|

�

Archives

September 2021

Categories

All

|

Back to Blog

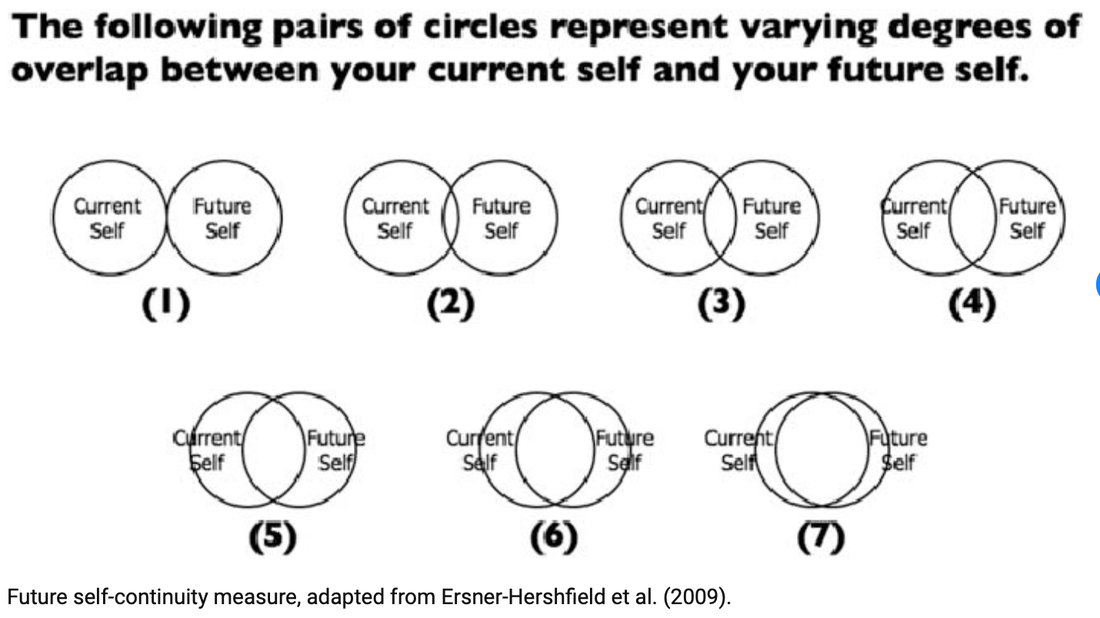

Are you friends with your future $£lf?7/26/2021 How do you see your self in the future? Research shows that people who are able to imagine their future self in a "vivid and realistic" manner as an extension of their current self end up having more money and assets. Source: Ersner-Hershfield et al. (2009) It can be difficult to imagine yourself 4 weeks, 4 years 40 years from now but the research shows that "what matters is how much a given individual feels he or she will be the same person over time" (i.e. approaching No 7 in the image above). By 'same' the researchers mean, you expect your interests, dislikes, values and beliefs to remain aligned. If you see your future self as a stranger, you won't feel like giving your money to help them because you won't feel like you are getting anything in return. In money terms, you are unlikely to save for the future or put money aside for retirement. On the other hand, If you feel like your future self is an extension of your current self, then helping your future self is just like giving your current self a helping hand. That feels good and so you'd be more likely to give your future self money through savings or pensions and feel rewarded. Interestingly this applies at a wider level - countries that have positive attitudes towards the elderly reported higher savings rates. How can you get closer to your future self?

