|

�

Archives

September 2021

Categories

All

|

Back to Blog

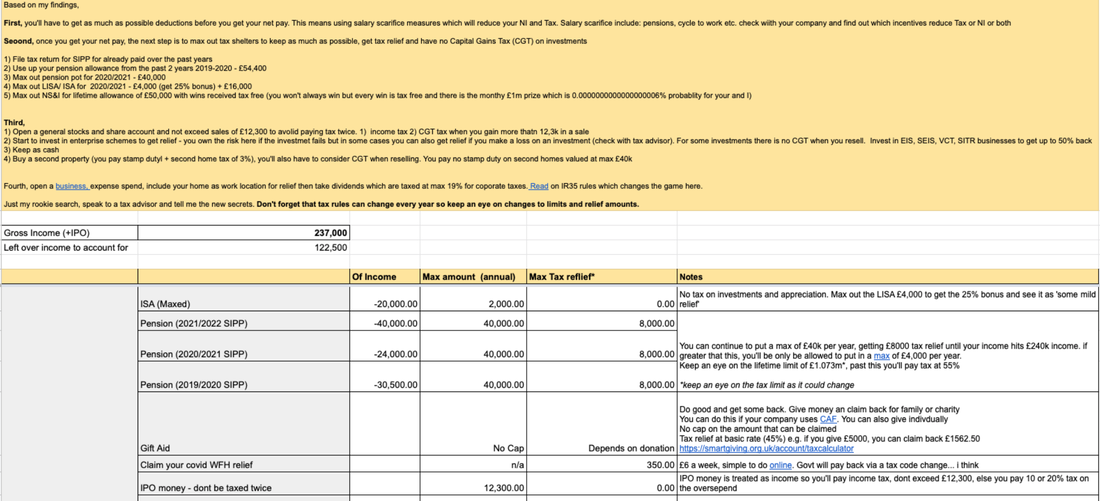

Someone reached out to me to try to solve the puzzle related to earning a high income as an employee (£237,000 to be exact) and using tax laws and perks to keep the most of the money to save and invest.

I scoured the tax rules to pull a quick report that broke down how that money can be allocated in tax friendly accounts or where tax relief can be obtained. This exercise was a great reminder on why we should invest in a tax advisor to help us keep most of our money. A tax advisor is available to all income levels and although there could be costs associated with this service you can save up and use them at least once a year to get your monies in order. If you are on a low income, you can get free advice from the government. I have just opened a Money pot called Life Admin where I'll be saving to get a tax advise and formalise a Will. Many wealth builders have great lawyers, accountants, doctors and financial advisors. What can a tax advisor do for you:

How to manage a £237,000 income and Tax. Click here or the image below to see the full report. Need a Tax Adviser, click here to choose who is appropriate for you or use the all in one service from Taxscouts and get 10% off.

