better pay, own businesses, and inspire others. This is my vision. Chiamaka Odikanwa |

New? Start Here

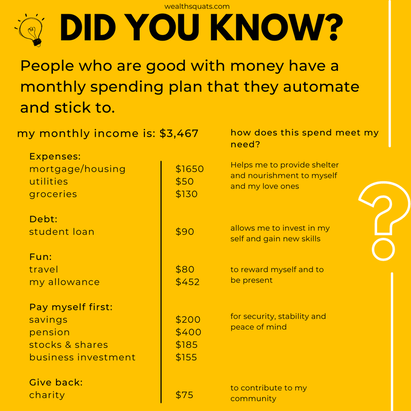

Build a Spending Plan

|

A spending plan is the most significant way to develop positive money habits and is the map to your rich life.

|

Learn what to say in Negotiations

|

Do you dread the idea of negotiating, but know that it can make a huge difference in your life? Do you want to learn how to negotiate your pay effectively and confidently, without spending hours on preparation? If so, this book is for you.

|

Master your money in 5 minutes

Start your money journey with a powerful conversation

Empowering Women to shift the data landscape

As someone who is passionate about promoting financial literacy, I am deeply concerned about the financial challenges that women face.

The data tells a story of ‘less’: on average, women live longer, earn less, invest less, own fewer assets, receive less business funding, and are less confident in their financial skills.

They also have more debt and are more stressed. This is why I am committed to increasing women’s financial capabilities and empowering them to take control of their financial futures.

The data tells a story of ‘less’: on average, women live longer, earn less, invest less, own fewer assets, receive less business funding, and are less confident in their financial skills.

They also have more debt and are more stressed. This is why I am committed to increasing women’s financial capabilities and empowering them to take control of their financial futures.

What does the UK data on Wealth & Assets say?

Why WealthSquats?

WealthSquats aims inspire visionary women aged 25-55 to belong in the financial world. By providing proven, action-oriented strategies, we enable them to enjoy today and build wealth for tomorrow with confidence and control.

We are changing the way women interact with money. For multiple reasons, we are not taught the fundamentals of how to manage our finances properly and this ultimately determines the options we have.

I now know that money is power and as women continue to advance in all areas of their lives, the ability to manage money is one area that can inspire confidence and induce a high quality of life.

This initative is for all types of women regardless of your age or income. These pages are a collection of simple, practical thoughts on wealth creation, growth and protection.

I have come to learn that financial literacy is a skill that can be built just like empathy, leadership, time management or public Speaking. Although I am no financial expert, my goal is to share my views on what I have learnt and continue to learn about money.

WealthSquats focuses on 4 areas.

Reach out, subscribe and share your views so that we can create a robust resource for everyone.

We are changing the way women interact with money. For multiple reasons, we are not taught the fundamentals of how to manage our finances properly and this ultimately determines the options we have.

I now know that money is power and as women continue to advance in all areas of their lives, the ability to manage money is one area that can inspire confidence and induce a high quality of life.

This initative is for all types of women regardless of your age or income. These pages are a collection of simple, practical thoughts on wealth creation, growth and protection.

I have come to learn that financial literacy is a skill that can be built just like empathy, leadership, time management or public Speaking. Although I am no financial expert, my goal is to share my views on what I have learnt and continue to learn about money.

WealthSquats focuses on 4 areas.

- Net worth: What are you worth in financial terms? Is it £4,500, £45,000 or more? Knowing and tracking your net worth is a great source of confidence, particularly when aligned to your personal life goals. We discuss how to calculate this value and what the figure means for your life in real terms.

- Pension: Statistically, we women live longer than men and this means that we need to focus on ensuring that we have a solid plan for enjoying rather than dreading retirement

- Savings and Investing: 85% of women do not own stocks and 51% have less than $500 in savings. Put simply, these numbers must change. We explore multiple options that help your money grow in a diversified way.

- Financial Literacy: As with everything, a little knowledge goes a long way. Having a basic understanding of your financial options gives you the freedom to make tailored choices that fit your own goals. I curate articles, videos in addition to my personal experience to arm you with resources to make better choices.

Reach out, subscribe and share your views so that we can create a robust resource for everyone.

The Wealth BasicsThe wealth basics is a guide to increase financial resilience. These actions were devised based on research, personal experiences and conversations with others.

|

Net worthWhat are your worth today in financial terms?

Your net worth is a good starting point to set financial goals that you want to achieve. Calculate yours by clicking the link below. PensionSaving for your old age may not sound sexy today but if someone told you that when you retire you would get $100 a month to live on, how would you react?

|

Saving & InvestingHow can you make your money grow?

Let's start creating wealth. Explore the saving and investment options that can help you make the right decisions for your short, medium and long term goals. Financial LiteracyDon't let the big financial terms scare you. Get educated on how to change your atitude towards money so you can control it.

|

"I have £125 every month to save and invest. What can I do with that?"

This amount (£) |

is for |

held in a |

and for how long? |

18 |

Emergency Account |

Short to Medium term |

|

25 |

Pension |

Long term |

|

20 |

Property |

Home Equity, Mortgage (overpayment) |

Medium to Long term |

10 |

Fun account |

Short term |

|

30 |

Stock Market Stocks & Funds, Vanguard life strategy funds, index trackers, Robo Investing |

Medium to long term |

|

7 |

Alternative Investing: Early Stage Private Equity, Peer to Peer lending, Art, Crypto |

Short to Medium term |

|

15 |

Bonds |

Short, Medium, Long term |

The above is an example. Do your own research to find the right mix that meets your goals and risk appetite In the UK, you can use an ISA to avoid paying additional tax on your investments. Investment into early stage companies can provide a tax relief through EIS-Enterprise Investment Scheme. Check the charges and costs associated with your investments.

What should I be doing with my finances if I am a...

Our financial decisions evolves with our varied life stages. Whatever stage you find your self, there are many options that meet your needs.

Disclaimer

The content on WealthSquats are my own thoughts and is not Financial Advice. Consult certified financial experts to get information that is suitable to you.

The content on WealthSquats are my own thoughts and is not Financial Advice. Consult certified financial experts to get information that is suitable to you.

© Copyright WealthSquats Ltd. Company Registration: 14992248