|

�

Archives

September 2021

Categories

All

|

Back to Blog

What money lies have I stopped telling myself? What is my biggest financial asset? How do I spend and save today? A few years ago I had ZERO knowledge about money and in this post, I look back to see what key mistakes I've stopped making that have become a game changer in my life. My 5 money mistakes

I remember always being so surprised that I had nothing left at the end of the month Spending and spending with no real plan Before I began to get an handle on my finances, my money would come into my current account and all of it would stay there. Slowly my rent, bills would get paid and if at all anything was left, I would still have a reason to spend it. I remember always being so surprised that I had nothing left at the end of the month and when I thought about the effort it would take to go through my spending, in my mind, it was not worth the effort. The money was already gone. Today, I have a budget which I optimise (find ways to reduce my expenses and increase my savings and investments) regularly. Nothing stays in my current account after all bills are paid (my current account doesn't pay interest) and monthly savings and investments have left. Every planned spending is accounted for and I no longer suffer the end-of-the-month-where-did-my pennies-go-syndrome. If you need a money goal to help you plan your spending start here. To be honest, by the time I was 23 years old, no one or school had taught me how to save, no one sat me down to talk about debt or showed me savings accounts and it definitely did not come up as a topic amongst my friends. I simply had no positive money role models. Not being deliberate about saving Just as I spent with no real plan, it is no shocker that I had nothing to save and this happened every time. To be honest, by the time I was 23 years old, no one or school had taught me how to save; no one sat me down, showed me savings accounts, opened a piggy bank and it definitely did not come up as a topic amongst my friends. I knew I wanted to have money but to me it was magic that makes this happen and this magic happens to special people. Little did I know that magic starts with a budget. A budget is the greatest energy source for your money - no lie, they are like batteries you charge to take you far. It shows you where all your money goes and how you are doing. Today, I know of many magic wands that are accessible to all of us where it is savings accounts, the stock market, pensions, private equity, real estate, peer to peer lending, Crypto. This is how I am now deliberate about my savings are as follows:

Thinking I've got my pay-check. That's all I can make right now... Once I got my first proper job, I breathed a sign of relief I now have money. I revised this thinking after my first pay-check (with National Insurance (NI) and taxes deducted, very little was left). Since this was my only source of income, there wasn't much else I could do except find ways to increase my income constantly - this was a hard task. I knew I had to find a way to fatten my income outside of my employment. I went to a seminar once and they spoke about making money while you sleep and multiplying your hourly rate. Since then, this quote from Dave Ramsey has stuck with me-Your most powerful wealth building tool is your income. One of the ways I am applying this principle is by allowing other companies to work for me by buying into funds or shares. When these companies do well, their prices increase and/or they give a dividend. If they don't do great, I take the risk of having lower return but on average and over a long period of time, I should win. Of course there are other things you can do like getting another job for your 5 to 9 but if want an 'simple' co-worker earning for you without any additional effort, you now know your options. The results:

Before writing this post, I looked at my overall pension to see the current value and hands down - it is the largest financial asset I own today. Not setting my pension to the max matching to get free employee match When I started my first job, I think I opted out of the work pension plan initially or I may have begun with saving 1%. At this time, if I put in up to to 5% of my salary, the company would match that 5% and I would have 10% paid into my pension pot. Now as a 23 year old, why would I give away 5% of my money for old age when I am young and in my view at that time, close to the London poverty line? I kept this view for about a year and half when I got serious about transforming my financial life. I spoke to a friend at that time who advised that the easiest place to start getting money was by increasing my pension saving to the 5%. This not only allows me to get free money but it also reduces my taxes. Before writing this post, I looked at my overall pension to see the current value and hands down - it is the largest financial asset I own today. This is not surprising given this UK research where pensions can make up to 60% of households net worth. This are some reasons for the growth:

