|

�

Archives

September 2021

Categories

All

|

Back to Blog

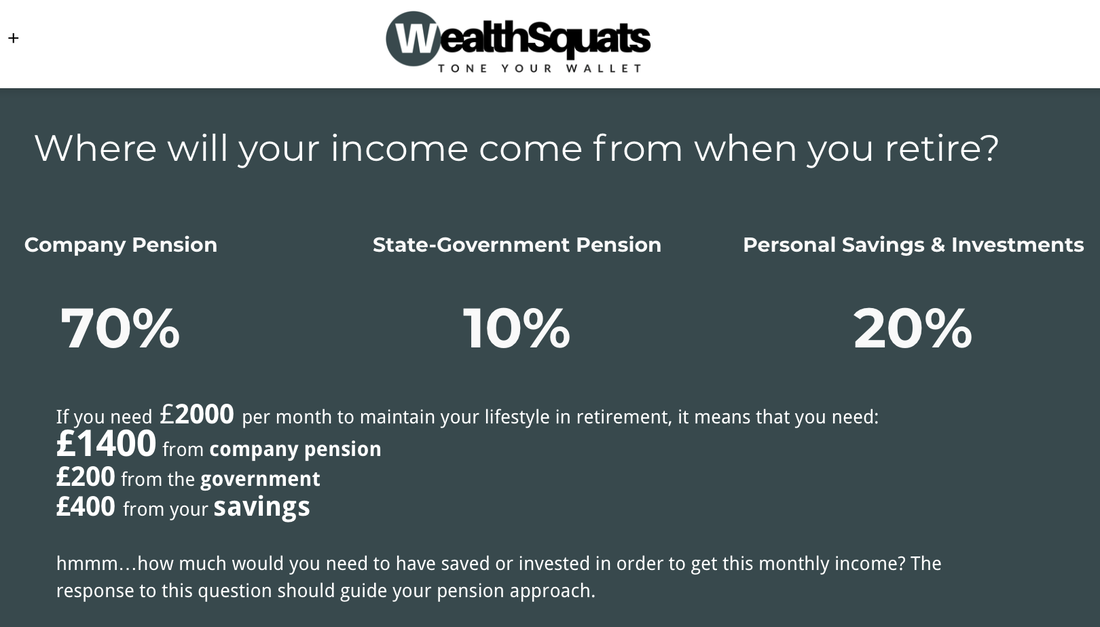

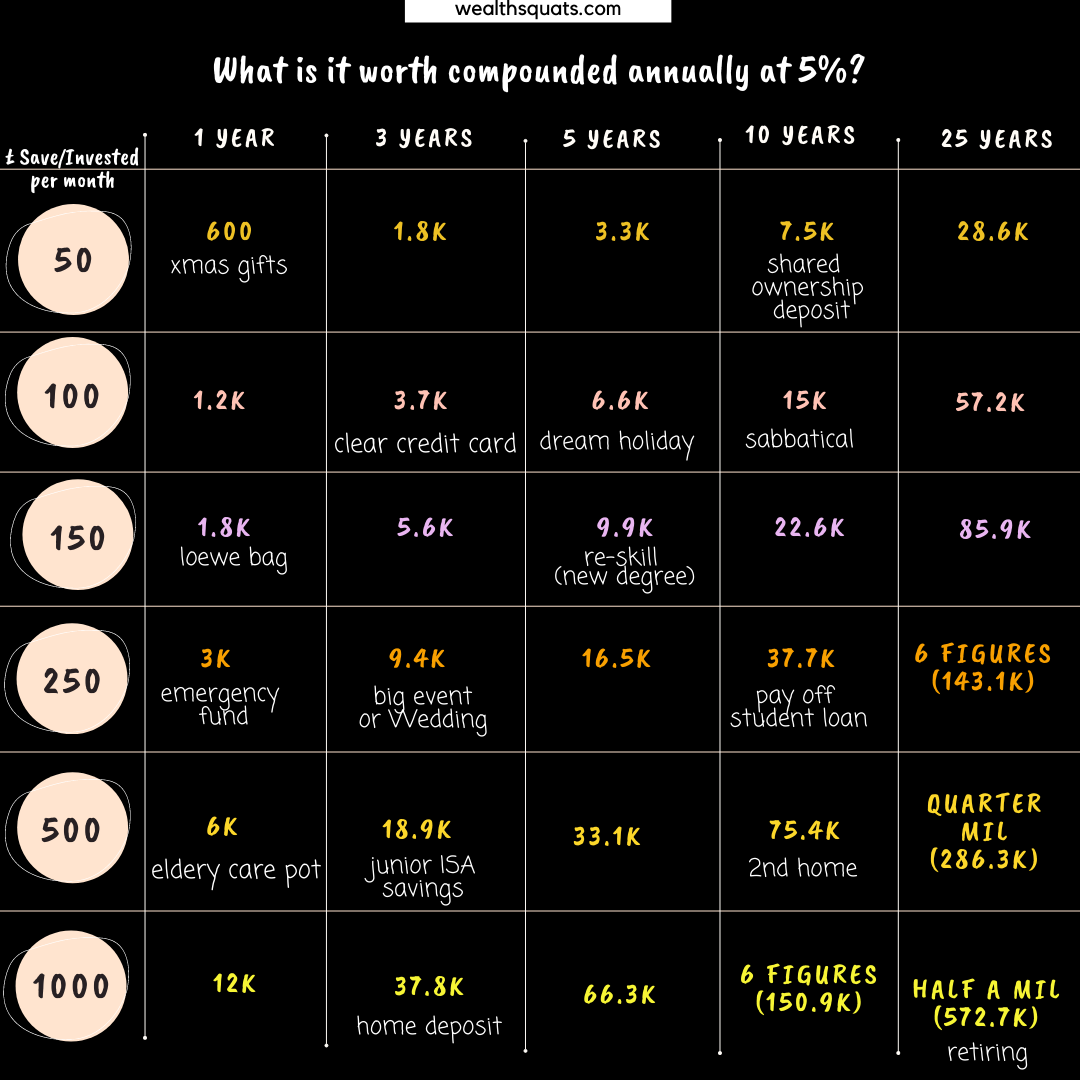

This is why I dread old age9/30/2021 The image below from tax.service.gov.uk is one reason I dread old age. It is from the UK government website and it says I'll get about £700 a month to live on when I am of retirement age. This is IF the state pension will still be around. I encourage you to look at your personal tax details to get a sense of your own situation. Notice that you can only get this monthly sum if you contribute for a minimum (10) and a maximum number of years (depending on your retirement age, example below is 26 years). This is also a reminder that state pension is mean to be one part of your pension income. If this amount allows you to meet your needs at say age 71, then do nothing new. If on the other hand, you want to travel, cover expenses, start businesses, eat well, and give more, then you'll need to supplement this by saving for your self today either in a work pension, a SIPP, a LISA or open a separate savings account solely for old age care. Flip the dread and read more on pensions. What can I do? A 3 min peek into your pension Have a look at your pension savings, how much is in there? Is it on track for the future? Do you need to make any change?

Check out this article on how to get a free pension top up. If you do not have a pension, you can open a savings account, a SIPP or a LISA; speak to a financial adviser or look online for the best product for yourself.

