|

�

Archives

September 2021

Categories

All

|

Back to Blog

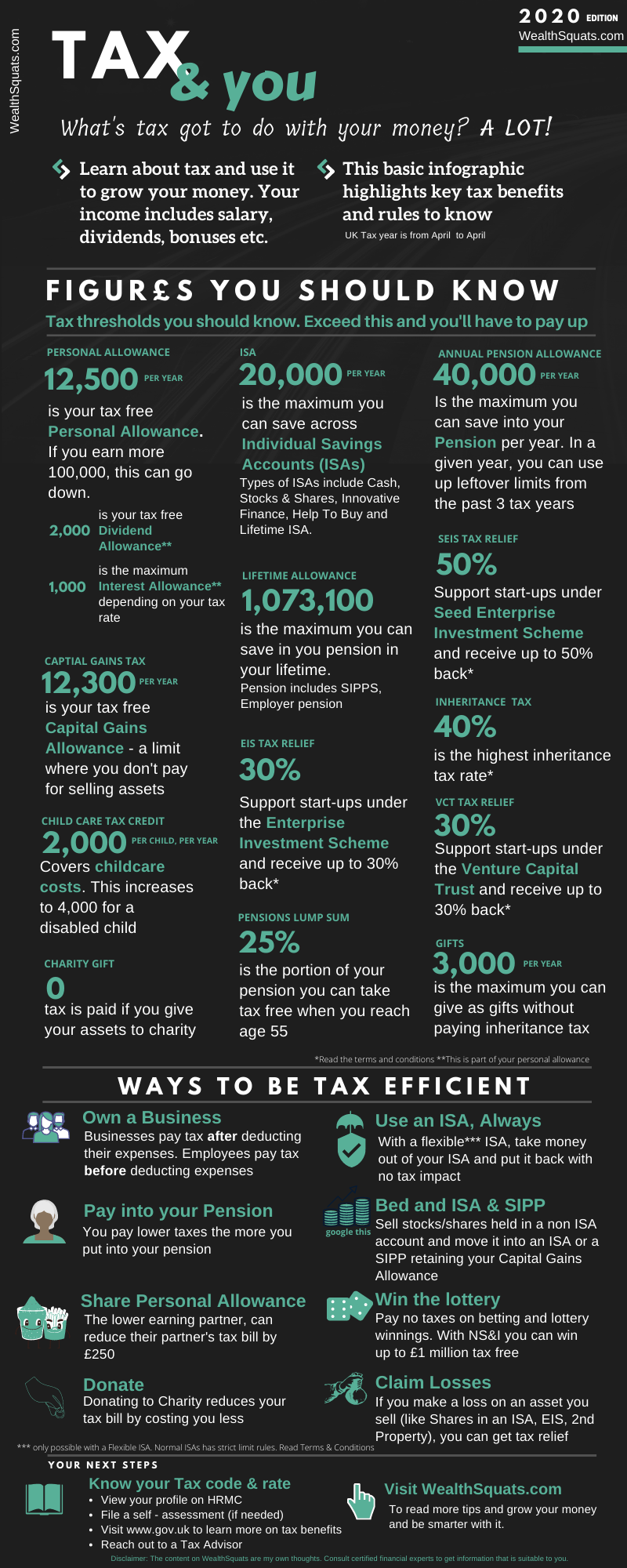

Tax is part of our lives whether we want it or not. It touches our income, contributes to our society, our healthcare, education, roads and more. In this post, I spend some time looking at the UK tax rules to find out which benefits we could use to grow and protect our money. I put my basic findings in an infographic to make it simple [Scroll down to view]. So let's learn about tax so we no longer label it as highly-confusing and downgrade it to somewhat confusing (a much better space to be in). [Quick definitions] The Tax WebThroughout this research, I found that Tax is actually not hard to understand on its own. The confusion comes when you have to consider all parts. Take this example: You have an income over the personal allowance threshold whilst saving for a pension and a home which your family will support you with a deposit. I call this the web because to understand your tax position, you need to understand the Tax rules for income, pension, stamp duty tax and gifts. No wonder you and I shun this topic...but to our own wealth demise. Did you know that if you make a loss when you sell your home, shares in an ISA, or a personal possession worth £6,000 you can get a tax relief? Imagine that getting paid when you lose. These are the kinds of helpful money tips I want to know about (I've added much more below). Get Clarity If you work for an employer, your income tax is typically handled by your company. If you are self employed, you'll file paperwork on your own or via an accountant/certified tax advisor to pay the appropriate tax and claim relief. Anyone can reach out to an accountant or tax advisor on tax matters. Before we move on, one question. What tax rate payer are you? If you don't know the answer, keep reading to find out. What Tax Rate Payer are you?

Your income determines how much tax you pay. The UK uses a progressive tax system, where the more you earn the more you pay in tax. So, if you earn up to £12,500 per year, you'll pay £0 tax. On the other hand, the highest income earners pay up to 45% of their income in tax. This can be very difficult to accept which is why many people look at ways to legally reduce their tax bill by using some of the options outlined in the infographic such as increasing payments to their pension, using ISAs to prevent being taxed again or not taking out dividend income for a given tax year (deferring it). Some others flee the UK to low tax rate countries. Just know that your tax solution or option is unique to your personal circumstance. Find out what tax rate payer your are here. TIP More tips & resources

Remember this: Get Tax Advice

Videos on Taxes

0 Comments

Read More

Back to Blog

Why do the rich pay less for housing month on month? How do they make their money grow? How many of them can survive one month without a pay-check? I read the 2020 report from Resolution Foundation on wealth in the UK to see what research says about how to be rich in the UK. Keep reading to see the surprising answers. First, a quick recap: What is Wealth? Wealth is your assets (An asset: is a thing of value that grows e.g. savings, pension, real estate, art, gold etc.) minus your debt. We also call this your net-worth. In this study, 4 types of wealth were measured:

