|

�

Archives

September 2021

Categories

All

|

Back to Blog

NS&I have cut Interest rates meaning you get less back for your money. There is speculation that other bank/lenders will follow NS&I's lead. This means that holding a lot of your money in cash will not make you rich anytime soon. What else can you do with your cash?

2 Comments

Read More

Back to Blog

Leaving university can be an overwhelming and stressful time for students and I firmly believe that Personal finance does not have to be one of these issues. The truth is, all you need are a few basics to set you up for life and luckily, these are not complicated. Looking back I wish I had someone to teach me personal finance whilst at university and so in this post, I share my experience, key tips and hacks related to budgeting, saving, investing and borrowing. Key points

University is a fantastic starting point to begin building a brilliant fiancial future because students have the benefit of time to apply their skills to do meaningful work My Experience I know from my experience, even with a degree in economics and a job in banking, I could use someone discussing money with me. It has been one of my goals to bring this valuable knowledge back to schools. I launched wealthsquats.com to start this journey. My vision is for all students to make clever financial choices whether it is how much to save, how to manage debt, how to use the stock market, how to be rich or how to have peace of mind about money. This post is my view of how students can get started on their financial journey. The first step is to set up some money goals that you want to acheive. When I began this journey, my goal was to track and increase my net worth. As I progressed, I increase the amount of money I paid into my company pension from 3% to 5% to benefit from company matching and I opened a Stocks & Shares ISA to get involved in the stock market. Will you be self employed or work for an employer? Many students will choose to work for themselves as the freelance and consulting industries continues to form a significant part of the UK economy. Others and the likely majority will find jobs with employers for instance through graduate schemes. As a student, what does it mean to be self-employed or employed? Self employed

Company Employed

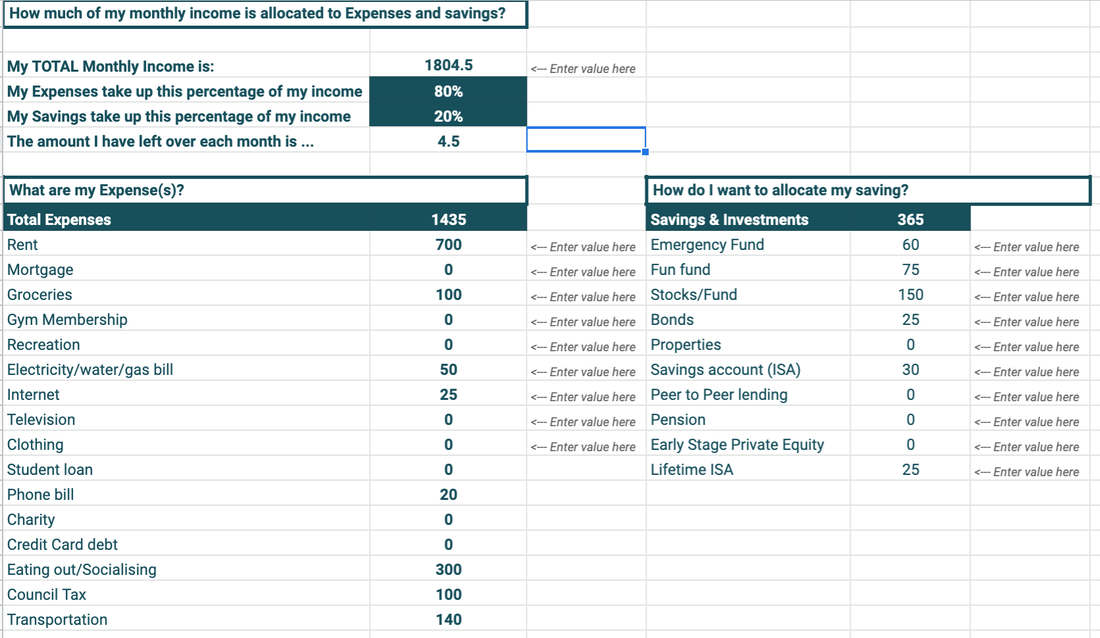

The first financial decision you make as a Graduate is what Salary to choose Let's use the example of a student who will be employed in London. The salary this student can expect to get in London is around £29,000 - the average annual salary for graduates in London. Of course depending on the role, sector and negotiation, this figure can vary. It is important to know that the salary you choose will form the basis of how much you can save or invest. If you are able to have other sources of income, your savings and investments can expand accordingly. The salary you choose upon graduation will form the basis of how much you can save or invest What could be your salary? Using the salary calculator, If you make, £29,000 a year your actual take home pay is around £1,800. As a working member of the population, you will start to contribute to the wider economy via taxes and national insurance. In addition, your company will likely have a pension plan which is deducted before you receive your take home pay. Also, if you have student loans, these will be deducted as well. For 2019/2020, the personal allowance - which is the amount of money on which you do not pay taxes on is £12,500. So what is likely to be your take home pay?

Your TAKE HOME PAY (salary after tax) is £1804.50 Next, we deduct your expenses?

Your TOTAL EXPENSES: £1435 What is LEFTOVER: (£1804.50 - £1435) = £369.5 Most people do not get rich by winning the lottery or via inheritance. For many, they just saved in assets that grow over a long period of time. What steps can I take to build a brilliant futureAs a student, it is from the £369.5 that you can start to save and invest. The expenses example above is just an example of what you can have to build a great financial future. This amount is much higher than what I began with and I focused on investing in things that grow. Step 1: Choose how much to save and where Here is how you could save or invest £369.5. £60 Emergency Fund (Cash Savings) £30 Oops account (Cash Savings) £75 Travel & Fun account £150 Stocks & Shares £25 LISA £25 Bond Account (5 years) TOTAL SAVINGS & INVESTMENTS: £365 To maximise your savings, continue to invest each month (automate this process) and keep tracking your performance. Most people do not get rich by winning the lottery or via inheritance. For many, they just saved in assets that grow over a long period of time. In my experience, I have found my pension to be one of the fastest way to grow my overall net worth this is because if I put in 5% of my salary, my company matches it by 5% so I get 100% increase each month on my pension savings. Step 2: Step up a budget Entering your savings and expenses into the WealthSquats tracker, you can see that your expenses make up around 80% of your income and you are only able to save around 20%. Now you can take steps to creatively think about how to increase your savings. In my case, I moved to a cheaper room to reduce my rent after reading that rent should take no more than 30% of my income. Thereafter, I significantly reduced my eating out and put every extra savings into cash savings or the stock market. Today, I still continue to find ways to optimise. There is a rule of thumb that says, wealth creators save 30% of their income and spend 70% on expenses. This rule is a rough guide but can help wealth builders like yourself to control your outgoings. I do not believe in budgeting and suffering, we should still live a good life no matter what income we have so it is crucial that you add 'enjoyment' into your budget so you do not restrict your self from doing what you like. Every month, I make sure that I save or invest my target amounts and once I've done that, I am free to spend whatever is left as I please! Step 3: Control your Debts Debt is another expense that can significantly reduce your ability to create wealth. I suggest you read this post on how to spot good and bad debt behaviours. To summarise, save and invest in things that grow Wealth building is fundamentally about saving and investing in things that grow. With this in mind, use the tips below to build that brilliant future.

Once you've got the hang of this, your money goals will evolve and you'll already have the wealth building basics. What to consider when deciding on your first salarySelf employed

Company Employed

So what choice will you make?

Remember to share these tips with your friends and start taking active steps to build a wonderful financial future. Get in touch if you have more questions. |

Proudly powered by Weebly