1 Comment

Read More

Back to Blog

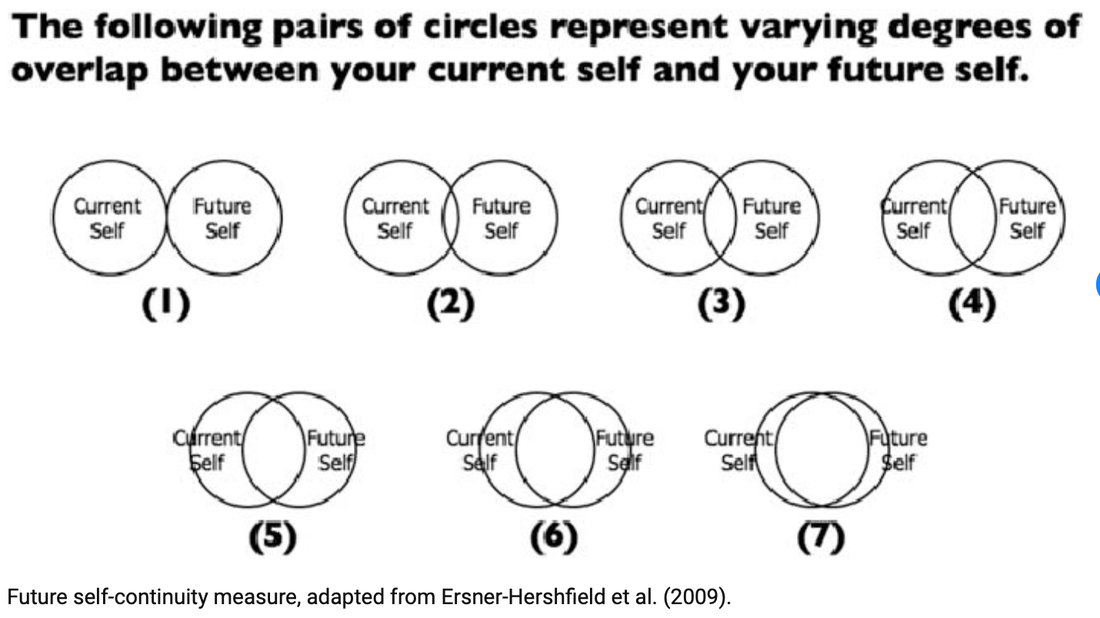

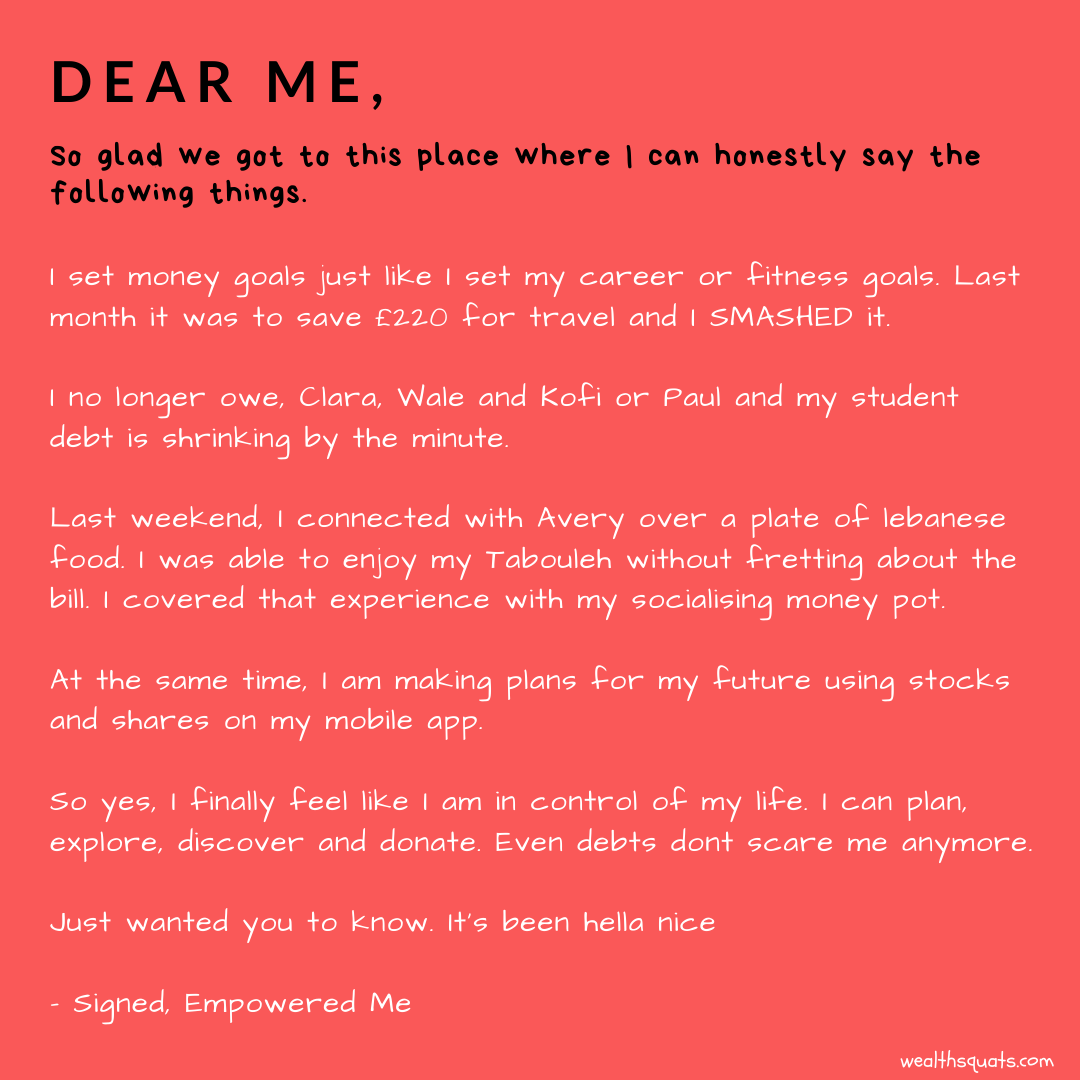

Are you friends with your future $£lf?7/26/2021 How do you see your self in the future? Research shows that people who are able to imagine their future self in a "vivid and realistic" manner as an extension of their current self end up having more money and assets. Source: Ersner-Hershfield et al. (2009) It can be difficult to imagine yourself 4 weeks, 4 years 40 years from now but the research shows that "what matters is how much a given individual feels he or she will be the same person over time" (i.e. approaching No 7 in the image above). By 'same' the researchers mean, you expect your interests, dislikes, values and beliefs to remain aligned. If you see your future self as a stranger, you won't feel like giving your money to help them because you won't feel like you are getting anything in return. In money terms, you are unlikely to save for the future or put money aside for retirement. On the other hand, If you feel like your future