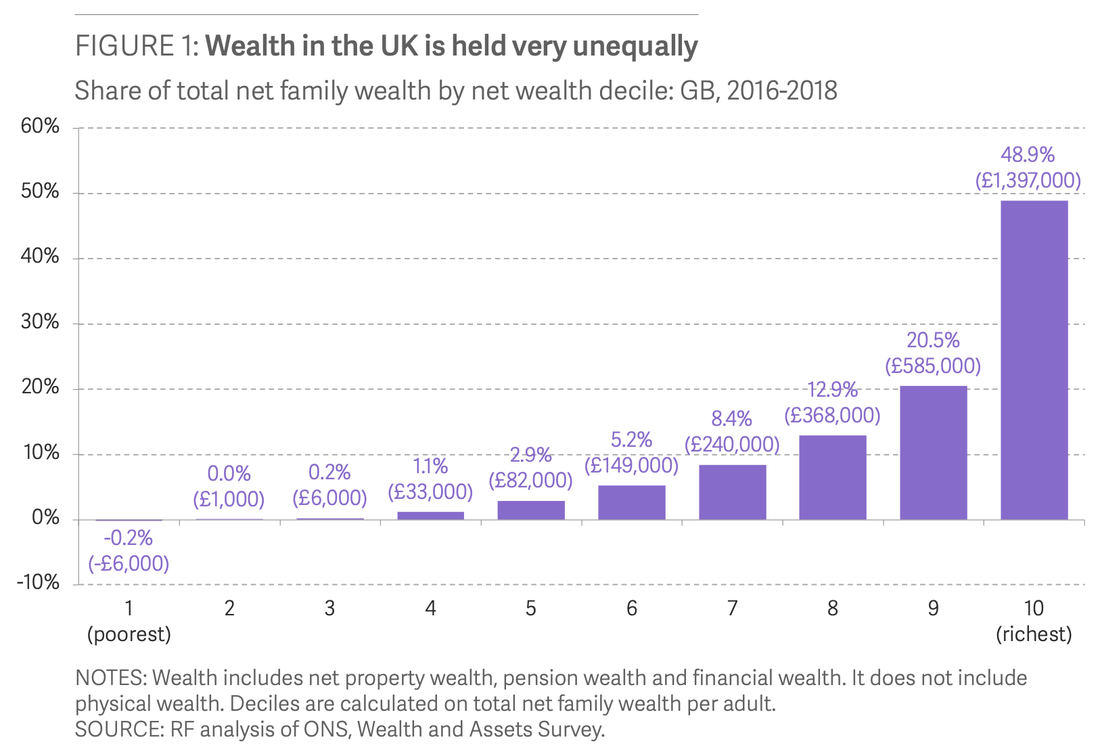

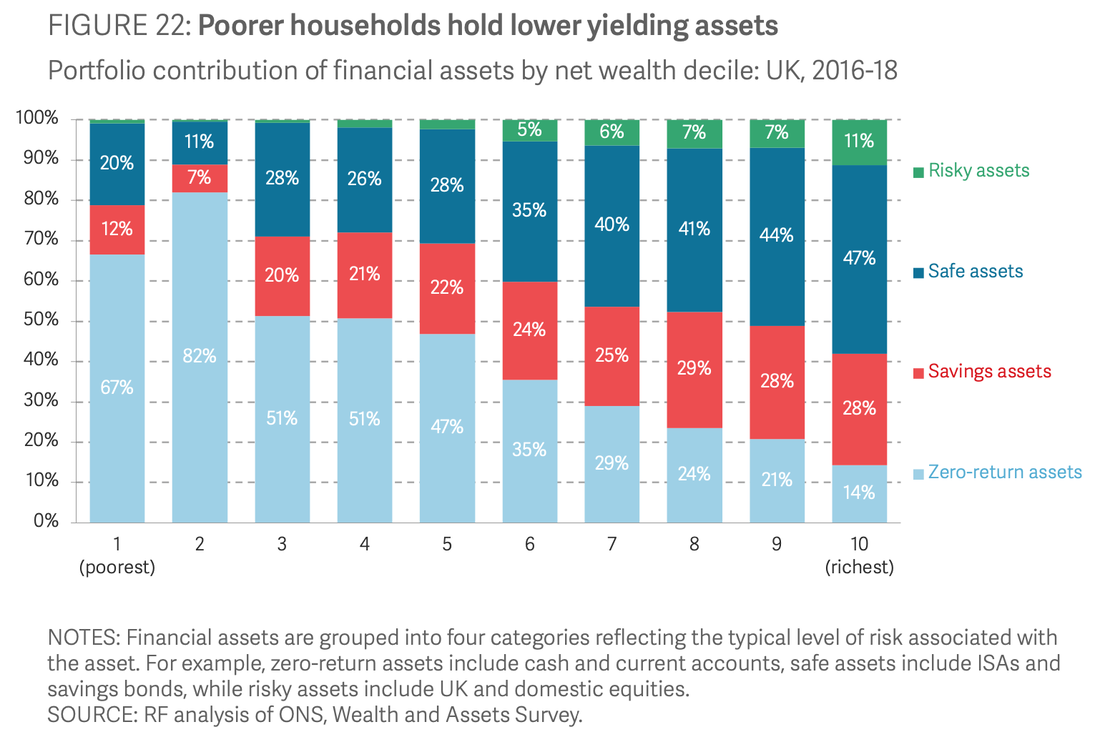

So, how do the rich manage their money?The top 10% have about 50% of UK's wealthThe average net worth of the 10% is £800,000. But, where do they grow their money? Keep reading to find out.Do it like the Rich: When it comes to financial assets, the Rich hold less cash and more of their money in growth assets like savings bonds, ISAs, and Stocks and Shares.Poor households hold most of their money in cash or current accounts where there is very little growth. When the rich hold money in savings bonds, ISAs, and Stocks and Shares, they benefit from:

