|

�

Archives

September 2021

Categories

All

|

Back to Blog

Recently I came across a new idea called Bond Ladder which allows investors like us to arrange our bonds in ways that provides flexibility with regular returns. This can be an attractive option if:

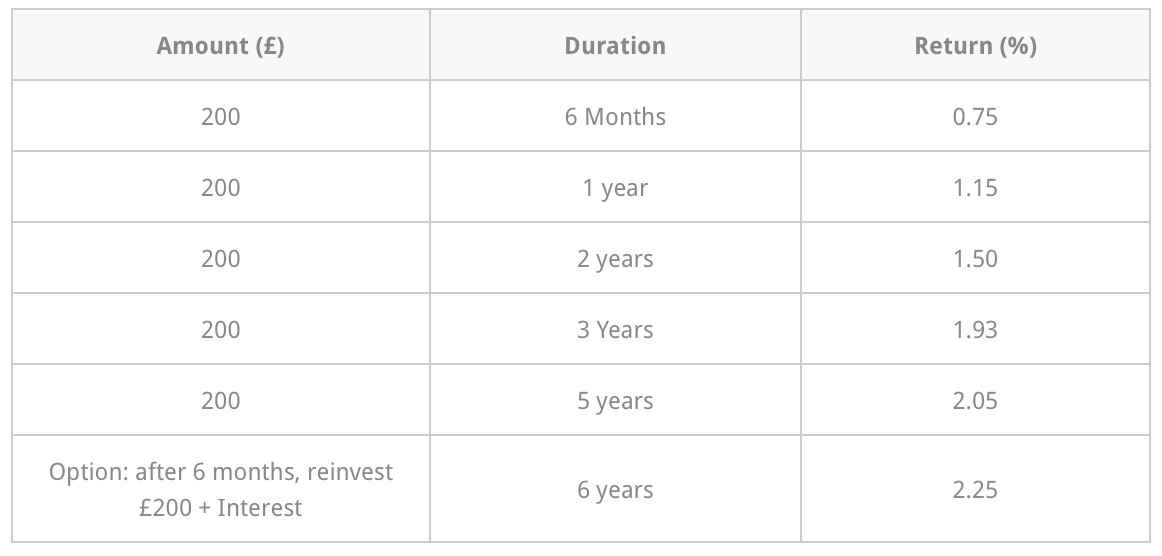

I am actually going to rename these bond trees as they money bloom all year round. Who doesn't like that How a bond ladder worksSay you have £1000 to save. You can either put the whole amount into a single fixed bond for 10 years with a 2.33% return. With this option you will not be able to access any part of the £1000 for the duration of the 10 years. If you feel that this ties you down, you can also opt to create bond ladder. With a bond ladder, you split your £1000 into different amounts across different bonds that mature at different times which also offer varying interest rates as return. With your £1000 bond ladder, you get the amount you invest back at different times so the first will be £200 + interest after 6 months. You can use that amount to sort our any expenses or you can reinvest it into for example, a 6 year bond to keep the process of building your ladder and getting a guaranteed income each time. As normal with bonds, you'll get the highest interest rate with a longer maturity period. Essentially the issuer or bond provider rewards you more the longer they hold your funds as a loan. If you are retired or you know someone who is about to retire A bond ladder is a good way to manage your savings or lump sum pension while you retain your capital. With a bond ladder, you are guaranteed a monthly (if you bond provides this) income via interest payments across multiple years. Remember Do keep an eye out of the interests you get to ensure that you are getting the types of returns you want. You can also create bond ladders using:

Click here to learn more about bonds.

0 Comments

Read More

Leave a Reply. |

Proudly powered by Weebly