self is an extension of your current self, then helping your future self is just like giving your current self a helping hand. That feels good and so you'd be more likely to give your future self money through savings or pensions and feel rewarded. Interestingly this applies at a wider level - countries that have positive attitudes towards the elderly reported higher savings rates. How can you get closer to your future self?

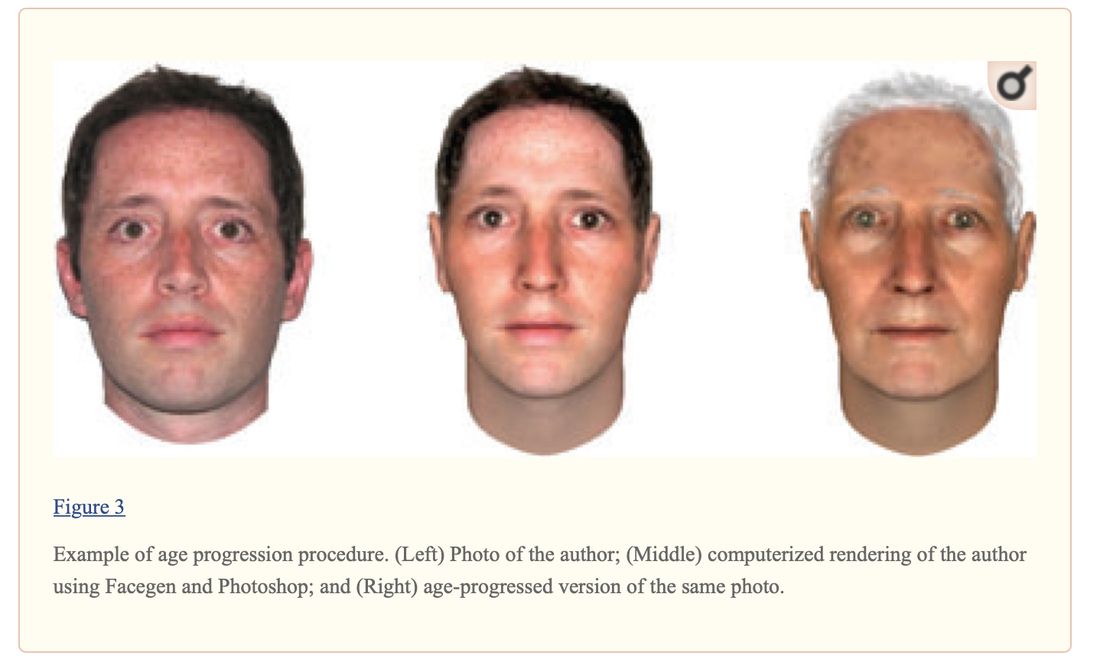

1) Create a realistic picture of future you via Apps at different ages - 25, 40, 60, and beyond (see example below). Do you like what you see? Are you willing to give old you some money? Save the image on your phone or print it out and hang it up. 2) As your future self, write an optimistic and detailed letter to your current self. Describe how you are doing and what you have accomplished. Want to get started? See our money habit of the month below. By doing these exercises, the hope is that you'll agree to give your future self a raise by saving and investing regularly for a better lifestyle.