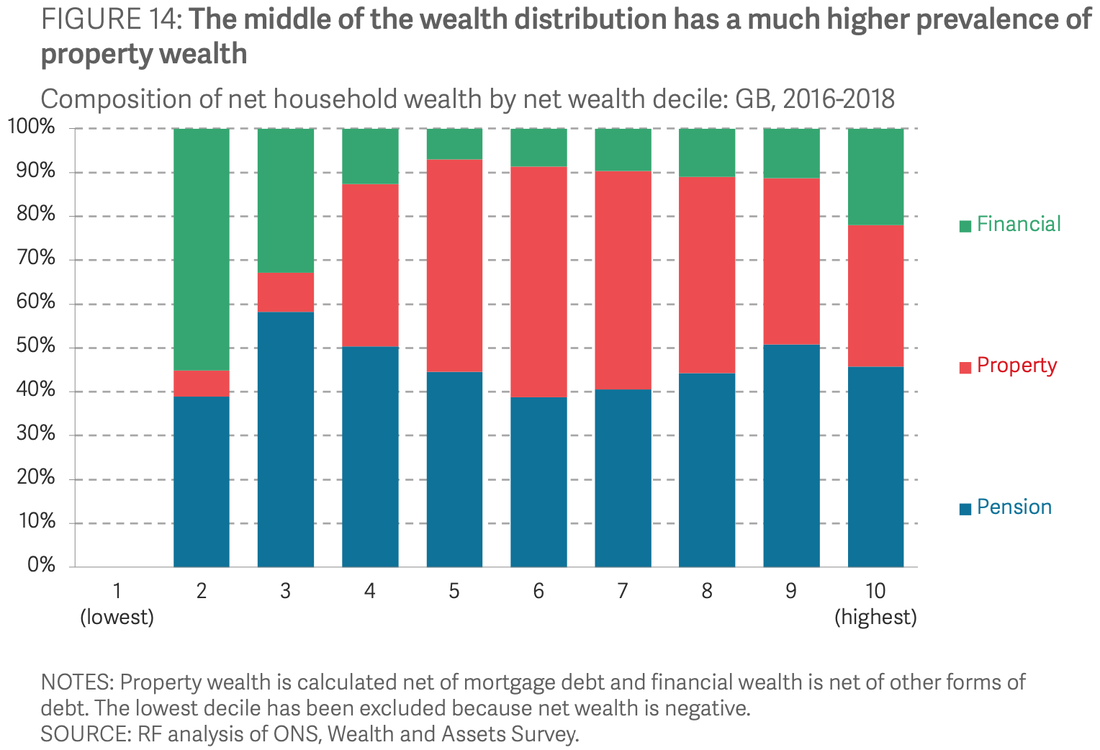

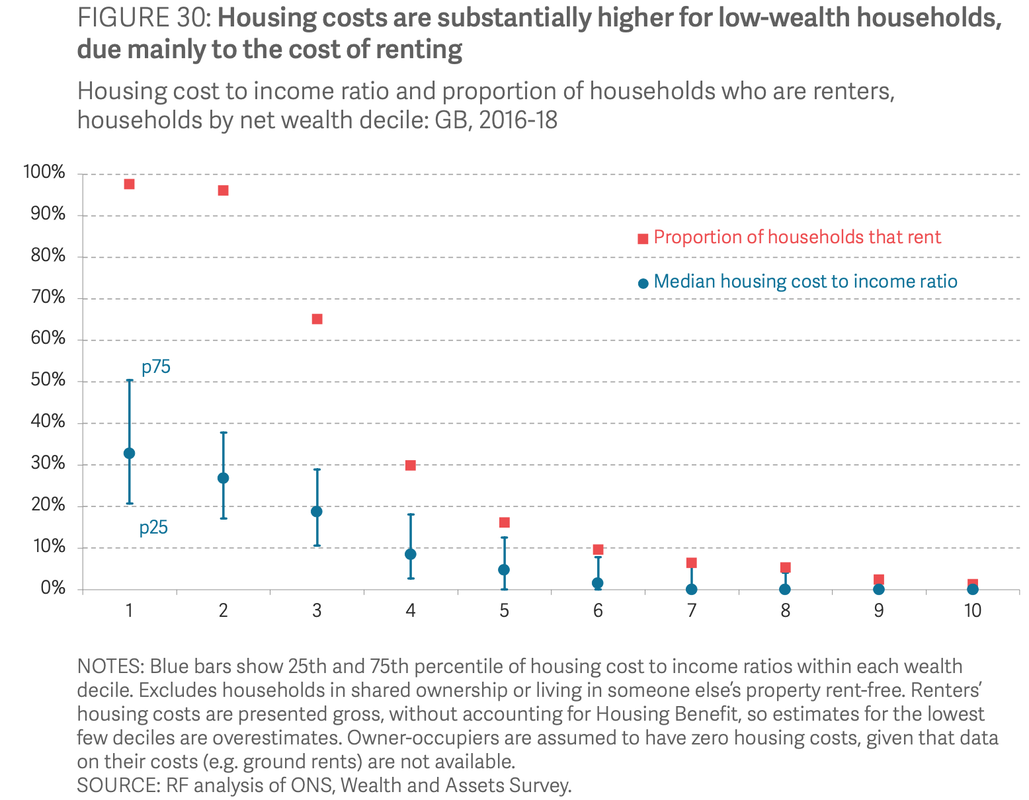

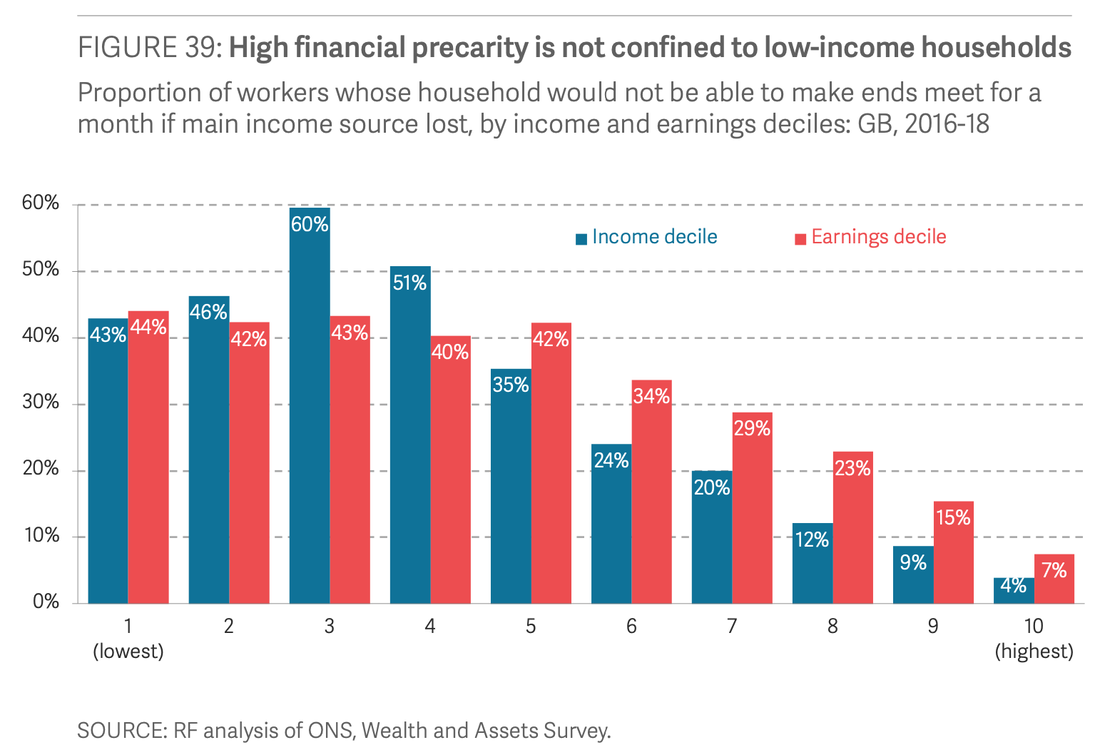

Do it like the Rich: The Rich have about 45% of their money in pension pots, 35% in property and 20% in financial assets (savings bonds, ISAs, and Stocks and Shares) Financial wealth (in high growth assets) increased substantially in the last 10 years and this contributed significantly (80%) to the overall wealth of the rich.As mentioned above, the financial assets of the rich are held in growing assets like bonds and the stock market. The Stock Market grew substantially in the past 10 years and it made the rich richer. The poor held most of their money in zero growth assets e.g. cash or current accounts and even when they added more money in these places, it grew at a much lower rate. Do it like the rich: Richer families tend to be homeowners Their housing costs are around 5% of their income if they own their home outright or 11% of their income if they have a mortgageDo it like the Rich: The Rich have emergency funds 7% of the rich would have a hard time if their main source of income is impacted as opposed to 44% of the poor.An emergency fund allows the rich to stay afloat if a shock like a pandemic or job loss takes place. Young females who are not degree educated were the most at risk if their income ran out. Do it like the Rich: There you have it. Some insights into the habits of the rich. Of course there are other ways to get rich, such as owning a successful business, investing in start ups, inheriting money or owning art for example. The options above are the accessible ways to start to build wealth and is the reality for many everyday people. See this infographic on how to spend £2000 which highlights the step by step guide to implementing the lessons above.

Which Rich habit will you start to use?

