|

What can I do with my money? |

Early Stage Private Equity

What is Early Stage Private Equity (PE)?

Private Equity is when you buy shares of a Private company. This is different from buying a stock because these companies are not listed on the Stock Exchange. They are usually small start-ups and early stage businesses that opt to use intermediaries likes Seedrs, Crowdcube to crowdfund investments. Once these intermediary sites, they present their company, their products, the amount of funding they need and what they plan to use that money for. This is one of the paths Revolut utilised to become a $1.7 billon pound enterprise.

Diversification

The proliferation of entrepreneurship has allowed people with diverse ideas to create all types of businesses such as, Anytime Yoga, Organic Crisps, Brewdog, AirSorted etc. Generally you need to make your own decisions about which company to invest in. Try to pick a variety of different companies that you want to see succeed. You can invest a little bit of your money to create a diverse and balanced PE portfolio.

Term

Because these companies are starting out, your investment is typically for a very long time. However, depending on the platform, you can likely get your investment back by selling your shares, waiting for the company to go public (if it is very successful) or waiting for the company to get acquired by another company.

Can the value of my share increase?

The value of your share can increase if the company is re-evaluated and found to have a higher valuation. However, your shares can be also be diluted meaning that the percentage of the company your shares represent can be reduced if the company continues to add more investors as they raise money. Some intermediaries will notify you if this were to happen so that you can make additional investments to retain your share value in the company.

For example, today you own 10 shares in Lala, a vegan sweets brand. Lala is made up of 100 shares, which means that your 10 shares represent a 10% stake in the company. Lala wants more funding to launch a marketing campaign and expand globally. The owners of Lala want to raise money by selling more shares. The owners of Lala add 20 shares to the pool by reducing the value of each existing share. 1 share used to be 1% of the company, now 1 share is 0.83% (1/120 *100). This means that the 10 shares your originally had, are now worth 8.3% of the company. If you still want to retain a stake of 10% of Lala, you'll have to buy 2 more shares.

I have a Seedrs account, where I have made investments into 4 companies across transport, farming, housing and mortgages and have received a combined return of 11.13% as of September 2018. This return was calculated by Seedrs and represents the current value of these companies.

Investment Window

When start-ups sign up to these intermediaries, they are typically given an investment window within which they can raise the investment they need. If they fail to do so, different intermediaries have different rules, be sure to read to reach the terms and conditions to see what happens in this scenario. Generally, when the start-up has closed their investment round, it is typically not possible to invest in them. The only way to buy into the company is to wait for another round or buy someone else's stake.

Tax relief

In the UK, the government wants to support early stage companies as they see them as an investment into the overall economy. The government has several schemes including the EIS, SEIS, VCT to support these companies.

Because you are investing in businesses that are at an early stage and are therefore high risk, the UK government can provide a tax relief of up to 30% on your investment. So if you invested £50 you can get back £15 from the government. This means that your actual investment costs you £35.

Once you have invested, you should receive share certificate and claim your tax relief. You can re-invest your tax return and continue to build your assets.

Private Equity is when you buy shares of a Private company. This is different from buying a stock because these companies are not listed on the Stock Exchange. They are usually small start-ups and early stage businesses that opt to use intermediaries likes Seedrs, Crowdcube to crowdfund investments. Once these intermediary sites, they present their company, their products, the amount of funding they need and what they plan to use that money for. This is one of the paths Revolut utilised to become a $1.7 billon pound enterprise.

Diversification

The proliferation of entrepreneurship has allowed people with diverse ideas to create all types of businesses such as, Anytime Yoga, Organic Crisps, Brewdog, AirSorted etc. Generally you need to make your own decisions about which company to invest in. Try to pick a variety of different companies that you want to see succeed. You can invest a little bit of your money to create a diverse and balanced PE portfolio.

Term

Because these companies are starting out, your investment is typically for a very long time. However, depending on the platform, you can likely get your investment back by selling your shares, waiting for the company to go public (if it is very successful) or waiting for the company to get acquired by another company.

Can the value of my share increase?