Back to Blog

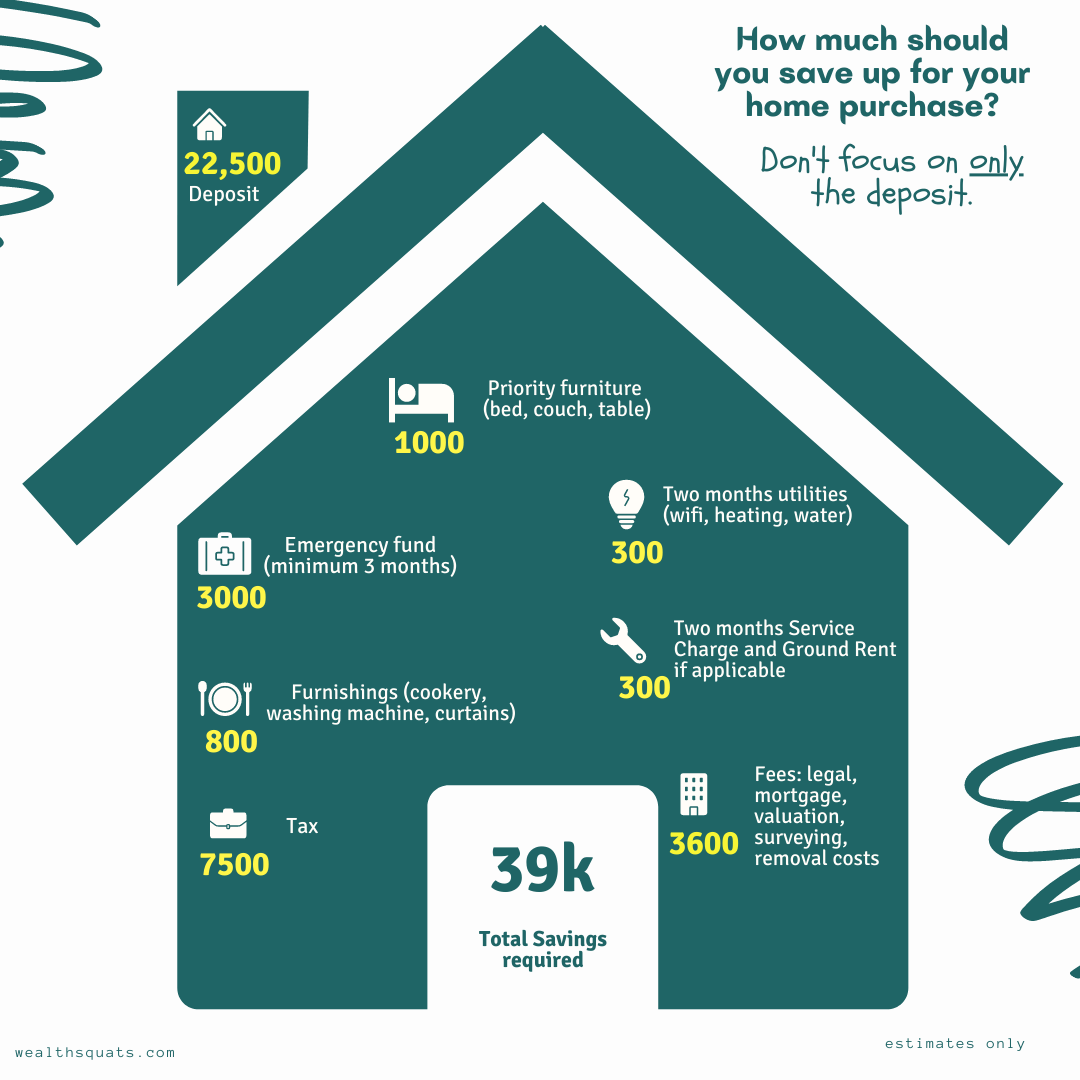

Home ownership is a goal many have but I have seen many stories of people buying their home and becoming worse off financially because they have saved for years and have put ALL their savings to get a roof over their head. 6 months later, they have save just enough to get a couch and the slog continues. This doesn't have to happen. in this post, we explore ways to avoid being house poor and it takes planning and prioritising your well being. Rule of Thumb: The deposit is just the start add fees, tax and savings. Key takeaways

Build your emergency fund. This fund should not be used for the home. Your emergency fund is purely for your own insurance and should cover a minimum of 3 months. I would even take this further and have a small pot for fun so you remember to prioritise yourself. Don't only save for your deposit, legal fees and Tax. Factor in payments for furniture, furnishings and at least two months utilities. Let us know if we are missing any other costs.  Get cash back for all the spending. As a new home owner, you'll be buying a lot of things in a given time period. So get cash back to get paid while you spend. This is money you can spend else where.

12+ guilt free ways I cut my spending to save more If it doesn't appreciate, get it pre-loved To save money, use pre-loved websites like e-bay or gumtree for things that you are not to precious about. Things like flower pots, cookery are great candidates. Stick to your budget and take your time You've already made a budget for your home purchase. Your budget is the cornerstone of your financial life - it is your partner in helping you to achieve your financial priorities. It also keeps your focused for all the other non home expenses you need. So future you asks that you stick to it and prioritise your joy. I stopped making these mistakes and it changed everything