Back to Blog

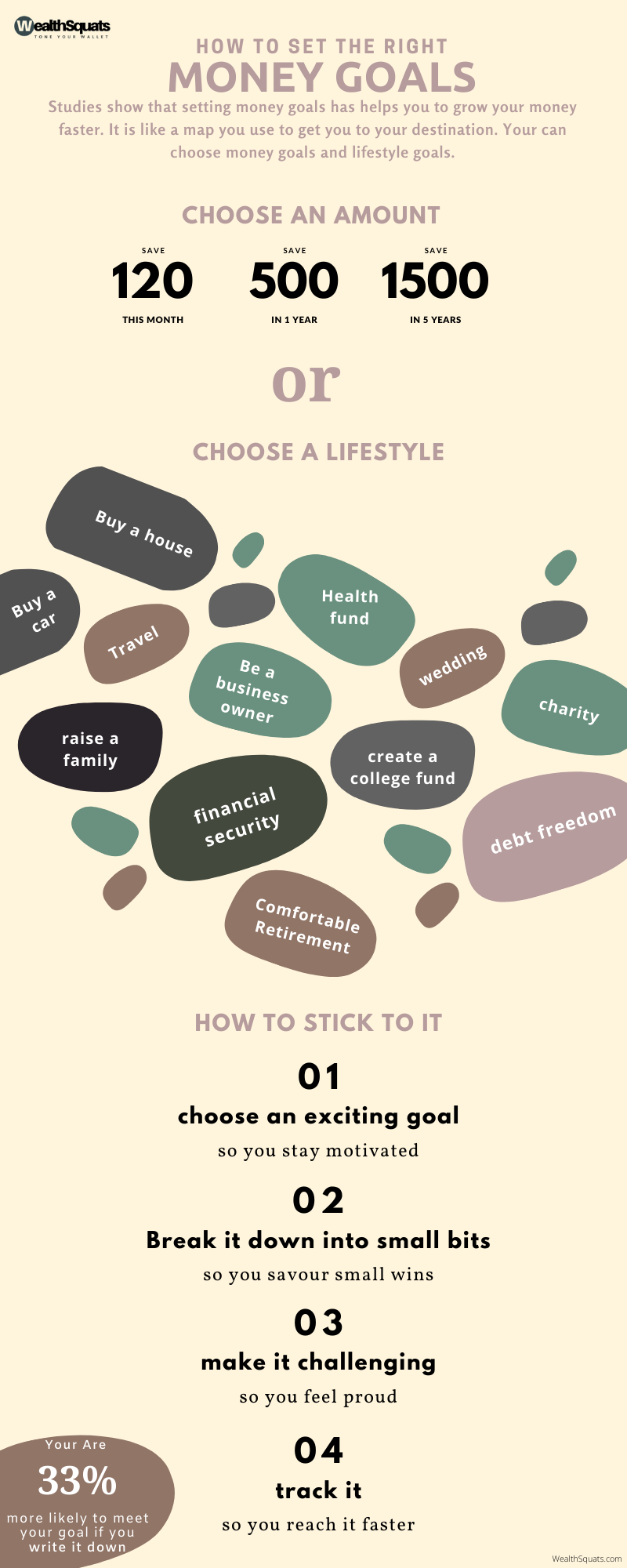

What do you want to be when you grow up? What is your 5 year plan? What are your career goals? What are your relationship goals? We've all heard this at one point in time and I wonder, why do we not also ask: WHAT ARE YOUR MONEY GOALS? if you are the kind of person that writes your life goals, does it include money goals? Research has shown that writing your goals down can make you reach them faster. Keep reading to find out how you can incorporate this money habit for success. What you need to know

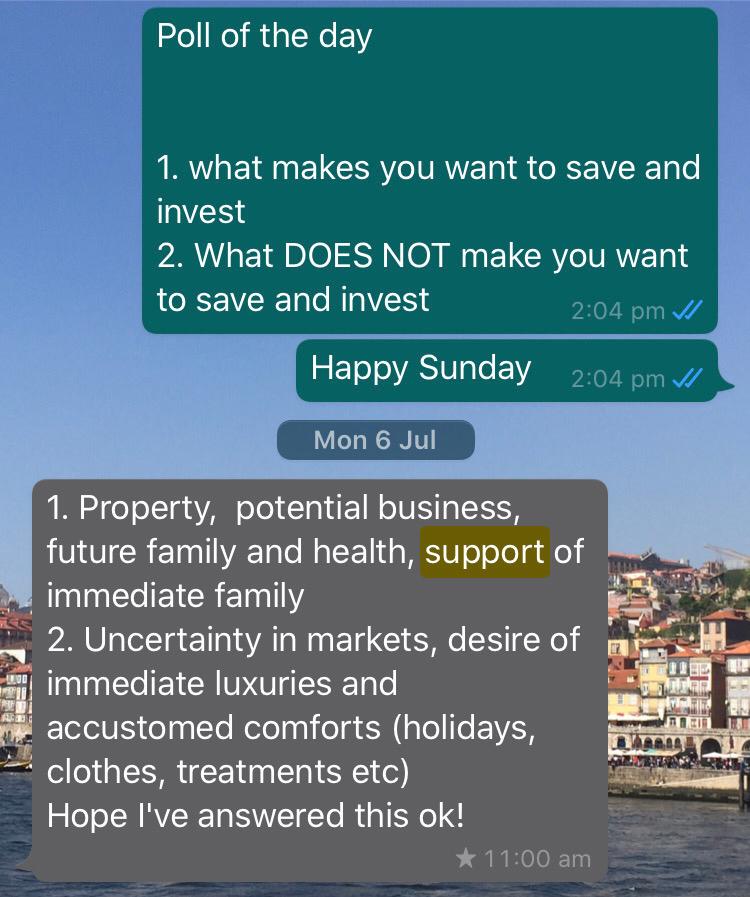

I asked 5 readers to share their money goals:I asked 2 questions: 1. What makes you want to save and invest 2. What DOES NOT make you want to save and invest Click on the images below to see their responses. The research and experience of writing money goals Every year, I write my money goals down. So far, I have found that I met them before or after the deadline I had initially set. I believe that there is some magic to writing things down. Once you write it down, it is autosaved in your brain and then somehow, you start to focus consciously or unconsciously to make it happen. My experience aside, research has shown that setting goals makes you more confident, motivate and in control - no wonder employers use performance reviews to set and monitor targets- they know that if done well, it motivates employees and can also help their business grow. If you want to actually make it happen, start by writing them down. 'A study by Gail Mathews, found that you are 33% more likely to meet your goals if you write them down, share it with a friend and review it frequently'. Want to meet a money goal? write it down. How to Write a Goal that you stick to (4 ways)1. Choose an exciting goal According to Business Insider, 'Instead of being afraid of your finances, focus on the goals that excite you'. Why? when you choose an exciting goal, you stay motivated to make it happen. Here are the types of goals you can write down: Types of Goals