I am now looking forward to being older; I've even calculated how much I'll need to live comfortably. I also have some peace of mind that the efforts I am putting in now will lead to a beautiful life and that is exciting. I like pensions because they force us to save for old age (otherwise, we will just stumble into it), once the money is gone it is out there working, growing to make the most for you. Fast forward to age 24, I read a book by Tony Robbins which simplified the foreign language and and so I quickly open my brokerage account with £25. I have not looked back. Believing the stock market is scary As a young girl, I remember watching CNN evening news and at 9pm GMT, we would hear the NYSE Bell ringing to close the day of trading. I must have watched this happen hundreds of time but I never understood why the bell was there in the first place and what those green and red triangles next to names like LSE, NYSE, DAX etc. meant. I did not know that I was witnessing the opening and closing of money making opportunities. The commentary the pundit gave after each closure was like a foreign language to me, one I found very boring. Fast forward to age 24, I read a book by Tony Robbins which simplified the foreign language and and so I quickly open my brokerage account with £25. I have not looked back. Today, I know the stock market is a huge source of wealth for the top 1% in the UK and is designed to be confusing (with the graphs and financial terms). It is actually not confusing and I am very supportive of the low fee robo-advisors that make it easy for you and me to take part this huge wealth engine. Last week, a family member was discussing a real estate scheme that guaranteed 8% return if she put in £5000. I immediately opened by brokerage app and told her that one of my fund is posting 22% gain. Five years ago, there is no way I wold have been able to suggest this as an option to explore but now I know more and can suggest ideas that could generate a 14% pay bump. This is the true power of knowledge. Now, your turn, do you have any mistakes you've made?

0 Comments

Read More

Back to Blog

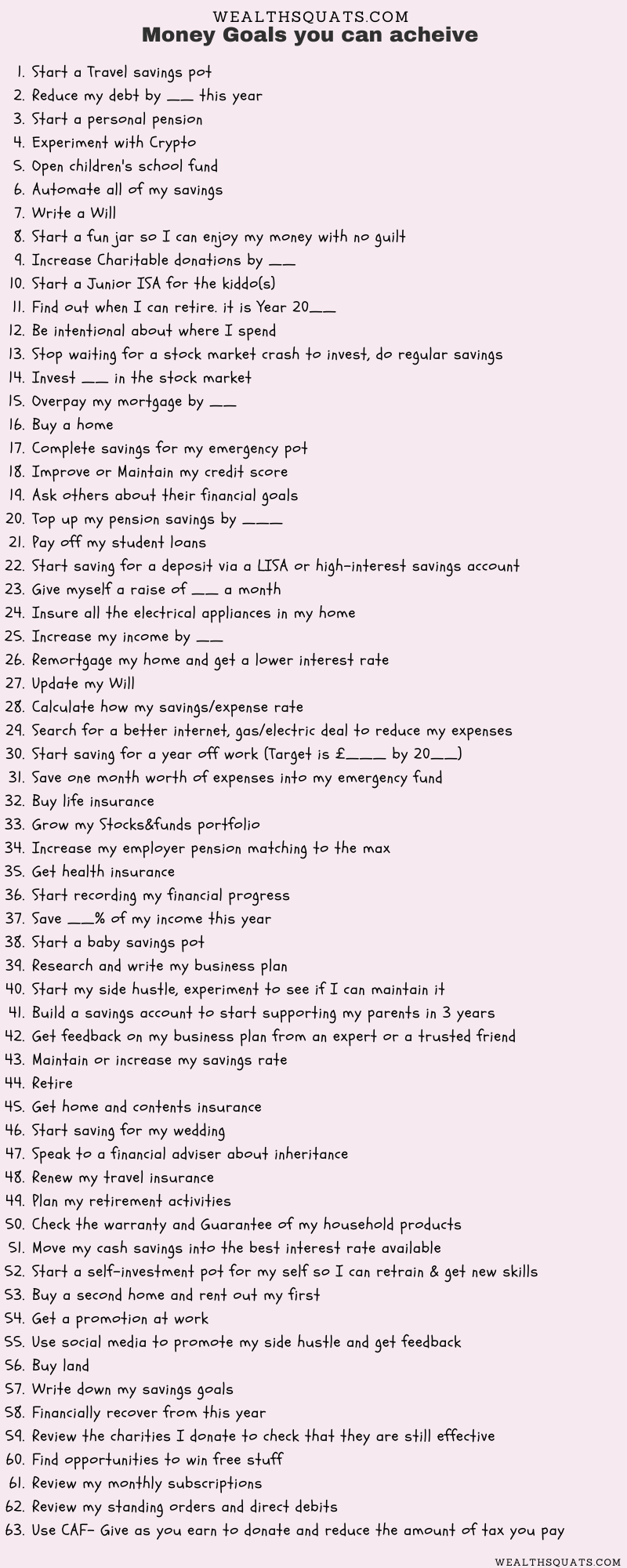

60+ Financial Goals you can achieve anytime12/20/2020 Here's a 60 plus list of money goals you can achieve anytime. We've covered the research behind the power of writing down your goals. So choose yours or add to the list. Do right with my cash savings