Back to Blog

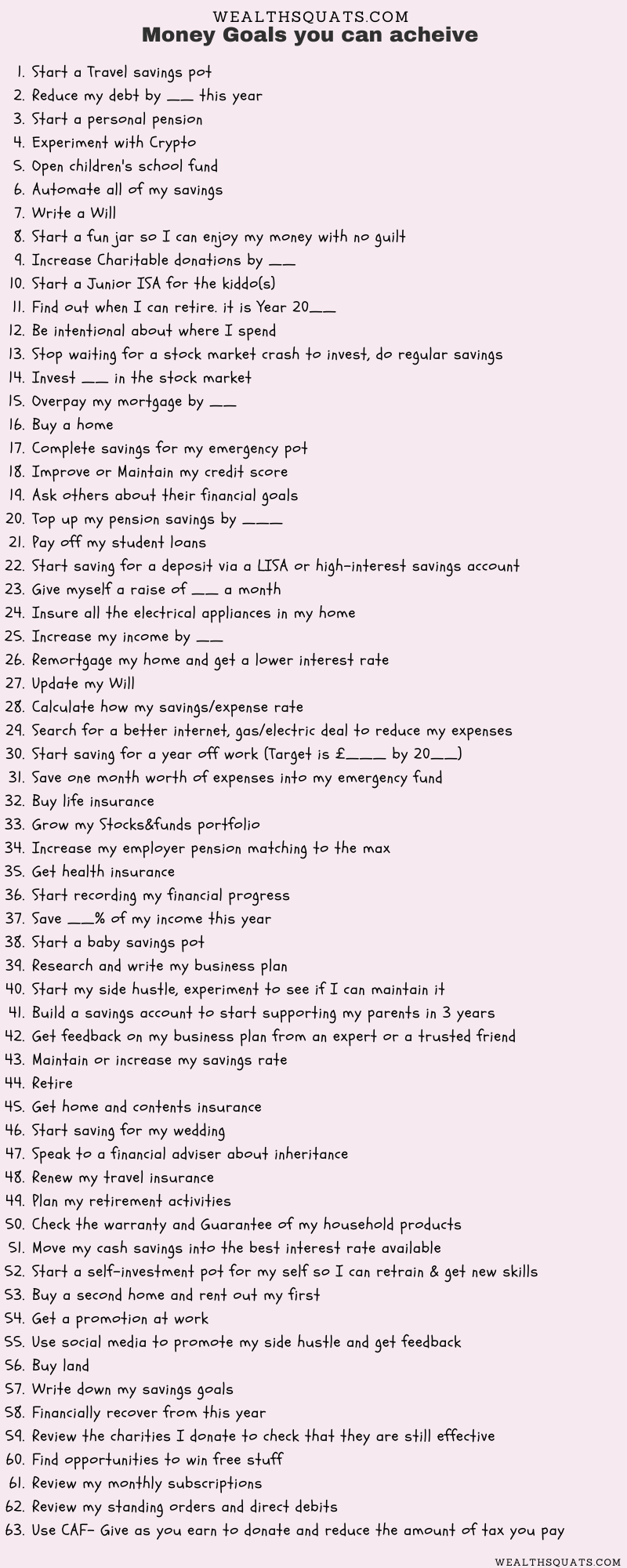

60+ Financial Goals you can achieve anytime12/20/2020 Here's a 60 plus list of money goals you can achieve anytime. We've covered the research behind the power of writing down your goals. So choose yours or add to the list. Do right with my cash savings

Travel & FunProtecting my Family

Save better and more

Manage Debt

Take care of my future

Give BackHomeownership

Financial Health Check

Experiment with my ideas

Enablers

Big overall Goals

Back to Blog

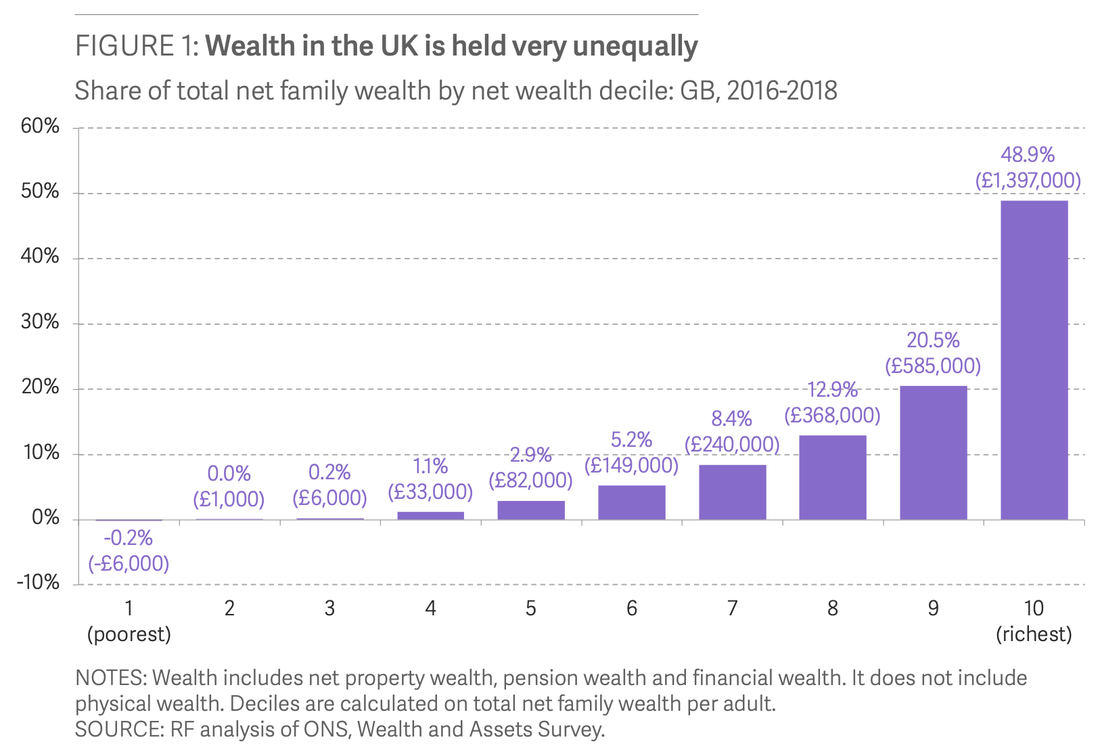

Why do the rich pay less for housing month on month? How do they make their money grow? How many of them can survive one month without a pay-check? I read the 2020 report from Resolution Foundation on wealth in the UK to see what research says about how to be rich in the UK. Keep reading to see the surprising answers. First, a quick recap: What is Wealth? Wealth is your assets (An asset: is a thing of value that grows e.g. savings, pension, real estate, art, gold etc.) minus your debt. We also call this your net-worth. In this study, 4 types of wealth were measured:

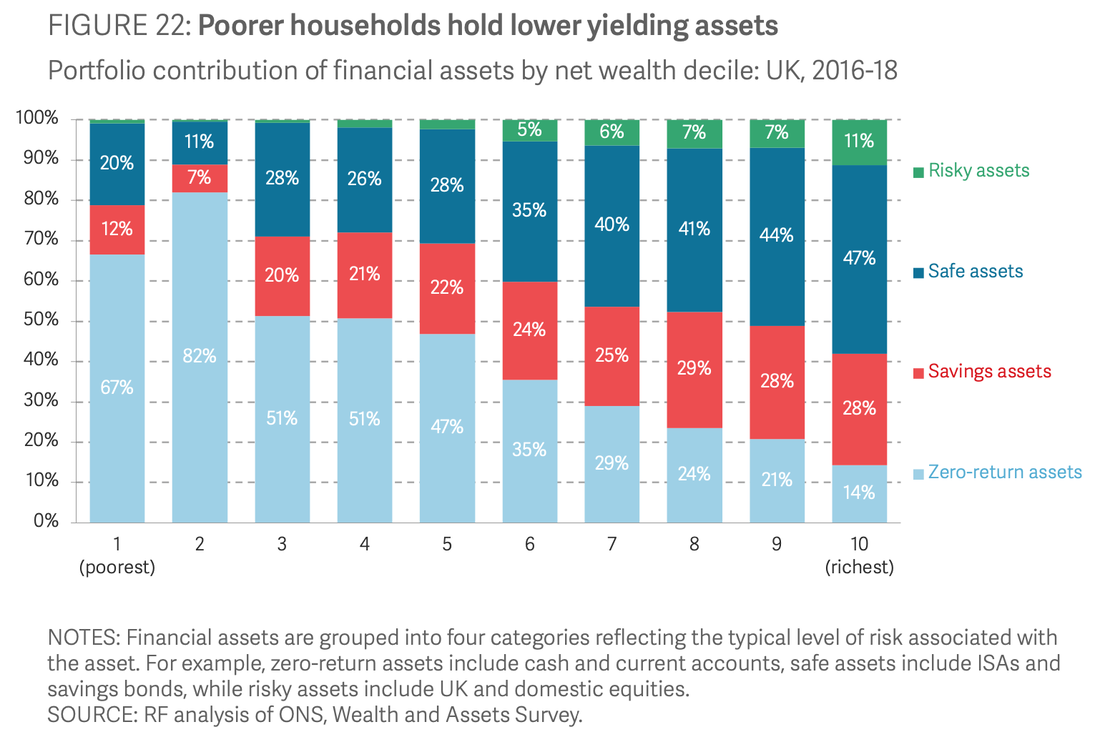

So, how do the rich manage their money?The top 10% have about 50% of UK's wealthThe average net worth of the 10% is £800,000. But, where do they grow their money? Keep reading to find out.Do it like the Rich: When it comes to financial assets, the Rich hold less cash and more of their money in growth assets like savings bonds, ISAs, and Stocks and Shares.Poor households hold most of their money in cash or current accounts where there is very little growth. When the rich hold money in savings bonds, ISAs, and Stocks and Shares, they benefit from:

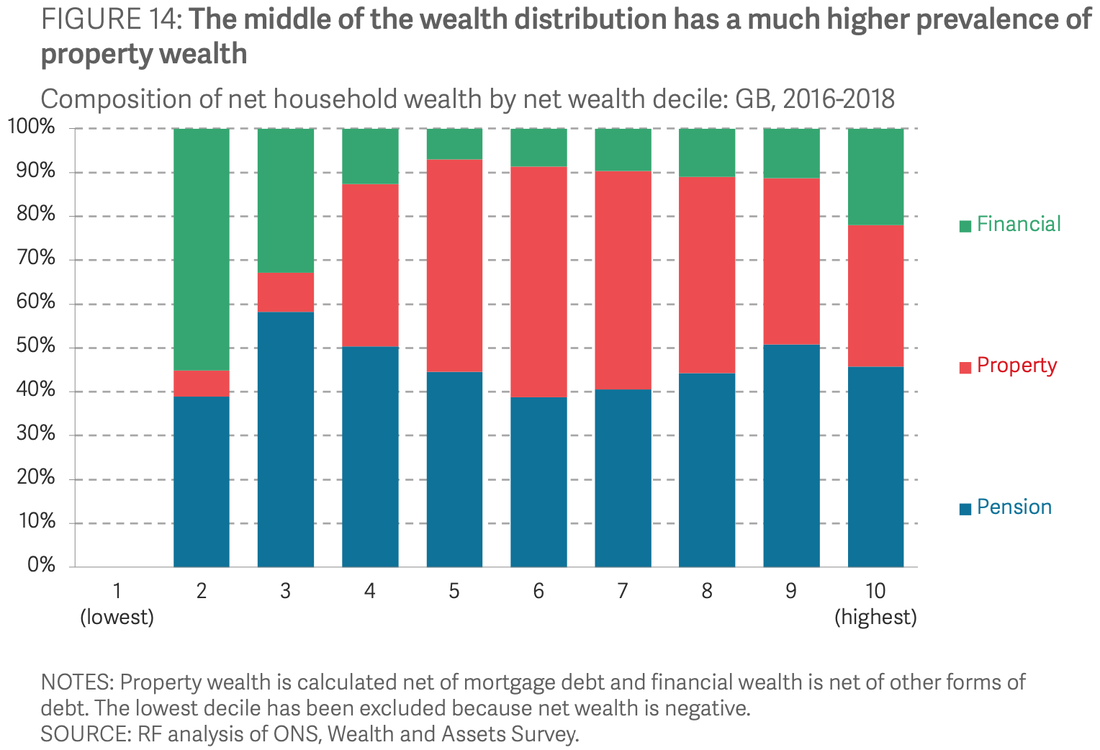

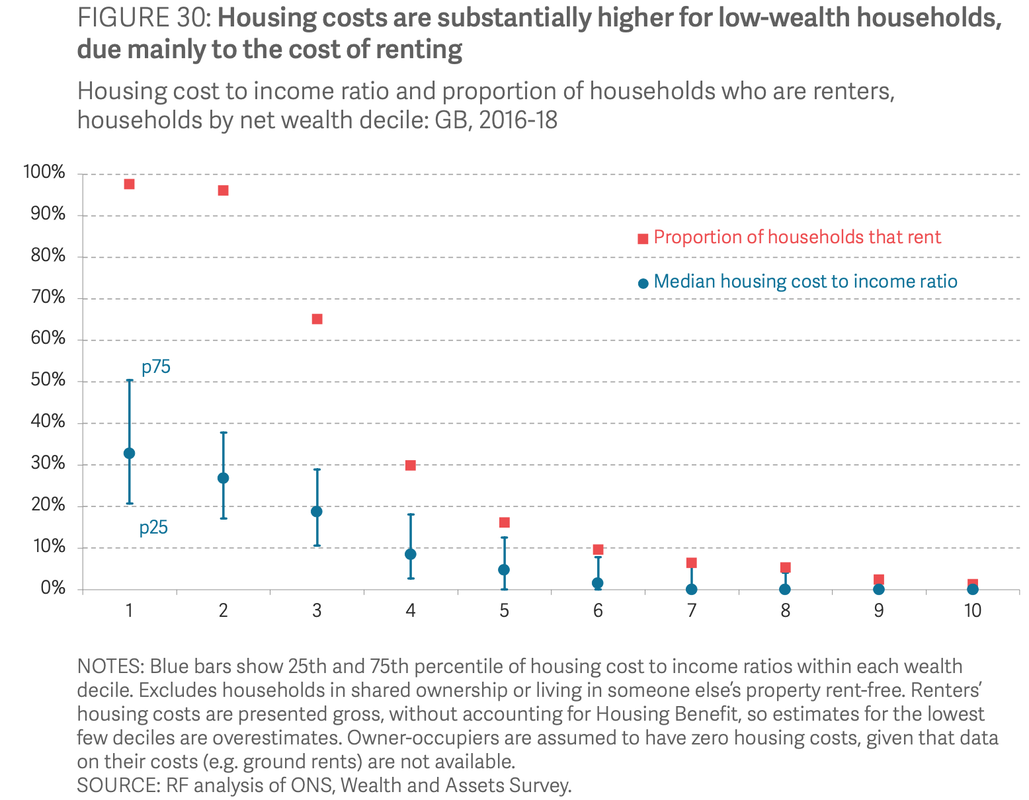

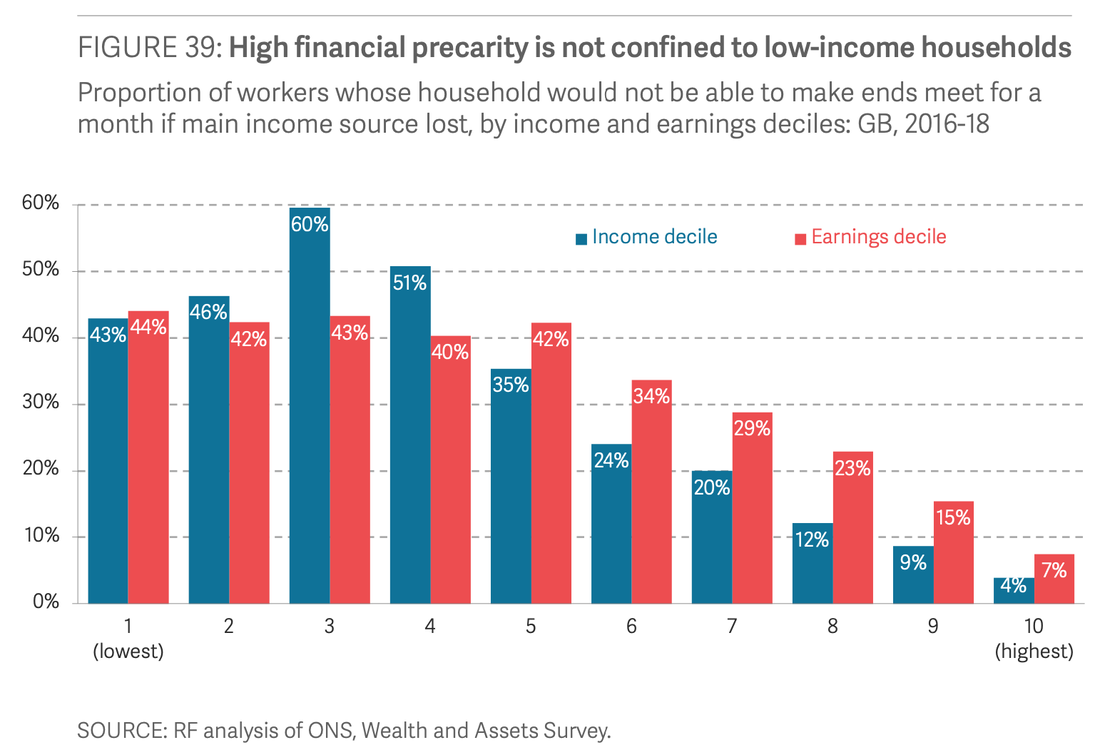

Do it like the Rich: The Rich have about 45% of their money in pension pots, 35% in property and 20% in financial assets (savings bonds, ISAs, and Stocks and Shares) Financial wealth (in high growth assets) increased substantially in the last 10 years and this contributed significantly (80%) to the overall wealth of the rich.As mentioned above, the financial assets of the rich are held in growing assets like bonds and the stock market. The Stock Market grew substantially in the past 10 years and it made the rich richer. The poor held most of their money in zero growth assets e.g. cash or current accounts and even when they added more money in these places, it grew at a much lower rate. Do it like the rich: Richer families tend to be homeowners Their housing costs are around 5% of their income if they own their home outright or 11% of their income if they have a mortgageDo it like the Rich: The Rich have emergency funds 7% of the rich would have a hard time if their main source of income is impacted as opposed to 44% of the poor.An emergency fund allows the rich to stay afloat if a shock like a pandemic or job loss takes place. Young females who are not degree educated were the most at risk if their income ran out. Do it like the Rich: There you have it. Some insights into the habits of the rich. Of course there are other ways to get rich, such as owning a successful business, investing in start ups, inheriting money or owning art for example. The options above are the accessible ways to start to build wealth and is the reality for many everyday people. See this infographic on how to spend £2000 which highlights the step by step guide to implementing the lessons above.

Which Rich habit will you start to use?