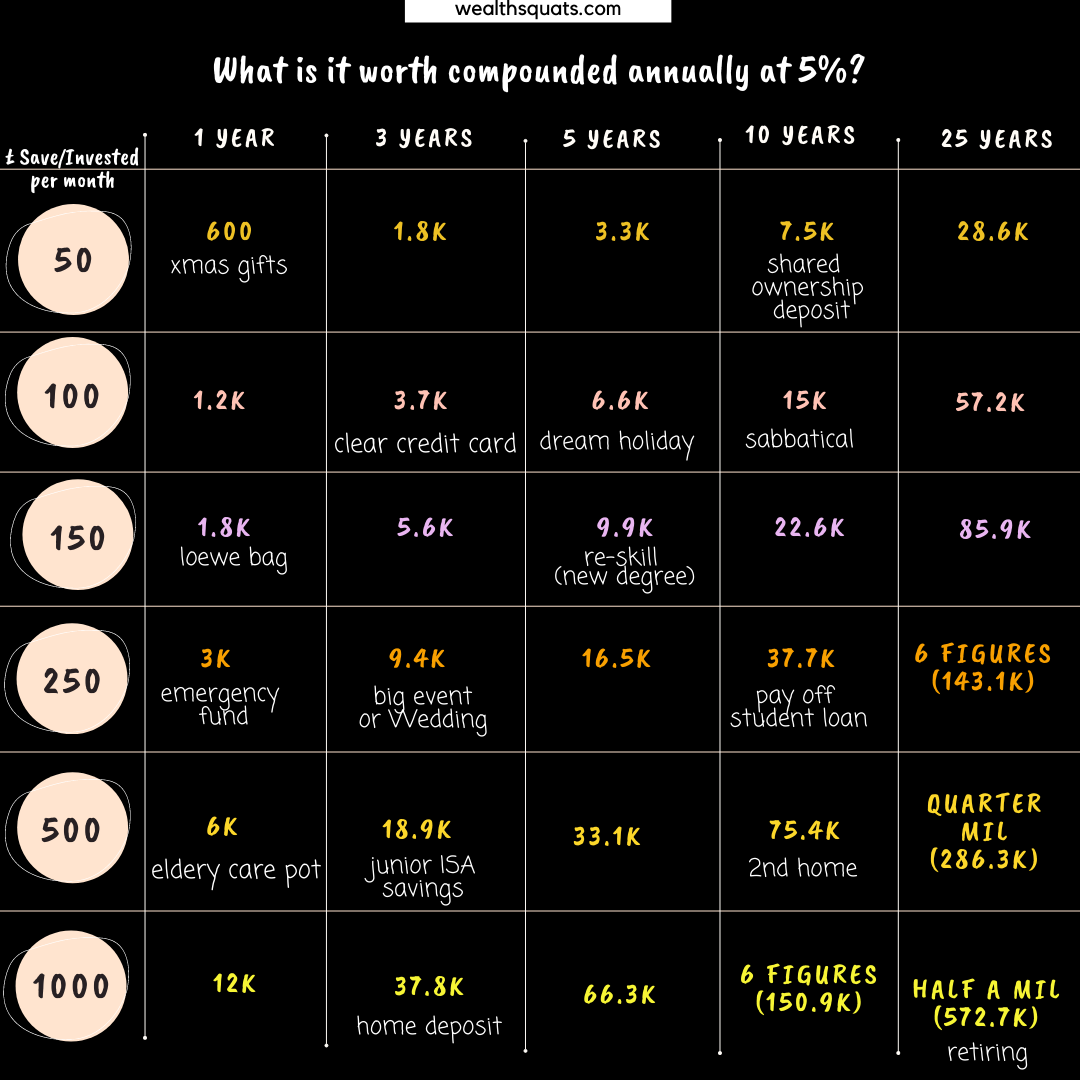

2. Break it down into small bits Big goals can feel overwhelming and when it comes to money goals it is important to break it down. A Harvard study explains, 'When we’re judging the difficulty of a goal, the first thing our brains see is the size of the gap that separates the goal from the baseline. The bigger the gap, the more difficult the goal' For example, if you are planning that trip to tour the East Africa and it would cost 2000. Saving 2000 might today can feel challenging. To make progress, you can break it down to save 100 a month and add more in months where you can. After 5 months, you'll have 500 saved and have covered 25% of the cost. With an exciting goal ahead of of you, you can celebrate the small progressive wins and that is key, 3. Make it Challenging If the goals is too simple, you won't be satisfied. Research has shown that you achieve 'greater satisfaction from achieving goals that help you improve as opposed to maintaining the status quo'. So, If you are dedicated to clearing your 3 credit card debts of 2000, 1000 and 300, you'll likely be more satisfied clearing the 300 than paying off the minimum for each month which would make you feel like you are not improving. Going back to the readers response on What DOES NOT make you want to save and invest? I noticed most of the response was about making sacrifices today so they can enjoy tomorrow. I think this is another crucial element of satisfaction, delaying gratification, allows the reward at the end to be more enjoyable. 4. Track It Truth session. Years ago I began tracking one specific money goal. Since then, that number has increased by a whopping 4024% to be exact. How come? What you cannot track, you cannot measure. Remember the research I mentioned earlier, it said, if you share your goal with a friend on a monthly basis, to keep you accountable, it happens. My friends are my spreadsheet, MUTAZ, and you readers of this post. I review my spreadsheet monthly to check how I am doing. Tracking helps me to stay focused and also allows me to think of new ways to reach my goals faster. Grab a copy of the WealthSquats smart budgeter to write and track yours. Need help on where how to start tracking? Use Financial Success Map to make a plan.In Summary

