Money Management is like learning how to write or read. You only need to learn it once and remain consistent.

- WealthSquats.com

|

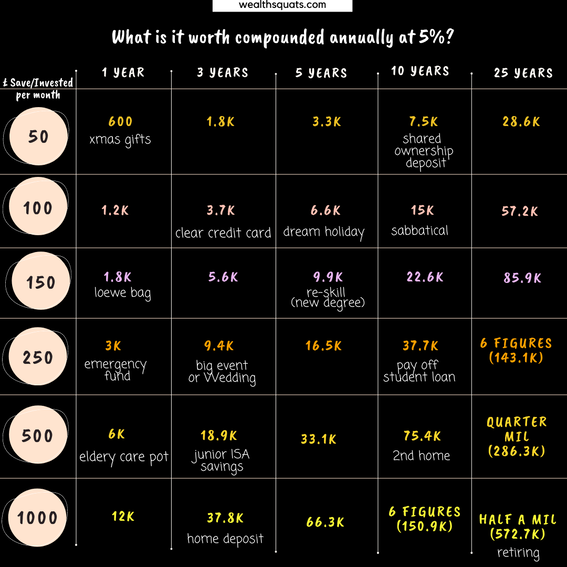

Ways you can grow your money? |

10 simple steps to Money Mastery

Step 1. Identify your starting point and set 1 or 2 money goals

Financial Success MapWhere are you on the map below and where would you like to be? Click on the boxes to draw your map |

|

||||

| Where Are You? | SAVINGS | PENSION | STOCK MARKET | EXPENSES | DEBT |

|---|---|---|---|---|---|

Haven't Started

|

I have nothing in savings | No Pension | Never Tried it | No Idea how much I spend | I don't know how much debt I have |

|

Thought About It

|

I have a savings account I put money in sometimes | I have a Company Pension | Looked into it but never started | I know whether or not I spend too much | I know how much debt I have, even if I don't control it |

Beginner

|

I regularly put money into a savings account (preferably an ISA) | I have fully-matched my Company Pension | I use a Trading/Robo-Investing App | I can cover my basic expenses (rent, food, utilities) without borrowing | I pay off some of my debt every month |

Improver

|

I have at least 1 month of basic expenses saved | I have a Company Pension plus my own retirement savings e.g. LISA, SIPP | I regularly contribute to my Stocks Account and feel confident choosing my stocks and funds | I track my expenses and cut them where I can | I structure my debt to maximise how quickly I pay them off |

Comfortable

|

I have 3 months of expenses saved | I have defined an Old-Age lifestyle goal and have started saving towards it | I maximise my returns by using an ISA and minimise my investment charges and fees | My expenses are maximum of 70% of my income, and can support my dependants | I don't take on unnecessary new debt and am paying off my old debts on time |

Savvy

|

I have 6 months of expenses saved plus a curveball account for minor emergences | I fully manage my own pension Account (e.g. a SIPP). I also have a plan for spending my pension | I have set a Stock Market goal and work to reach it | Less than 70% of my income is taken up by my expenses | I choose when I take on debt, for example getting a mortgage to buy a home |

Money Ninja

|

My savings are tax advantageous and I readily use them to invest, e.g. in property, art, land, gold bars etc. | I have a (side) business(es) that can keep paying me even after I retire | I have a portfolio that pays dividends that I can comfortably live on | I can cover all my basic and luxury expenses without borrowing | Eventually, all my debts turn into assets |