Back to Blog

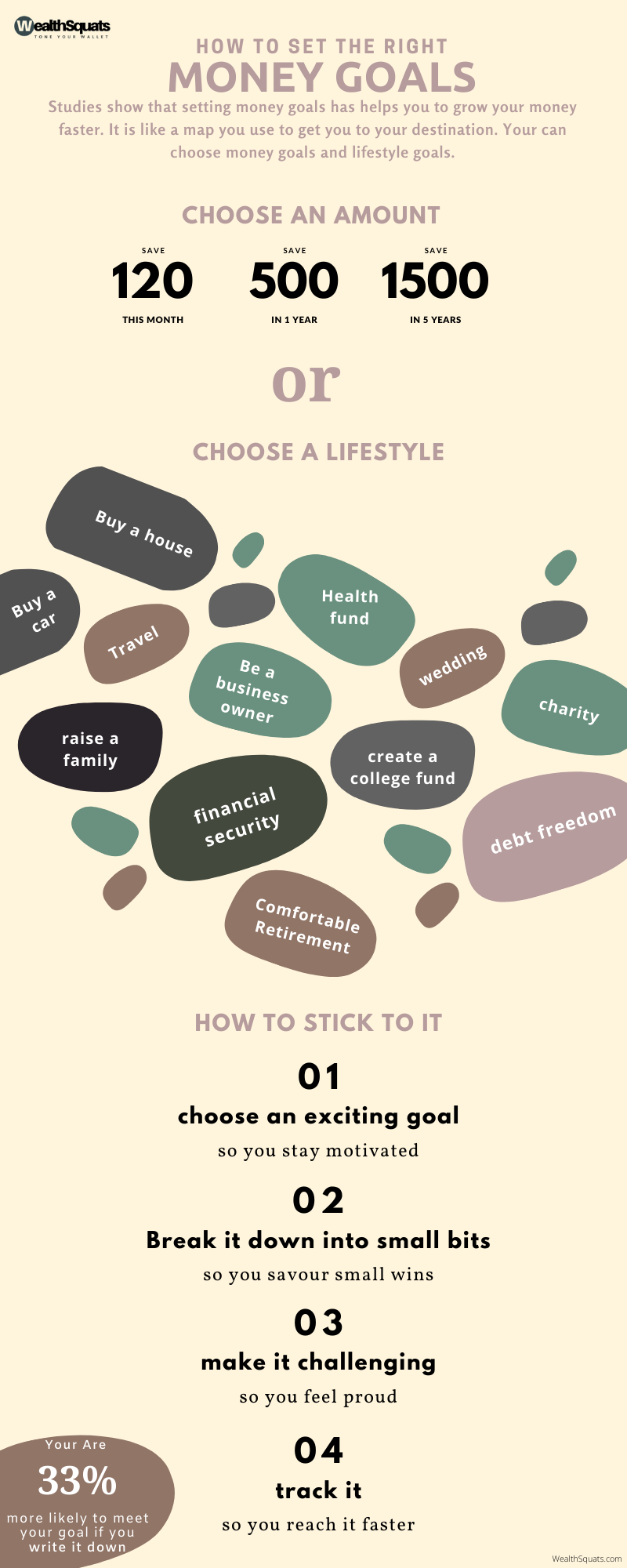

What do you want to be when you grow up? What is your 5 year plan? What are your career goals? What are your relationship goals? We've all heard this at one point in time and I wonder, why do we not also ask: WHAT ARE YOUR MONEY GOALS? if you are the kind of person that writes your life goals, does it include money goals? Research has shown that writing your goals down can make you reach them faster. Keep reading to find out how you can incorporate this money habit for success. What you need to know

I asked 5 readers to share their money goals:I asked 2 questions: 1. What makes you want to save and invest 2. What DOES NOT make you want to save and invest Click on the images below to see their responses. The research and experience of writing money goals Every year, I write my money goals down. So far, I have found that I met them before or after the deadline I had initially set. I believe that there is some magic to writing things down. Once you write it down, it is autosaved in your brain and then somehow, you start to focus consciously or unconsciously to make it happen. My experience aside, research has shown that setting goals makes you more confident, motivate and in control - no wonder employers use performance reviews to set and monitor targets- they know that if done well, it motivates employees and can also help their business grow. If you want to actually make it happen, start by writing them down. 'A study by Gail Mathews, found that you are 33% more likely to meet your goals if you write them down, share it with a friend and review it frequently'. Want to meet a money goal? write it down. How to Write a Goal that you stick to (4 ways)1. Choose an exciting goal According to Business Insider, 'Instead of being afraid of your finances, focus on the goals that excite you'. Why? when you choose an exciting goal, you stay motivated to make it happen. Here are the types of goals you can write down: Types of Goals

2. Break it down into small bits Big goals can feel overwhelming and when it comes to money goals it is important to break it down. A Harvard study explains, 'When we’re judging the difficulty of a goal, the first thing our brains see is the size of the gap that separates the goal from the baseline. The bigger the gap, the more difficult the goal' For example, if you are planning that trip to tour the East Africa and it would cost 2000. Saving 2000 might today can feel challenging. To make progress, you can break it down to save 100 a month and add more in months where you can. After 5 months, you'll have 500 saved and have covered 25% of the cost. With an exciting goal ahead of of you, you can celebrate the small progressive wins and that is key, 3. Make it Challenging If the goals is too simple, you won't be satisfied. Research has shown that you achieve 'greater satisfaction from achieving goals that help you improve as opposed to maintaining the status quo'. So, If you are dedicated to clearing your 3 credit card debts of 2000, 1000 and 300, you'll likely be more satisfied clearing the 300 than paying off the minimum for each month which would make you feel like you are not improving. Going back to the readers response on What DOES NOT make you want to save and invest? I noticed most of the response was about making sacrifices today so they can enjoy tomorrow. I think this is another crucial element of satisfaction, delaying gratification, allows the reward at the end to be more enjoyable. 4. Track It Truth session. Years ago I began tracking one specific money goal. Since then, that number has increased by a whopping 4024% to be exact. How come? What you cannot track, you cannot measure. Remember the research I mentioned earlier, it said, if you share your goal with a friend on a monthly basis, to keep you accountable, it happens. My friends are my spreadsheet, MUTAZ, and you readers of this post. I review my spreadsheet monthly to check how I am doing. Tracking helps me to stay focused and also allows me to think of new ways to reach my goals faster. Grab a copy of the WealthSquats smart budgeter to write and track yours. Need help on where how to start tracking? Use Financial Success Map to make a plan.In Summary |

Proudly powered by Weebly