Back to Blog

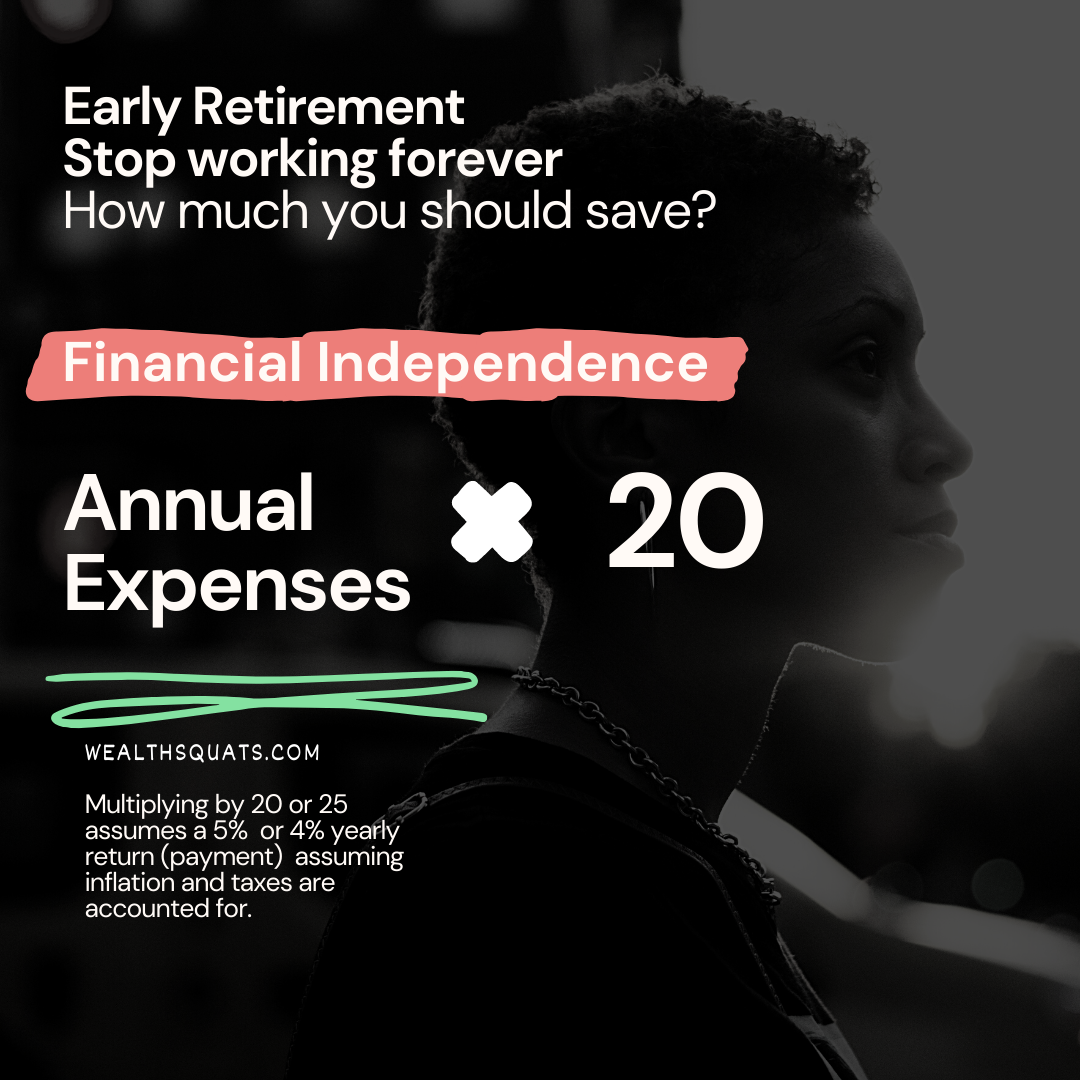

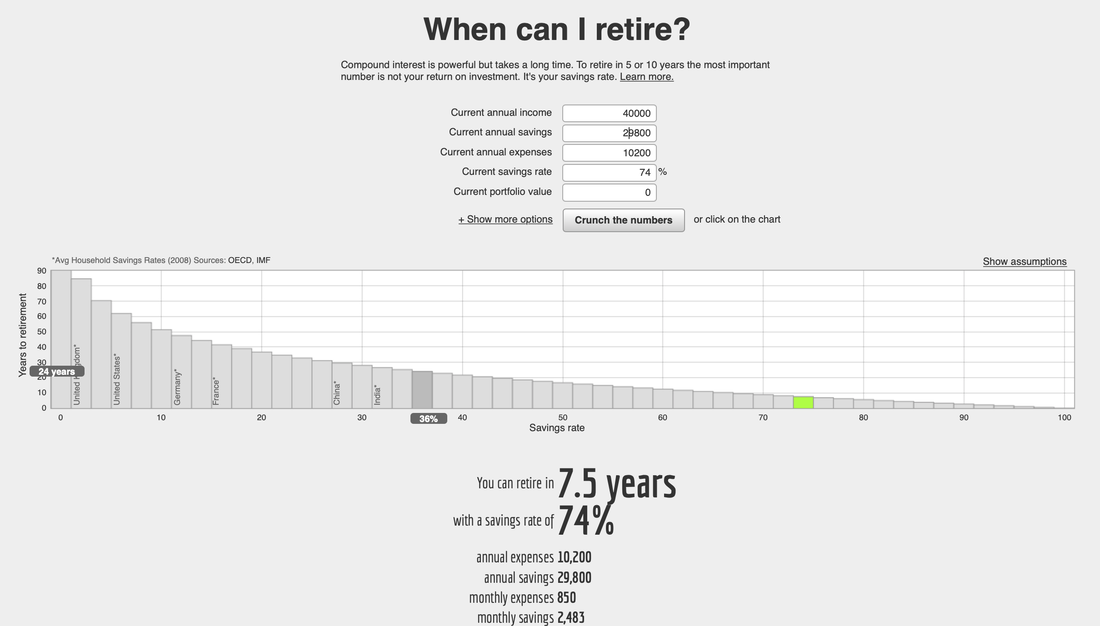

Save this to Stop Working FOREVER7/20/2020 Achieving financial independence is a major goal that many of us have. It is owning the chance to save enough money to maintain a desired lifestyle, stop working forever and doing what you please with your time. If you think you need millions saved to achieve this goal, I have found that this is not necessary the case. You can reach this goal much earlier than you might imagine. What you need How much do you spend per month? What lifestyle do you have today What lifestyle do you want when you retire Let's start by making some assumptionsLet's take the following example:

This is the amount you need to save to stop workingTaking the figures above, your financial independence number is (15,000 * 20) = 300,000 So you need to save 300,000 which pays 4% per year (after taxes and inflation). 4% is 15,000 which means your expenses are fully covered. If you want to cover accommodate other expenses or luxuries like travel, you can multiply the annual expense by 25. I've seen other articles that suggest multiplying your annual expense with a figure between 20 to 30. Multiplying by 20 means you expect your savings to pay you 5% annually, if you multiply by 25, you assume a 4% return. It is important to note that returns will vary with changes in the economy. When the economy is up, you can expect higher return and pay yourself more. With a bad economy, you reduce your spending. You'll also notice that the rule assumes you are invested mostly in the stock market, read more about this here. How many years are you away from retirement? 6 years? You can also use this calculator to find out. My financial independence number is too high - what can I do? Before completing this post, I calculated the financial independence number for a friend. This was the first time she'd ever calculated this figure. Once she saw this, she found her number to be achievable and started to think about how to reduce her expenses and particularly her debts to achieve freedom faster. What can you do:

Calculator: How long will it take you to retire? Find out hereSo go ahead, calculate your figure and Memorise this number Watch the Video below to learn about the FIRE movement.