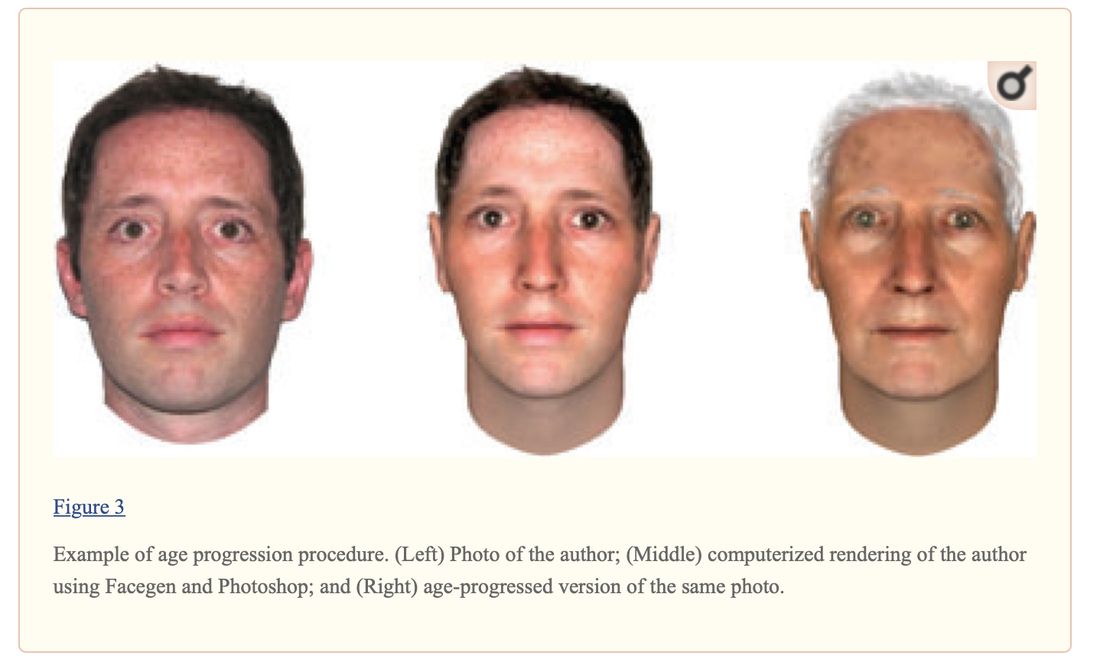

1) Create a realistic picture of future you via Apps at different ages - 25, 40, 60, and beyond (see example below). Do you like what you see? Are you willing to give old you some money? Save the image on your phone or print it out and hang it up. 2) As your future self, write an optimistic and detailed letter to your current self. Describe how you are doing and what you have accomplished. Want to get started? See our money habit of the month below. By doing these exercises, the hope is that you'll agree to give your future self a raise by saving and investing regularly for a better lifestyle.

1 Comment

Read More

Back to Blog

Keeping a Monthly Record10/20/2018 One of the positive financial habits that I am learning to develop is to perform a monthly check of my finances. Blackrock, an asset management firm found that women who are considered Smart Savers spend more than 7 hours per month reviewing and making changes to their savings and investments. How do I apply this practice? On the 12th of each month (I have this set-up as a recurring calendar appointment), I spend at least 1 hour where I pull up my networth tracker (download your copy here) and answer 2 questions:

How did I do this month? To answer this question, I open all my savings and investments accounts, look at the current values and add them into my networth tracker. Where the investments have grown, I mark them in green and where there a losses, I mark them in red. This allows to me visually see how each asset is performing month to month. If you have any liabilities like a student loan which you are slowly paying off, you can also use the tracker to make a record of your financial performance. To finish up, I sum up (automated via the tracker) the values of my assets and liabilities to re-calculate my overall networth. This singular figure allows me to know how I am progressing towards my own financial goals. Do I need to make any changes? Once I have updated my networth tracker, I look at each assets/liability and decide if I want to make any adjustment. Example of adjustments:

This month (October 2018), I chose to add new funds to my brokerage account that focus on investing in small sized businesses around the world. I also chose to add bonds to my LISA account which I have chosen to be my personal pension savings account. I began record keeping in November 2015. This practice has provided me with better control of my finances. It has also enabled me to plan and to be flexible with making changes which contributes to making me a more confident investor. I truly believe that if you do not know where you are, you cannot decide where you are going. I encourage you to develop your own record keeping practice set a date, use a spreadsheet or an App and GO! Do you keep a record? Which Apps do you use? Let me know.

Back to Blog

Where did I learn my money habits?9/23/2018 One of my friends asked her dad about how to save and he told her to google itLooking back it is very likely that my friend's dad did not know much about saving and investing. To begin my own journey into understanding how I could plan and manage my money better, I had to go to the beginning and be honest about the following question-What do I know about money today and how to make it work for me? To unravel this question, we must first understand where individuals learn habits in the first instance? As a child, you learn your speech, behaviors and values from your surroundings which is made up of family and friends. In just the same way you also learn your money habits from your surroundings. Your money habits include how you spend, save and think about money. “Your money habits include how you spend, save and think about money.” Your surroundings can have a profound effect on how you manage your money. It also defines your path to wealth. It is therefore critical to assess how much your money habits is attributed to what you have learnt from your surrounding in line with evaluating your current circumstance. This insight will allow you to understand how a family can have wealth for generations, because the rich teach their children rich habits and the less well off teach less well off habits. Teach can also be observation. Take for example, if you lived in a household where there was always a scramble to pay rent and meet monthly expenses, you could accept this a normal and find yourself with very little to spend at the end of each month as a working adult. But you can make another choice, you can take the time to assess why the scramble took place and plan how you can make money work for you and not fear it. “Your surroundings can have a profound effect on how you manage your money. It also defines your path to wealth.” My middle class parents did not teach me about money and financial management. This was in part due to the fact that they did not get an education from their parents. To be frank, money is not a subject that most families or friends discuss in open. To some any topic about money is best held in private or not at all. But if you want to manage money successfully, you need to understand it and you need to talk about it in order to develop successful money habits. WealthSquats is intended to help others understand that they can start their own path towards financial with the right information, patience and discipline. There is no complex jargon about finance-it is basic, it is simple and it works. It all starts with knowing that with what you have today, you can make the most of it by starting small. If you want to manage money successfully, you need to understand it and you need to talk about it in order to develop successful money habits Take Pleasure in saving money

|

Proudly powered by Weebly