|

�

Archives

September 2021

Categories

All

|

Back to Blog

What do you want to be when you grow up? What is your 5 year plan? What are your career goals? What are your relationship goals? We've all heard this at one point in time and I wonder, why do we not also ask: WHAT ARE YOUR MONEY GOALS? if you are the kind of person that writes your life goals, does it include money goals? Research has shown that writing your goals down can make you reach them faster. Keep reading to find out how you can incorporate this money habit for success. What you need to know

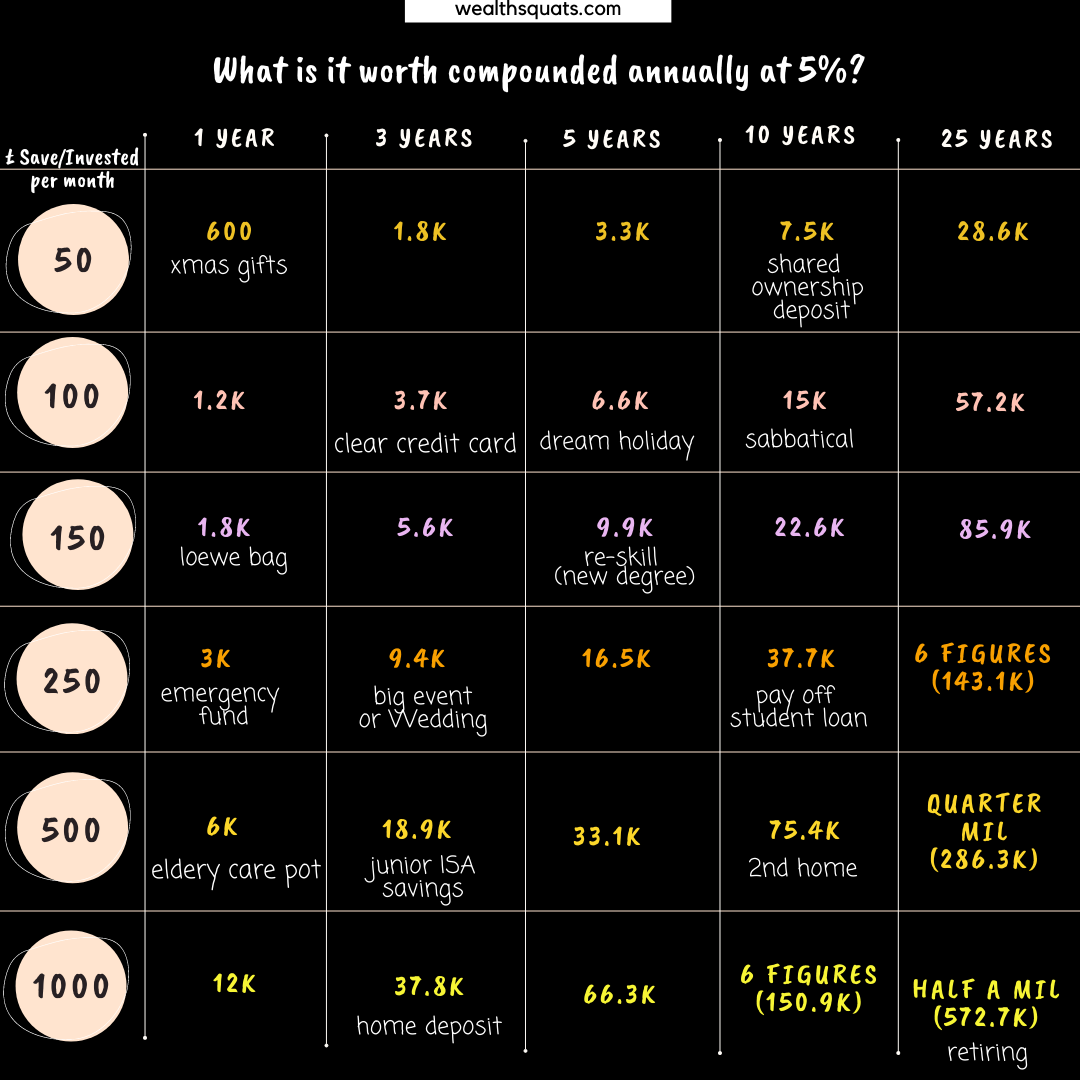

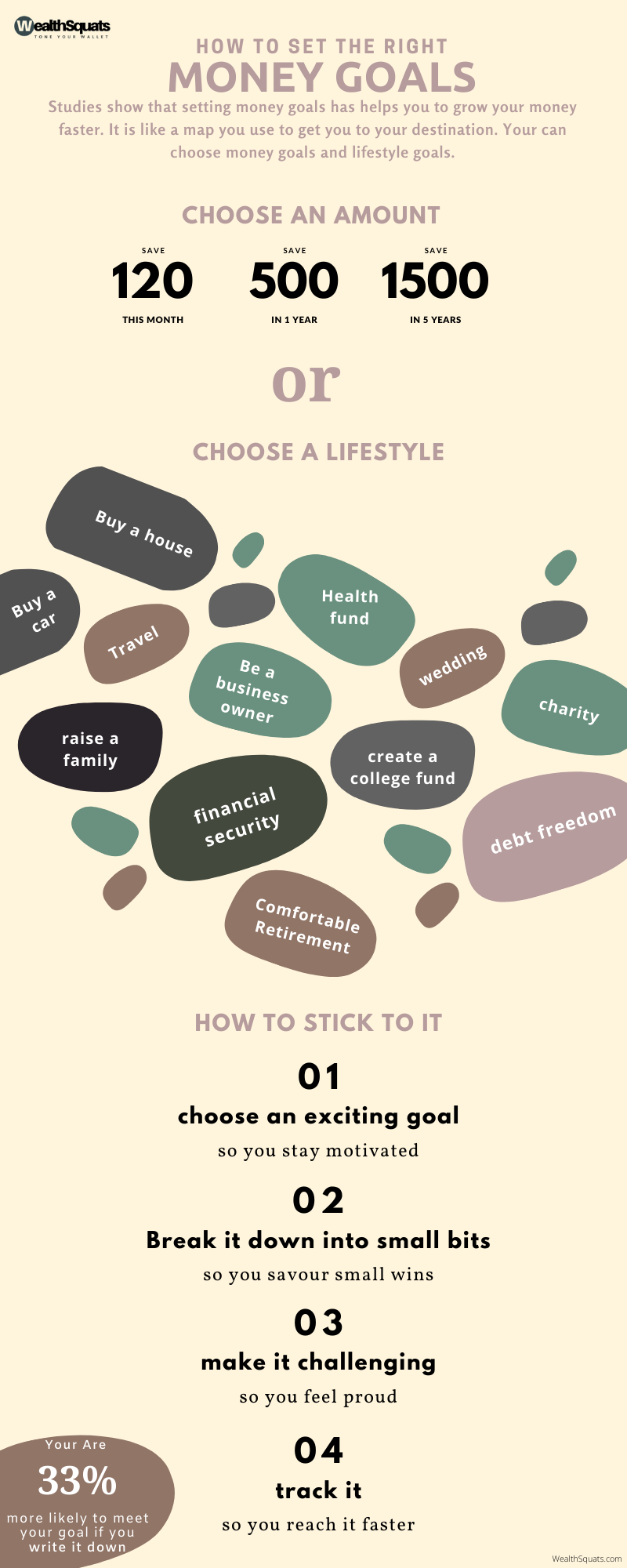

I asked 5 readers to share their money goals:I asked 2 questions: 1. What makes you want to save and invest 2. What DOES NOT make you want to save and invest Click on the images below to see their responses. The research and experience of writing money goals Every year, I write my money goals down. So far, I have found that I met them before or after the deadline I had initially set. I believe that there is some magic to writing things down. Once you write it down, it is autosaved in your brain and then somehow, you start to focus consciously or unconsciously to make it happen. My experience aside, research has shown that setting goals makes you more confident, motivate and in control - no wonder employers use performance reviews to set and monitor targets- they know that if done well, it motivates employees and can also help their business grow. If you want to actually make it happen, start by writing them down. 'A study by Gail Mathews, found that you are 33% more likely to meet your goals if you write them down, share it with a friend and review it frequently'. Want to meet a money goal? write it down. How to Write a Goal that you stick to (4 ways)1. Choose an exciting goal According to Business Insider, 'Instead of being afraid of your finances, focus on the goals that excite you'. Why? when you choose an exciting goal, you stay motivated to make it happen. Here are the types of goals you can write down: Types of Goals