The value of your share can increase if the company is re-evaluated and found to have a higher valuation. However, your shares can be also be diluted meaning that the percentage of the company your shares represent can be reduced if the company continues to add more investors as they raise money. Some intermediaries will notify you if this were to happen so that you can make additional investments to retain your share value in the company.

For example, today you own 10 shares in Lala, a vegan sweets brand. Lala is made up of 100 shares, which means that your 10 shares represent a 10% stake in the company. Lala wants more funding to launch a marketing campaign and expand globally. The owners of Lala want to raise money by selling more shares. The owners of Lala add 20 shares to the pool by reducing the value of each existing share. 1 share used to be 1% of the company, now 1 share is 0.83% (1/120 *100). This means that the 10 shares your originally had, are now worth 8.3% of the company. If you still want to retain a stake of 10% of Lala, you'll have to buy 2 more shares.

I have a Seedrs account, where I have made investments into 4 companies across transport, farming, housing and mortgages and have received a combined return of 11.13% as of September 2018. This return was calculated by Seedrs and represents the current value of these companies.

Investment Window

When start-ups sign up to these intermediaries, they are typically given an investment window within which they can raise the investment they need. If they fail to do so, different intermediaries have different rules, be sure to read to reach the terms and conditions to see what happens in this scenario. Generally, when the start-up has closed their investment round, it is typically not possible to invest in them. The only way to buy into the company is to wait for another round or buy someone else's stake.

Tax relief

In the UK, the government wants to support early stage companies as they see them as an investment into the overall economy. The government has several schemes including the EIS, SEIS, VCT to support these companies.

Because you are investing in businesses that are at an early stage and are therefore high risk, the UK government can provide a tax relief of up to 30% on your investment. So if you invested £50 you can get back £15 from the government. This means that your actual investment costs you £35.

Once you have invested, you should receive share certificate and claim your tax relief. You can re-invest your tax return and continue to build your assets.

What does a Early Stage Private Equity listing look like?

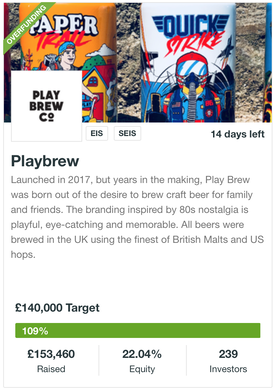

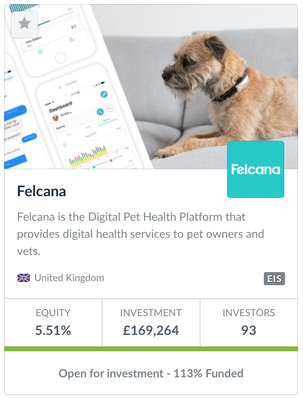

Lets look at the example below from Crowdcube and Seedrs where Playbrew and Felcana respectively, are looking for investors.

- In the case of Playbrew, they want to raise £140,000 from investors

- Both companies mention the amount of equity they want to release. This equity is the percentage that investors will cumulatively have in the company through this round of investing. So if you invest £140,000 in Playbrew, you'll get 22.04%, if your invest £140, you'll get 0.22%.

- As the funding commences, the number of investors who have bought into the company is shown. For Felcana, 93 investors provided an investment of £169,264. These 93 investors will put in various amount ranging from £13, £40, £100 or more.

- Some of these companies continue to accept investments even after they have reached their targets. You can see that Playbrew and Felcana have exceeded their target by 9% and 13% respectively. Companies do this because they set a range of thresholds, in the case of Playbrew, £140,000 is the minimum investment they are seeking.

|

|

What are my next steps with Early Stage Private Equity?

|

I want to add property to my overall investment portfolio. Explore Real Estate

Disclaimer

The content on WealthSquats are my own thoughts and is not financial advice. Consult certified financial experts to get information that is suitable to you.

The content on WealthSquats are my own thoughts and is not financial advice. Consult certified financial experts to get information that is suitable to you.

© Copyright WealthSquats Ltd. Company Registration: 14992248