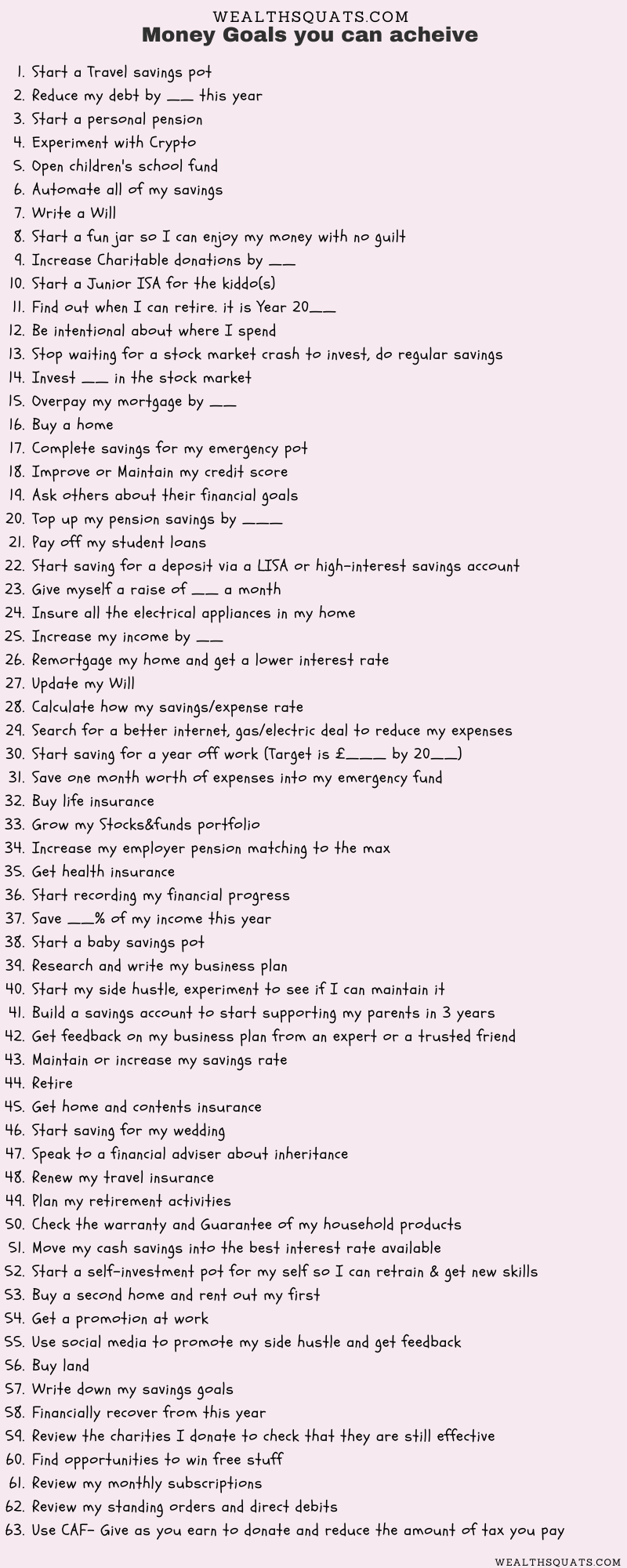

60+ Money goals you can achieve anytime

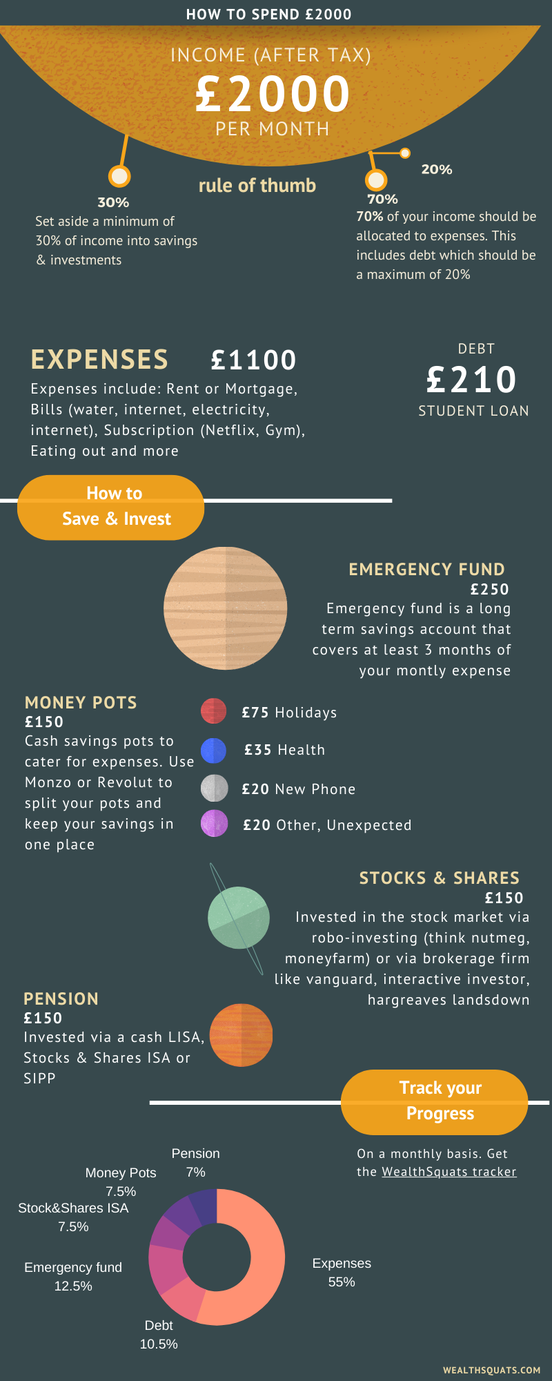

Step 2. Build your Emergency Fund to create a vital cushion

Step 3. Create your Oops or curveball savings account to manage planned expenses using this method

Step 4. Start a Pension pot to build a desired old you lifestyle

Step 5. Invest in the Stock Market and learn how you can easily own companies that work to make your money grow

Step 6. Change the game on your Debts and use it as an investment

Step 7. Automate your savings and Investment. A brilliant way save more without any hassle

Step 8. Identify new ways of increasing your income so you can save and invest more

Step 9. What you cannot track you cannot manage. Grab your own copy of WealthSquats Smart Budgeter to help you manage your money with ease

Step 10. Make sure all of the above is Tax efficient by using ISAs and paying low fees

Digital Money ManagerTurn your smartphone into your very own Money Manager. Click here to find a comprehensive list of Apps, websites, to help you budget, invest in the stock market, shop for loans and more all on the go.

|

Stay focused on your money goals with these money cue cards

Sign Up!Grow your money and Get Smarter with monthly WealthSquats insights!

|

|

Disclaimer

The content on WealthSquats are my own thoughts and is not financial advice. Consult certified financial experts to get information that is suitable to you.

The content on WealthSquats are my own thoughts and is not financial advice. Consult certified financial experts to get information that is suitable to you.

© Copyright WealthSquats Ltd. Company Registration: 14992248