2. Break it down into small bits Big goals can feel overwhelming and when it comes to money goals it is important to break it down. A Harvard study explains, 'When we’re judging the difficulty of a goal, the first thing our brains see is the size of the gap that separates the goal from the baseline. The bigger the gap, the more difficult the goal' For example, if you are planning that trip to tour the East Africa and it would cost 2000. Saving 2000 might today can feel challenging. To make progress, you can break it down to save 100 a month and add more in months where you can. After 5 months, you'll have 500 saved and have covered 25% of the cost. With an exciting goal ahead of of you, you can celebrate the small progressive wins and that is key, 3. Make it Challenging If the goals is too simple, you won't be satisfied. Research has shown that you achieve 'greater satisfaction from achieving goals that help you improve as opposed to maintaining the status quo'. So, If you are dedicated to clearing your 3 credit card debts of 2000, 1000 and 300, you'll likely be more satisfied clearing the 300 than paying off the minimum for each month which would make you feel like you are not improving. Going back to the readers response on What DOES NOT make you want to save and invest? I noticed most of the response was about making sacrifices today so they can enjoy tomorrow. I think this is another crucial element of satisfaction, delaying gratification, allows the reward at the end to be more enjoyable. 4. Track It Truth session. Years ago I began tracking one specific money goal. Since then, that number has increased by a whopping 4024% to be exact. How come? What you cannot track, you cannot measure. Remember the research I mentioned earlier, it said, if you share your goal with a friend on a monthly basis, to keep you accountable, it happens. My friends are my spreadsheet, MUTAZ, and you readers of this post. I review my spreadsheet monthly to check how I am doing. Tracking helps me to stay focused and also allows me to think of new ways to reach my goals faster. Grab a copy of the WealthSquats smart budgeter to write and track yours. Need help on where how to start tracking? Use Financial Success Map to make a plan.In Summary

1 Comment

Read More

|

Proudly powered by Weebly