|

What can I do with my money? |

Robo Investing

What is Robo Investing?

Robo Advisor Companies such as moneyfarm, nutmeg, moneybox are in the business of picking diversified funds for you. These companies create standard portfolios with a mix of stocks, cash, funds, debts etc. on behalf of their customers with the aims of generating them a return. In response to changing market conditions, Robo Advisors can change the portfolio mix as they wish, to generate gains.

As an investor, when you chose to invest via a robo advisor, you own shares of their existing portfolio and this can beneficial for a few reasons:

You may be wondering how they are able to charge relatively lower fees, this is due to the use of Artificial Intelligence (AI). These companies use algorithms that monitor the markets to make investment decisions. As a result, they are able to deduct the cost of a human advisor.

However, do keep in mind that robo advisors are fund managers and so they charge fees for their services. So carefully check the costs associated with each provider. My rule of thumb is that costs/charges should not exceed 1% of your investment. These companies typically charge their fees from your investment and not your returns.

What type of account should I open?

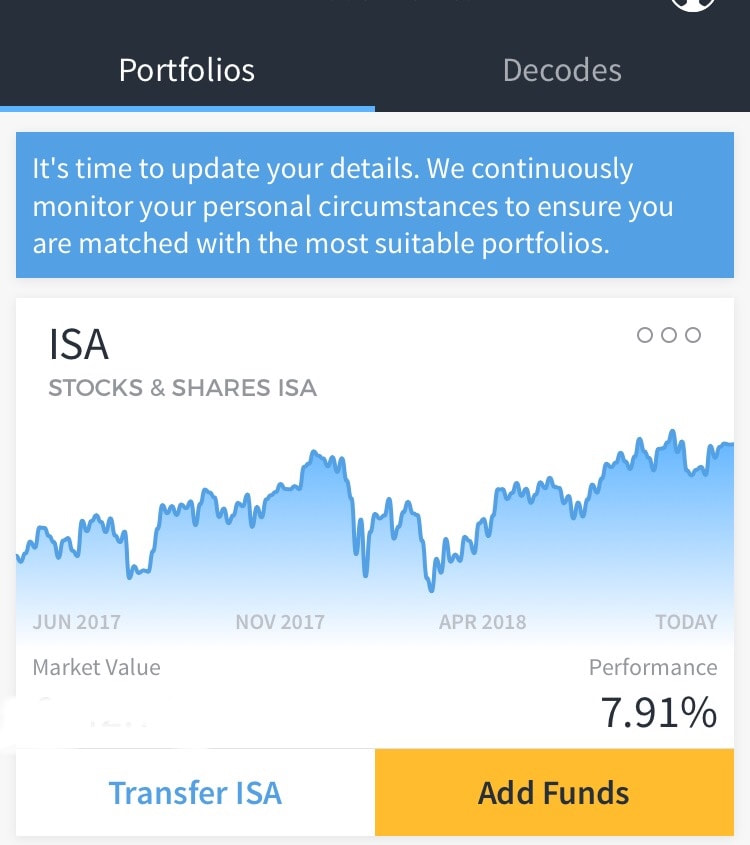

I use the Stocks & Shares ISA to hold my Robo investments and benefit from the tax relief. Keep in mind that you are allowed to open only one Stocks & Shares ISA account in a given year. As of October 4th, 2018, my robo investment with moneyfarm has generated a return of 7.91%. In addition, some Robo Advisors are part of the Financial Services Compensation Scheme (FSCS) which is aimed at protecting investments up to a value e.g. £50,000. Look out for these providers that mention this so that you can have some peace of mind on your investments.

How do I sign up?

You can sign up with Robo Advisors on their website or via their mobile App. When you sign up, these providers (see a list below) qualify you based on your goals, investment time horizon and previous investing experience. This is just to ensure that they create the best portfolio for you and that you understand the risks typical with investing.

Robo Advisor Companies such as moneyfarm, nutmeg, moneybox are in the business of picking diversified funds for you. These companies create standard portfolios with a mix of stocks, cash, funds, debts etc. on behalf of their customers with the aims of generating them a return. In response to changing market conditions, Robo Advisors can change the portfolio mix as they wish, to generate gains.

As an investor, when you chose to invest via a robo advisor, you own shares of their existing portfolio and this can beneficial for a few reasons:

- You can start investing with a very small amount. Some robo advisors allow investors to start investing from £1. This makes a huge difference when you compare that you'll need $262.95 + trading costs to get one Tesla stock (October 6, 2018).

- There are no trading costs or brokerage fees. High trading costs can be barrier to investors by increasing the amount you need to enter the stock market. With Robo Advisors, you can invest a lump sum or a monthly amount to build your investments over time.

- They are accessible. These companies are relatively new, have user friendly apps that are simple to download, use, and understand.

You may be wondering how they are able to charge relatively lower fees, this is due to the use of Artificial Intelligence (AI). These companies use algorithms that monitor the markets to make investment decisions. As a result, they are able to deduct the cost of a human advisor.

However, do keep in mind that robo advisors are fund managers and so they charge fees for their services. So carefully check the costs associated with each provider. My rule of thumb is that costs/charges should not exceed 1% of your investment. These companies typically charge their fees from your investment and not your returns.

What type of account should I open?

I use the Stocks & Shares ISA to hold my Robo investments and benefit from the tax relief. Keep in mind that you are allowed to open only one Stocks & Shares ISA account in a given year. As of October 4th, 2018, my robo investment with moneyfarm has generated a return of 7.91%. In addition, some Robo Advisors are part of the Financial Services Compensation Scheme (FSCS) which is aimed at protecting investments up to a value e.g. £50,000. Look out for these providers that mention this so that you can have some peace of mind on your investments.

How do I sign up?

You can sign up with Robo Advisors on their website or via their mobile App. When you sign up, these providers (see a list below) qualify you based on your goals, investment time horizon and previous investing experience. This is just to ensure that they create the best portfolio for you and that you understand the risks typical with investing.

List of Robo Advisors (UK)

|

|

What are my next steps with Robo Investing ?

|

I want a diversified portfolio that allows me to keep more of my returns. Explore Exchange Traded Funds

Disclaimer

The content on WealthSquats are my own thoughts and is not financial advice. Consult certified financial experts to get information that is suitable to you.

The content on WealthSquats are my own thoughts and is not financial advice. Consult certified financial experts to get information that is suitable to you.

© Copyright WealthSquats Ltd. Company Registration: 14992248