|

�

Archives

September 2021

Categories

All

|

Back to Blog

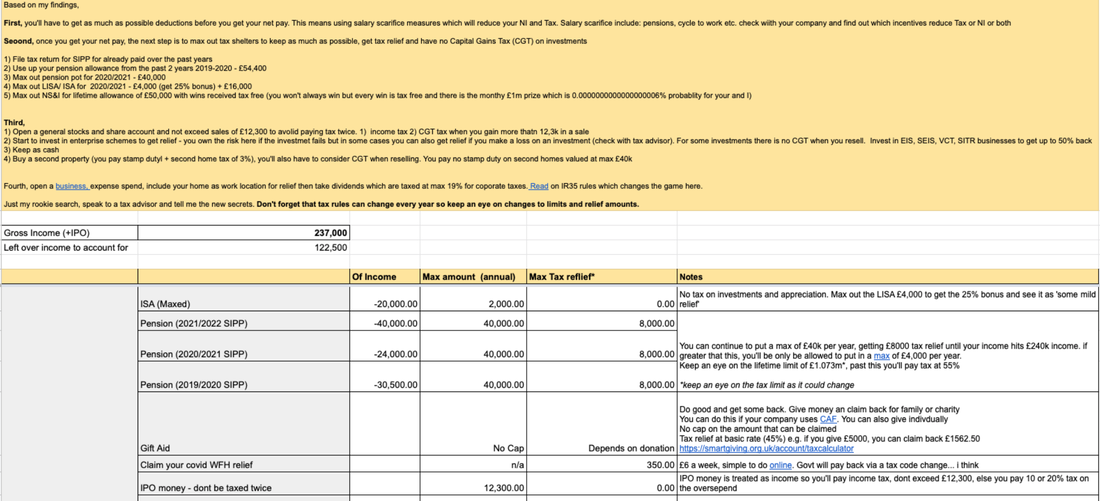

Someone reached out to me to try to solve the puzzle related to earning a high income as an employee (£237,000 to be exact) and using tax laws and perks to keep the most of the money to save and invest.

I scoured the tax rules to pull a quick report that broke down how that money can be allocated in tax friendly accounts or where tax relief can be obtained. This exercise was a great reminder on why we should invest in a tax advisor to help us keep most of our money. A tax advisor is available to all income levels and although there could be costs associated with this service you can save up and use them at least once a year to get your monies in order. If you are on a low income, you can get free advice from the government. I have just opened a Money pot called Life Admin where I'll be saving to get a tax advise and formalise a Will. Many wealth builders have great lawyers, accountants, doctors and financial advisors. What can a tax advisor do for you:

How to manage a £237,000 income and Tax. Click here or the image below to see the full report. Need a Tax Adviser, click here to choose who is appropriate for you or use the all in one service from Taxscouts and get 10% off.

0 Comments

Read More

|

Proudly powered by Weebly