Travel & FunProtecting my Family

Save better and more

Manage Debt

Take care of my future

Give BackHomeownership

Financial Health Check

Experiment with my ideas

Enablers

Big overall Goals

Back to Blog

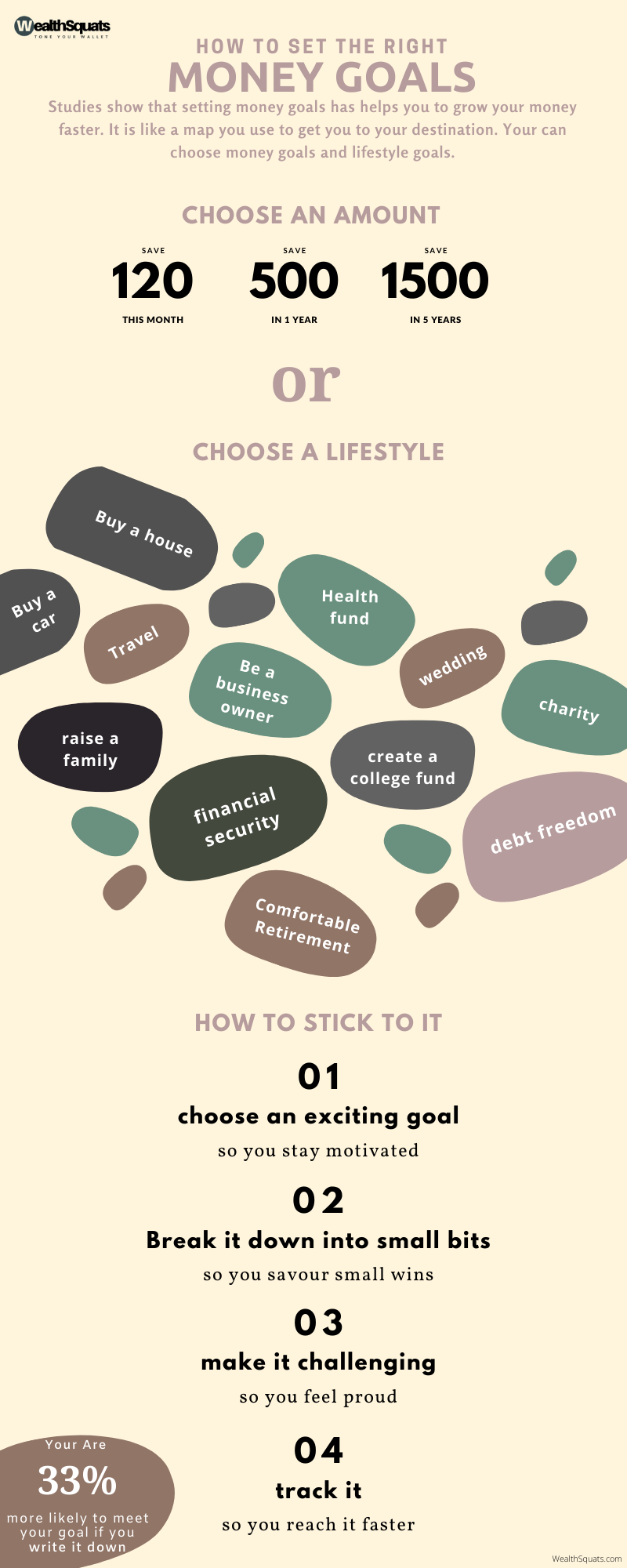

What do you want to be when you grow up? What is your 5 year plan? What are your career goals? What are your relationship goals? We've all heard this at one point in time and I wonder, why do we not also ask: WHAT ARE YOUR MONEY GOALS? if you are the kind of person that writes your life goals, does it include money goals? Research has shown that writing your goals down can make you reach them faster. Keep reading to find out how you can incorporate this money habit for success. What you need to know