Back to Blog

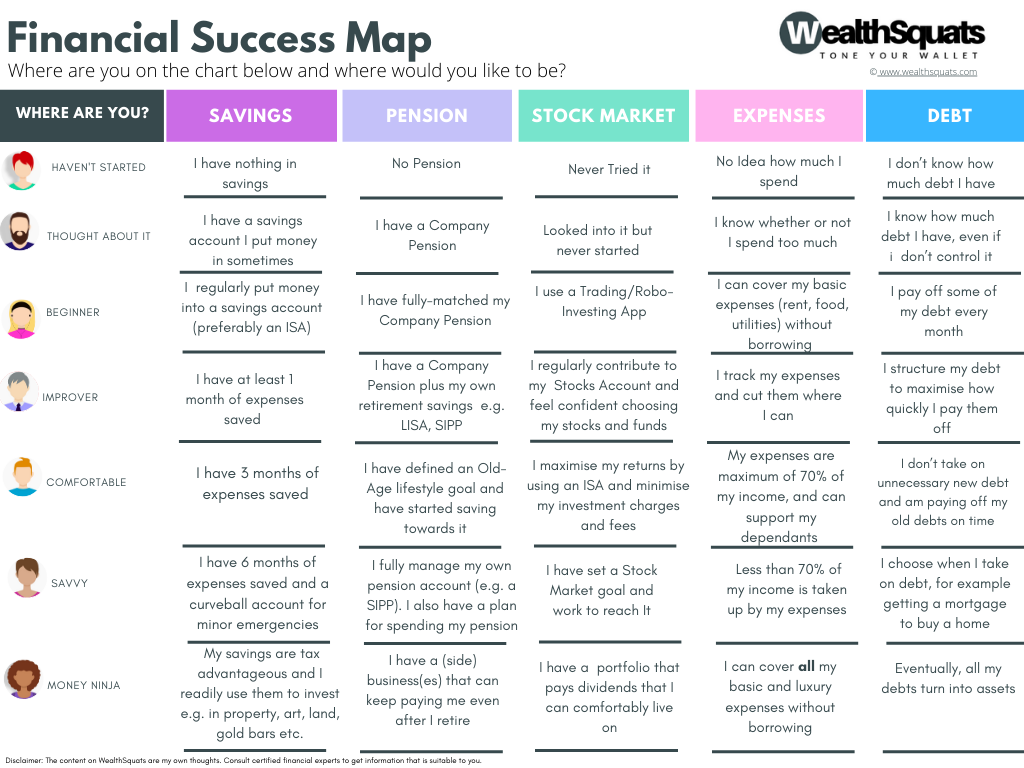

With COVID-19 restrictions easing up in the UK and around the world, many of us are left asking - what's next for me, my career, my health and my finances. Some of us are unsure, confused and looking for clear answers. In my previous post, I wrote candidly about how this pandemic has made me re-think and replan for the future. Since then, I have spent the last weeks trying to define the milestones of financial success. Specifically, what could it feel like or look like? I tapped into research and my personal experience and I have designed an interactive financial success map lets me assess how I am doing with my money goals.

I asked 5 readers to share their financial success Map...

Back to Blog

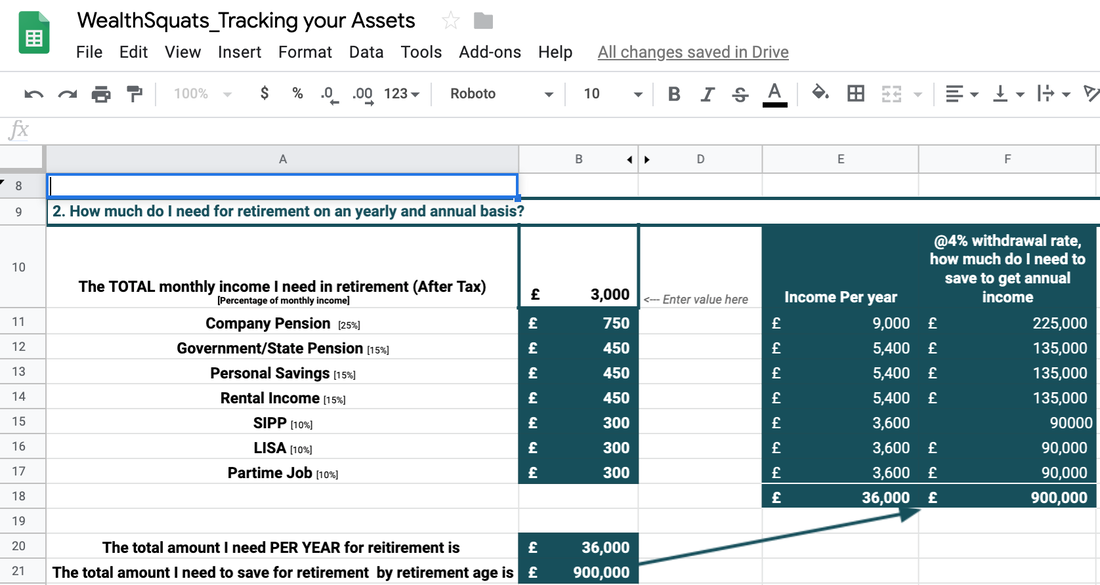

It is the year 2056, I am age 62 and have just retired. I have paid off my mortgage, I have healthcare coverage and I need £3000 per month (net tax) to be happily retired. Research has shown that UK retirees need around this amount to maintain a certain comfortable lifestyle that allows for some luxuries likes holidays, fine dining and more. Why did I choose £3000 as my happily retired monthly figure? At 62, I envision a life where I can spend on luxuries, management my expenses and retain or increase the lifestyle that I had when working. An undesirable scenario for me is a position where I am used to a certain lifestyle and then in retirement, I find that I have to downsize significantly. So if I was living on £2500 while I working, In retirement, I don't want to have only £1,500 as income. Studies show that most retirees want there income to be around 70% of their working income in retirement. My £3000 will cover, healthcare, bills, food, clothing, travel, donations and a few luxuries. It is very crucial that my mortgage is paid off or at least close enough to being paid off (2 years away). This way, I will not have to work to discharge the loan or feel the stress of using my savings to cover meet my debt obligations. My ideal situation would be to have my primary home paid off and to have a rental property where I can continue to hold assets. We are likely to live longer and with a retirement age at 62, I can expect to live till I am 85 or longer. This means that my income must last for at least 23 years. My income at retirement will change from getting a whole UNSCLICED PIZZA on day 1 to getting different pizza slices on different days Today, I work for a company and each month on a specific date, I get a salary. That salary is provided once and it funnelled into my expense, savings and investment. Fast forward to age 62, my retirement age. My income will no longer come at a specific date but it will come from different sources to make up £3000. It could look something like this: £750 from Company Pension received in on 8th of each month £450 from State Pension received in on 8th of each month £450 from Personal Savings account received in on 8th of each month £450 from rental income received in on 15th of each month £300 from SIPP received in on 17th of each month £300 from LISA received in on 17th of each month £300 from part-time job received in on 23rd of each month This reconfiguration of my potential income at age 62, changes the way I think of a pay-check. It will mean that for instance, I'll have to organise my spending not around one date but multiple dates. This is a mindset shift that I have to be aware of and start getting use to as the retirement age comes closer. The above is an example. The £3000 I estimate is for an individual. If that amount covers a couple, adjust your income sources to reflect your cirumstance. umm Did I say £900,000? Now that I know how much I want to live on at 62, I now had to figure out how much I needed to save in order to get £3000 monthly. See the table below for full details. To estimate how much I need to save, I learn of the concept of '4% drawdown rate'. This the rate at which I can take out of my savings in order to maintain my pension pot and not run out of money. Let's take my LISA, each month, I need £300 from that account to live on. In 1 year, I need £3600 = £300 x 12. If I want to withdraw 4% of my LISA account at 62, I need (£3600/4% = £90,000 saved in my account upon retirement. So the Ideal scenario is that my LISA will grow annually at 4% and if I withdraw 4% annually, I actually NEVER run out of that £90,000 saved. This is called the natural yield. So if my annual income i £36,000 net, I need (£36,000 / 4%) = £900,000 saved at the age of 62 to maintain the lifestyle I desire. This calculation is based on a number of assumption related interests rates and inflation. However, it gives me a view of the size of the pension pot I'll eventually need. Seeing this figure, I can spend all the £900,000 in 25 years (£900000/£36000). However if I anticipate that I will live longer than 25 years, I need that £900,000 to last much longer. Want to simulate your pension pot? Have a go at the Wealthsquats calculator shown in the table above. Alternatively you can do a quick search and find other like the People Pension calculator At what age can you access your pension? For each of the pension sources I have mentioend above, you'll need to keep in mind when you can actually start to withdraw from them. For instance, the age when you can access State Pension will differ depending on your birth year, so if that age is 68 years, and you wish to retire at 55, you'll need to find ways to cover the income you would have received from our state pension. So part of my pension plan is looking at the age and time when I can access these income sources. Some Interesting things I found out:

Know the Pension Carry forward rule. I learnt this from a friend. Every year I put in £40,000 into my pension this is the maximum annual allowance permitted by the government. I also manage my wife’s finances and she currently has around £160,000 in her pension pot. For the years where we do not put the full pension allowance, I use the pension carry forward rule where in a given year, I can pay the difference from the annual allowance for the past 3 years. This looks like this; Year 2016 I contribute £30,000 into my pension (I have £10,000 left for my annual allowance) Year 2017 I contribute £20,000 into my pension (I have £20,000 left for my annual allowance) Year 2018 I contribute £20,000 into my pension (I have £20,000 left for my annual allowance) Year 2019 I contribute £40,000 into my pension (I have maxed out my allowance, nothing is left) In 2019, I can contribute a total of £90,000 into my pension because I am able to carry forward £10k+20k+20k= £50,000. I want to get my pension situation sorted

There are many variables that impact your growth and longevity of your pension pot. Keep these in mind when reviewing your circumstance.

What you can do now?

Options avaliable for you

More information Read our full guide on pensions here to get started. I also found this website from The People Pension to be useful.

Back to Blog

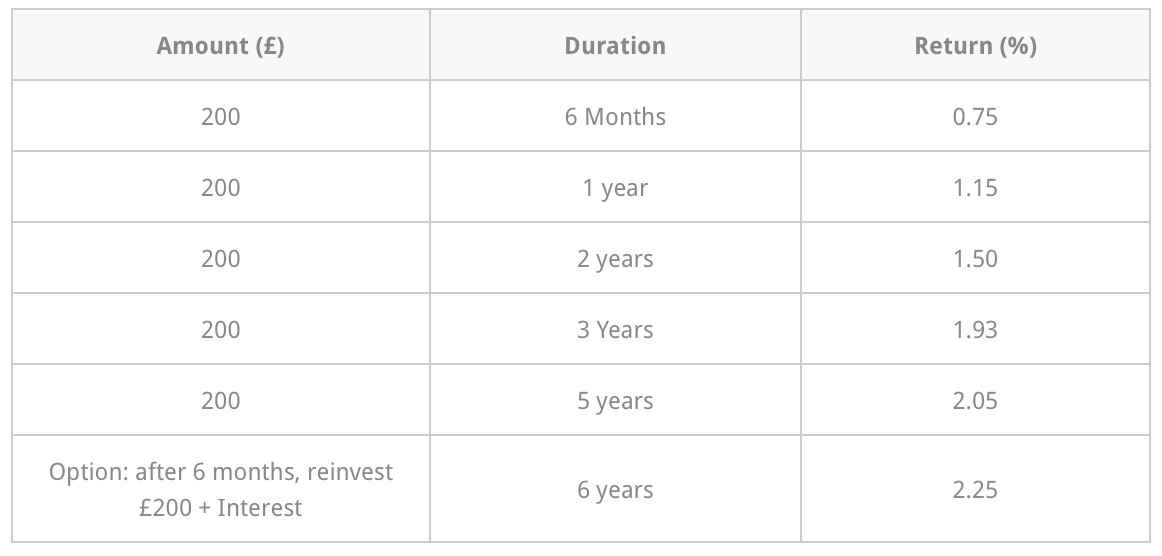

Recently I came across a new idea called Bond Ladder which allows investors like us to arrange our bonds in ways that provides flexibility with regular returns. This can be an attractive option if:

I am actually going to rename these bond trees as they money bloom all year round. Who doesn't like that How a bond ladder worksSay you have £1000 to save. You can either put the whole amount into a single fixed bond for 10 years with a 2.33% return. With this option you will not be able to access any part of the £1000 for the duration of the 10 years. If you feel that this ties you down, you can also opt to create bond ladder. With a bond ladder, you split your £1000 into different amounts across different bonds that mature at different times which also offer varying interest rates as return. With your £1000 bond ladder, you get the amount you invest back at different times so the first will be £200 + interest after 6 months. You can use that amount to sort our any expenses or you can reinvest it into for example, a 6 year bond to keep the process of building your ladder and getting a guaranteed income each time. As normal with bonds, you'll get the highest interest rate with a longer maturity period. Essentially the issuer or bond provider rewards you more the longer they hold your funds as a loan. If you are retired or you know someone who is about to retire A bond ladder is a good way to manage your savings or lump sum pension while you retain your capital. With a bond ladder, you are guaranteed a monthly (if you bond provides this) income via interest payments across multiple years. Remember Do keep an eye out of the interests you get to ensure that you are getting the types of returns you want. You can also create bond ladders using:

Click here to learn more about bonds.

Back to Blog

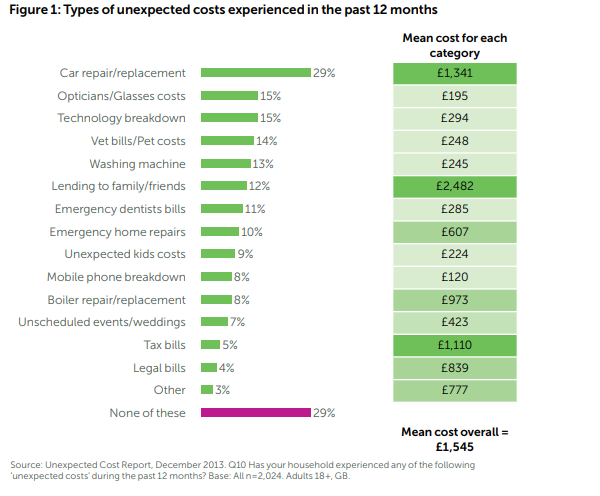

Recently I came across the following key words Financial Vulnerability, Financial Capability and Financial resilience. I generally attribute the words vulnerability, capability and resilience to life, emotions and an overall wellbeing. In the articles spewing these words they explored the following how easy is it for you to weather a sudden financial storm? In other words, how ready are you to manage curve balls. In this blog, we discuss the need for a new savings account to cover unexpected however large or small. Imagine this, two individuals Niya and Hurley receive an email that says you owe £450 from phone contract which you did not formally close if you do now address the cost, it will continue to increase. This is how people become suddenly poor A key goal of WealthSquats to encourage ourselves to build financial resilience, the ability to progress with our financial goals in the face of the unexpected. It is about building a strong finical muscle. What are examples of curve balls |

Proudly powered by Weebly