Net worth

Every year Forbes calculates the net worth of the richest people on earth. This year (2018), Jeff Bezos, founder and CEO of Amazon topped the list with a net worth of $112billion. Forbes calculated this number by valuing his assets including his shares in Amazon, his ownership of The Washington Post, any property he owns, salary he earns as well all subtracting his liabilities.

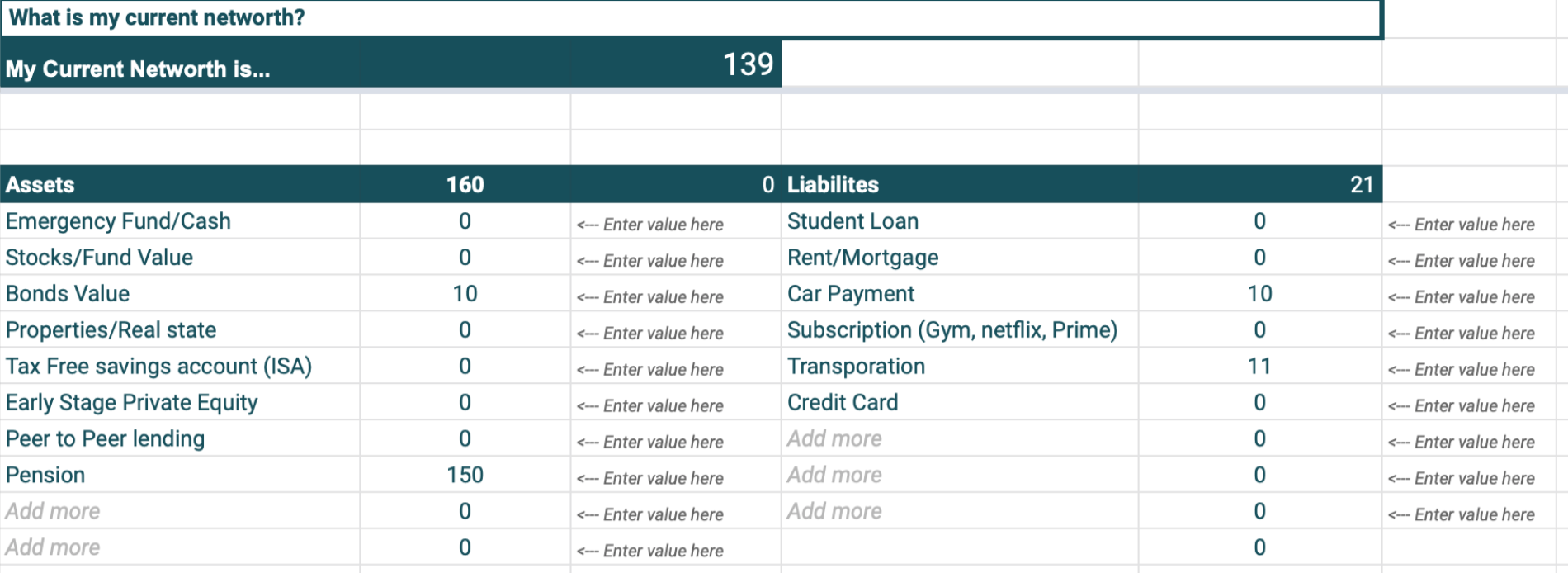

The starting value of my Net worth was the trigger that put me on a path to better financial awareness and education. In order to create and build wealth, we need to start by knowing what we have. Your Net worth = Assets - Liabilites. The assets are products that increase in value.

The starting value of my Net worth was the trigger that put me on a path to better financial awareness and education. In order to create and build wealth, we need to start by knowing what we have. Your Net worth = Assets - Liabilites. The assets are products that increase in value.