|

�

Archives

September 2021

Categories

All

|

Back to Blog

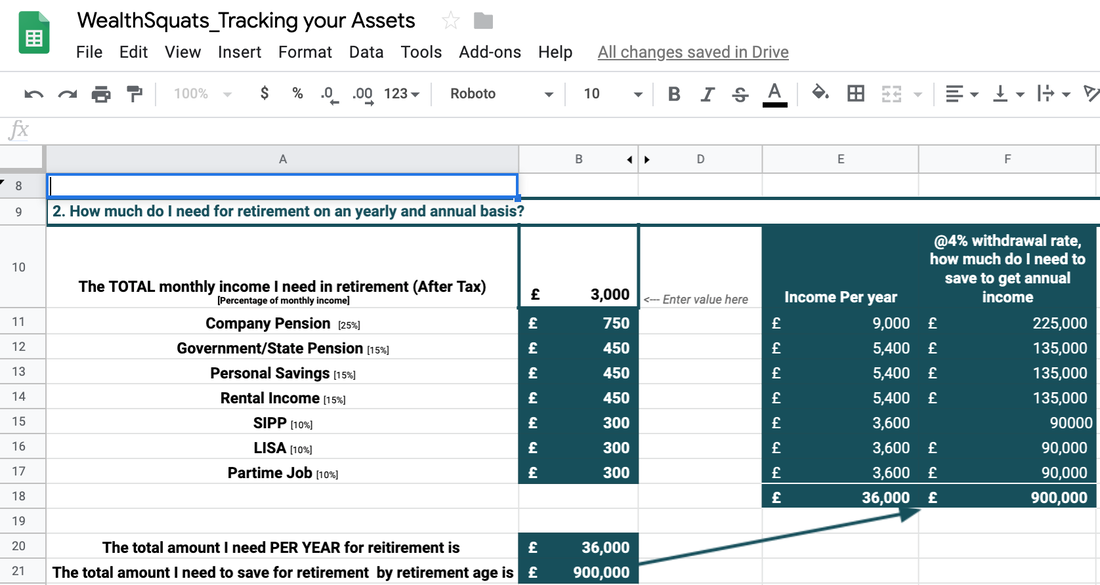

It is the year 2056, I am age 62 and have just retired. I have paid off my mortgage, I have healthcare coverage and I need £3000 per month (net tax) to be happily retired. Research has shown that UK retirees need around this amount to maintain a certain comfortable lifestyle that allows for some luxuries likes holidays, fine dining and more. Why did I choose £3000 as my happily retired monthly figure? At 62, I envision a life where I can spend on luxuries, management my expenses and retain or increase the lifestyle that I had when working. An undesirable scenario for me is a position where I am used to a certain lifestyle and then in retirement, I find that I have to downsize significantly. So if I was living on £2500 while I working, In retirement, I don't want to have only £1,500 as income. Studies show that most retirees want there income to be around 70% of their working income in retirement. My £3000 will cover, healthcare, bills, food, clothing, travel, donations and a few luxuries. It is very crucial that my mortgage is paid off or at least close enough to being paid off (2 years away). This way, I will not have to work to discharge the loan or feel the stress of using my savings to cover meet my debt obligations. My ideal situation would be to have my primary home paid off and to have a rental property where I can continue to hold assets. We are likely to live longer and with a retirement age at 62, I can expect to live till I am 85 or longer. This means that my income must last for at least 23 years. My income at retirement will change from getting a whole UNSCLICED PIZZA on day 1 to getting different pizza slices on different days Today, I work for a company and each month on a specific date, I get a salary. That salary is provided once and it funnelled into my expense, savings and investment. Fast forward to age 62, my retirement age. My income will no longer come at a specific date but it will come from different sources to make up £3000. It could look something like this: £750 from Company Pension received in on 8th of each month £450 from State Pension received in on 8th of each month £450 from Personal Savings account received in on 8th of each month £450 from rental income received in on 15th of each month £300 from SIPP received in on 17th of each month £300 from LISA received in on 17th of each month £300 from part-time job received in on 23rd of each month This reconfiguration of my potential income at age 62, changes the way I think of a pay-check. It will mean that for instance, I'll have to organise my spending not around one date but multiple dates. This is a mindset shift that I have to be aware of and start getting use to as the retirement age comes closer. The above is an example. The £3000 I estimate is for an individual. If that amount covers a couple, adjust your income sources to reflect your cirumstance. umm Did I say £900,000? Now that I know how much I want to live on at 62, I now had to figure out how much I needed to save in order to get £3000 monthly. See the table below for full details. To estimate how much I need to save, I learn of the concept of '4% drawdown rate'. This the rate at which I can take out of my savings in order to maintain my pension pot and not run out of money. Let's take my LISA, each month, I need £300 from that account to live on. In 1 year, I need £3600 = £300 x 12. If I want to withdraw 4% of my LISA account at 62, I need (£3600/4% = £90,000 saved in my account upon retirement. So the Ideal scenario is that my LISA will grow annually at 4% and if I withdraw 4% annually, I actually NEVER run out of that £90,000 saved. This is called the natural yield. So if my annual income i £36,000 net, I need (£36,000 / 4%) = £900,000 saved at the age of 62 to maintain the lifestyle I desire. This calculation is based on a number of assumption related interests rates and inflation. However, it gives me a view of the size of the pension pot I'll eventually need. Seeing this figure, I can spend all the £900,000 in 25 years (£900000/£36000). However if I anticipate that I will live longer than 25 years, I need that £900,000 to last much longer. Want to simulate your pension pot? Have a go at the Wealthsquats calculator shown in the table above. Alternatively you can do a quick search and find other like the People Pension calculator At what age can you access your pension? For each of the pension sources I have mentioend above, you'll need to keep in mind when you can actually start to withdraw from them. For instance, the age when you can access State Pension will differ depending on your birth year, so if that age is 68 years, and you wish to retire at 55, you'll need to find ways to cover the income you would have received from our state pension. So part of my pension plan is looking at the age and time when I can access these income sources. Some Interesting things I found out:

Know the Pension Carry forward rule. I learnt this from a friend. Every year I put in £40,000 into my pension this is the maximum annual allowance permitted by the government. I also manage my wife’s finances and she currently has around £160,000 in her pension pot. For the years where we do not put the full pension allowance, I use the pension carry forward rule where in a given year, I can pay the difference from the annual allowance for the past 3 years. This looks like this; Year 2016 I contribute £30,000 into my pension (I have £10,000 left for my annual allowance) Year 2017 I contribute £20,000 into my pension (I have £20,000 left for my annual allowance) Year 2018 I contribute £20,000 into my pension (I have £20,000 left for my annual allowance) Year 2019 I contribute £40,000 into my pension (I have maxed out my allowance, nothing is left) In 2019, I can contribute a total of £90,000 into my pension because I am able to carry forward £10k+20k+20k= £50,000. I want to get my pension situation sorted

There are many variables that impact your growth and longevity of your pension pot. Keep these in mind when reviewing your circumstance.

What you can do now?

Options avaliable for you

More information Read our full guide on pensions here to get started. I also found this website from The People Pension to be useful.

1 Comment

Read More

|

Proudly powered by Weebly