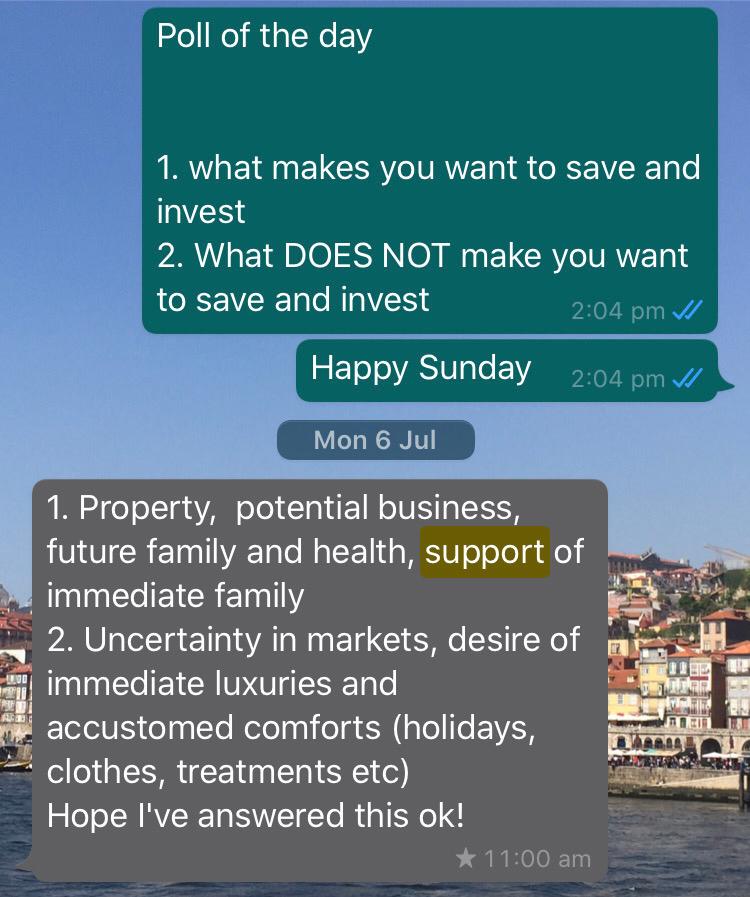

I asked 5 readers to share their money goals:I asked 2 questions: 1. What makes you want to save and invest 2. What DOES NOT make you want to save and invest Click on the images below to see their responses. The research and experience of writing money goals Every year, I write my money goals down. So far, I have found that I met them before or after the deadline I had initially set. I believe that there is some magic to writing things down. Once you write it down, it is autosaved in your brain and then somehow, you start to focus consciously or unconsciously to make it happen. My experience aside, research has shown that setting goals makes you more confident, motivate and in control - no wonder employers use performance reviews to set and monitor targets- they know that if done well, it motivates employees and can also help their business grow. If you want to actually make it happen, start by writing them down. 'A study by Gail Mathews, found that you are 33% more likely to meet your goals if you write them down, share it with a friend and review it frequently'. Want to meet a money goal? write it down. How to Write a Goal that you stick to (4 ways)1. Choose an exciting goal According to Business Insider, 'Instead of being afraid of your finances, focus on the goals that excite you'. Why? when you choose an exciting goal, you stay motivated to make it happen. Here are the types of goals you can write down: Types of Goals