0 Comments

Read More

Back to Blog

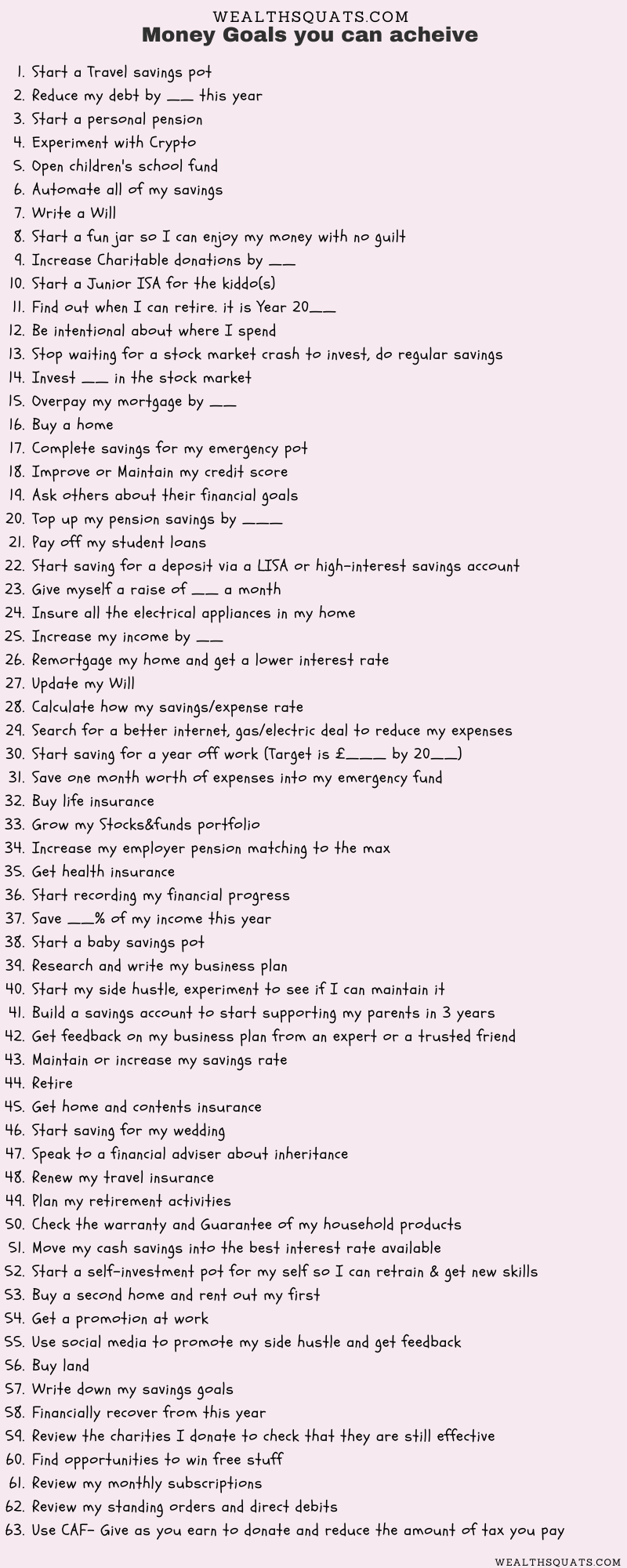

60+ Financial Goals you can achieve anytime12/20/2020 Here's a 60 plus list of money goals you can achieve anytime. We've covered the research behind the power of writing down your goals. So choose yours or add to the list. Do right with my cash savings

