|

�

Archives

September 2021

Categories

All

|

Back to Blog

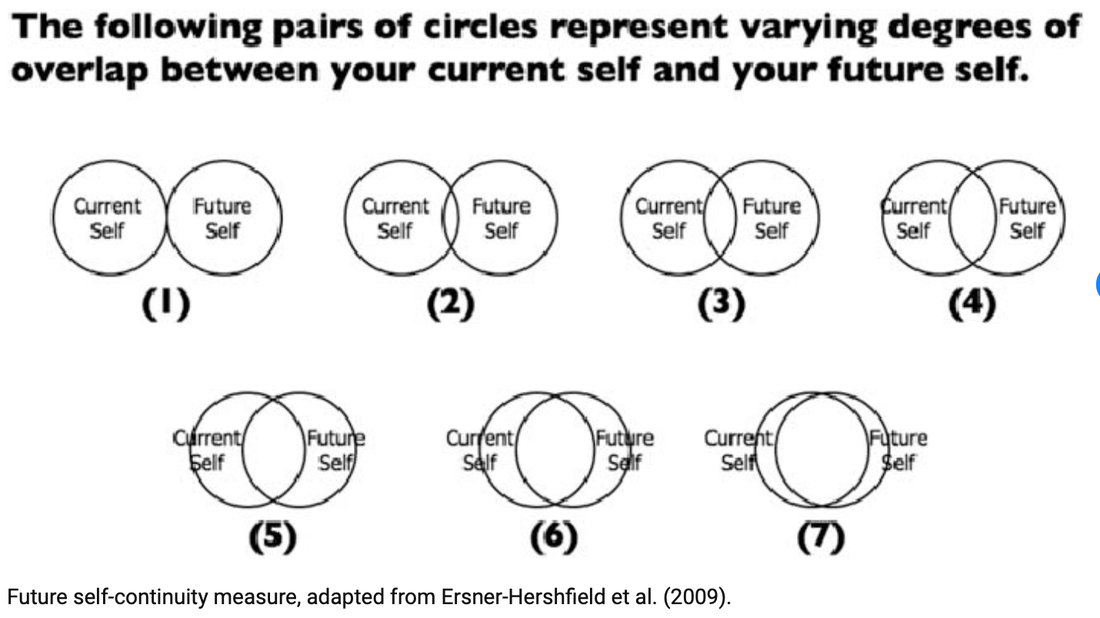

Are you friends with your future $£lf?7/26/2021 How do you see your self in the future? Research shows that people who are able to imagine their future self in a "vivid and realistic" manner as an extension of their current self end up having more money and assets. Source: Ersner-Hershfield et al. (2009) It can be difficult to imagine yourself 4 weeks, 4 years 40 years from now but the research shows that "what matters is how much a given individual feels he or she will be the same person over time" (i.e. approaching No 7 in the image above). By 'same' the researchers mean, you expect your interests, dislikes, values and beliefs to remain aligned. If you see your future self as a stranger, you won't feel like giving your money to help them because you won't feel like you are getting anything in return. In money terms, you are unlikely to save for the future or put money aside for retirement. On the other hand, If you feel like your future self is an extension of your current self, then helping your future self is just like giving your current self a helping hand. That feels good and so you'd be more likely to give your future self money through savings or pensions and feel rewarded. Interestingly this applies at a wider level - countries that have positive attitudes towards the elderly reported higher savings rates. How can you get closer to your future self?

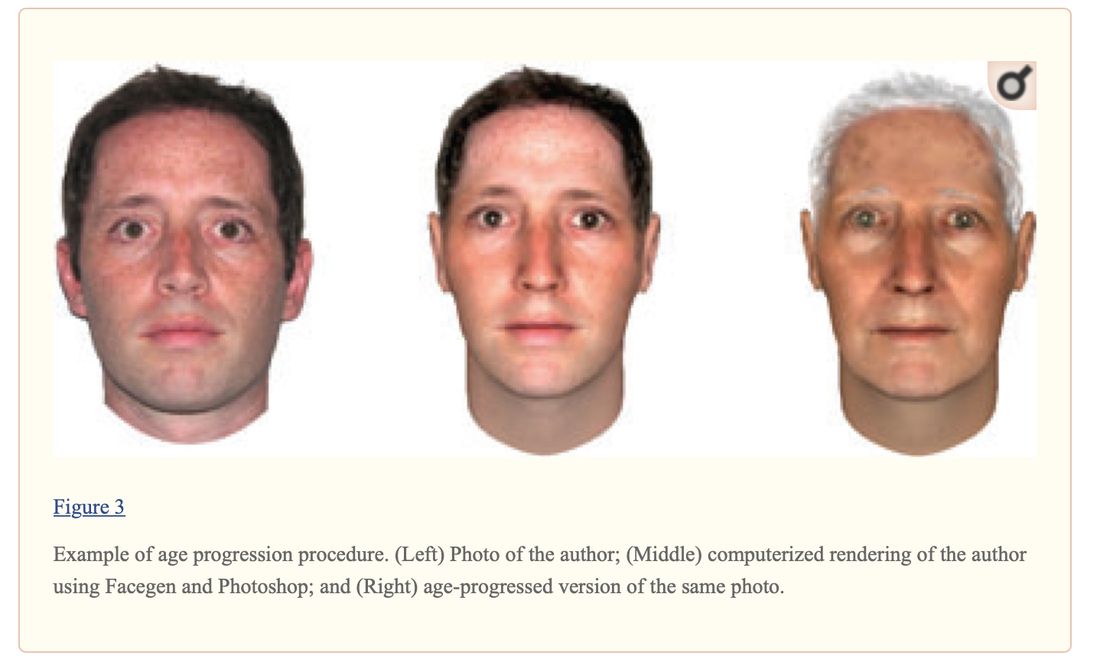

1) Create a realistic picture of future you via Apps at different ages - 25, 40, 60, and beyond (see example below). Do you like what you see? Are you willing to give old you some money? Save the image on your phone or print it out and hang it up. 2) As your future self, write an optimistic and detailed letter to your current self. Describe how you are doing and what you have accomplished. Want to get started? See our money habit of the month below. By doing these exercises, the hope is that you'll agree to give your future self a raise by saving and investing regularly for a better lifestyle.

1 Comment

Read More

|

Proudly powered by Weebly