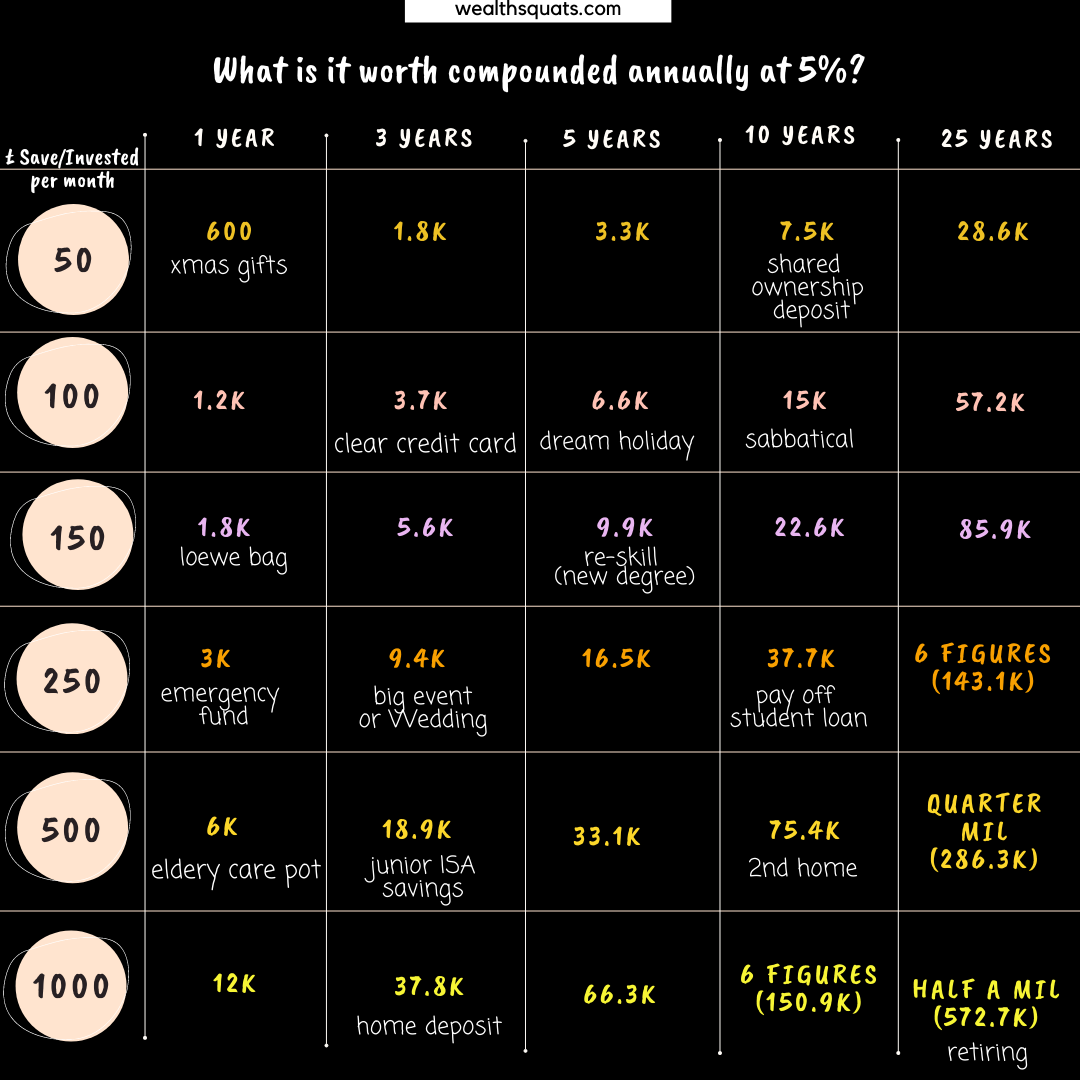

2. Break it down into small bits Big goals can feel overwhelming and when it comes to money goals it is important to break it down. A Harvard study explains, 'When we’re judging the difficulty of a goal, the first thing our brains see is the size of the gap that separates the goal from the baseline. The bigger the gap, the more difficult the goal' For example, if you are planning that trip to tour the East Africa and it would cost 2000. Saving 2000 might today can feel challenging. To make progress, you can break it down to save 100 a month and add more in months where you can. After 5 months, you'll have 500 saved and have covered 25% of the cost. With an exciting goal ahead of of you, you can celebrate the small progressive wins and that is key, 3. Make it Challenging If the goals is too simple, you won't be satisfied. Research has shown that you achieve 'greater satisfaction from achieving goals that help you improve as opposed to maintaining the status quo'. So, If you are dedicated to clearing your 3 credit card debts of 2000, 1000 and 300, you'll likely be more satisfied clearing the 300 than paying off the minimum for each month which would make you feel like you are not improving. Going back to the readers response on What DOES NOT make you want to save and invest? I noticed most of the response was about making sacrifices today so they can enjoy tomorrow. I think this is another crucial element of satisfaction, delaying gratification, allows the reward at the end to be more enjoyable. 4. Track It Truth session. Years ago I began tracking one specific money goal. Since then, that number has increased by a whopping 4024% to be exact. How come? What you cannot track, you cannot measure. Remember the research I mentioned earlier, it said, if you share your goal with a friend on a monthly basis, to keep you accountable, it happens. My friends are my spreadsheet, MUTAZ, and you readers of this post. I review my spreadsheet monthly to check how I am doing. Tracking helps me to stay focused and also allows me to think of new ways to reach my goals faster. Grab a copy of the WealthSquats smart budgeter to write and track yours. Need help on where how to start tracking? Use Financial Success Map to make a plan.In Summary |

Proudly powered by Weebly