Travel & FunProtecting my Family

Save better and more

Manage Debt

Take care of my future

Give BackHomeownership

Financial Health Check

Experiment with my ideas

Enablers

Big overall Goals

Back to Blog

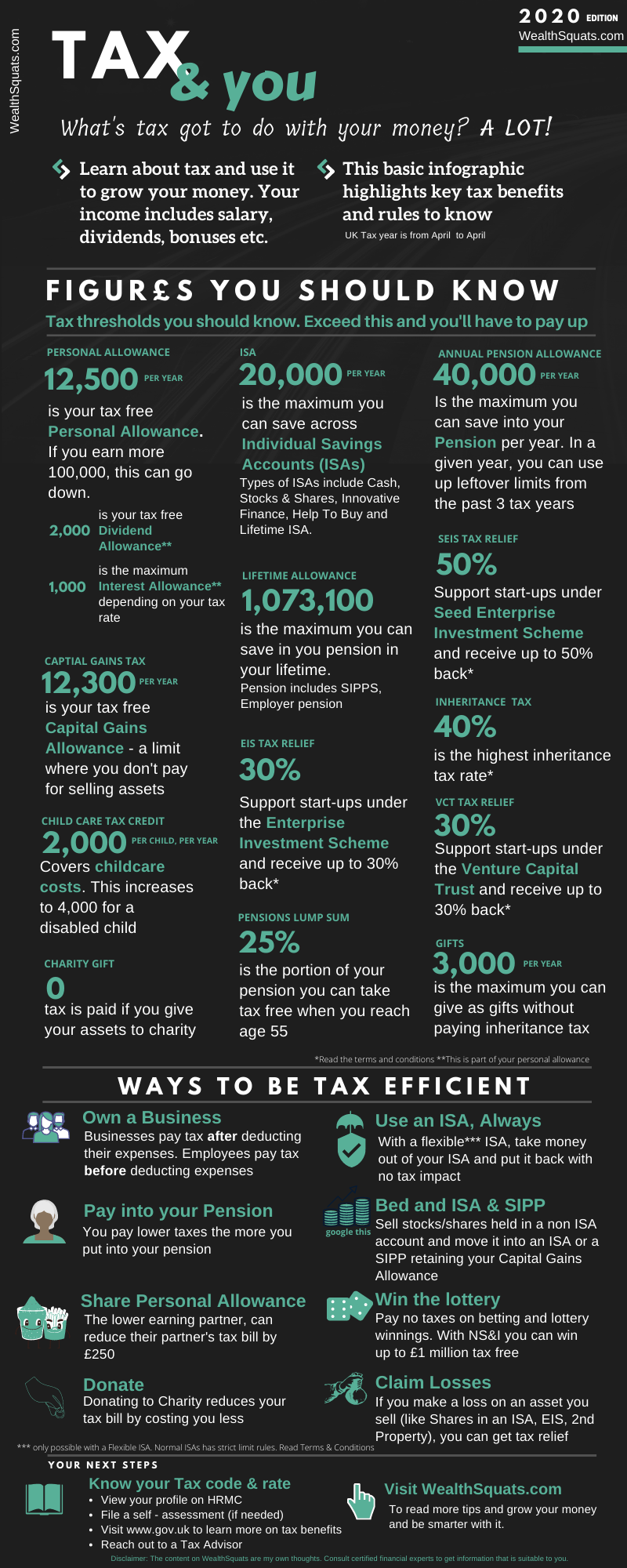

Tax is part of our lives whether we want it or not. It touches our income, contributes to our society, our healthcare, education, roads and more. In this post, I spend some time looking at the UK tax rules to find out which benefits we could use to grow and protect our money. I put my basic findings in an infographic to make it simple [Scroll down to view]. So let's learn about tax so we no longer label it as highly-confusing and downgrade it to somewhat confusing (a much better space to be in). [Quick definitions] The Tax WebThroughout this research, I found that Tax is actually not hard to understand on its own. The confusion comes when you have to consider all parts. Take this example: You have an income over the personal allowance threshold whilst saving for a pension and a home which your family will support you with a deposit. I call this the web because to understand your tax position, you need to understand the Tax rules for income, pension, stamp duty tax and gifts. No wonder you and I shun this topic...but to our own wealth demise. Did you know that if you make a loss when you sell your home, shares in an ISA, or a personal possession worth £6,000 you can get a tax relief? Imagine that getting paid when you lose. These are the kinds of helpful money tips I want to know about (I've added much more below). Get Clarity If you work for an employer, your income tax is typically handled by your company. If you are self employed, you'll file paperwork on your own or via an accountant/certified tax advisor to pay the appropriate tax and claim relief. Anyone can reach out to an accountant or tax advisor on tax matters. Before we move on, one question. What tax rate payer are you? If you don't know the answer, keep reading to find out. What Tax Rate Payer are you?

Your income determines how much tax you pay. The UK uses a progressive tax system, where the more you earn the more you pay in tax. So, if you earn up to £12,500 per year, you'll pay £0 tax. On the other hand, the highest income earners pay up to 45% of their income in tax. This can be very difficult to accept which is why many people look at ways to legally reduce their tax bill by using some of the options outlined in the infographic such as increasing payments to their pension, using ISAs to prevent being taxed again or not taking out dividend income for a given tax year (deferring it). Some others flee the UK to low tax rate countries. Just know that your tax solution or option is unique to your personal circumstance. Find out what tax rate payer your are here. TIP More tips & resources

Remember this: Get Tax Advice

Videos on Taxes

|

Proudly powered by Weebly